Offshore is the fastest growing segment, Asia-Pacific is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The pervasive issue of aging oil and gas infrastructure stands as a primary driver for the global corrosion protection market. As vital assets such as pipelines, offshore platforms, and refining units exceed their initial design life, their vulnerability to corrosion intensifies, demanding continuous and specialized protective interventions. Such degradation necessitates advanced monitoring, maintenance, and material solutions to ensure operational safety and prevent environmental damage. According to Offshore Technology, in January 2025, Top Companies List of Asset Integrity Management in Global 2025, over 70% of oil and gas infrastructure is 30 years old or more, demonstrating the significant requirement for proactive corrosion management to extend asset operational lifespans.Key Market Challenges

The substantial capital expenditure required for implementing comprehensive corrosion protection systems presents a notable impediment to market expansion. This financial burden frequently results in the deferral of essential investments, particularly for aging infrastructure or during periods of economic instability, thereby risking asset integrity and operational longevity. The increasing cost environment further exacerbates this challenge, compelling companies to prioritize capital allocation with greater scrutiny.Key Market Trends

Advancements in Nanocoatings and Graphene-Based Coatings are significantly influencing the global oil and gas corrosion protection market by offering superior material performance. These innovative coatings provide enhanced durability, chemical resistance, and barrier properties, which are crucial for safeguarding critical infrastructure such as pipelines and offshore platforms in harsh operating environments. The ongoing development and deployment of these advanced materials enable a proactive approach to asset integrity, extending the operational lifespan of equipment and reducing the frequency of maintenance. For instance, in April 2025, Zentek completed successful testing of its ZenARMOR™ nano-pigment in military-grade aerospace paints, demonstrating strong corrosion inhibition under rigorous ASTM standards, and is collaborating with Jazeera Paints in Saudi Arabia to integrate this nanotechnology into corrosion protection products.Key Market Players Profiled:

- 3M Company

- Akzo Nobel N.V.

- Hempel A/S

- BASF SE

- The Sherwin Williams Company

- RPM International, Inc

- Jotun A/S

- Chase Corporation

- Axalta Coating Systems, LLC

- Metal Coatings Corporation

Report Scope:

In this report, the Global Oil and Gas Corrosion Protection Market has been segmented into the following categories:By Type:

- Coatings

- Paints

- Inhibitors

- Others

By Location:

- Offshore

- Onshore

By Sector:

- Upstream

- Midstream

- Downstream

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Oil and Gas Corrosion Protection Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M Company

- Akzo Nobel N.V.

- Hempel A/S

- BASF SE

- The Sherwin Williams Company

- RPM International, Inc

- Jotun A/S

- Chase Corporation

- Axalta Coating Systems, LLC

- Metal Coatings Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

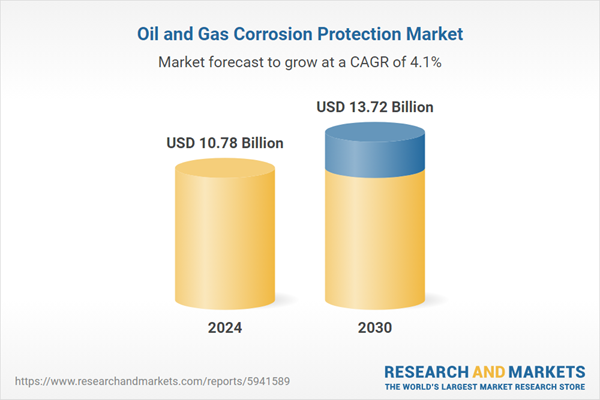

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.78 Billion |

| Forecasted Market Value ( USD | $ 13.72 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |