Enterprise Resource Planning (ERP) Market Trends:

Rising Digital Transformation

The increasing digital transformation is one of the key factors propelling the market's growth. For instance, according to the publisher, the global digital transformation market size reached USD 692 Billion in 2023. Looking forward, the publisher expects the market to reach USD 2.84 trillion by 2032, exhibiting a growth rate (CAGR) of 16.9% during 2024-2032. As businesses increasingly shift toward digital-first operations, ERP systems are critical to this transformation. They automate and integrate core business processes such as finance, HR, supply chain, and customer relationship management (CRM), providing a unified platform for business management. These factors are expected to propel the enterprise resource planning (ERP) market share in the coming years.Increasing Remote Work Trends

The rise of remote work and mobile workforces has increased demand for ERP systems that provide mobile access and remote functionality. A rising number of employees across various regions are working remotely. For instance, according to CXOToday, by 2025, an estimated 60 to 90 million Indians will work remotely, accounting for nearly 10.12% to 15.17% of the Indian workforce. Mobile ERP solutions allow employees to access business-critical information and perform tasks from anywhere. These factors further positively influence the enterprise resource planning (ERP) market size.Technological Innovations

The integration of ERP systems with emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and blockchain is enhancing ERP capabilities. For instance, in September 2024, Eton Solutions, a wealth management enterprise resource planning system company, introduced EtonGPT, a generative artificial intelligence module for worldwide family offices. EtonGPT combines the transactional capabilities of Eton Solution's ERP platform with conversational AI functionality, thereby boosting the enterprise resource planning (ERP) market growth.Global Enterprise Resource Planning (ERP) Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component, business segment, deployment type, organization size, and vertical.Breakup by Component:

- Solutions

- Services

According to the market outlook, ERP solutions refer to the software platforms that provide businesses with the tools and modules to manage their operations. Moreover, ERP services encompass the implementation, customization, training, and ongoing support needed to operate an ERP solution effectively. These services ensure that ERP systems are tailored to meet the unique needs of a business.

Breakup by Business Segment:

- Sales and Marketing

- Finance and Accounting

- Order Management

- Others

According to the market overview, the finance industry is subject to ever-changing and complex regulations (e.g., Sarbanes-Oxley Act, IFRS, GAAP). ERP systems help organizations ensure compliance by automating processes related to financial reporting, auditing, and data integrity. Moreover, organizations need to make faster and more informed decisions. ERP systems offer real-time financial reporting, dashboards, and analytics that provide a holistic view of the company’s financial health, leading to better decision-making. This is positively influencing the enterprise resource planning (ERP) market share.

Breakup by Deployment Type:

- On-premises

- Cloud-based

On-premises accounted for the largest market share

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud-based. According to the report, on-premises represented the largest market segmentation.Many organizations prefer on-premises ERP systems due to the higher level of control they provide over sensitive business and customer data. For industries dealing with highly confidential information, such as banking, healthcare, or defense, keeping data within the organization’s IT infrastructure ensures tighter control. Moreover, on-premises solutions allow companies to deploy and manage their security protocols according to specific requirements, which is particularly crucial for businesses with strict security guidelines and compliance needs.

Breakup by Organization Size:

- Large Organizations

- Small and Medium-Sized Organizations

Large organizations accounted for the largest market share

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large organizations and small and medium-sized organizations. According to the report, large organizations represented the largest market segmentation.Large enterprises often operate with multiple business units, subsidiaries, or divisions. An ERP system provides a centralized platform to manage and streamline diverse functions across the entire organization. Moreover, large organizations have complex workflows involving various departments like finance, supply chain, HR, procurement, and production. This is expanding the enterprise resource planning (ERP) market share across the segmentation.

Breakup by Vertical:

- BFSI

- Manufacturing

- Healthcare

- Education

- Government

- Automotive

- Others

Manufacturing accounted for the largest market share

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, manufacturing, healthcare, education, government, automotive, and others. According to the report, manufacturing represented the largest market segmentation.Manufacturing companies need to optimize the use of raw materials, machinery, and labor to maximize productivity. ERP systems provide advanced planning and scheduling tools to allocate resources efficiently, reducing downtime and production costs. Moreover, ERP solutions help manufacturers manage production capacity, ensuring that machinery, workforce, and other resources are aligned with production demands.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America has the largest market share, including the growing adoption of ERP software by small and medium-sized companies, increasing investments by ERP vendors in software development, the presence of numerous market players, etc. Besides this, companies across North America are investing heavily in digital transformation initiatives. This push is driving the adoption of ERP solutions to streamline business processes, integrate data, and improve overall efficiency. The need for real-time data analysis and automation of operations is pushing enterprises towards modern ERP systems.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Epicor Software Corporation (KKR & Co. Inc.)

- International Business Machines Corporation

- Kronos Incorporated (Hellman & Friedman LLC)

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- The Sage Group Plc

- TOTVS S.A

- Unit4 (Advent International)

- Workday Inc.

- Yonyou Network Technology Co. Ltd.

Key Questions Answered in This Report

1. How big is the Enterprise Resource Planning (ERP) market?2. What is the expected growth rate of the global Enterprise Resource Planning (ERP) market during 2025-2033?

3. What are the key factors driving the global Enterprise Resource Planning (ERP) market?

4. What has been the impact of COVID-19 on the global Enterprise Resource Planning (ERP) market?

5. What is the breakup of the global Enterprise Resource Planning (ERP) market based on the business segment?

6. What is the breakup of the global Enterprise Resource Planning (ERP) market based on the deployment type?

7. What is the breakup of the global Enterprise Resource Planning (ERP) market based on the organization size?

8. What is the breakup of the global Enterprise Resource Planning (ERP) market based on the vertical?

9. What are the key regions in the global Enterprise Resource Planning (ERP) market?

10. Who are the key players/companies in the global Enterprise Resource Planning (ERP) market?

Table of Contents

Companies Mentioned

- Epicor Software Corporation (KKR & Co. Inc.)

- International Business Machines Corporation

- Kronos Incorporated (Hellman & Friedman LLC)

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- The Sage Group Plc

- TOTVS S.A

- Unit4 (Advent International)

- Workday Inc.

- Yonyou Network Technology Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | August 2025 |

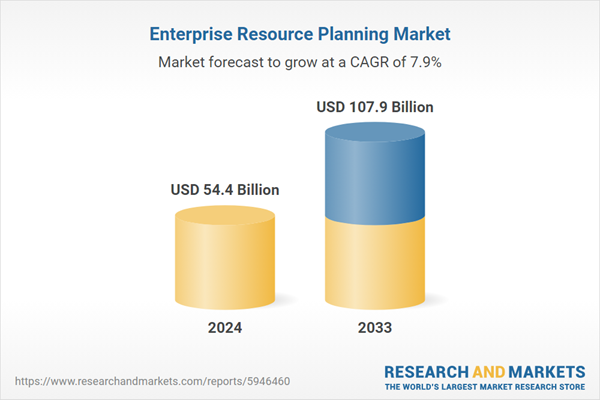

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 54.4 Billion |

| Forecasted Market Value ( USD | $ 107.9 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |