Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The ASEAN electric two-wheeler market is undergoing a transformative shift as consumer preferences evolve toward cleaner and more cost-effective transportation alternatives. Rapid urbanization and dense traffic in metropolitan areas have amplified the demand for electric scooters and motorcycles. Governments across Southeast Asia are reinforcing the transition through regulatory support, including purchase subsidies, import duty reductions, and tax incentives. Technological developments in battery performance, range, and charging infrastructure further strengthen the ecosystem necessary for mass EV adoption. Rising awareness about the environmental impact of fossil fuel vehicles is also driving consumers to explore electric options.

The surge in investments and collaborations across the value chain - from local manufacturing and battery production to service networks - indicates a maturing market landscape. Fleet operators, particularly in last-mile delivery and ride-hailing sectors, are increasingly turning to electric two-wheelers to reduce operational costs. The market is also benefiting from innovations such as battery swapping stations, mobile charging units, and digital apps offering real-time diagnostics and performance monitoring. These developments collectively improve the user experience and accelerate market penetration.

Despite the positive momentum, several challenges continue to impact market expansion. High upfront vehicle costs, limited charging infrastructure, and inadequate consumer awareness restrict potential adoption in certain areas. Reliability concerns related to battery lifespan and performance in tropical climates are additional hurdles. Market players must also contend with fragmented regulatory environments and policy inconsistencies across the region. Addressing these issues through coordinated policymaking and infrastructure investment will be critical in ensuring sustained growth through 2030.

Market Drivers

Rising Urban Congestion

As cities across Southeast Asia experience rapid population growth and urbanization, road congestion has become a major concern. Traditional motorcycles, although popular, contribute to traffic density and pollution. According to the ASEAN Automotive Federation, total motorcycle and scooter sales across ASEAN countries reached 9.5 millin units in the January to September 2024 period, reflecting a year-on-year increase of 0.9% compared to 9.4 million units during the same period in 2023. Electric two-wheelers offer a practical solution due to their compact design and suitability for short urban commutes.Governments and urban planners are now integrating electric mobility into public transportation strategies to reduce vehicular load and emissions. For instance, As reported by the Indonesia Ministry of Industry in March 2025, the country aims to deploy 2 million electric motorcycles by 2026, supported by incentives and partnerships with battery-swapping networks and local manufacturers. Riders benefit from quieter operation, lower maintenance, and easy navigation in congested streets, making electric vehicles a logical alternative.

The adaptability of e-scooters and electric motorcycles to crowded city conditions makes them especially appealing to daily commuters and delivery personnel, who need quick, efficient, and cost-effective mobility. With continuous urban infrastructure development and smart city initiatives in progress, electric two-wheelers are positioned as critical tools in future urban transport ecosystems. These factors create a strong case for the growth of e-two-wheelers as congestion solutions in Southeast Asia.

Market Challenges

Limited Charging Infrastructure

One of the most pressing challenges limiting the growth of electric two-wheelers in Southeast Asia is the inadequate availability of charging infrastructure. Many urban and semi-urban areas lack reliable public charging stations, making it difficult for users to operate electric vehicles for long distances or routine commuting. The absence of standardized charging connectors, limited fast-charging options, and lack of integration with digital navigation systems further hinder convenience. For fleet operators and individual users alike, this creates uncertainty and range anxiety, especially in areas where charging stations are sparsely located. Building a robust charging network requires significant investment, cross-sector collaboration, and supportive zoning regulations.Key Market Trends

Battery Swapping Networks

Battery swapping is emerging as a scalable alternative to conventional plug-in charging, especially in densely populated urban centers. The model allows users to exchange depleted batteries for fully charged ones at designated stations, reducing downtime and eliminating the need for home charging setups. This trend is particularly beneficial for delivery riders and commercial fleets operating on time-sensitive schedules. Battery swapping networks also decouple battery ownership from the vehicle, lowering the upfront cost and enabling flexible subscription-based models.Governments and private operators are collaborating to expand these networks, integrating them into mobility hubs and high-traffic areas. The system addresses range anxiety while promoting efficient energy distribution and battery lifecycle management. With smart tracking and AI integration, operators can monitor usage, battery health, and station performance in real-time. As the model gains traction, it is likely to reshape the electric two-wheeler ecosystem in ASEAN, offering both convenience and operational scalability.

Key Market Players

- Zero Motorcycles Inc.

- Hero Electric Vehicles Pvt. Ltd

- Vmoto Limited

- AIMA Technology Group Co. Ltd

- Dongguan Tailing Electric Vehicle Co. Ltd

- Piaggio & C. SpA

- Ather Energy Pvt. Ltd

- Energica Motor Company

- Honda Motor Co. Ltd

- Gogoro Inc.

Report Scope:

In this report, the ASEAN Electric Two-Wheeler Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:ASEAN Electric Two-Wheeler Market, By Range:

- 50-100 Km

- 101-150 Km

- Less than 50 Km

- Above 150 Km

ASEAN Electric Two-Wheeler Market, By Battery Capacity:

- < 25 Ah

- >25 Ah

ASEAN Electric Two-Wheeler Market, By Battery:

- Lead Acid

- Li-ion

ASEAN Electric Two-Wheeler Market, By Vehicle:

- Scooter/Mopeds

- Motorcycle

ASEAN Electric Two-Wheeler Market, By Country:

- Indonesia

- Vietnam

- Thailand

- Malaysia

- Philippines

- Rest of ASEAN

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the ASEAN Electric Two-Wheeler Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Zero Motorcycles Inc.

- Hero Electric Vehicles Pvt. Ltd

- Vmoto Limited

- AIMA Technology Group Co. Ltd

- Dongguan Tailing Electric Vehicle Co. Ltd

- Piaggio & C. SpA

- Ather Energy Pvt. Ltd

- Energica Motor Company

- Honda Motor Co. Ltd

- Gogoro Inc.

Table Information

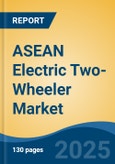

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.07 Billion |

| Forecasted Market Value ( USD | $ 2.23 Billion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |