Confectionery and Bakery Packaging Market Analysis:

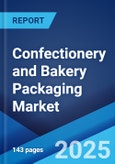

Market Growth and Size: The global confectionery and bakery packaging market is experiencing significant growth, attributed to the rising consumption of bakery and confectionery products across the globe. The market's expansion is fueled by diverse consumer tastes and the availability of a wide range of packaging types, including flexible packaging, rigid packaging, and others.Major Market Drivers: The market is influenced by key drivers, such as increasing health consciousness among consumers, the rising interest toward homemade products, and the influence of social media on consumer choices. In line with this, the growth of the organized retail sector, escalating focus on product traceability and supply chain transparency, shifting consumer preference for multi-pack and value packs, the surging demand for child-friendly packaging with safety features and appealing designs, and the globalization of food products are propelling the market growth.

Technological Advancements: In the realm of technological advancements, the confectionery and bakery packaging market are witnessing significant innovations. Smart packaging incorporating quick response (QR) codes and near field communication (NFC) technology for enhanced consumer engagement and product information are becoming more prevalent. Automation in packaging lines is increasing efficiency and reducing labor costs. The use of three-dimensional (3D) printing technology for creating custom packaging designs is on the rise. Developments in biodegradable and compostable materials are addressing environmental concerns. Innovations in lightweight and strong materials reduce transportation costs and carbon footprint.

Industry Applications: The confectionery and bakery packaging market is integral across various segments, such as retail, frozen bakery, and convenience foods. In retail, packaging for items like bread, cakes, and chocolates focuses on enhancing shelf appeal and preserving freshness. The frozen bakery segment requires packaging that withstands low temperatures and maintains product quality. Convenience foods demand portable, easy-to-use packaging for on-the-go consumption. The catering and hospitality industry needs robust, bulk packaging for efficient storage and transport. High-quality, decorative packaging distinguishes the gift and premium sector. Health-focused packaging in the wellness sector emphasizes nutritional information and portion control. Industrial packaging ensures the safe transport of production ingredients.

Key Market Trends: The emerging trends in the confectionery and bakery packaging market include personalization and customization in packaging to cater to individual preferences, growing emphasis on minimalist and clean-label packaging, and the trend of vintage and retro packaging designs. Moreover, the development of interactive packaging with augmented reality (AR) features, the rise of subscription-based and direct-to-consumer sales models, the trend towards experiential and premium packaging for luxury confectionery and bakery products, and the use of bold colors and innovative graphics in packaging design are supporting the market growth.

Geographical Trends: In terms of geographical trends, the confectionery and bakery packaging market is led by regions such as North America, Europe, and the Asia-Pacific. North America and Europe have long been dominant due to high consumption rates of bakery and confectionery products, coupled with advanced packaging technologies and high consumer spending power. However, the Asia-Pacific region is emerging as a significant market, driven by growing economies like China and India. The increase in disposable incomes, urbanization, and the westernization of diets in these regions contribute to market growth. The Asia-Pacific market benefits from a large population base, increased retail sector growth, and evolving consumer preferences, making it a potential leader in the confectionery and bakery packaging market.

Competitive Landscape: The competitive landscape of the confectionery and bakery packaging market is marked by the presence of numerous players, ranging from large multinational corporations to small regional companies. This market is characterized by intense competition, with companies constantly striving for innovation, cost-effectiveness, and product differentiation. Major players invest in research and development (R&D) to introduce new and advanced packaging solutions. Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their market presence and product portfolios.

Challenges and Opportunities: The confectionery and bakery packaging market faces several challenges, including the need to balance cost with quality and functionality. Environmental concerns and the push for sustainable packaging solutions present both a challenge and an opportunity for innovation. Regulatory compliance across different regions can be complex and challenging. However, these challenges also open doors for opportunities. There is significant potential for growth in emerging markets due to changing consumer lifestyles. The demand for innovative and convenient packaging solutions offers opportunities for creativity and technological advancements. Additionally, the increasing trend toward personalized and premium packaging presents opportunities for differentiation and value addition in the market.

