Heightened awareness of environmental issues, such as plastic pollution and its impact on ecosystems, has increased consumer and regulatory pressure for sustainable alternatives. Consequently, the bio-degradable polymers segment would generate approximately 10.31% share of the market by 2030. Stringent regulations and policies promoting eco-friendly materials in various industries have stimulated the adoption of bio-degradable polymers in thermoformed plastics. Thus, these aspects will pose lucrative growth prospects for the segment.

Thermoforming allows for the creation of packaging solutions with versatile shapes and sizes. This flexibility is crucial, especially when packaging requirements vary across different products. Thermoformed plastics can be molded into various forms, accommodating diverse packaging needs. Thermoformed plastics are lightweight compared to traditional packaging materials like glass or metal. Hence, these factors will boost the demand for the market. Moreover, Thermoforming offers unparalleled design flexibility, allowing manufacturers to create packaging and product components with intricate shapes, contours, and features. This flexibility enables the design of unique and visually appealing packaging that can enhance the overall branding and marketing of products. Thermoformed plastics can be easily customized to incorporate brand-specific elements such as logos, colors, and textures.

However, Thermoformed plastics manufacturers face growing pressure to align with environmental regulations to reduce plastic waste and mitigate the ecological impact of plastic materials. Compliance with these regulations requires a proactive approach, entailing changes in manufacturing processes, material selection, and waste management practices. Adhering to sustainability standards demands substantial investments in research and development to explore and implement innovative, eco-friendly materials and production methods. Thus, these aspects can hamper the growth of the market.

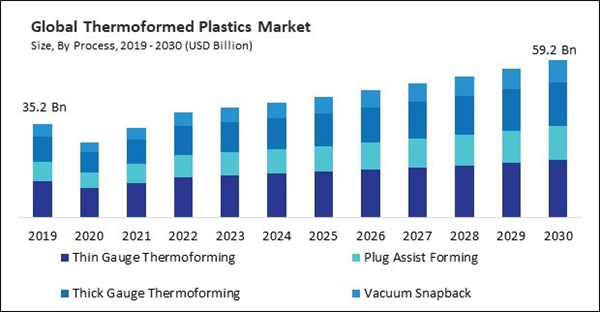

By Process Analysis

On the basis of process, the market is divided into plug assist forming, thick gauge thermoforming, thin gauge thermoforming, and vacuum snapback. The thin gauge thermoforming segment recorded the maximum revenue share in the market in 2022. Thin gauge thermoforming excels in applications where lightweight materials are crucial. Industries such as automotive, aerospace, and electronics, where reducing overall weight is a key consideration for improved fuel efficiency, performance, and portability, have increasingly turned to thin gauge thermoformed plastics. As a result, there will be increased growth in the segment.By Application Analysis

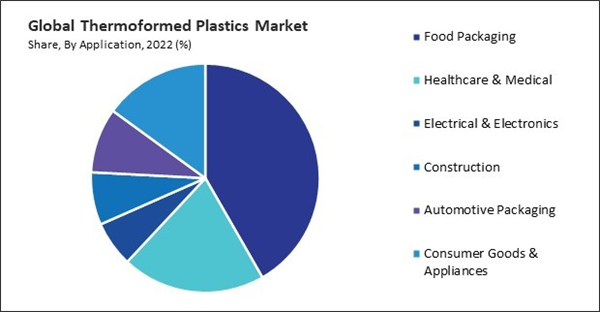

Based on application, the market is divided into healthcare & medical, food packaging, electrical & electronics, automotive packaging, construction, and consumer goods & appliances. The healthcare and medical segment procured a substantial revenue share in the market in 2022. Thermoformed plastics play a crucial role in packaging medical devices and pharmaceutical products. The healthcare industry relies on precise and sterile packaging for medical instruments, and thermoformed plastics provide a versatile solution that meets these requirements. Thus, owing to these factors, the segment will witness increased demand in the upcoming years.By Product Analysis

Based on product, the market is segmented into polymethyl methacrylate (PMMA), bio-degradable polymers, polyethylene (PE), acrylonitrile butadiene styrene (ABS), poly vinyl chloride (PVC), high impact polystyrene (HIPS), polystyrene (PS), and polypropylene (PP). The polypropylene (PP) segment held the largest revenue share in the market in 2022. Polypropylene's versatile properties make it suitable for various thermoforming applications. Its ability to take on complex shapes and its adaptability to different molding processes contribute to its popularity in various industries. One of the key advantages of polypropylene is its cost-effectiveness. Compared to other thermoplastics, PP is often a more economical choice for thermoforming applications, making it attractive to manufacturers aiming for cost-efficient production. Hence, the segment will grow rapidly in the coming years.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured a considerable revenue share in the market in 2022. The Asia Pacific region, comprising countries such as China, India, Japan, and South Korea, has been a focal point for industrialization and economic growth. Rapid urbanization and industrial development in these nations have driven the demand for various plastic products, including those manufactured through thermoforming processes. Thus, these aspects will pose lucrative growth prospects for the segment.Recent Strategies Deployed in the Market

- Dec-2023: Sonoco Products Company has completed the acquisition of Clear Pack Company, a manufacturer of thermoformed and extruded plastic materials and containers. Under this acquisition, Clear Pack will strengthen the position of Sonoco in the consumer products and food service packaging industries.

- Feb-2023: Pactiv Evergreen Inc. has formed a collaboration with Americas Styrenics LLC, a manufacturer of polystyrene in North America. Under this collaboration, Pactiv plans to provide its clients with inventive foam polystyrene packaging solutions. Furthermore, it aims to contribute to the creation of sustainable food merchandising and packaging alternatives, highlighting the practicality of polystyrene foam.

- Dec-2022: Placon Corporation, a manufacturer of thermoformed packaging, has launched the Crystal Seal Cravings product line made with recycled PET material. The product line, crafted from post-consumer recycled PET material and bearing a recycling symbol, will empower the company to achieve its sustainability objectives.

- Sep-2022: Greiner Packaging GmbH has acquired Alpenkräuter Warengesellschaft mbH (ALWAG), a PET flake producer. Through this acquisition of ALWAG, Greiner Packaging will have more locations in Serbia, including one recycling company and two manufacturing bases.

- Oct-2021: Pactiv Evergreen Group Holdings Inc., a subsidiary of Pactiv Evergreen Inc., has acquired Fabri-Kal, a manufacturer of consumer brand and foodservice packaging solutions. Through this acquisition, Fabri-Kal aims to enhance and broaden Pactive Evergreen's standing in the foodservice and consumer packaging industries.

List of Key Companies Profiled

- Pactiv Evergreen Inc. (Reynolds Group Ltd.)

- Genpak, LLC (Great Pacific Enterprises, Inc.)

- Sonoco Products Company

- Brentwood Industries, Inc.

- Hoffmann Neopac AG

- Placon Corporation

- Anchor Packaging LLC

- Greiner Packaging GmbH (Greiner AG)

- Dongguan Ditai Plastic Products Co., Ltd.

- Palram Industries Ltd.

Market Report Segmentation

By Process (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Thin Gauge Thermoforming

- Plug Assist Forming

- Thick Gauge Thermoforming

- Vacuum Snapback

- Food Packaging

- Healthcare & Medical

- Electrical & Electronics

- Construction

- Automotive Packaging

- Consumer Goods & Appliances

- Polypropylene (PP)

- Polymethyl Methacrylate (PMMA)

- Bio-degradable Polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- High Impact Polystyrene (HIPS)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Pactiv Evergreen Inc. (Reynolds Group Ltd.)

- Genpak, LLC (Great Pacific Enterprises, Inc.)

- Sonoco Products Company

- Brentwood Industries, Inc.

- Hoffmann Neopac AG

- Placon Corporation

- Anchor Packaging LLC

- Greiner Packaging GmbH (Greiner AG)

- Dongguan Ditai Plastic Products Co., Ltd.

- Palram Industries Ltd.