Speak directly to the analyst to clarify any post sales queries you may have.

MARKET TRENDS & OPPORTUNITIES

Growing Demand for Compact Storage Solutions

The rise of smaller and more specialized tools also contributes to the demand for compact storage. As technology advances, tools are becoming more compact without sacrificing functionality. Compact tool storage products are designed to accommodate these smaller tools, providing tailored compartments and secure spaces to keep them organized and protected. For instance, the PACKOUT™ compact toolbox by Milwaukee offers the most durable and versatile storage system. The PACKOUT™ Compact toolbox is constructed with impact-resistant polymers and features a 75-lb weight capacity. This portable toolbox is easily transported with its carry handle and reinforced hinges. Its modular storage allows a customized storage system for easy transportation and organization of tools and accessories.Rising DIY Activities

DIY activities are considered a significant hobby in France, Germany, Italy, and the UK. This trend has also gained traction in developing economies such as India, Brazil, and South Africa. Residential consumers often take on repair and enhancement projects that enhance their skills and prove cost-effective. Tool storage devices facilitate the transport and storage of tools and are suitable for several activities, such as gardening, repair and maintenance, and home improvement. The use of storage boxes and bags increases work efficiency. Furthermore, keeping equipment and tools in the proper order or conveniently can save significant time and energy. As a result, tool storage and toolkits are in high demand for home improvement applications, thereby surging the tool storage products market expansion.SEGMENTATION INSIGHTS

INSIGHTS BY CATEGORY TYPE

The global tool storage products market by category type is segmented into stationary and portable. The stationary products segment held the most prominent share of the industry in 2023. The stationary products segment is constructed from durable materials such as steel; these cabinets often feature locking mechanisms to secure valuable tools. The demand for stationary tool storage is mainly due to significant usage by large manufacturing industries such as automotive, oil & gas, and mining, among others. They are also used in DIY activities, as most vendors offer user-friendly tool storage products for convenient and efficient tool storage solutions.Segmentation by Category Type

- Stationary

- Portable

INSIGHTS BY PRODUCT TYPE

The global tool storage products market by product type is segmented into toolboxes, tool pushcarts, chests & cabinets, bags, belts & pouches, and other tool storage products. In 2023, the toolbox segment dominated the market as they are extensively utilized and available in various materials, including wood, steel, and metal. Steel toolboxes are popular because of their robustness and provide heightened security. The increasing demand for toolboxes across various automotive, construction, and manufacturing industries is a major driving factor for segmental growth. Further, expanding the construction industry in emerging economies such as India and China is anticipated to boost the sales of toolboxes in the Asia Pacific region. The heightened demand for residential buildings is a crucial driver behind the construction sector's growth. Thus, this expansion has led to an increased workforce in construction, consequently raising a surge in the demand for toolboxes in the APAC region.Segmentation by Product Type

- Toolboxes

- Tool Pushcart

- Chest & Cabinets

- Bags, Belts & Pouches

- Other Tool Storage Products

INSIGHTS BY MATERIAL

The global tool storage products market by material is segmented into steel, plastic, wood, and other materials. The steel segment is the largest segment of the market; it accounted for over 30% of the total market share in 2023. The demand for steel storage solutions is rising due to several factors that reflect the evolving needs of industries and businesses. One of the leading factors is its robust and durable nature, making it an ideal solution for storing tools in manufacturing facilities. Further, they are versatile and come in various forms, such as shelving units, cabinet racks, and pellets. This versatility allows manufacturing facilities and other industries to choose storage options that meet their requirements for small parts organization or bulk storage. However, the plastic segment is growing at a high CAGR due to its convenience, cost-effectiveness, and quick-solution nature in storing equipment for everyday use. Due to the increased prevalence of house ownership, customers often seek storage alternatives that make organizing and transferring equipment easier.Segmentation by Material

- Steel

- Plastic

- Wood

- Other Materials

INSIGHTS BY APPLICATION

The global tool storage products market is segmented into professional and consumer grades based on application. The professional grade dominated the market in 2023, owing to its durability and security. These products are engineered with heavy-duty materials, often utilizing high-quality steel or reinforced plastics, ensuring they can withstand the rigors of demanding work environments. Additionally, innovation and technology integration further distinguish professional-grade tool storage products. Some models feature built-in power strips, USB ports, or connectivity options, enabling professionals to charge their tools or connect electronic devices directly within the storage unit. Technology integration enhances the storage solution's functionality and convenience, catering to modern professionals' evolving needs.Segmentation by Application

- Professional Grade

- Consumer Grade

INSIGHTS BY DISTRIBUTION CHANNEL

The offline distribution channel dominated the global tool storage products market in 2023. The preference for offline channels remains high to minimize the risk of receiving damaged products since tool storage products involve high costs. Popularity in areas that lack connectivity and high consumer trust is associated with experiencing the quality of products driving the growth of this segment. However, the online channel holds a relatively lower global tool storage products market share but is expected to grow at the highest during the forecast period. The proliferation of e-commerce and a rise in the awareness of the benefits of online purchases, such as heavy discounts, occasional offers, and convenience, drive the growth of the online segment.Segmentation by Distribution Channel

- Offline

- Online

GEOGRAPHICAL ANALYSIS

North America claimed the largest share and is expected to maintain its dominance in the global tool storage products market, valued at over USD 617 million in 2023. The large market share can be attributed to the early adoption of advanced technologies in the U.S. and Canada, ongoing investments in the construction sector, and the widespread presence of major manufacturers in the region. Moreover, the region’s increasing aerospace and industrial activities support the demand for several tool storage products. Furthermore, manufacturers' substantial research and development investments to introduce innovative and more efficient products will likely open up new opportunities, leading to significant growth in the market during the forecast period.Segmentation by Geography

- North America

- Europe

- APAC

- Latin America

- Middle East & Africa

COMPETITIVE LANDSCAPE

The global tool storage products market is highly competitive, with many vendors. The rapid technological changes adversely impact market vendors as consumers increasingly expect continuous innovations and upgrades to existing products. The present scenario drives vendors to alter and refine their unique value propositions to achieve a stronger market presence. Some global tool storage products market vendors are Stanley Black & Decker, Apex Tools Group (JOBOX), Kennedy MFG, Techtronics Industries, Macto Tools Corporation, and others. The presence of diversified global and regional vendors characterizes the market. Many vendors enhance several product features by using lightweight and compact materials. Such initiatives will likely enable vendors to gain a competitive edge over other vendors in the market. Further, as international players continue expanding their footprint in the global tool storage products market, regional vendors will likely find competing with global players increasingly difficult. The competition will be solely based on quality, materials, and price. The market competition is expected to intensify further with the rising frequency of product extensions, technological innovations, and mergers & acquisitions.Key Company Profiles

- Stanley Black & Decker

- Apex Tool Group (JOBOX)

Other Prominent Vendors

- Kennedy Manufacturing

- Techtronic Industries (TTI)

- Emerson Electric Co.

- Rubbermaid Commercial Products

- Vertex Engineering Works

- STAHLWILLE Eduard Wille GmbH & Co. KG

- Uline

- Matco Tools Corporation

- SHUTER Enterprise Co. Ltd.

- Machan International Co., Ltd.

- Hänel Storage Systems

- GT Line

- FACOM

- Bull Metal Products, Inc.

- Akro-Mils

- EliteToolboxes

- Boxo USA

- New Pig Corporation

- KNIPEX

- Montezuma

- Paxshell Private Limited

- Eastman Group

KEY QUESTIONS ANSWERED

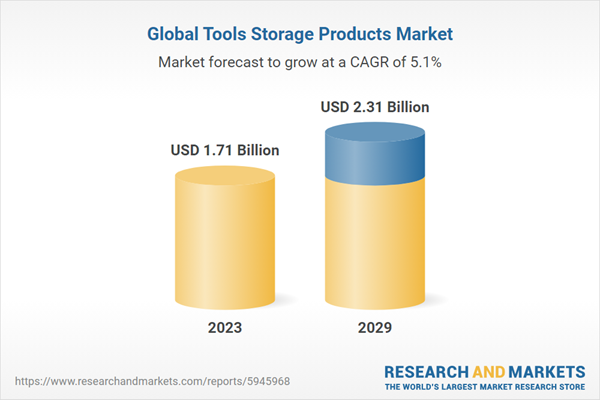

1. How big is the tool storage products market?2. What is the growth rate of the global tool storage products market?

3. Which region dominates the global tool storage products market share?

4. What are the significant trends in the tool storage products industry?

5. Who are the key players in the global tool storage products market?

Table of Contents

Companies Mentioned

- Stanley Black & Decker

- Apex Tool Group (JOBOX)

- Kennedy Manufacturing

- Techtronic Industries (TTI)

- Emerson Electric Co.

- Rubbermaid Commercial Products

- Vertex Engineering Works

- STAHLWILLE Eduard Wille GmbH & Co. KG

- Uline

- Matco Tools Corporation

- SHUTER Enterprise Co. Ltd.

- Machan International Co., Ltd.

- Hänel Storage Systems

- GT Line

- FACOM

- Bull Metal Products, Inc.

- Akro-Mils

- EliteToolboxes

- Boxo USA

- New Pig Corporation

- KNIPEX

- Montezuma

- Paxshell Private Limited

- Eastman Group

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | March 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.71 Billion |

| Forecasted Market Value ( USD | $ 2.31 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |