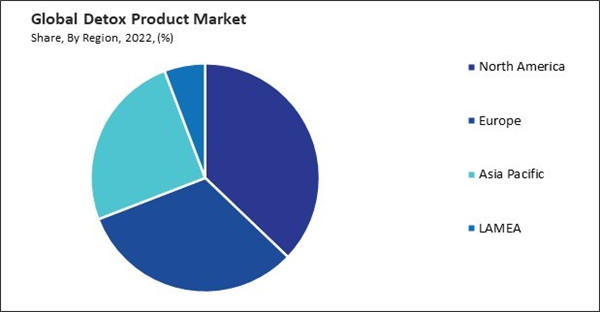

An escalating number of North American consumers are adopting a proactive stance toward preserving their health and wellness. Therefore, the North America region captured $20,269.8 million revenue in the market in 2022. The high obesity rates in Canada can have a significant impact on the market. As obesity rates continue to rise, individuals may increasingly seek solutions to manage their weight, improve their health, and address related health concerns. As per the Government of Canada, about 1 in 4 Canadian adults (26.6%) are currently living with obesity. Obesity rates in Canadian adults are higher in men compared to women (28.0% versus 24.7%, respectively). In rural areas, about 1 in 3 Canadian adults are living with obesity (31.4%). Furthermore, in urban areas, about 1 in 4 Canadian adults are living with obesity (25.6%).

As health consciousness rises, individuals are progressively more inclined to embrace healthier lifestyles and make well-informed decisions regarding their dietary and overall lifestyle choices. Detox products are often perceived as a way to support overall well-being by removing toxins from the body and promoting better health. Many consumers view detoxification as a proactive measure to prevent illness and promote longevity. Customers see it as a way to rid the body of harmful substances and reduce the risk of disease, aligning with the broader trend of preventive healthcare. Additionally, the clean label movement, emphasizing transparency and simplicity in product ingredients, has gained momentum in recent years. Consumers are scrutinizing product labels and seeking products with recognizable, natural ingredients, driving demand for natural and organic products. The potential health hazards linked to synthesized preservatives, additives, and artificial ingredients frequently encountered in processed food and consumer goods elicit apprehension among many consumers. Natural and organic products are considered safer and purer alternatives, free from potentially harmful chemicals. Therefore, the growing interest in natural and organic products drives the market's growth.

However, Consumer resistance and doubt may result from the absence of scientific evidence substantiating the effectiveness and safety of this. Many consumers are increasingly cautious about investing in products that lack credible scientific backing, especially concerning matters related to their health and well-being. Without scientific evidence, some manufacturers of this may resort to making exaggerated or misleading claims about the benefits of their products. This can contribute to consumer confusion and misinformation, leading to unrealistic expectations and potential disappointment with the results of detox regimens. When scientific evidence does not substantiate product claims, scrutiny from regulators, caution letters, and even penalties may ensue. Hence, the lack of scientific evidence is hampering the market's growth.

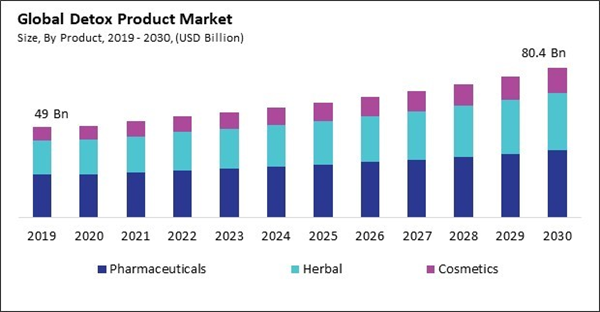

By Products Analysis

Based on product, the market is divided into pharmaceuticals, herbals, and cosmetics. In 2022, the pharmaceuticals segment garnered the highest revenue share in the detox product market. Pharmaceutical-grade detox products undergo rigorous testing and clinical trials, giving consumers confidence in their efficacy and safety compared to non-pharmaceutical alternatives. Healthcare professionals often recommend pharmaceutical-grade detox products due to their proven effectiveness and ability to address specific health concerns, increasing consumer trust and demand.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe region generated a substantial revenue share in the market. European consumers strongly prefer natural, organic, and environmentally friendly products. made from natural and plant-based ingredients are highly sought after, as they align with consumers' sustainability, purity, and environmental responsibility values. Hence, the preference for natural products is propelling the market's growth in the region.List of Key Companies Profiled

- Novartis AG

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- Himalaya Global Holdings Ltd.

- Mallinckrodt PLC

- Daiichi Sankyo Company, Limited

- Sun Pharmaceutical Industries Ltd.

- Bioforce

- Herbalife nutrition Ltd.

- Amway Corporation

Market Report Segmentation

By Product- Pharmaceuticals

- Herbal

- Cosmetics

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Novartis AG

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- Himalaya Global Holdings Ltd.

- Mallinckrodt PLC

- Daiichi Sankyo Company, Limited

- Sun Pharmaceutical Industries Ltd.

- Bioforce

- Herbalife nutrition Ltd.

- Amway Corporation