Confectionery and Bakery Packaging Market Trends:

Increasing consumer demand for convenience foods

The surge in consumer demand for convenience foods significantly drives the global confectionery and bakery packaging market. In today's fast-paced world, there is an increasing preference for ready-to-eat (RTE) and easy-to-prepare food items, including bakery and confectionery products. This trend is not just confined to urban areas but is also evident in suburban and rural settings. Consumers seek products that offer ease of consumption, portability, and minimal preparation time, factors that are vital in their busy lifestyles. Consequently, packaging companies are innovating to create solutions that not only maintain product freshness and quality but also provide convenience. Furthermore, packaging that enables extended shelf life, while maintaining the taste and texture of the products, is increasingly in demand.Escalating focus on environmental sustainability

Environmental sustainability is a critical driver in the global confectionery and bakery packaging market. There is a growing awareness and concern among consumers about the environmental impact of packaging waste, particularly plastic. This awareness is driving demand for eco-friendly packaging solutions that are biodegradable, recyclable, or made from renewable resources. Manufacturers are responding by exploring alternative materials like paper, bioplastics, and plant-based materials that have a lower carbon footprint and are less harmful to the ecosystem. Additionally, there is a focus on reducing the overall amount of packaging used and increasing the use of post-consumer recycled materials. Governments and regulatory bodies worldwide are also implementing stricter regulations on packaging waste, further compelling companies to adopt sustainable practices.Advancements in packaging technologies

Advancements in packaging technologies are a major factor propelling the growth of the confectionery and bakery packaging market. Innovations in this field are focused on enhancing product shelf life, maintaining quality, and improving user experience. Active and intelligent packaging technologies are at the forefront of these innovations. These technologies are crucial for bakery and confectionery products, which are often susceptible to spoilage due to factors like moisture and microbial growth. Improved packaging technologies ensure that these products remain fresh and safe for consumption over a longer period, thereby reducing food waste.Surging online food retailing

The growth of online food retailing is significantly influencing the confectionery and bakery packaging market. With the rise of e-commerce and online shopping, there is an increasing demand for packaging that can withstand the rigors of shipping and handling while preserving the quality and integrity of food products. Packaging for online retail must be robust enough to protect products from physical damage during transportation and from environmental factors such as temperature and humidity. This necessity has led to the development of innovative packaging solutions that are both sturdy and lightweight, minimizing shipping costs while ensuring product safety. Additionally, the rise of online retail has brought about a need for packaging that is visually appealing and brand-centric, as it plays a crucial role in the unboxing experience, an important aspect of customer satisfaction in online shopping.Confectionery and Bakery Packaging Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and application.Breakup by Type:

- Paper Packaging

- Glass Packaging

- Plastic Packaging

- Others

Paper packaging accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes paper packaging, glass packaging, plastic packaging, and others. According to the report, paper packaging represented the largest segment.The paper packaging segment is driven by the increasing emphasis on sustainability and eco-friendliness. The segment benefits from a rising consumer preference for biodegradable and recyclable materials, in response to growing environmental concerns and stringent regulations against plastic waste. Innovations in paper packaging, such as improved barrier properties and durability, are making it more competitive with traditional materials. Additionally, the aesthetic appeal and ease of customization of paper packaging make it a preferred choice in sectors like food and beverages, personal care, and healthcare.

The glass packaging segment is driven by the increasing demand for premium and high-quality packaging solutions, particularly in the food, beverage, and cosmetics industries. Glass is favored for its non-reactive nature, preserving product integrity and extending shelf life, which is crucial in sectors like pharmaceuticals and gourmet food. Its recyclability and perception as a sustainable material align with consumer and regulatory trends toward environmental responsibility.

The plastic packaging segment is driven by the increasing need for cost-effective, versatile, and durable packaging solutions. Plastic's popularity stems from its flexibility, lightweight nature, and ability to be molded into various shapes and sizes, catering to a wide range of products. Advances in plastic packaging technology, such as improved barrier properties and the development of bioplastics, are enhancing its functionality and environmental profile. The convenience offered by plastic packaging in terms of portability and preservation of product quality, particularly in food and beverage, personal care, and pharmaceutical sectors, continues to fuel its demand.

The other packaging materials segment is driven by the increasing demand for innovative and specialized packaging solutions. The segment includes materials like metal, wood, and textiles, which cater to niche markets that require specific packaging characteristics.

Breakup by Application:

- Confectionery

- Bakery

Confectionery accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes confectionery and bakery. According to the report, confectionery represented the largest segment.The confectionery segment is driven by the increasing demand for innovative and diverse flavors, catering to evolving consumer palates. As consumers become more adventurous with their taste preferences, manufacturers are experimenting with unique flavor combinations, leading to a broader variety of confectionery products. This diversification necessitates specialized packaging to maintain flavor integrity, appeal to aesthetic sensibilities, and differentiate products on retail shelves. Additionally, the health-conscious trend is prompting a surge in demand for sugar-free and low-calorie options, influencing packaging to highlight health benefits and ingredient transparency.

The bakery segment is driven by the increasing preference for convenience and health-conscious eating among consumers. The rising popularity of ready-to-eat and easy-to-prepare bakery items, such as pre-sliced bread and frozen pastries, requires packaging solutions that offer extended shelf life, maintain product freshness, and are convenient to use. Additionally, the growing trend towards gluten-free and organic bakery products is influencing packaging design to clearly communicate these attributes. The emphasis on sustainability is also crucial, as consumers increasingly seek eco-friendly packaging options. This trend is pushing manufacturers to innovate with biodegradable and recyclable materials, further shaping the bakery packaging segment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest confectionery and bakery packaging market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The North America confectionery and bakery packaging segment is driven by the increasing demand for convenience and premium packaging solutions. The region, with its high consumer spending power, shows a strong preference for innovative and convenient packaging, such as resealable and easy-to-open options, that cater to on-the-go lifestyles. Additionally, there is a growing interest in artisanal and gourmet products, which require premium and aesthetically appealing packaging. Environmental concerns also play a significant role, as there is a rising demand for sustainable and eco-friendly packaging options in this region.

The Asia Pacific confectionery and bakery packaging segment is driven by the increasing urbanization and rising disposable incomes, leading to greater consumption of packaged confectionery and bakery products. The region is experiencing a surge in demand for functional packaging that ensures product safety and extends shelf life, particularly important due to the diverse climatic conditions across the region.

The Europe confectionery and bakery packaging segment is driven by the increasing awareness of environmental sustainability and stringent regulatory standards for packaging materials. Consumers in this region are highly conscious of the ecological impact of packaging, leading to a preference for recyclable and biodegradable materials. Additionally, the well-established bakery culture in Europe necessitates packaging that maintains the freshness and quality of a wide range of bakery products, from artisan bread to pastries, aligning with the region’s culinary traditions.

The Latin America confectionery and bakery packaging segment is driven by the increasing modernization of retail infrastructure and the growing influence of Western eating habits. The packaging market in this area is adapting to accommodate the need for cost-effective yet quality packaging solutions that cater to the diverse and growing consumer base, particularly in emerging economies like Brazil and Argentina.

The Middle East and Africa confectionery and bakery packaging segment is driven by the increasing economic growth and urbanization, particularly in countries like UAE and South Africa. The packaging market here is focusing on innovative solutions that cater to the unique climatic conditions, ensuring product longevity and freshness, while also considering cultural preferences and the significant role of food items as gifts in social and religious festivities.

Leading Key Players in the Confectionery and Bakery Packaging Industry:

Key players in the confectionery and bakery packaging market are actively engaging in a variety of strategic initiatives to strengthen their market positions. A significant focus is on research and development to introduce innovative packaging solutions that are not only aesthetically appealing but also functional and sustainable. These companies are investing in advanced technologies to develop eco-friendly packaging materials, addressing the growing consumer demand for environmental sustainability. Many are expanding their global presence through strategic mergers and acquisitions, partnerships with local companies, and setting up new manufacturing facilities, especially in emerging markets. They are also enhancing their product portfolios to cater to the diverse needs of different segments, from luxury and artisanal products to mass-market items. Furthermore, to gain a competitive edge, these market players are increasingly focusing on customization and personalization in packaging, aligning with consumer trends towards unique and differentiated products.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Amcor Plc

- Berry Global Inc (Berry Global Group, Inc)

- Bomarko Inc

- Crown Holdings, Inc

- Huhtamaki Oyj

- Mondi Group

- Sonoco Products Company

- Stanpac Inc

- Westrock Company

Key Questions Answered in This Report:

- How has the global confectionery and bakery packaging market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global confectionery and bakery packaging market?

- What is the impact of each driver, restraint, and opportunity on the global confectionery and bakery packaging market?

- What are the key regional markets?

- Which countries represent the most attractive confectionery and bakery packaging market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the confectionery and bakery packaging market?

- What is the breakup of the market based on application?

- Which is the most attractive application in the confectionery and bakery packaging market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global confectionery and bakery packaging market?

Table of Contents

Companies Mentioned

- Amcor Plc

- Berry Global Inc (Berry Global Group Inc)

- Bomarko Inc

- Crown Holdings Inc

- Huhtamaki Oyj

- Mondi Group

- Sonoco Products Company

- Stanpac Inc

- Westrock Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 120 Billion |

| Forecasted Market Value ( USD | $ 182.6 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |