Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Technological Advancements

Technological innovations and advancements play a pivotal role in shaping the landscape of land drilling rigs. The integration of automation, IoT, AI, and data analytics has transformed drilling operations, enhancing efficiency, accuracy, and safety. Advanced drilling technologies enable companies to access unconventional resources, such as shale gas and tight oil, previously deemed inaccessible. These innovations reduce drilling time, improve precision, and minimize environmental impact by optimizing resource extraction. Furthermore, the development of smart drilling rigs equipped with real-time monitoring capabilities enhances decision-making processes, reducing downtime and operational costs. As the industry continues to embrace cutting-edge technologies, the demand for modernized rigs remains high, driving market growth.Energy Demand and Oil Prices

The global demand for energy, particularly oil and natural gas, significantly influences the land drilling rigs market. Fluctuations in oil prices directly impact drilling activities, as higher prices often incentivize increased exploration and drilling efforts. The quest to meet the energy demands of growing economies, coupled with geopolitical factors impacting oil production, drives the need for more drilling rigs. Conversely, during periods of low oil prices or market volatility, drilling operations may decrease as companies adjust their budgets and strategies. The correlation between energy demand, oil prices, and drilling activity remains a fundamental driver shaping the growth trajectory of the land drilling rigs market.Geopolitical and Regulatory Factors

Geopolitical tensions, governmental policies, and regulatory frameworks significantly impact the land drilling rigs market. Changes in regulations related to environmental protection, safety standards, and land access permissions directly influence the industry's operations and costs. Additionally, geopolitical events such as conflicts or trade agreements can disrupt oil supply chains, affecting drilling activities and investment decisions. Regulatory shifts towards cleaner energy sources and sustainability initiatives also shape the market by influencing the adoption of drilling technologies that minimize environmental impact. The industry's ability to adapt to evolving geopolitical and regulatory landscapes remains crucial in driving market growth and sustainability.Exploration and Production Opportunities

The discovery of new reserves and untapped resources fuels the demand for land drilling rigs. As accessible conventional oil and gas reservoirs diminish, exploration and production efforts increasingly target unconventional sources. Technological advancements in horizontal drilling and hydraulic fracturing have unlocked previously inaccessible reservoirs, expanding opportunities for drilling activities. Emerging markets and regions with vast untapped resources present lucrative opportunities for drilling rig manufacturers and service providers. The identification and exploitation of new oil and gas reserves continue to be a pivotal driver propelling the growth of the land drilling rigs market.Infrastructure Development and Industrial Expansion

Economic growth and infrastructure development drive the demand for energy resources, consequently influencing land drilling rig activities. Rapid industrialization, urbanization, and infrastructure projects in developing economies necessitate increased energy supply, stimulating drilling operations. As industries expand and infrastructure projects multiply, the demand for oil and gas to fuel these developments escalates, driving the need for drilling rigs. Moreover, the growing global population and rising standards of living amplify the energy consumption, further bolstering the demand for land drilling rigs to meet these burgeoning needs.Key Market Challenges

Environmental and Regulatory Hurdles

One of the primary challenges confronting the land drilling rigs market is navigating stringent environmental regulations and sustainability concerns. The industry faces increased scrutiny due to its environmental impact, including land disturbance, water usage, and emissions. Stricter regulations aimed at reducing carbon footprints, minimizing water usage, and mitigating environmental risks compel drilling companies to adopt eco-friendly practices and technologies, often adding complexities and costs to operations. Additionally, obtaining permits for land access becomes more challenging as governments and communities emphasize conservation efforts and protect ecologically sensitive areas. Balancing the need for energy exploration with environmental stewardship presents a significant challenge for the land drilling rig sector, necessitating continuous innovation to meet regulatory standards while ensuring operational efficiency.Volatility in Oil and Gas Prices

The global land drilling rigs market is highly sensitive to fluctuations in oil and gas prices, posing a substantial challenge to sustained growth and profitability. Periodic shifts in oil prices due to geopolitical tensions, production decisions by major oil-producing countries, or economic factors impact drilling activities. Lower oil prices often result in reduced exploration and drilling investments by companies, affecting the demand for drilling rigs and related services. Conversely, higher prices may stimulate drilling activities but can also lead to market volatility and uncertainty. The challenge for the land drilling rig industry lies in managing these price fluctuations and their consequent effects on investment decisions, profitability, and market demand.Technological and Innovation Barriers

While technological advancements drive market growth, they also present challenges for the land drilling rigs sector. The integration of cutting-edge technologies, such as automation, AI, and data analytics, requires substantial investments in research, development, and implementation. Accessing and adopting these innovations might be challenging for smaller companies with limited resources. Moreover, the transition from traditional drilling methods to advanced technologies demands specialized skills and training for the workforce, posing a barrier to the widespread adoption of these technologies. Overcoming these technological barriers requires collaborative efforts within the industry, strategic partnerships, and continuous investment in research and development to make innovations more accessible and cost-effective.Global Economic Uncertainty and Market Demand

Economic uncertainties, geopolitical tensions, and market fluctuations globally pose a significant challenge to the land drilling rigs market. Periods of economic downturns or geopolitical instability can lead to reduced investments in energy projects, limiting the demand for drilling rigs and services. Moreover, shifts in energy policies, trade disputes, or geopolitical conflicts can disrupt the supply chain and impact market demand unpredictably. Adapting to these volatile market conditions while ensuring operational resilience and financial stability remains a critical challenge for companies operating in the land drilling rigs market. Strategies focused on diversification, flexibility, and agile responses to changing market dynamics are essential to navigate these challenges effectively.Key Market Trends

Focus on Digitalization and Automation

The land drilling rigs market is witnessing a significant shift towards digitalization and automation. Integration of technologies like IoT sensors, data analytics, and AI-driven predictive maintenance systems has revolutionized drilling operations. Automation streamlines processes, enhances operational efficiency, and improves safety standards. Real-time data collection and analysis enable better decision-making, reducing downtime and optimizing drilling processes. Additionally, the implementation of remote monitoring and control systems allows for safer and more efficient operations, minimizing human intervention in hazardous environments. As the industry continues to prioritize efficiency and safety, the adoption of digitalization and automation trends is expected to grow, reshaping the landscape of land drilling rigs.Rise in Directional and Horizontal Drilling

Directional and horizontal drilling techniques have gained prominence in the land drilling rigs market due to their ability to access previously inaccessible reservoirs and increase productivity. These methods allow drilling companies to reach multiple reservoirs from a single well, maximizing resource extraction while minimizing environmental impact. Horizontal drilling facilitates the extraction of oil and gas from unconventional formations, such as shale, tight sand, and coal beds. The increased focus on unconventional resources has led to a surge in the demand for rigs capable of directional and horizontal drilling, signaling a significant trend in the market.Environmental Sustainability Initiatives

Sustainability has become a focal point for the land drilling rigs market, driven by increased environmental awareness and regulatory pressures. Companies are investing in eco-friendly drilling technologies and practices to minimize environmental impact. Innovations in water recycling, reduced emissions, and the development of electric or hybrid-powered rigs aim to mitigate the ecological footprint of drilling operations. Furthermore, there's a growing emphasis on restoring land post-drilling activities through reclamation and rehabilitation efforts. Sustainability initiatives are becoming a prominent trend shaping the market, with stakeholders prioritizing responsible and environmentally conscious drilling practices.Adoption of Rig Standardization and Modularization

Standardization and modularization of drilling rigs are gaining traction in the industry, offering cost-effective and efficient solutions. Standardized rig designs and modular components enable quicker rig assembly, reduce downtime, and enhance operational flexibility. Modular rigs allow for easier transportation to remote or challenging locations, reducing logistical challenges. Standardization also facilitates easier maintenance, spare part availability, and interchangeable components across different rigs, optimizing operational efficiency. This trend towards rig standardization and modularization is poised to streamline operations and reduce overall costs in the land drilling rigs market.Increased Focus on Safety and Risk Management

Safety remains a paramount concern in the land drilling rigs market, driving a trend towards continuous improvement in safety protocols and risk management. Companies are investing in advanced safety technologies, training programs, and stringent safety measures to protect workers and assets. Implementation of predictive maintenance systems, remote monitoring, and real-time risk assessment tools helps in identifying and mitigating potential hazards proactively. Additionally, there's a growing emphasis on fostering a safety-oriented culture within organizations to minimize incidents and downtime. As safety regulations tighten and stakeholders prioritize worker well-being, the trend towards enhancing safety measures will continue to shape the market.Segmental Insights

Type Insights

The mobile land drilling rigs segment emerged as the dominant force in the global market and is poised to maintain its supremacy throughout the forecast period. The mobile land drilling rigs, characterized by their flexibility and adaptability, witnessed heightened demand due to several key factors. Firstly, the shift towards unconventional resources, such as shale gas and tight oil, necessitated drilling operations in remote and challenging terrains. Mobile rigs, designed for agility and mobility, proved instrumental in accessing these unconventional reserves, driving their increased adoption. Moreover, the capability of mobile rigs to swiftly relocate and set up in different locations appealed to drilling companies seeking versatility in their operations, especially in regions with diverse geological formations. Additionally, advancements in mobile rig technologies, including improved mobility, enhanced power efficiency, and the integration of automation and digitalization, further fueled their dominance. The flexibility offered by mobile rigs in accommodating varying drilling requirements and their ability to navigate geographically diverse landscapes positioned them as the preferred choice for companies aiming for operational efficiency, cost-effectiveness, and the exploration of unconventional reservoirs. As the industry continues to prioritize access to unconventional resources and operational versatility, the mobile land drilling rigs segment is anticipated to maintain its dominance, offering a flexible and adaptable solution to meet evolving drilling needs.Drive Mode Insights

The mechanical drive mode segment emerged as the dominant force in the global land drilling rigs market and is poised to maintain its dominance through the forecast period. The mechanical drive mode, characterized by its reliability, robustness, and established operational efficiency, witnessed widespread adoption due to several key factors. Mechanical drive systems have historically been the backbone of land drilling rigs, offering proven performance in various drilling conditions. The familiarity, durability, and well-established nature of mechanical drive systems have instilled confidence among drilling companies, particularly in challenging terrains and harsh environments. Additionally, the mechanical drive mode's ability to generate high torque and handle variable drilling conditions, including hard rock formations, solidified its position as the preferred choice for many drilling operations. While electrical and compound drive modes have seen advancements and gained attention for their potential efficiencies, the reliability and proven track record of mechanical drive systems continue to resonate with industry stakeholders. Moreover, the established infrastructure, availability of skilled manpower, and lower initial investment costs associated with mechanical drive systems further contribute to their sustained dominance in the global land drilling rigs market. As the industry seeks reliability, adaptability, and consistent performance in drilling operations, the mechanical drive mode segment is anticipated to maintain its leading position, offering a dependable and established solution for diverse drilling requirements.Application Insights

The oil and gas industry application segment emerged as the dominant force in the global land drilling rigs market and is anticipated to maintain its dominance throughout the forecast period. Several pivotal factors contributed to the dominance of land drilling rigs within the oil and gas sector. The relentless demand for oil and gas to meet global energy needs continues to be a driving force behind the utilization of land drilling rigs. Exploration and extraction activities in both conventional and unconventional reserves remain crucial for the oil and gas industry's sustenance and growth. The versatility of land drilling rigs in accessing diverse geological formations, including deepwater, shale, and offshore reserves, positions them as indispensable assets for oil and gas companies. Furthermore, technological advancements, particularly in directional drilling and hydraulic fracturing techniques, have propelled the demand for land drilling rigs in unlocking previously untapped resources. The ongoing quest to discover and extract hydrocarbons efficiently from challenging terrains and unconventional reservoirs further solidifies the dominance of land drilling rigs within the oil and gas industry. Additionally, the continual need for maintenance and development of existing wells to optimize production levels augments the demand for land drilling rigs, emphasizing their pivotal role in sustaining and expanding oil and gas operations. As the global energy demand persists and the oil and gas industry seeks to explore newer reserves while maximizing production from existing fields, the application of land drilling rigs within this sector is expected to maintain its dominant position, driving growth and innovation in the market.Regional Insights

North America emerged as the dominant region in the global land drilling rigs market and is anticipated to maintain its stronghold throughout the forecast period. Several factors contributed to North America's dominance in this market. The region's abundance of shale reserves, particularly in the United States, spurred a significant surge in drilling activities, driving the demand for land drilling rigs. Technological advancements, such as hydraulic fracturing and horizontal drilling, revolutionized the extraction of unconventional resources like shale gas and tight oil, further fueling the need for advanced drilling rigs. Moreover, stringent environmental regulations and safety standards in North America pushed for the adoption of modern and eco-friendly drilling technologies, boosting the market for more efficient and sustainable land drilling rigs. Additionally, the presence of established oil and gas companies, coupled with favorable government policies supporting energy exploration, contributed to North America's dominance. The region's continuous efforts to expand its energy production capabilities, coupled with ongoing investments in technological innovations, position North America at the forefront of the global land drilling rigs market. As North America maintains its focus on optimizing oil and gas production, alongside advancements in drilling technologies and a commitment to environmental sustainability, it is expected to remain the dominant region in the land drilling rigs market for the foreseeable future.Report Scope:

In this report, the Global Land Drilling Rigs Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Land Drilling Rigs Market, By Type:

- Conventional

- Mobile

Land Drilling Rigs Market, By Drive Mode:

- Mechanical

- Electrical

- Compound

Land Drilling Rigs Market, By Application:

- Oil and Gas industry

- Metal and Mining Industry

Land Drilling Rigs Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Land Drilling Rigs Market.Available Customizations:

Global Land Drilling Rigs market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nabors Industries Ltd.

- Helmerich & Payne, Inc.

- Precision Drilling Corporation

- Patterson-UTI Energy, Inc.

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- China National Petroleum Corporation (CNPC)

- Sinopec Oilfield Service Corporation

Table Information

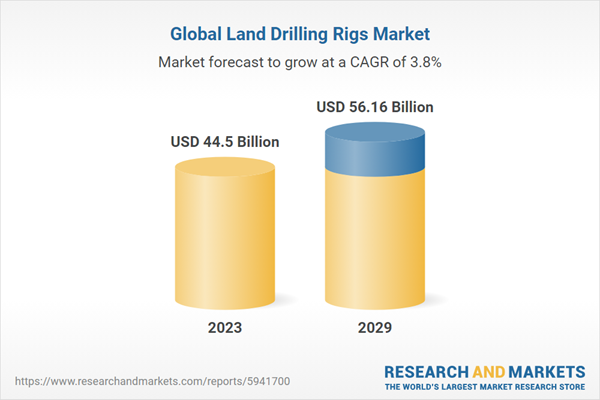

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 44.5 Billion |

| Forecasted Market Value ( USD | $ 56.16 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |