Lactose intolerance and dairy allergies or sensitivities prompt consumers to choose dairy-free alternatives. Non-dairy probiotic beverages provide an accessible and palatable solution for individuals who avoid traditional dairy products. Consequently, the non-dairy segment would generate approximately 19.86 % share of the market by 2030. Food and beverage manufacturers have responded to the demand for non-dairy probiotic options by introducing innovative formulations.

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July 2023, Danone SA has developed Almimama, a probiotic supplement aimed at reducing the incidence of mastitis. Mastitis, affecting approximately one in four mothers, leads to symptoms such as flu-like symptoms, breast pain, skin rashes, fever, and breast engorgement due to inflammation in the breast. In March 2023, BioGaia AB introduced Aldermis, its own cosmetic probiotic product. Aldermis addresses dry and sensitive skin, offering a multi-purpose skin ointment containing BioGaia's patented bacteria strain L. reuteri DSM 17938. Additionally, this strain is among the most scientifically proven probiotic strains globally, renowned for its efficacy and safety.

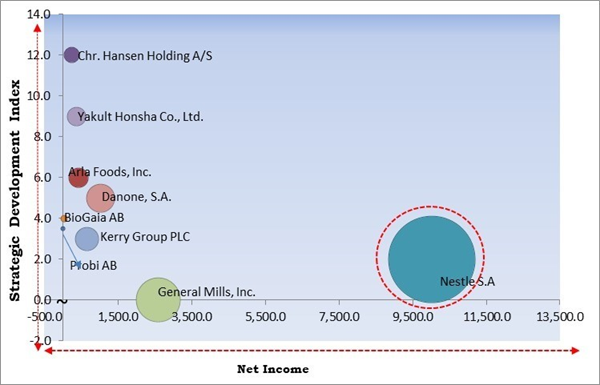

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Nestle S.A are the forerunners in the Market. In October, 2023, Nestle SA introduced a novel proprietary blend for infant nutrition, which combines a probiotic strain with different levels of six human milk oligosaccharides (HMOs). This blend is designed to support the developing infant throughout various stages of life. And Companies such as General Mills, Inc. Danone, S.A., and Kerry Group PLC are some of the key innovators in Market.Market Growth Factors

Consumers are becoming more proactive in managing their health and are increasingly adopting preventive healthcare measures. The understanding that a healthy gut is linked to overall well-being has led to a surge in the demand for products that can positively impact digestive health. Thus, these aspects will boost the demand for probiotics in the coming years.Functional foods and beverages with added probiotics are seen as a way to address specific health concerns, focusing on improving digestive health. Awareness of the intricate relationship between gut health and the immune system drives consumers to seek products that support both aspects actively. Hence, these factors will assist in the growth of the market.

Market Restraining Factors

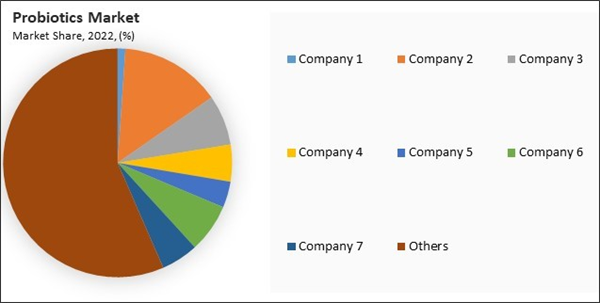

Probiotic products are subject to specific labelling regulations that require accurate and transparent information. Companies need to provide clear details about the probiotic strains present, viable cell counts, and any other relevant information. Ensuring compliance with these labelling requirements can be intricate, and inaccuracies or non-compliance can lead to regulatory issues. Thus, these factors will restrain the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.h2 class="report-highlight">By Ingredient Analysis

Based on ingredients, the market is segmented into bacteria and yeast. In 2022, the yeast segment garnered a 16.23 % revenue share in the market. Certain yeast strains, particularly Saccharomyces boulardii, have been associated with promoting digestive health. Studies suggested that Saccharomyces boulardii may help address antibiotic-associated diarrhea and irritable bowel syndrome (IBS). This added functionality appealed to consumers seeking probiotic products for digestive health and overall immune support. Thus, these aspects will boost the demand in the segment.

By Probiotic Food & Beverages Analysis

The probiotic food and beverages segment is divided into dairy products, non-dairy, baked food, cereals, fermented meat, and others. The dairy products segment recorded the 39.21 % revenue share in the market in 2022. Yogurt has been a traditional carrier of probiotics, and its popularity has continued to grow. Probiotic yogurts, which contain live and active cultures, are widely consumed for potential health benefits, especially for gut health. Yogurt's taste, texture, and versatility make it a preferred choice for incorporating probiotics into the diet. Thus, these aspects will lead to increased growth in the segment.By Product Analysis

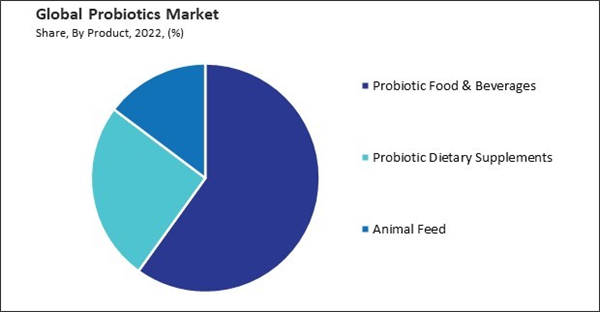

On the basis of product, the market is divided into probiotic food & beverages, probiotic dietary supplements, and animal feed. The probiotics food and beverages segment recorded the 59.92 % revenue share in the market in 2022. Food and beverage manufacturers continually innovate to introduce new probiotic products that cater to diverse consumer preferences. This includes developing probiotic-enhanced products beyond traditional dairy items to include a broader range of functional foods and beverages. These aspects will fuel the demand in the segment.By End-Use Analysis

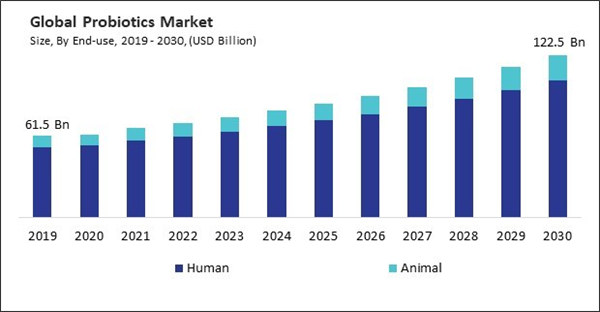

Based on end-use, the market is divided into human and animal. In 2022, the animal segment witnessed a 14.07 % revenue share in the market. Probiotics play a crucial role in maintaining a balanced gut microbiome in animals. A healthy gut microbiota is associated with improved nutrient utilization, reduced risk of digestive disorders, and enhanced resilience to stressors. Probiotics offer a natural and sustainable approach to support animal health without relying heavily on antibiotics. Thus, these aspects will boost the demand in the segment.By Distribution Channel Analysis

On the basis of distribution channel, the market is divided into hypermarkets/supermarkets, specialty stores, pharmacies/drugstores, online stores, and others. The hypermarkets/supermarkets segment recorded the 35.14 % revenue share in the market in 2022. Hence, these factors will help in the growth of the segment. The presence of probiotic products in these retail outlets ensures that a wide range of consumers can easily access and purchase these products during their routine grocery shopping. Hence, these aspects can lead to increased growth in the segment.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired a 27.36 % revenue share in the market. Europe has been experiencing a growing awareness among consumers regarding the importance of maintaining a healthy lifestyle. Products like yogurt, kefir, and other fermented foods containing probiotics have gained popularity. Thus, these aspects will lead to increased demand in the coming years.Recent Strategies Deployed in the Market

- Oct-2023: Nestle SA has introduced a novel proprietary blend for infant nutrition, which combines a probiotic strain with different levels of six human milk oligosaccharides (HMOs). This blend is designed to support the developing infant throughout various stages of life.

- Oct-2023: Lallemand Health Solutions, apart of Lallemand Inc., announced the acquisition of Dietary Pros Inc., a full-service contract manufacturer. The company stated its pride in acquiring Dietary Pros, a leading contract manufacturer specializing in formulating probiotic solutions for the supplement and nutraceutical sectors.

- Mar-2023: BioGaia AB introduced Aldermis, its own cosmetic probiotic product. Aldermis addresses dry and sensitive skin, offering a multi-purpose skin ointment containing BioGaia's patented bacteria strain L. reuteri DSM 17938. Additionally, this strain is among the most scientifically proven probiotic strains globally, renowned for its efficacy and safety.

- Jul-2023: Danone SA has developed Almimama, a probiotic supplement aimed at reducing the incidence of mastitis. Mastitis, affecting approximately one in four mothers, leads to symptoms such as flu-like symptoms, breast pain, skin rashes, fever, and breast engorgement due to inflammation in the breast.

- Jul-2023: Yakult Honsha Co. Ltd. announced plans to construct a factory in the U.S. state of Georgia, aiming to boost its international sales. The company will invest $305 million in the facility located in the southeastern U.S., expected to commence operations in 2026. This marks Yakult's second U.S. plant following its first in California, which opened in 2014. The Georgia plant is envisioned to play a pivotal role in establishing a nationwide supply network.

List of Key Companies Profiled

- Chr.Hansen Holding A/S

- General Mills, Inc.

- Yakult Honsha Co. Ltd.

- Nestle S.A.

- Danone SA

- Probi

- Arla Foods, Inc.

- Lallemand Inc.

- Kerry

- BioGaia AB

Market Report Segmentation

By Ingredient- Bacteria

- Yeast

- Probiotic Food & Beverages

- Dairy Products

- Non-Dairy

- Cereals

- Baked Food

- Fermented Meat

- Others

- Probiotic Dietary Supplements

- Animal Feed

- Human

- Animal

- Hypermarkets / Supermarkets

- Specialty Stores

- Pharmacies / Drugstores

- Online Stores

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Chr. Hansen Holding A/S

- General Mills, Inc.

- Yakult Honsha Co. Ltd.

- Nestle S.A.

- Danone SA

- Probi

- Arla Foods, Inc.

- Lallemand Inc.

- Kerry

- BioGaia AB