Clinical diagnostics refer to a branch of medicine that focuses on detecting and identifying diseases and medical conditions. They allow healthcare professionals to accurately diagnose a wide range of illnesses through various tests, procedures, and evaluations. They provide reliable and timely information that aids in medical decision making. They also offer clinicians data that is vital for assessing patient health, planning treatment protocols, and making prognostic evaluations by employing a range of sophisticated methodologies. They play an essential role in healthcare by supporting accurate and early diagnoses, which facilitates preventive care and monitors the effectiveness of treatments.

The increasing number of autoimmune disorders like lupus and rheumatoid arthritis are driving the need for specialized clinical diagnostics to detect these conditions early and manage them effectively around the world. Moreover, the rising trend of medical tourism, particularly in countries with advanced healthcare systems, is catalyzing the demand for a wide range of clinical diagnostic tests. In addition, the growing inclination towards personalized medicine and diagnostics on account of the surging prevalence of chronic and infectious diseases and the increasing aging population, which is more prone to develop these medical conditions, is influencing the market positively.

Apart from this, the rising number of specialized diagnostic centers ensure easier access to testing, which is favoring the growth of the market. Furthermore, the growing preference for point of care testing (POCT) that allows healthcare providers to diagnose and monitor patients at the point of care quickly and easily is creating a positive outlook for the market.

Clinical Diagnostics Market Trends/Drivers:

Increase in lifestyle diseases

The prevalence of lifestyle-related diseases like obesity, hypertension, and diabetes is on the upswing, globally. The sedentary lifestyles and poor dietary habits prevalent today contribute significantly to these conditions. Clinical diagnostics play a crucial role in early detection, facilitating preventive measures and tailored treatment plans. Timely diagnosis can often be lifesaving and can reduce the overall burden on healthcare systems. The rise in lifestyle diseases thereby elevates the need for advanced clinical diagnostics to manage and contain these conditions effectively.Rise in healthcare awareness

The public is becoming more aware about the importance of healthcare and preventative measures, partly due to increased accessibility to information via the internet and public health campaigns. This increased awareness is leading to a higher rate of people seeking regular check-ups and diagnostic tests as part of preventative healthcare. Such proactive health management significantly drives the demand for clinical diagnostics, as individuals seek to understand their health metrics and catch potential issues early.Growing government initiatives and policies

Governments worldwide are investing heavily in healthcare infrastructure and promoting policies that encourage regular medical screenings. Initiatives, such as subsidized healthcare, public health campaigns targeting early disease detection, and increased funding for medical research have a direct impact on the demand for clinical diagnostics. These programs make diagnostic services more accessible and affordable for the population, thereby driving up utilization rates.Clinical Diagnostics Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global clinical diagnostics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on test, product, and end user.Breakup by Test:

- Lipid Panel

- Liver Panel

- Renal Panel

- Complete Blood Count

- Electrolyte Testing

- Infectious Disease Testing

- Others

Lipid panel dominates the market

The report has provided a detailed breakup and analysis of the market based on the test. This includes lipid panel, liver panel, renal panel, complete blood count, electrolyte testing, infectious disease testing, and others. According to the report, lipid panel represented the largest segment. A lipid panel is a blood test that measures different types of fats and cholesterol levels in the blood, notably low-density lipoprotein (LDL), high-density lipoprotein (HDL), and triglycerides. The test provides valuable information about the risk for heart disease of an individual and helps guide decisions about what treatment can be best if there is borderline or high risk.A liver panel is a group of blood tests that evaluate the function of the liver and check for signs of liver damage or inflammation. The panel can include tests like alanine aminotransferase (ALT), aspartate aminotransferase (AST), alkaline phosphatase (ALP), and bilirubin, among others. These results can aid in diagnosing liver diseases such as hepatitis or cirrhosis, and can also monitor the effects of certain medications on the liver.

The renal panel, also commonly known as a kidney panel, consists of various tests aimed at assessing kidney function. It often includes measurements of elements such as creatinine, blood urea nitrogen (BUN), and electrolytes like sodium, potassium, and chloride. The test is critical for diagnosing kidney diseases and for monitoring individuals who are at risk for kidney complications due to conditions like diabetes or high blood pressure.

Breakup by Product:

- Instruments

- Reagents

- Others

Instruments holds the largest share in the market

A detailed breakup and analysis of the market based on the product has also been provided in the report. This includes instruments, reagents, and others. According to the report, instruments accounted for the largest market share. Instruments in clinical diagnostics refer to the specialized machinery and devices used to carry out various tests. These range from simple equipment like centrifuges, which separate different components of blood, to more complex machines like polymerase chain reaction (PCR) devices, which are used for DNA testing. Other instruments can include hematology analyzers for blood cell counts, biochemistry analyzers for measuring chemical substances in the blood, and imaging devices like X-rays or MRIs. These instruments are designed to be highly accurate and efficient, allowing for quick and reliable diagnoses.Reagents are the chemical substances or compounds used in conjunction with diagnostic instruments to conduct tests. They interact with the samples of blood, urine, or tissue to produce measurable outcomes. Reagents can include antibodies used in immunoassays, chemical indicators, and enzymes. They are typically produced under strict quality control measures to ensure their efficacy and reliability.

Breakup by End User:

- Hospital Laboratory

- Diagnostic Laboratory

- Point-of-care Testing

- Others

Diagnostic laboratory dominates the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital laboratory, diagnostic laboratory, point-of-care testing, and others. According to the report, diagnostic laboratory represented the largest segment. Diagnostic laboratories are specialized facilities that focus solely on conducting diagnostic tests. They often serve multiple healthcare providers and may even accept samples from across different regions. These labs typically offer a wide array of tests, including specialized ones that a hospital lab might not provide. Diagnostic laboratories are crucial for outpatient care and ongoing monitoring of chronic conditions.Point-of-care testing (POCT) refers to diagnostic tests that are conducted at or near the site where care is provided, usually by non-laboratory personnel. These tests are often simpler and quicker, designed to provide immediate results that can be acted upon without delay. Examples include glucose monitoring for diabetes patients and rapid strep tests in a primary care setting. POCT is invaluable in situations that require quick decision-making and immediate treatment.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest clinical diagnostics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The increasing awareness about the benefits of clinical diagnostics among the masses represents one of the primary factors bolstering the market growth in the North American region. Moreover, the rising adoption of automation in medical testing is contributing to the market growth in the region. Besides this, the growing utilization of mobile health (m-health) applications is influencing the market positively.

Competitive Landscape:

The leading companies are integrating artificial intelligence (AI), machine learning (ML), and the internet of things (IoT) to interpret complex data sets, including medical images like X-rays and MRIs that can identify patterns and anomalies that can be missed by human eyes, thereby increasing the accuracy of diagnoses. They are also using genomic sequencing technologies like next-generation sequencing (NGS) that enable rapid and accurate identification of genetic markers for various diseases, which allows for personalized treatment plans that are more targeted and effective. Moreover, key players are utilizing liquid biopsy that allows for the detection of cancer cells or DNA fragments in the blood, which offers a less invasive alternative to traditional tissue biopsies.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Abbott Laboratories

- Becton Dickinson and Company

- bioMérieux SA

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Qiagen N.V.

- Quest Diagnostics Incorporated

- Siemens AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc

Key Questions Answered in This Report:

- What is clinical diagnostics?

- How big is the clinical diagnostics market?

- What is the expected growth rate of the global clinical diagnostics market during 2025-2033?

- What are the key factors driving the global clinical diagnostics market?

- What is the leading segment of the global clinical diagnostics market based on test?

- What is the leading segment of the global clinical diagnostics market based on product?

- What is the leading segment of the global clinical diagnostics market based on end user?

- What are the key regions in the global clinical diagnostics market?

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Becton Dickinson and Company

- bioMérieux SA

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Qiagen N.V.

- Quest Diagnostics Incorporated

- Siemens AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Table Information

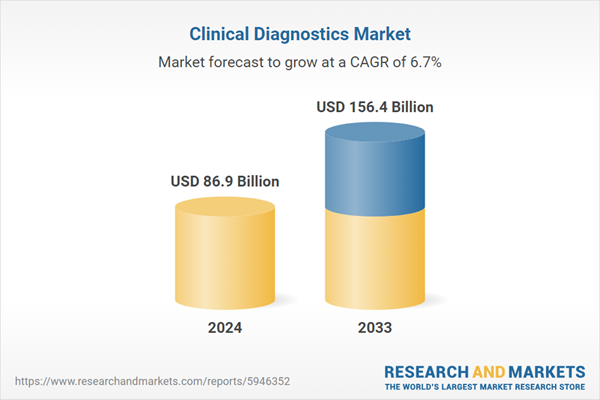

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 86.9 Billion |

| Forecasted Market Value ( USD | $ 156.4 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |