Earthing Equipment Market Trends:

Growing Construction and Infrastructure Projects

With urbanization speeding up in emerging economies, there is an increase in the need for dependable and effective electrical grounding solutions in residential, commercial, and industrial buildings. New buildings need strong earthing equipment to guarantee safety and adherence to strict electrical safety regulations. Additionally, advanced earthing solutions are required for handling higher electrical loads and ensuring uninterrupted power supply when expanding and upgrading existing infrastructure like highways, railways, and airports. The increasing need for reliable grounding systems in construction and infrastructure projects is supporting the earthing equipment market growth. In 2023, the National Development and Reform Commission (NDRC) of China revealed its initial set of infrastructure projects funded by newly issued government bonds. These projects concentrated on restoring areas following floods in the Beijing-Tianjin-Hebei area and consisted of improvements in flood control and disaster prevention.Technological Advancements

Advanced protection mechanisms are essential for ensuring safety and efficiency in current electrical systems. New advancements such as merging high-speed grounding switches with cutting-edge protection systems improve the ability to quickly and efficiently control arc faults. These improvements increase safety by lowering the chance of electrical dangers, decreasing equipment damage, and maintaining smooth operations. Moreover, the incorporation of smart technologies in grounding systems enhances efficiency, streamlines installation, and decreases expenses. The growing need for dependable earthing systems in new and current electrical infrastructure is leading to the development of more intelligent, efficient, and cost-saving solutions. These innovations reflect the latest earthing equipment market trends, emphasizing the integration of smart technologies to meet evolving safety and performance standards. In 2023, ABB introduced a novel product that integrated its ultra-fast earthing switch (UFES) with Relion technology to enhance arc protection. This intelligent, economical solution expanded ABB's choices for arc protection, improving safety and dependability while decreasing the complexity and expenses of installation. The new mix was designed to offer quicker and more efficient arc fault mitigation for new and current switchgear applications.Rise in Renewable Energy Projects

The increasing number of solar and wind energy projects is driving the demand for specialized grounding solutions that can handle the unique requirements of these installations. Renewable energy systems commonly need high-voltage equipment and must have strong and dependable earthing systems to ensure safety and efficiency, as they are affected by changing weather conditions. Additionally, government incentives and policies encouraging clean energy adoption are leading to investments in renewable projects, further driving the advanced earthing equipment demand. In 2024, Tata Power revealed its intention to spend ₹20,000 crore in FY2024-25 to broaden its renewable energy assets and improve its transmission and distribution operations. The chairman of the company announced that this investment would come after a ₹12,000 crore spending in FY2023-24. The company planned to raise its clean energy capacity to 15 GW by establishing a 4.3 GW solar manufacturing facility in Tamil Nadu. Furthermore, Tata Power concentrated on growing the infrastructure for electric vehicle (EV) charging and solar rooftop ventures.Earthing Equipment Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product and application.Breakup by Product:

- MS Flat

- CI Flat

- GI Wire

CI flat accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes MS flat, CI flat, and GI wire. According to the report, CI flat represented the largest segment.CI flat accounts for the majority of the market share because of its extensive usage and demonstrated dependability in various applications. CI flat is popular due to its great electrical conduction, long-lasting quality, and affordability, making it a top pick for industrial and residential grounding systems. The robust nature of CI flat ensures long-term performance with minimal maintenance, which is crucial for maintaining safety standards in electrical systems. Moreover, the growing infrastructure projects and industrial growth are driving the demand for CI flat. The extensive usage and reliability of CI flat notably contributes to the overall earthing equipment market size, making it a dominant segment in the industry. In March 2024, the Prime Minister of India launched and laid the groundwork for connectivity ventures totaling INR 15,400 crores in Kolkata. The plans involved various Metro segments like Howrah Maidan-Esplanade and Taratala-Majerhat, in addition to expansions for Pune Metro, Kochi Metro, and Agra Metro. These advancements were focused on improving movement within cities and easing traffic congestion on roads.

Breakup by Application:

- Residential

- Commercial

- Industrial

Industrial holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial. According to the report, industrial accounted for the largest market share.Industrial represents the largest segment as per the earthing equipment market outlook due to the growing demand for dependable earthing solutions in diverse industrial uses. Industries like manufacturing, oil and gas, power generation, and telecommunications need sophisticated earthing systems to guarantee the safety and effectiveness of their activities. In industrial environments with complex infrastructure and high electrical loads, reliable earthing equipment is crucial to avoid electrical hazards and protect equipment from damage. The ongoing industrialization, particularly in developing countries, is driving the need for earthing equipment in this sector.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest earthing equipment market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for earthing equipment.Asia Pacific holds the biggest market share due to the rapid pace of industrialization and rising focus on infrastructure development. The growing investments in renewable energy initiatives and expanding electrical networks, is driving the need for efficient earthing solutions in the region. Moreover, the increasing awareness about electrical safety standards and stringent government regulations are bolstering the market growth. Furthermore, the rising awareness about electrical safety standards and stringent government regulations are increasing the earthing equipment market value in the region. The IndoMach industrial machinery and engineering trade fair, held from June 21-23, 2024, in Hyderabad, attracted over 5,000 visitors on its second day. The event showcased more than 750 live machinery and 900 brands, including Ashlok Earthing, a manufacturer of earthing and lightning products. The fair featured cutting-edge technologies across various industrial applications, such as automation, robotics, and heavy machinery. The exhibition highlighted innovations and products from both national and international exhibitors. Additionally, discounts on cutting-edge products and services were offered throughout the exhibition.

Competitive Landscape:

- The earthing equipment market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include ABB Ltd., CG Power and Industrial Solutions Limited (Avantha Group), Eaton Corporation Inc., Emerson Electric Co., General Electric, Harger Lightning & Grounding, Kingsmill Industries UK Ltd., Schneider Electric SE, Toshiba Corporation, etc.

- Major stakeholders in the industry are concentrating on strategic efforts to enhance their market standing. These efforts involve investing in research operations for new earthing solutions, diversifying product offerings, and utilizing mergers and acquisitions (M&A) to improve capabilities and market presence. Moreover, leading earthing equipment companies are establishing strategic alliances and partnerships to access new markets and enhance their distribution channels. Emphasis is also placed on adhering to stringent safety regulations and standards, ensuring high-quality products, and providing comprehensive after-sales services to maintain user satisfaction and loyalty. In 2024, the University of Nottingham partnered with Kingsmill Industries Ltd to innovate clean energy solutions for earthing equipment and lightning protection products. The collaboration aimed to enhance Kingsmill's competitive edge by integrating advanced power electronics and smart functionalities into their products.

Key Questions Answered in This Report

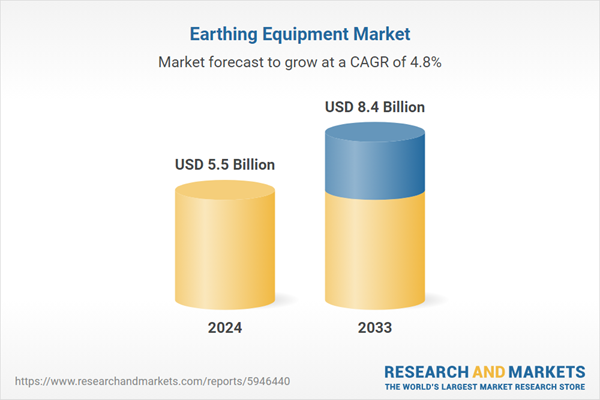

1. What was the size of the global earthing equipment market in 2024?2. What is the expected growth rate of the global earthing equipment market during 2025-2033?

3. What are the key factors driving the global earthing equipment market?

4. What has been the impact of COVID-19 on the global earthing equipment market?

5. What is the breakup of the global earthing equipment market based on the product?

6. What is the breakup of the global earthing equipment market based on the application?

7. What are the key regions in the global earthing equipment market?

8. Who are the key players/companies in the global earthing equipment market?

Table of Contents

Companies Mentioned

- ABB Ltd.

- CG Power and Industrial Solutions Limited (Avantha Group)

- Eaton Corporation Inc.

- Emerson Electric Co.

- General Electric

- Harger Lightning & Grounding

- Kingsmill Industries UK Ltd.

- Schneider Electric SE

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 5.5 Billion |

| Forecasted Market Value ( USD | $ 8.4 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |