The market for capacitive sensors is growing substantially as industries continue to embrace advanced sensing technologies. Companies are constantly seeking new applications of capacitive sensors across industries like consumer electronics, automotive, medical care, and industrial automation. All this development is driving the demand for sensors that provide accurate touch recognition, contactless sensing, and ruggedness, which are becoming essential components of contemporary devices and systems. Technological innovations are playing a key role in defining market trends. Businesses are constantly enhancing sensor performance through increased sensitivity, minimized power consumption, and implementing them in smaller, space-efficient designs. The increasing shift towards automating industries is also impelling the capacitive sensor market growth.

The United States capacitive sensor market is growing at a very fast rate, owing to the growing need for sophisticated sensing technologies in different industries. Firms in the country are increasingly adding capacitive sensors to different applications, including consumer electronics, automobiles, and industrial automation. The ongoing innovation in touch-sensitive and contact-less solutions is fueling market demand as these sensors provide improved user experiences and more durability. The consumer electronics industry is a key source of market growth, with increasing demand for capacitive touchscreens in smartphones, tablets, and other handheld devices. Manufacturers continue to develop their technologies to provide more responsive, power-conscious, and robust touch interfaces, meeting changing consumers' needs. Furthermore, the continuing transition towards smart home devices and wearable technologies is stimulating greater use of capacitive sensors in these devices. In 2025, Apple announced its plans to launch a smart home display device towards the end of the year. The device is going to function as a central point for smart home products.

Capacitive Sensor Market Trends:

Growing use of capacitive sensors in the healthcare industry

Capacitive sensors are applied across medical devices for a variety of purposes, from monitoring vital signs to the detection of certain medical conditions. An increase in medical devices and equipment demands and chronic disease occurrences is driving the capacitive sensors market. PwC's Health Research Institute (HRI) anticipates an 8% annual medical cost trend in 2025 for the Group market and 7.5% for the Individual market. This record trend is driven by inflationary pressures, expenses on prescription drugs, and the use of behavioral health services, thus emphasizing the necessity of cost-effective and innovative medical technology. Capacitive sensors are very useful for non-contact object detection, which can minimize the possibility of contamination or disease transfer. This property comes in handy particularly in sanitary use, for instance, an operating theater or laboratory, where any form of direct contact would sacrifice sterility. They can also detect nearness like any alteration in the immediate electrical field, thereby offering a favorable capacitive sensor market outlook. This makes them useful for applications such as detecting patients' breathing or heart rate without coming into direct contact with their skin, hence ensuring convenience and minimality of invasion.Escalating requirement for industrial automation

There is a growing shift towards industrial automation and the implementation of smart factory technologies, which are sensor-dependent, such as capacitive sensors. According to the publisher, the global industrial automation services market was USD 233.5 Billion in 2024 and is anticipated to reach USD 459.5 Billion by 2033 at a CAGR of 7.42% from 2025-2033, highlighting the growing demand for sensor-based automation technologies. Such sensors have the important function of sensing and measuring various variables such as temperature, pressure, and proximity to facilitate efficient and effective functioning. The non-contact sensing feature of capacitive sensors is useful in industrial automation applications where physical contact can result in wear and tear or damage to the sensor or the object sensed. Through the implementation of capacitive sensors, companies can achieve precise and reliable detection with no chance of mechanical breakdown. Capacitive sensors are also viable to detect liquids, solids, powders, and even granular materials.Growing demand for Internet of Things (IoT) and artificial intelligence (AI)

One of the major capacitive sensor market trends includes the usage of capacitive sensors in Internet of Things (IoT) devices for data gathering. Moreover, the International Data Corporation states that the rollout of 41 billion IoT devices can happen in 2025, and this highlights the importance of the role that capacitive sensors will provide to make intelligent, connected environments possible. They suit IoT applications perfectly since they are capable of detecting and measuring capacitance change, and this is ideal for proximity sensing, touch interfaces, and object detection. In addition, the spread of AI-based smart devices, including smartphones, tablets, and smart home interfaces, is driving the need for capacitive sensors to deliver precise and responsive touch performance. AI algorithms further improve user experience by deciphering touch inputs, facilitating advanced gestures, and enhancing overall touch-based interface performance.

Capacitive Sensor Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global capacitive sensor market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end use industry.Analysis by Type:

- Touch Sensor

- Motion Sensor

- Position Sensor

- Others

Analysis by End Use Industry:

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Healthcare

- Food and Beverages

- Oil and Gas

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Capacitive Sensor Market Analysis

The US capacitive sensor market is experiencing strong growth with increasing demand in consumer electronics, automotive, and industrial automation applications. Expansion in the market has been largely driven by technological innovations and increased usage of smart devices, including smartphones and tablets. The automotive sector is incorporating capacitive sensors for applications such as touch-based infotainment systems, driver support, and climate control. Besides, the transition to Industry 4.0 and the growing use of IoT devices are driving demand for high-precision sensors in manufacturing. Dominant players are upgrading R&D to improve sensor performance and miniaturization, further driving market growth. Favorable government policies promoting advanced manufacturing and higher defense and aerospace use spending also offer opportunities. But high development expenses and complexity in legacy systems integration could be limiting factors. However, the visibility of influential market players and the quick pace of technological integration make the U.S. a powerful figure in revenue for the world's markets.Europe Capacitive Sensor Market Analysis

Europe's capacitive sensor market is expanding continuously, underpinned by robust demand in automotive and consumer electronics sectors. Smart technologies adoption is driven by the region's emphasis on sustainability and energy efficiency, where capacitive sensors are a critical component in touch-sensitive interfaces and proximity sensing. Germany and France are among countries at the forefront of automotive innovation, incorporating sensors in electric vehicles and advanced driver-assistance systems. In addition, healthcare and industry segments are embracing capacitive sensors for enhanced monitoring and automation. Strict EU norms regarding safety and energy levels even support the use of effective sensor technology. Although mature markets and cost pressures can restrict growth at a fast pace, steady investment in R&D and the onset of Industry 4.0 continue to enable long-term growth.Asia Pacific Capacitive Sensor Market Analysis

Asia Pacific is the market leader with the highest share in the world capacitive sensor market, spurred by intense industrialization, growing electronics production, and increasing use of smart devices. China, Japan, and South Korea dominate consumer electronics manufacturing, embedding capacitive sensors in smartphones, wearables, and home automation. The region enjoys the highest automotive and healthcare markets, with higher investment in sensor-based technologies. Government drives for digitization and smart manufacturing also spur market growth.Latin America Capacitive Sensor Market Analysis

Latin America capacitive sensor market is growing incrementally, driven by growing applications in automotive, consumer electronics, and industrial automation. Key drivers are Brazil and Mexico, where manufacturing expansion and growing demand for touch devices are the key drivers. However, economic uncertainty and a lack of R&D base are challenges. Nonetheless, the prospects for future opportunities exist from IoT and smart technologies adoption.Middle East and Africa Capacitive Sensor Market Analysis

Middle East and Africa capacitive sensor market is at a nascent growth stage, fueled by surging investments in smart infrastructure, automotive, and healthcare. The use of smart consumer electronics and industrial automation is growing, particularly across Gulf countries. While market penetration is still low because of high prices and lack of awareness, government support initiatives and digitalization endeavors will propel growth.Competitive Landscape:

Market players in the global capacitive sensor market are actively engaging in strategic activities such as partnerships, product innovation, and acquisitions to strengthen their market position. Companies are continuously developing advanced capacitive sensors with enhanced functionality, such as improved sensitivity, energy efficiency, and miniaturization, to cater to the growing demand in industries like consumer electronics, automotive, and healthcare. Key players are also forming strategic alliances with other technology firms to integrate capacitive sensors into emerging applications, including smart devices and IoT solutions. Additionally, as per capacitive sensor market forecasts, manufacturers are expected to invest in research and development (R&D) to make new technologies and expand their product portfolios, ensuring they stay competitive in the rapidly evolving market landscape.The report provides a comprehensive analysis of the competitive landscape in the capacitive sensor market with detailed profiles of all major companies, including:

- 3M Company

- Analog Devices Inc.

- Cirque Corporation (Alps Electric Co. Ltd.)

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Omron Corporation

- Renesas Electronics Corporation

- Schneider Electric

- STMicroelectronics N.V.

- Synaptics Incorporated

- Texas Instruments Incorporated

Key Questions Answered in This Report

1. How big is the capacitive sensor market?2. What is the future outlook of capacitive sensor market?

3. What are the key factors driving the capacitive sensor market?

4. Which region accounts for the largest capacitive sensor market share?

5. Which are the leading companies in the global capacitive sensor market?

Table of Contents

Companies Mentioned

- 3M Company

- Analog Devices Inc.

- Cirque Corporation (Alps Electric Co. Ltd.)

- Infineon Technologies AG

- Microchip Technology Inc

- NXP Semiconductors N.V.

- Omron Corporation

- Renesas Electronics Corporation

- Schneider Electric

- STMicroelectronics N.V.

- Synaptics Incorporated

- Texas Instruments Incorporated etc.

Table Information

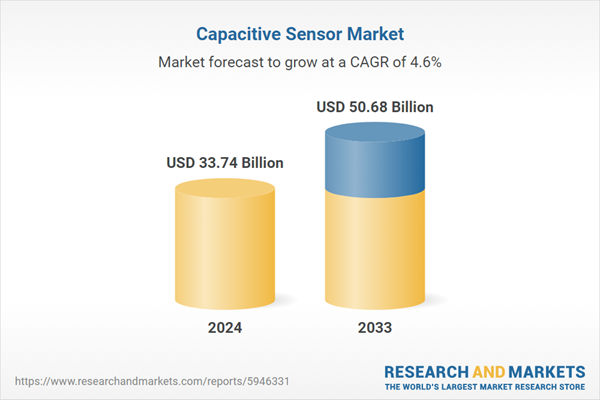

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 33.74 Billion |

| Forecasted Market Value ( USD | $ 50.68 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |