Adhesive Films Market Growth

Adhesive films are adhesives in the form of films, which adhere to surfaces with the help of heat or pressure. The market can be segmented into resin-type, technology, and end-use. The growth of the adhesive films market is driven by the rising industrialisation in the Asia-Pacific region. Many vendors have been attracted by the easy availability of raw materials, cheap labour, and low transportation costs to set up production facilities in the Asia-Pacific region. Countries like China and India have emerged as global hubs for packaging, construction, automotive, and other industries.It is anticipated that the high population growth and favourable laws laid down by several regional governments in the Asia-Pacific will have a positive effect on the manufacturing sector. For example, the Government of India's Make in India initiative contributes significantly to the expansion of the country’s manufacturing sector, which further aids the growth of the adhesive films industry. With the growing demand from various sectors such as packaging, automotive, electrical and electronics, and construction, the market is expected to witness increased growth over the forecast period. The increasing urban population is a significant trend driving the demand for products such as drugs, drinks, FMCGs, and other consumer products.

Key Trends and Developments

Rising demand for recyclable adhesive films, demand for flexible packaging solutions in the food a sector, and innovations in adhesive film technology are the key trends propelling the market growth.August 2024

Herma is significantly expanding its range of wash-off self-adhesive materials, with the offering of a total of six film and paper products certified with the wash-off adhesive 72Hpw. These wash-off adhesives are crucial for labels, as they enable the effective removal of printing inks during recycling.July 2024

Phytons, a German-based startup, announced the development of a groundbreaking self-adhesive film featuring microstructures designed to reduce glare on photovoltaic (PV) modules. This innovation is expected to enhance the performance of solar panels during peak sunlight hours, thereby increasing energy efficiency and making solar technology more viable. The introduction of such advanced adhesive films aligns with the growing demand for high-performance materials in the renewable energy sector, further driving the adhesive films market.May 2023

Park Aerospace Corp. launched its Aeroadhere FAE-350-1 Structural Film Adhesive, specifically designed for bonding primary and secondary structures in the aerospace sector. This structural adhesive film is poised to meet the stringent demands of the aerospace industry, where weight reduction and durability are critical. As aerospace manufacturers increasingly seek innovative materials to enhance aircraft performance and safety, the demand for advanced adhesive films is expected to rise significantly.August 2022

Toyo-Morton, the largest producer of laminating adhesives in Japan and a part of the Toyo Ink Group, announced the launch of the ECOAD series of polyurethane solvent-free laminating adhesive systems. This new product line is aimed at the food packaging and industrial sectors, particularly in Asia, where solvent-based systems currently prevail.Rising Demand for Eco-Friendly Adhesives

Rising demand for eco-friendly and recyclable adhesive films has led to increased development of biodegradable adhesive films. Power Adhesives has announced the launch of the world's first certified biodegradable hot melt adhesive, known as tecbond 214B. This innovative adhesive is made with 44% biobased materials and is designed to break down naturally when exposed to oxygen, ultraviolet light, and heat, leaving no harmful residues or microplastics, which can boost adhesive films demand. Taghleef Industries, another company, introduced its NATIVIA® films, which are biobased and biodegradable flexible packaging films. These films are designed to support sustainability in the packaging industry by offering alternatives to traditional fossil-based plastics. The growing use of adhesive films in medical and healthcare applications can aid market growth Companies are focusing on developing specialised adhesive films that offer biocompatibility, breathability, and hypoallergenic properties for applications such as surgical drapes, medical tapes, and wound care products.Demand for Flexible Packaging Solutions in the Food and Beverage Sector

Government bodies are implementing regulations such as the Plastic Waste Management Rules and the Extended Producer Responsibility (EPR) framework in countries like India. These policies promote sustainable packaging practices by encouraging manufacturers to adopt recyclable and eco-friendly materials, thereby boosting demand for flexible packaging solutions and eventually adhesive films demand growth that use adhesive films to meet these standards. Moreover, the U.S. government has been promoting sustainable packaging through various initiatives, such as the Save Our Seas 2.0 Act, which aims to reduce plastic waste and improve recycling systems. This act encourages the adoption of eco-friendly packaging materials, including flexible packaging solutions that are recyclable or made from recycled content, especially for the food and beverage sector. Adhesive films are used in the lamination process, which enhances barrier properties, making the packaging resistant to moisture, oxygen, and light, which is essential for preserving food quality and extending shelf life.Rising Use in Healthcare Industry

The trend of using adhesive films in healthcare applications is rapidly gaining momentum, driven by the need for reliable and safe adhesion in medical settings. These films play a crucial role in advanced wound care, where they protect wounds from contaminants while allowing moisture to escape, thereby promoting healing. For instance, silicone-based dressings adhere gently to the skin, reducing trauma during removal. Additionally, the rise of wearable health monitors has increased the demand for adhesive films that securely attach sensors and electrodes to the skin, requiring strong adhesion and hypoallergenic properties for long-term wear. In surgical environments, adhesive films are essential for securing drapes and incise films, maintaining a sterile field and protecting surgical sites from contamination. They are also vital in the assembly of medical devices, ensuring that components remain securely attached during use, such as in insulin pumps. Furthermore, many medical adhesives comply with stringent biocompatibility standards (e.g., ISO 10993), ensuring their safety for direct skin contact. This trend in the adhesive films market represents a significant advancement in modern medical practices.Continuous Innovations in Adhesive Film Technology

Ongoing innovations enhance performance and application and offer opportunities in product formulations and applications. Recent advancements have led to the development of smart adhesive films embedded with sensors and conductive materials. These films are particularly useful in the electronics industry, where they can monitor the performance of devices in real time, providing valuable data for maintenance and optimisation, and contributing to the adhesive films market revenue. Companies like Pontacol AG have introduced thermoplastic adhesive films designed for composite preforms. These films improve the mechanical properties of finished composite parts by providing a reliable bond between fibre-reinforced layers during manufacturing. The films eliminate the need for traditional sewing threads or binders, simplifying the production process and enhancing efficiency. Moreover, companies like Axiom Materials are producing high-performance epoxy film adhesives that offer enhanced peel strength and durability for various applications, including the aerospace and automotive sectors. These adhesives can withstand extreme temperatures and environmental conditions, making them suitable for demanding applications.Adhesive Films Market Trends

The rising use of adhesive films in automotive applications for bonding and assembly can fuel the demand of adhesive films market. The total sales of new vehicles in the USA were around 1,421,551 units in August 2024 with a growth rate of 6% compared to August 2023. Out of which, passenger cars constituted around 266,569 units which can further contribute to the growth of the adhesive films industry as they are used as adhesive and mounting tapes in the manufacture of vehicles.Increasing demand for secure and efficient packaging solutions driven by e-commerce growth. Global e-commerce sales are projected to reach USD 6.09 trillion in 2024, reflecting an 8.4% increase from the previous year. This growth trajectory indicates a robust expansion in online shopping as consumers increasingly turn to digital platforms for their purchasing needs.

Adhesive Films Market Restraints

Fluctuations in the prices of raw materials affect production costs. Stringent regulations regarding environmental and safety standards are affecting the market as there are rising environmental concerns over the disposal and recycling of adhesive films. High competition from alternative adhesives and bonding solutions can affect adhesive films demand forecast. This is due to the saturation in mature markets which leads to slower growth rates.Challenges related to the durability and long-term performance of adhesive films in certain applications fuels the need of improving the performance and eco-friendliness of adhesive films. Need for continuous innovation to meet evolving industry standards and customer requirements can lead to economic downturns which can affect investment and demand in key industries. Furthermore, disruptions in the supply chain impact the availability of raw materials and finished products.

Adhesive Films Industry Segmentation

“Adhesive Films Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Resin Type

- Epoxy

- Cyanate Ester

- Acrylic

- Others

Market Breakup by Technology

- Heat Cured

- Pressure Cured

- EB/UV Cured

Market Breakup by End Use

- Aerospace

- Electrical and Electronics

- Automotive and Transportation

- Consumer Goods

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Adhesive Films Market Share

Market Insights by Resin Type

The epoxy resin is expected to grow at a CAGR of 6.6% in the forecast period. This growth is largely attributed to the rising demand for epoxy adhesives in industries such as automotive, construction, and electronics, which are significant consumers of adhesive films and influence adhesive films market dynamics and trends. Innovations in epoxy resin formulations are enhancing performance characteristics such as temperature resistance, flexibility, and curing times. For instance, developments in two-component epoxy systems provide versatile performance that meets the demanding requirements of various applications. Cyanate ester resins, on the other hand, offer superior thermal stability and are often used in aerospace components. Lastly, acrylic adhesives are commonly used in automotive applications and consumer products due to their good weather resistance and clarity.Market Insights by Technology

EB/UV curing technologies are gaining significant traction and are expected to hold the largest share in the market. The demand for EB/UV cured adhesives is increasing due to their ability to provide faster curing times, higher efficiency, and stronger bonding capabilities compared to traditional curing methods. These adhesives are particularly favoured in industries such as packaging, electronics, and automotive due to their excellent performance under various conditions.Market Insights by End Use

The electrical and electronics sector are expected to exhibit a growth rate of 6.8% between 2025 and 2034 and account for a major adhesive films market share. Rapid innovations in technology, including the Internet of Things (IoT), artificial intelligence (AI), and 5G communications, are fuelling the development of new electronic products. These technologies enhance connectivity and efficiency across various sectors, leading to increased demand for electrical components. In the aerospace sector, the growing demand for advanced materials in aircraft manufacturing is driving the need for high-performance adhesive solutions. Similarly, in automotive industries, the increasing trend toward electric vehicles is boosting the demand for innovative adhesive solutions.Adhesive Films Market Regional Insights

North America Adhesive Films Market Growth

The markets in Canada and USA are expected to grow at a CAGR of 5.7% and 4.9% in the forecast period. The growth of the adhesive films market in the region is driven by the increasing adoption of bio-based thermoplastic adhesive films and advancements in manufacturing technologies that enhance product performance.Companies are focusing on developing innovative adhesive solutions for various applications, including automotive, medical, and electronics sectors. The demand for high-performance adhesive films that can withstand extreme conditions is particularly strong in these industries.

Asia-Pacific Adhesive Films Market Outlook

The Asia-Pacific region holds a significant market share and is expected to grow at a CAGR of 7.8% in the forecast period. The growth in production operations in the Asia-Pacific region will further boost the adhesive films market opportunities. India, China, and Australia markets are expected to exhibit a CAGR of 8.9%, 7.4%, and 5.3% between 2025 and 2034.The aerospace and defence sector in India is expected to reach around USD 70 billion by 2030. The passenger traffic in the country has been growing at 15% per year with the total number of passengers increasing from 70 to 200 million for both domestic and international flights in the past 10 years, which indicates rising demand for airlines. This has consequently boosted the demand for adhesive films such as epoxies which possess superior strength and low density, making them suitable for fillers for bonding composites in the manufacture of aircraft.

Europe Adhesive Films Market Dynamics

Europe is witnessing significant growth in the market due to the increasing demand from the automotive and construction sectors. As per the adhesive films industry analysis, countries like Germany and France are investing heavily in new technologies that enhance the performance of adhesive films used in these applications.European governments are promoting sustainability through regulations that encourage the use of eco-friendly materials. This shift is driving manufacturers to develop biodegradable and recyclable adhesive films, aligning with consumer preferences for sustainable products. The Circular Economy Action Plan (CEAP) is a cornerstone of the European Green Deal aimed at promoting sustainable practices across various industries. It emphasizes the importance of reducing waste and enhancing product sustainability.

Latin America Adhesive Films Market Trends

In Latin America, particularly in Brazil and Argentina, the market is driven by growth in the building and construction sectors. The adhesive films industry revenue in construction applications is expected to rise as infrastructure projects expand. For instance, São Paulo's Rodoanel Mario Covas is a major infrastructure project that aims to create a ring road around São Paulo to improve urban mobility and facilitate the flow of goods. The northern section of the Rodoanel has faced delays but is set to resume construction in 2024, with completion expected by 2026.The automotive industry in Latin America is also a significant contributor to market growth, with rising production rates leading to increased use of adhesive films for lightweighting and structural bonding applications.

Middle East and Africa Adhesive Films Market Drivers

The Middle East is witnessing rapid urbanisation and infrastructure development, particularly in countries like Saudi Arabia, where mega housing projects are boosting demand for adhesive films.In South Africa, government policies aimed at developing manufacturing industries are fostering a conducive environment for the adhesive films demand forecast. The Manufacturing Support Programme (MSP) in the country encourages manufacturers to improve their processes and product quality, which is essential for producing high-performance adhesive films. This includes support for local manufacturers and initiatives to improve production capabilities.

Innovative Startups in Adhesive Films Market

Startups in the adhesive films market are making significant developments by focusing on innovative and specialised applications. For instance, some startups are developing eco-friendly conductive adhesive films designed for the electrical and electronics industries, which provide moisture and heat resistance for flexible printed circuit boards. Some other companies are developing thermal dynamic adhesive coating specifically for 3D printing that enhances adhesion during the printing process while preventing warping.JHC

Founded in 2016, JHC specialises in developing eco-friendly conductive adhesive films for the electrical and electronics industries. Their products are designed to connect electronic components to flexible printed circuit boards (FPCB) and are notable for their moisture and heat resistance.Layerneer

Established in 2017, Layerneer focuses on developing innovative thermal dynamic adhesive coatings for 3D printing applications. Their flagship product, BED WELD, is designed to be applied directly to glass-based printer beds, ensuring that the first layer of the printed object adheres properly and prevents warping.Competitive Landscape

The report presents a detailed analysis of the following key players in the global adhesive films industry, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions. Key players are focusing on technological advancements, including the development of high-performance adhesive films that incorporate smart technologies and eco-friendly materials. Additionally, companies are investing in customisation capabilities to cater to specific industry needs, such as automotive and medical applications.Henkel AG & Co. KGaA

Henkel AG & Co. KGaA is a diversified German company, specialising in consumer and industrial products. It operates through two main business units: Adhesive Technologies, which provides adhesives, sealants, and functional coatings, and Consumer Brands, offering products such as detergents, cleaning agents, fabric softeners, and hair care items.H.B. Fuller Company

H.B. Fuller Company is an American manufacturer of industrial adhesives based in St. Paul, Minnesota. Founded in 1887, the company has grown to become one of the largest adhesives manufacturers globally, with a diverse portfolio that includes over 10,000 adhesive products.3M Company

This is a multinational conglomerate headquartered in Maplewood, Minnesota. The company produces over 60,000 products across various sectors including safety and industrial solutions, healthcare, consumer goods, and electronics.Other major players in the adhesive films market are Arkema [AKE (EPA)], Hexcel Corporation, Solvay S.A, and Toray Advanced Composites (Royal Ten Cate), among others.

Key Price Indicators in the Market for Adhesive Films

- Raw Material Costs: Prices of key raw materials such as polymers and chemicals.

- Production Costs: Expenses related to manufacturing and processing of adhesive films.

- Regulatory Compliance Costs: Costs associated with meeting environmental and safety regulations.

- Distribution Costs: Logistics and transportation expenses for distributing adhesive films can affect adhesive films market expansion.

- Innovation and R&D Costs: Investment in research and development for new product formulations.

- Energy Costs: Energy consumption costs during the production process.

- Labor Costs: Wages and labour costs involved in the manufacturing process.

Table of Contents

Companies Mentioned

The key companies featured in this Adhesive Films market report include:- Henkel AG and Co. KGaA

- HB Fuller Company

- 3M Company

- Arkema S.A

- Hexcel Corporation

- Solvay S.A

- Toray Advanced Composites

Table Information

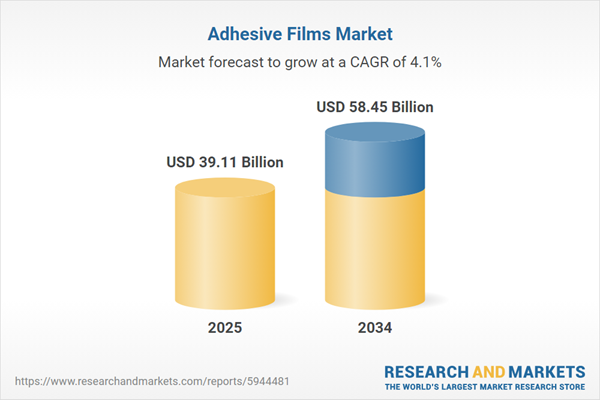

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 39.11 Billion |

| Forecasted Market Value ( USD | $ 58.45 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |