Intracorporeal Lithotripsy is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The rising global burden of urolithiasis primarily drives the Global Urolithiasis Management Devices Market, with increasing prevalence expanding the patient population needing intervention. Shifting lifestyles, dietary habits, and metabolic disorders contribute to this growing caseload. According to "The global, regional, and national burden of urolithiasis in 204 countries and territories, 2000-2021: a systematic analysis for the Global Burden of Disease Study 2021" via ResearchGate, in November 2024, there were 106 million incident cases of urolithiasis in 2021. This incidence ensures consistent demand for detection, treatment, and prevention instruments, stimulating market growth. The broader urology devices market reflects robust strategic investment; HealthLeaders Media reported in January 2024 that Boston Scientific acquired Axonics for $3.7 billion, underscoring significant financial commitments.Key Market Challenges

The high cost associated with advanced urolithiasis management devices and surgical interventions presents a significant impediment to market growth. This financial burden directly restricts widespread adoption, particularly in developing regions where healthcare budgets are limited and patient out-of-pocket expenses are substantial. The investment required for advanced equipment, such as laser lithotripters and flexible ureteroscopes, can be prohibitive for many healthcare facilities. This limitation curtails the market penetration of innovative solutions, thereby reducing potential sales and usage in areas with a high prevalence of urinary tract calculi.Key Market Trends

The increasing shift of urological procedures to Ambulatory Surgical Centers (ASCs) is a significant trend impacting the global urolithiasis management devices market. This trend is driven by the advantages ASCs offer, such as cost-effectiveness for patients and healthcare systems, shorter waiting times, and a more streamlined patient experience compared to traditional hospital settings.As procedures become less invasive and technological advancements facilitate outpatient care, more complex urological interventions, including certain stone removal procedures, are being safely performed in ASCs. According to a March 2025 report from MedPAC, the volume of ASC surgical procedures per fee-for-service Medicare beneficiary rose by 5.7 percent in 2023. This expansion directly influences device manufacturers to adapt their sales and distribution strategies to cater to the unique procurement and inventory management needs of ASCs, fostering demand for devices optimized for outpatient use.

Key Market Players Profiled:

- Allengers Medical Systems Ltd

- Boston Scientific Corp

- Cook Medical Inc

- CONMED Corp

- DiREX Group

- Dornier MedTech GmbH

- HealthTronics Inc

- Karl Storz SE & Co KG

- Lumenis Inc

- Siemens Healthcare Ltd

Report Scope:

In this report, the Global Urolithiasis Management Devices Market has been segmented into the following categories:By Treatment Type:

- Extracorporeal Shock Wave Lithotripsy (ESWL)

- Intracorporeal Lithotripsy

- Percutaneous Nephrolithotomy

- Others

By End Use:

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Urolithiasis Management Devices Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Allengers Medical Systems Ltd

- Boston Scientific Corp

- Cook Medical Inc

- CONMED Corp

- DiREX Group

- Dornier MedTech GmbH

- HealthTronics Inc

- Karl Storz SE & Co KG

- Lumenis Inc

- Siemens Healthcare Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

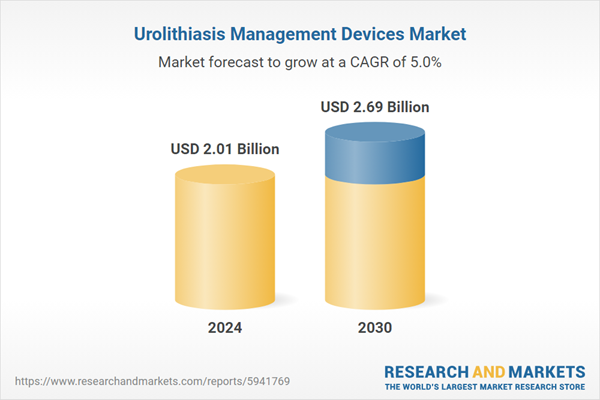

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.01 Billion |

| Forecasted Market Value ( USD | $ 2.69 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |