Biopesticides Market Analysis:

- Major Market Drivers: Key market drivers include the rising consumer demand for organic and chemical-free food which has pushed farmers to adopt more sustainable pest control methods. Stricter regulations on synthetic pesticides across the world are also promoting the use of biopesticides as an eco-friendly alternative. Significant advancements in microbial and botanical formulations have improved their efficacy making them more viable for commercial agriculture. In line with this, growing awareness of environmental sustainability and the need to reduce chemical residues in food products are further boosting the market’s expansion.

- Key Market Trends: Key market trends include the growing adoption of organic farming and sustainable agriculture mainly driven by consumer demand for chemical-free produce. Technological innovations in microbial and botanical formulations are expanding their efficacy and use in integrated pest management systems. Regulatory support for reducing synthetic pesticide use is also fueling the market. In addition to this, the expansion of biopesticide applications in emerging regions along with rising investments in research and development (R&D) are boosting market growth. These trends highlight a strong shift toward eco-friendly and effective pest control solutions.

- Geographical Trends: Geographical trends in the market show significant growth across several regions. North America leads the market due to high adoption of organic farming and stringent regulations on synthetic pesticides. Europe follows by closely, driven by environmental awareness and regulatory support for sustainable agriculture. The Asia-Pacific region is experiencing rapid growth, fueled by increasing agricultural activities, demand for organic produce and expanding awareness of sustainable farming practices. Latin America is also emerging as a key region, with rising adoption of biopesticides in response to export demands for chemical-free crops and sustainable farming initiatives.

- Competitive Landscape: Some of the major market players in the biopesticides industry include BASF, Bayer AG, Certis USA LLC, FMC Corporation, Isagro, Koppert Biological Systems, Marrone Bio Innovations, Novozymes Biologicals, Stockton (Israel) Ltd., Syngenta Crop Protection AG, The Dow Chemical Company, Valent BioSciences LLC., among many others.

- Challenges and Opportunities: The market faces various challenges including limited shelf life, slower action compared to chemical pesticides and higher production costs, which can hinder widespread adoption. In line with this, the lack of awareness among farmers in certain regions and the need for specific environmental conditions pose obstacles. However, opportunities abound as demand for organic produce and sustainable farming rises, driven by consumer preferences and regulatory pressures. Technological advancements, particularly in microbial formulations, and government support for eco-friendly agriculture offer significant potential for growth, especially in emerging markets like Asia-Pacific and Latin America.

Biopesticides Market Trends:

Increased Investments in Research and Development

Increased investments in research and development (R&D) are driving the growth of biopesticides by fostering the creation of new products with broader applications and enhanced pest control efficacy. These R&D efforts focus on identifying new microbial strains, improving product formulations, and expanding the spectrum of pests that biopesticides can effectively target. Additionally, advancements in bioengineering and computational biology are accelerating the discovery process, allowing for more efficient solutions tailored to specific agricultural needs. This surge in R&D is pivotal in addressing the growing demand for sustainable and environmentally friendly crop protection methods. Increased R&D investments are one of the key biopesticides market growth drivers, as they are fostering innovation in new products and technologies that offer broader pest control and enhanced efficacy. For instance, in April 2024, Syngenta and Lavie Bio announced their partnership to accelerate biopesticide R&D, aiming to reduce the time it takes to bring new solutions to the market. Lavie Bio's computational system allows for faster discovery and development of microbial strains, potentially shortening the process by 2-3 years. The partnership seeks to address the increasing demand for innovative biocontrol solutions in different geographies and crops while also emphasizing the integration of biologicals and chemicals for more efficient pest management.Rising Adoption of Organic Farming

The growing consumer demand for organic, chemical-free produce is significantly boosting the adoption of biopesticides in agriculture. As more consumers seek healthier food options, farmers are turning to biopesticides to meet this demand while maintaining crop yields. Biopesticides, derived from natural organisms, are essential for organic farming as they offer effective pest control without harmful chemical residues. This trend is further driven by stricter regulations on synthetic pesticides and the rising awareness of sustainable farming practices, making biopesticides a critical tool for organic growers worldwide. These factors, including consumer preferences, regulatory pressures, and sustainable practices, are creating significant business opportunities in the biopesticides market. For instance, in July 2024, India and Taiwan implemented a mutual recognition agreement (MRA) to streamline the trade of organic agricultural products. The MRA will eliminate the need for dual certifications, significantly reducing compliance costs. This will open up export opportunities for products such as rice, processed food, tea, and medicinal plants from India to Taiwan and vice versa. The MRA is expected to boost trade in the organic sector and is facilitated by India's APEDA and Taiwan's agriculture and food agency.Technological Advancements

Technological advancements in microbial and botanical biopesticide formulations are improving their effectiveness in pest control and promoting wider adoption in integrated pest management (IPM) systems. Innovations focus on enhancing stability, targeting specific pests, and ensuring faster action under various environmental conditions. These advancements allow for better compatibility with other agricultural inputs, improving overall crop protection strategies. Additionally, bioengineering techniques are enabling the development of more efficient microbial strains and plant-based solutions, making biopesticides a more viable, eco-friendly alternative to conventional chemical pesticides. This progress is driving increased acceptance among farmers globally. For instance, in November 2023, Renaissance BioScience and Certis Belchim entered a partnership to develop an innovative biopesticide using RNAi technology. The collaboration aims to create an environmentally friendly solution for a major agricultural pest through Renaissance's yeast-based RNA interference platform. Both companies are committed to advancing eco-friendly alternatives in pest management.Biopesticides Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, formulation, source, mode of application, and crop type.Breakup by Product:

- Bioherbicides

- Bioinsecticides

- Biofungicides

- Others

Bioinsecticides accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes bioherbicides, bioinsecticides, biofungicides, and others. According to the report, bioinsecticides represented the largest segment.According to biopesticides market report, bioinsecticides hold a dominant share in the market due to their effectiveness in pest management and their eco-friendly nature. Derived from natural organisms such as bacteria, fungi, and plants, bioinsecticides target specific pests without harming non-target species or the environment. The increasing demand for sustainable agricultural practices, stricter regulations on chemical pesticides, and growing consumer preference for organic products have fueled their adoption. Bioinsecticides are particularly favored for their ability to combat pests without contributing to chemical resistance, making them a key component in integrated pest management systems across global agriculture.

Breakup by Formulation:

- Liquid

- Dry

Liquid holds the largest share of the industry

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes liquid and dry. According to the report, liquid represented the largest segment.Liquid biopesticides hold the largest share of the biopesticides industry due to their ease of application, versatility, and effectiveness in pest control. Liquid formulations can be applied directly to crops via spraying, allowing for better coverage and faster action against pests and diseases. These biopesticides are often more stable and can be mixed with other agricultural inputs, making them convenient for farmers. Additionally, their suitability for use in various farming practices, including conventional and organic systems, has increased their demand. The growing preference for sustainable agriculture and the shift away from chemical pesticides further support the dominance of liquid biopesticides. For instance, in May 2023, the Minister for Cooperation, Minister for Rural Development, and Minister for Food inaugurated the liquid biopesticide, biofertilizer, and micronutrient mixture production units in Eriyode, Dindigul, India. These units, operated by the Tamil Nadu Cooperative Marketing Federation Limited, were set up at a cost of ₹1.25 crore and ₹50 lakh, with the capacity to produce 50,000 liters of biopesticide and biofertilizer per year and 2,000 metric tonnes of micronutrient mixture per year. These initiatives and investments in production capacity are creating a positive biopesticides market outlook, driving growth and encouraging further adoption of sustainable agricultural practices globally.

Breakup by Source:

- Microbials

- Plant Extract

- Biochemicals

Microbials represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the source. This includes microbials, plant extracts, and biochemicals. According to the report, microbials represented the largest segment.Microbials represent the leading segment of the biopesticides market due to their proven efficacy, environmental safety, and target-specific action. Comprising bacteria, fungi, viruses, and protozoa, microbial biopesticides offer natural solutions for pest control without harming non-target organisms, making them ideal for sustainable agriculture. These biopesticides are particularly effective against a wide range of pests and diseases, reducing the need for chemical pesticides. Increased demand for organic produce and the shift toward environmentally friendly farming practices have further bolstered the adoption of microbial biopesticides. Their role in integrated pest management systems also contributes to their dominance in the market. According to the biopesticides market forecast, the microbial segment is projected to expand significantly, fueled by growing demand for organic farming solutions and innovations in microbial pest control technologies.

Breakup by Mode of Application:

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Post-Harvest

Foliar spray exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the mode of application have also been provided in the report. This includes foliar spray, seed treatment, soil treatment, and post-harvest. According to the report, foliar spray represented the largest segment.Foliar spray holds a dominant position in the biopesticides market due to its efficiency in delivering active ingredients directly to the target areas of plants. This method allows for rapid absorption of biopesticides through the leaves, providing immediate protection against pests and diseases. Foliar sprays are especially favored in managing pest infestations and fungal outbreaks as they ensure even distribution and quicker action. The ease of application and compatibility with existing farming practices further enhance its popularity among farmers. According to biopesticides industry overview, the increasing adoption of precision agriculture and advanced spraying technologies has further boosted the use of foliar spray methods, making them the preferred choice for many farmers. Additionally, foliar spray minimizes wastage as compared to soil application and is effective in a wide range of crops, contributing to its widespread use. The growing demand for sustainable agricultural practices has reinforced the dominance of foliar spray in the biopesticides market.

Breakup by Crop Type:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

Fruits and Vegetables dominates the market

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals and grains, oilseeds and pulses, fruits and vegetables, and others. According to the report, fruits and vegetables represented the largest segment.Fruits and vegetables dominate the biopesticides market due to their high susceptibility to pests and diseases, which drives demand for sustainable crop protection solutions. Biopesticides are increasingly used in fruit and vegetable cultivation because they offer environmentally friendly, residue-free pest control, meeting the rising consumer demand for organic and chemical-free produce. The growing focus on organic farming and sustainable agriculture is driving the biopesticides demand. This trend is further supported by increasing consumer awareness of food safety and environmental concerns. Additionally, regulatory restrictions on synthetic pesticides have further propelled the adoption of biopesticides in this segment. Farmers prefer biopesticides for fruits and vegetables as they reduce the risk of resistance in pests and ensure compliance with stringent food safety standards, contributing to the segment's leading position in the market.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest biopesticides market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for biopesticides.North America leads the biopesticides market, accounting for the largest market share due to several key factors. The region's strong focus on sustainable agriculture and the increasing adoption of organic farming practices have significantly boosted the demand for biopesticides. Additionally, stringent regulations on the use of chemical pesticides, combined with growing consumer awareness regarding the environmental and health impacts of synthetic chemicals, have accelerated the shift toward biopesticides. The presence of major biopesticide manufacturers and ongoing research and development in biological crop protection solutions also contribute to North America's dominance in the global biopesticides market. For instance, in December 2023, the US EPA registered the world's first sprayable dsRNA biopesticide, Ledprona, developed by Greenlight Biosciences. This biopesticide targets the Colorado potato beetle and is based on RNA interference technology. Ledprona is a safer alternative to chemical-based pesticides, providing an effective tool for farmers while addressing the challenges of climate change and resistance management.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the biopesticides industry include BASF, Bayer AG, Certis USA LLC, FMC Corporation, Isagro, Koppert Biological Systems, Marrone Bio Innovations, Novozymes Biologicals, Stockton (Israel) Ltd., Syngenta Crop Protection AG, The Dow Chemical Company, Valent BioSciences LLC., etc.

- The biopesticides market is highly competitive, driven by growing demand for sustainable and eco-friendly pest control solutions. Numerous players, ranging from established firms to innovative startups, are competing by offering diverse product portfolios that cater to various agricultural needs. Biopesticides companies are focusing on product innovation, targeting specific pests, and improving formulation technologies to enhance efficacy and ease of application. The competition is further intensified by regulatory pressures favoring biopesticides over chemical alternatives, leading to increased investments in research and development. Market participants are also exploring partnerships and acquisitions to strengthen their market presence and expand their global reach.

Key Questions Answered in This Report

1. What is the market size for the global biopesticides market?2. What is the global biopesticides market growth?

3. What are the global biopesticides market drivers?

4. What are the key industry trends in the global biopesticides market?

5. What is the impact of COVID-19 on the global biopesticides market?

6. What is the global biopesticides market breakup by product?

7. What is the global biopesticides market breakup by formulation?

8. What is the global biopesticides market breakup by source?

9. What is the global biopesticides market breakup by mode of application?

10. What is the global biopesticides market breakup by crop type?

11. What are the major regions in the global biopesticides market?

12. Who are the key companies/players in the global biopesticides market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Biopesticides Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Product

6.1 Bioherbicides

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Bioinsecticides

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Biofungicides

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Others

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by Formulation

7.1 Liquid

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Dry

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by Source

8.1 Microbials

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Plant Extracts

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Biochemicals

8.3.1 Market Trends

8.3.2 Market Forecast

9 Market Breakup by Mode of Application

9.1 Foliar Spray

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Seed Treatment

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Soil Treatment

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Post-Harvest

9.4.1 Market Trends

9.4.2 Market Forecast

10 Market Breakup by Crop Type

10.1 Cereals and Grains

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Oilseeds and Pulses

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Fruits and Vegetables

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Others

10.4.1 Market Trends

10.4.2 Market Forecast

11 Market Breakup by Region

11.1 North America

11.1.1 United States

11.1.1.1 Market Trends

11.1.1.2 Market Forecast

11.1.2 Canada

11.1.2.1 Market Trends

11.1.2.2 Market Forecast

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Market Trends

11.2.1.2 Market Forecast

11.2.2 Japan

11.2.2.1 Market Trends

11.2.2.2 Market Forecast

11.2.3 India

11.2.3.1 Market Trends

11.2.3.2 Market Forecast

11.2.4 South Korea

11.2.4.1 Market Trends

11.2.4.2 Market Forecast

11.2.5 Australia

11.2.5.1 Market Trends

11.2.5.2 Market Forecast

11.2.6 Indonesia

11.2.6.1 Market Trends

11.2.6.2 Market Forecast

11.2.7 Others

11.2.7.1 Market Trends

11.2.7.2 Market Forecast

11.3 Europe

11.3.1 Germany

11.3.1.1 Market Trends

11.3.1.2 Market Forecast

11.3.2 France

11.3.2.1 Market Trends

11.3.2.2 Market Forecast

11.3.3 United Kingdom

11.3.3.1 Market Trends

11.3.3.2 Market Forecast

11.3.4 Italy

11.3.4.1 Market Trends

11.3.4.2 Market Forecast

11.3.5 Spain

11.3.5.1 Market Trends

11.3.5.2 Market Forecast

11.3.6 Russia

11.3.6.1 Market Trends

11.3.6.2 Market Forecast

11.3.7 Others

11.3.7.1 Market Trends

11.3.7.2 Market Forecast

11.4 Latin America

11.4.1 Brazil

11.4.1.1 Market Trends

11.4.1.2 Market Forecast

11.4.2 Mexico

11.4.2.1 Market Trends

11.4.2.2 Market Forecast

11.4.3 Others

11.4.3.1 Market Trends

11.4.3.2 Market Forecast

11.5 Middle East and Africa

11.5.1 Market Trends

11.5.2 Market Breakup by Country

11.5.3 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porters Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Indicators

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 BASF

16.3.1.1 Company Overview

16.3.1.2 Product Portfolio

16.3.1.3 Financials

16.3.1.4 SWOT Analysis

16.3.2 Bayer AG

16.3.2.1 Company Overview

16.3.2.2 Product Portfolio

16.3.2.3 Financials

16.3.2.4 SWOT Analysis

16.3.3 Certis USA LLC

16.3.3.1 Company Overview

16.3.3.2 Product Portfolio

16.3.4 FMC Corporation

16.3.4.1 Company Overview

16.3.4.2 Product Portfolio

16.3.4.3 Financials

16.3.4.4 SWOT Analysis

16.3.5 Isagro

16.3.5.1 Company Overview

16.3.5.2 Product Portfolio

16.3.5.3 Financials

16.3.6 Koppert Biological Systems

16.3.6.1 Company Overview

16.3.6.2 Product Portfolio

16.3.7 Marrone Bio Innovations

16.3.7.1 Company Overview

16.3.7.2 Product Portfolio

16.3.7.3 Financials

16.3.8 Novozymes Biologicals

16.3.8.1 Company Overview

16.3.8.2 Product Portfolio

16.3.9 Stockton (Israel) Ltd.

16.3.9.1 Company Overview

16.3.9.2 Product Portfolio

16.3.10 Syngenta Crop Protection AG

16.3.10.1 Company Overview

16.3.10.2 Product Portfolio

16.3.10.3 SWOT Analysis

16.3.11 The Dow Chemical Company

16.3.11.1 Company Overview

16.3.11.2 Product Portfolio

16.3.12 Valent BioSciences LLC.

16.3.12.1 Company Overview

16.3.12.2 Product Portfolio

List of Figures

Figure 1: Global: Biopesticides Market: Major Drivers and Challenges

Figure 2: Global: Biopesticides Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Biopesticides Market: Breakup by Product (in %), 2024

Figure 4: Global: Biopesticides Market: Breakup by Formulation (in %), 2024

Figure 5: Global: Biopesticides Market: Breakup by Source (in %), 2024

Figure 6: Global: Biopesticides Market: Breakup by Mode of Application (in %), 2024

Figure 7: Global: Biopesticides Market: Breakup by Crop Type (in %), 2024

Figure 8: Global: Biopesticides Market: Breakup by Region (in %), 2024

Figure 9: Global: Biopesticides Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Biopesticides (Bioherbicides) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Biopesticides (Bioherbicides) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Biopesticides (Bioinsecticides) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Biopesticides (Bioinsecticides) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Biopesticides (Biofungicides) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Biopesticides (Biofungicides) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Biopesticides (Other Product Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Biopesticides (Other Product Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Biopesticides (Liquid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Biopesticides (Liquid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Biopesticides (Dry) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Biopesticides (Dry) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Biopesticides (Microbials) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Biopesticides (Microbials) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Biopesticides (Plant Extract) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Biopesticides (Plant Extract) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Biopesticides (Biochemicals) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Biopesticides (Biochemicals) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Biopesticides (Foliar Spray) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Biopesticides (Foliar Spray) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Biopesticides (Seed Treatment) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Biopesticides (Seed Treatment) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Biopesticides (Soil Treatment) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Biopesticides (Soil Treatment) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Biopesticides (Post-Harvest) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Biopesticides (Post-Harvest) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Biopesticides (Cereals and Grains) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Biopesticides (Cereals and Grains) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Biopesticides (Oilseeds and Pulses) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Biopesticides (Oilseeds and Pulses) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Biopesticides (Fruits and Vegetables) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Biopesticides (Fruits and Vegetables) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Global: Biopesticides (Other Crop Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Global: Biopesticides (Other Crop Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: North America: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: North America: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: United States: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: United States: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Canada: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Canada: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Asia Pacific: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Asia Pacific: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: China: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: China: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Japan: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Japan: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: India: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: India: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: South Korea: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: South Korea: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Australia: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Australia: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Indonesia: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Indonesia: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Others: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Others: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Europe: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Europe: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Germany: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Germany: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: France: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: France: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: United Kingdom: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: United Kingdom: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Italy: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Italy: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Spain: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Spain: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Russia: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Russia: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Others: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Others: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Latin America: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Latin America: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Brazil: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Brazil: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Mexico: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Mexico: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Others: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Others: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 90: Middle East and Africa: Biopesticides Market: Sales Value (in Million USD), 2019 & 2024

Figure 91: Middle East and Africa: Biopesticides Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 92: Global: Biopesticides Industry: SWOT Analysis

Figure 93: Global: Biopesticides Industry: Value Chain Analysis

Figure 94: Global: Biopesticides Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Biopesticides Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Biopesticides Market Forecast: Breakup by Product (in Million USD), 2025-2033

Table 3: Global: Biopesticides Market Forecast: Breakup by Formulation (in Million USD), 2025-2033

Table 4: Global: Biopesticides Market Forecast: Breakup by Source (in Million USD), 2025-2033

Table 5: Global: Biopesticides Market Forecast: Breakup by Mode of Application (in Million USD), 2025-2033

Table 6: Global: Biopesticides Market Forecast: Breakup by Crop Type (in Million USD), 2025-2033

Table 7: Global: Biopesticides Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Global: Biopesticides Market: Competitive Structure

Table 9: Global: Biopesticides Market: Key Players

Companies Mentioned

- BASF

- Bayer AG

- Certis USA LLC

- FMC Corporation

- Isagro

- Koppert Biological Systems

- Marrone Bio Innovations

- Novozymes Biologicals

- Stockton (Israel) Ltd.

- Syngenta Crop Protection AG

- The Dow Chemical Company

- Valent BioSciences LLC.

Table Information

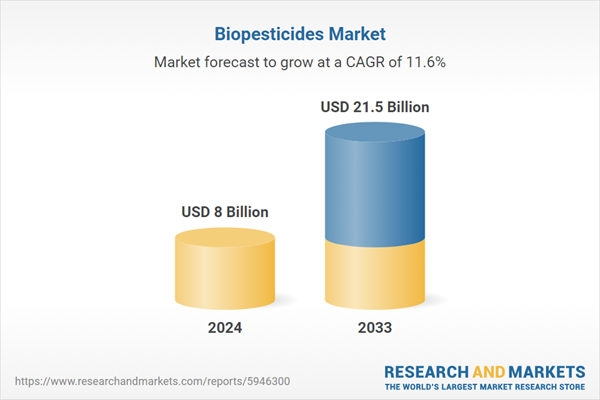

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 8 Billion |

| Forecasted Market Value ( USD | $ 21.5 Billion |

| Compound Annual Growth Rate | 11.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |