Specialty Coating Product is the fastest growing segment, Asia-Pacific is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global coating equipment market is significantly influenced by the increased demand stemming from diverse end-use industries. As various manufacturing sectors expand their output and refine product specifications, the necessity for robust and aesthetically pleasing surface treatments escalates. This widespread industrial growth drives the requirement for advanced coating solutions, ranging from protective layers on heavy machinery to decorative finishes on consumer goods, directly impacting the demand for sophisticated application systems.Key Market Challenges

The high initial capital expenditure associated with acquiring and implementing advanced coating systems presents a significant challenge impeding the growth of the Global Coating Equipment Market. This financial barrier primarily impacts smaller enterprises and businesses in developing regions, restricting their capacity to invest in modern, efficient coating technologies. The necessity for substantial upfront investment, often involving complex financing and extended payback periods, creates a deterrent for potential buyers, especially during periods of economic uncertainty.Key Market Trends

The shift towards eco-friendly and low-volatile organic compound (VOC) coating equipment is a significant trend, driven by escalating regulatory pressures and heightened environmental awareness across industries. This focus involves adopting coating solutions that minimize ecological impact through reduced emissions and lower energy usage. Manufacturers are increasingly utilizing waterborne, powder, and UV-curable formulations, which require specialized application machinery. AkzoNobel, in September 2024, launched its Interpon D2525 Low-E powder coatings, capable of cutting energy consumption by as much as 20% during curing or accelerating curing times by up to 25%. This technological advancement supports sustainable practices and requires compatible coating equipment for efficient application and consistent performance.Key Market Players Profiled:

- Nordson Corporation

- Gema Switzerland GmbH

- J. Wagner GmbH

- Anest Iwata Corporation

- Carlisle Companies Inc.

- The Eastwood Company

- Graco Inc.

- Red Line Industries Limited

- Statfield Equipments Pvt. Ltd.

Report Scope:

In this report, the Global Coating Equipment Market has been segmented into the following categories:By Product:

- Speciality Coating Product

- Powder Coating Product

- Liquid Coatings Product

By Application:

- Automotive

- Aerospace

- Construction

- Industrial

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Coating Equipment Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nordson Corporation

- Gema Switzerland GmbH

- J. Wagner GmbH

- Anest Iwata Corporation

- Carlisle Companies Inc.

- The Eastwood Company

- Graco Inc.

- Red Line Industries Limited

- Statfield Equipments Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

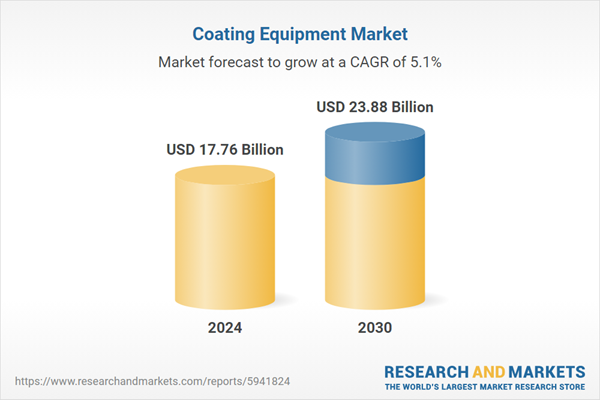

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.76 Billion |

| Forecasted Market Value ( USD | $ 23.88 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |