Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Demand for Milk & Dairy Products

The global demand for milk and dairy products is surging, and this trend is expected to significantly impact the compound feed market. Compound feed, a blend of raw materials and supplements, optimized for the diet of livestock, plays a pivotal role in the dairy industry. As consumers become more health-conscious, their preference for high-quality dairy products increases. This demand for superior quality dairy inevitably necessitates healthier, well-nourished livestock, leading to an increase in the use of compound feed. Moreover, the growing awareness of the direct correlation between the diet of livestock and the quality of dairy products further fuels the demand for compound feed. Additionally, with the continuous growth of the global population and the subsequent rise in dairy consumption, farmers are under pressure to enhance milk production. Compound feed not only improves herd health but also boosts milk yield, justifying its escalating demand. Thus, the increasing demand for milk and dairy products is driving the growth of the global compound feed market.Increased Growth in Poultry Industry

The global compound feed market is expected to experience significant growth, largely driven by the rising demand in the poultry industry. As this sector expands, the requirement for quality feed designed to optimize poultry health and productivity becomes increasingly paramount. Compound feed, a blend of assorted raw materials and supplements, meets these needs by offering a balanced diet to animals. This feed enables efficient weight gain and productivity in poultry, which in turn facilitates increased poultry production to meet the growing global demand for poultry products. Furthermore, the escalating consumer consciousness regarding the quality of poultry products, driven by concerns over food safety and animal welfare, is likely to reinforce this trend. Consumers are now more willing to pay premium prices for poultry products from animals fed with high-quality, nutritious feed, thereby providing a substantial boost to the compound feed market. Consequently, the interplay of these factors - the expansion of the poultry industry, the need for quality feed, and the rising consumer consciousness - sets the stage for a significant uptick in the global demand for compound feed.Increasing Pet Adoption

The global demand for compound feed is projected to grow significantly due to the rise in pet adoption across the world. As the trend of pet humanization continues to take root, pet owners are increasingly looking for premium food products that can ensure their pets' optimal health and well-being. This demand extends to compound feed, which is specially formulated to provide a balanced mix of the necessary nutrients, including proteins, carbohydrates, fiber, and essential vitamins and minerals. This shift towards high-quality, nutritious pet food is driven by the increased awareness among pet owners about the importance of proper nutrition for the longevity and overall health of their pets. In addition, the surge in pet adoption has been particularly noticeable during the COVID-19 pandemic, when many individuals and families, spending more time at home, have decided to adopt pets. This scenario has resulted in an increased demand for compound feed on a global scale, as the new pet owners turn to these nutritionally complete feeds to ensure their pets get the essential nutrients they need to thrive.Technological Advancements in Compound Feed Production

Technological advancements in compound feed production are acting as catalysts, driving the global demand for compound feed in unprecedented ways. Innovations in feed technology have optimized production processes, resulting in nutrient-rich products with improved digestibility, thereby enhancing livestock productivity. High-tech equipment and precision feeding techniques have enabled manufacturers to produce feed with a precise blend of ingredients tailored to the specific nutritional requirements of different livestock. This customization of feed not only boosts the health and growth rate of the animals but also reduces wastage, leading to cost-effective farming. Furthermore, advancements in biotechnology have introduced genetically modified organisms (GMO), further revolutionizing the compound feed industry. GMO-based feeds have been found to increase yield and resistance to diseases, thereby contributing to a rise in demand. The incorporation of automation and AI in feed production also promises operational efficiency, minimization of human error, and a consistent quality of feed. All these factors combined help meet the ever-growing demand for meat, dairy products, and poultry in an increasingly populated world. Therefore, technological advancements in compound feed production are not just a trend, but a necessity that is projected to escalate the global demand for compound feed.Key Market Challenges

High Cost of Raw Materials

The escalating cost of raw materials is expected to exert a substantial downward pressure on the global demand for compound feed. Compound feed, a blend of various feed ingredients tailored to maximize animal health and productivity, is heavily reliant on the consistent availability and affordability of its constituent raw materials. These include grains, oilseeds, and other agro-industrial byproducts, the prices of which are precariously subject to fluctuating market conditions and environmental factors. As these costs rise, so does the production cost of compound feed, making it increasingly prohibitive for end-users, particularly in cost-sensitive markets. Consumers may then opt for more economically viable alternatives, or reduce their livestock count to manage expenses, thereby diminishing the overall demand for compound feed. Moreover, the high raw material costs could deter potential entrants from investing in this sector, further constricting the market growth. In essence, the spiraling cost of raw materials presents a significant challenge to the global compound feed industry, likely to result in a marked decrease in demand.Consumer Demand for Natural Feed

The global feed industry has traditionally been dominated by compound feed, synthetic formulations designed to provide animals with a complete and balanced diet. However, increasing consumer demand for natural products is expected to disrupt this trend. As consumers become more health-conscious, they're also becoming more conscious of the foods they feed their livestock, leading to an increased demand for natural, organic feed. This shift in preferences is likely to result in a decrease in the demand for compound feed. The use of natural feed not only satisfies consumer demand for more organic products, but it also benefits the livestock, leading to better health and productivity, which in turn leads to superior quality products. This consumer-driven shift towards natural feed will significantly reshape the market dynamics in the global feed industry, possibly at the expense of the compound feed market. However, it's important to note that transitioning from compound to natural feed is not without its challenges. Natural feed can be more expensive and harder to source, which may slow down its adoption. But with increased research and innovation in this space, it's likely that these obstacles will be overstated.Key Market Trends

Increase in Industrial Livestock Production

The global demand for compound feed is anticipated to surge significantly, primarily driven by the escalating industrial livestock production. This rise is attributable to the increasing global meat consumption, motivated by the world's growing population and the elevation of living standards, especially in developing countries. Industrial livestock production, characterized by high-density animal housing, requires consistent and nutritionally balanced feed to maintain optimal animal health and productivity. Compound feed, which is a blend of various raw materials and supplements, is designed to provide this comprehensive nutrition, thus making it an integral element of industrial animal husbandry. Furthermore, the intensifying awareness about the importance of animal health to human health and its impact on the quality of animal-based products is another contributing factor. This recognition is prompting livestock producers to invest more heavily in quality feeds, further fueling the demand for compound feed. Additionally, advancements in feed technology, such as precision feeding systems and the development of specialty feeds for specific animal life-stages or conditions, also augment this upward trend. Consequently, the rise in industrial livestock production worldwide is expected to propel the compound feed market.Expansion of Animal Farming in Emerging Economies

The global expansion of animal farming in emerging economies is expected to have a significant impact on the global demand for compound feed. As these economies continue to grow, there is an increasing emphasis on livestock farming to meet the rising demand for animal-based products such as meat, dairy, and eggs. This uptick in livestock farming necessitates an increased demand for compound feed, which is a blend of various raw materials and supplements, aimed at enhancing the health and productivity of the livestock. Furthermore, the gradual transition from traditional farming practices to commercial and mechanised farming observed in these developing nations is contributing to the augmentation of compound feed usage. Modern farming practices recognise the benefits of compound feed in achieving optimal animal health, yield, and subsequently, profitability. Additionally, the burgeoning middle class in these economies is resulting in a dietary shift towards protein-rich foods, thereby propelling the demand for meat and dairy products. Consequently, this has a domino effect on the demand for compound feed, an essential element in producing such products. In conclusion, the upward trajectory in animal farming combined with the dietary transition in emerging economies is expected to drive the global demand for compound feed upwards.Segmental Insights

Ingredient Insights

Based on the Ingredient, the cereals segment currently holds a dominant position in the Global Compound Feed Market. This can be attributed to several factors, including the high nutritional value that cereal-based feeds provide. These feeds offer a balanced combination of essential nutrients, making them a popular choice among livestock owners. Moreover, their affordability and widespread availability make them easily accessible to a wide range of customers. Furthermore, the versatility of cereals is another key advantage that contributes to their market dominance. Cereals can be incorporated into various feed types, such as pellets, mash, or crumbles, catering to the specific dietary needs of different animals. This adaptability allows livestock owners to customize their feed formulations while ensuring optimal nutrition and growth. All these factors combined have contributed to the cereals segment's significant market share in the Global Compound Feed Market. With their nutritional benefits, affordability, availability, and versatility, cereal-based feeds continue to play a vital role in meeting the dietary requirements of livestock worldwide.Livestock Insights

Based on the Livestock, the Poultry segment is currently dominating the Global Compound Feed Market. This can be attributed to the increasing demand for poultry products such as eggs and meat, driven by factors like population growth and changing dietary habits. As the world population continues to grow, the demand for protein-rich food sources like poultry products has been on the rise. Additionally, with the changing dietary habits of consumers, there has been a shift towards healthier and leaner protein options, making poultry products an attractive choice. The need for high-quality feed to ensure healthy poultry growth further contributes to this trend. To meet the growing demand for poultry products, farmers and industry players are focusing on providing nutritionally balanced feed that promotes optimal growth and health in poultry. This includes incorporating essential nutrients, vitamins, and minerals in the feed formulations, ensuring that the poultry receives the right nutrition throughout their development stages.Regional Insights

• During the forecast period, the Asia Pacific region is expected to emerge as the largest market for compound feed. This is primarily attributed to the increasing income levels of the population, which has led to a rise in the demand for meat consumption. The market in this region is poised to experience substantial growth, driven by the growing affluence and changing dietary preferences of consumers. Several countries within the Asia Pacific region have already witnessed a surge in the consumption of compound feed, reflecting the region's potential for further expansion. In addition, both the North American and European regions are expected to witness significant growth in the compound feed market. The North American region, in particular, is experiencing a rising demand for poultry and cattle products, which is driving the market growth. Similarly, the European market is benefitting from the increasing production of meat products, as the demand for these items continues to surge. These developed nations are anticipated to witness substantial growth in the compound feed market in the coming years.• Moreover, in Africa and the Middle East region, the demand for compound feed is projected to continue its upward trajectory, driven by the growing demand for animal products. This region presents significant opportunities for market expansion, as the consumption of animal-based products is on the rise. The increasing urbanization, economic development, and changing dietary patterns are contributing to the growing demand for compound feed in these regions. Overall, the compound feed market is poised for considerable growth across different regions, driven by various factors such as income growth, changing dietary preferences, and increasing demand for animal products. The forecast period presents immense opportunities for market players to capitalize on these trends and cater to the evolving needs of consumers.

Report Scope:

In this report, the Global Compound Feed Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Compound Feed Market, By Ingredient:

- Cereals

- Cakes & Meals

- By-Products

- Supplements

- Others

Compound Feed Market, By Livestock:

- Ruminants

- Swine

- Poultry

- Aquaculture

- Others

Compound Feed Market, By Source:

- Plant-Based

- Animal-Based

Compound Feed Market, By Form:

- Mash

- Pellets

- Crumbles

- Others

Compound Feed Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Compound Feed Market.Available Customizations:

Global Compound Feed market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cargill, Inc.

- Charoen Pokphand Foods Public Company Limited

- Land O’ Lakes Inc.

- New Hope Group Co. Ltd.

- Guangdong HAID Group Co., Ltd

- Tyson Foods, Inc.

- Nutreco N.V.

- Alltech, Inc.

- De Heus Animal Nutrition

- ForFarmers N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | February 2024 |

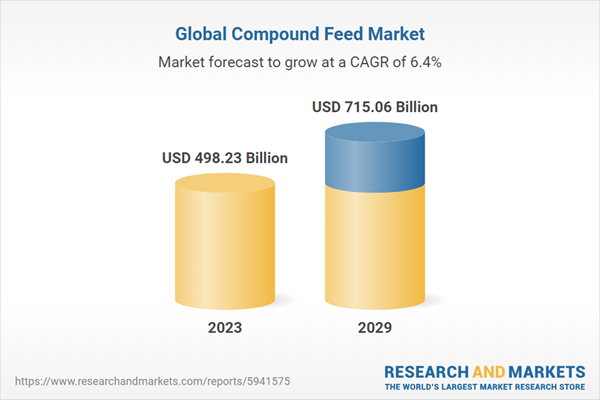

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 498.23 Billion |

| Forecasted Market Value ( USD | $ 715.06 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |