Lubricants are substances specifically designed to reduce friction and wear between two surfaces in motion or in contact with each other. They possess unique properties that allow them to create a protective film or layer between the moving parts, preventing direct metal-to-metal contact and reducing frictional forces. They also possess additives that enhance their properties, such as anti-wear agents, detergents, dispersants, and corrosion inhibitors. These additives improve the lubricant's ability to withstand extreme temperatures, pressures, and harsh environments, extending the lifespan of the equipment or machinery. Besides, they help minimize energy losses, heat generation, and component wear, resulting in improved efficiency, reduced maintenance costs, and increased equipment reliability. These also play a crucial role in various industries and applications, from automotive and manufacturing to aerospace. Additionally, they are widely used in household settings for various purposes, such as lubricating door hinges and locks to ensure the smooth operation of gardening tools.

Lubricants Market Trends:

The expansion of the industrial sector, such as the manufacturing, automotive, construction, and transportation industries, is driving the global market. Moreover, with rising restrictions by various governments to reduce emissions and promote sustainability, there has been increasing development and adoption of environmentally friendly lubricants that are biodegradable, low in toxicity, and have reduced environmental footprints. Apart from this, continual advancements in lubricant technology, such as the formulation of synthetic lubricants, bio-based lubricants, and specialty lubricants that offer enhanced efficiency, extended drain intervals, and reduced environmental impact, are impacting the market. Furthermore, the increasing industrial activities and infrastructure development are creating a positive market outlook. Besides, the growing demand for energy, including fossil fuels, renewable energy, and power generation, is fuelling the market as lubricants are essential for the efficient operation of energy generation and extraction equipment, such as gas turbines, wind turbines, and drilling machinery. Additionally, the growing emphasis on reducing fuel consumption and improving energy efficiency is acting as another growth-inducing factor. Besides, continual advancements in machinery and equipment design have led to increased performance, higher operating speeds, and more demanding operating conditions. This is catalyzing the market. Other factors, including the rapid expansion of the wind energy sector, rising adoption of electric vehicles (EVs), and growing demand for bio-degradable lubricants, are also influencing the overall market.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global lubricants market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product type, base oil and end use industry.Product Type Insights:

- Engine Oil

- Transmission/Hydraulic Fluid

- Metalworking Fluid

- General Industrial Oil

- Gear Oil

- Grease

- Process Oil

- Others

Base Oil Insights:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

End Use Industry:

- Power Generation

- Automotive and Other Transportation

- Heavy Equipment

- Food and Beverage

- Metallurgy and Metalworking

- Others

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global lubricants market. Detailed profiles of all major companies have been provided. Some of the companies covered include AMSOIL Inc., BP p.l.c., Chevron Corporation, China National Petroleum Corporation, China Petrochemical Corporation, ENEOS Corporation, ExxonMobil Corporation, Fuchs Petrolub SE, Phillips 66 Company, Saudi Arabian Oil Co., Shell plc, TotalEnergies SE. etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the global lubricants market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global lubricants market?

- What is the impact of each driver, restraint, and opportunity on the global lubricants market?

- What are the key regional markets?

- Which countries represent the most attractive lubricants market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the lubricants market?

- What is the breakup of the market based on the base oil?

- Which is the most attractive base oil in the lubricants market?

- What is the breakup of the market based on the end use industry?

- Which is the most attractive end use industry in the lubricants market?

- What is the competitive structure of the global lubricants market?

- Who are the key players/companies in the global lubricants market?

Table of Contents

Companies Mentioned

- AMSOIL Inc.

- BP p.l.c.

- Chevron Corporation

- China National Petroleum Corporation

- China Petrochemical Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- Fuchs Petrolub SE

- Phillips 66 Company

- Saudi Arabian Oil Co.

- Shell plc

- TotalEnergies SE. etc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | March 2025 |

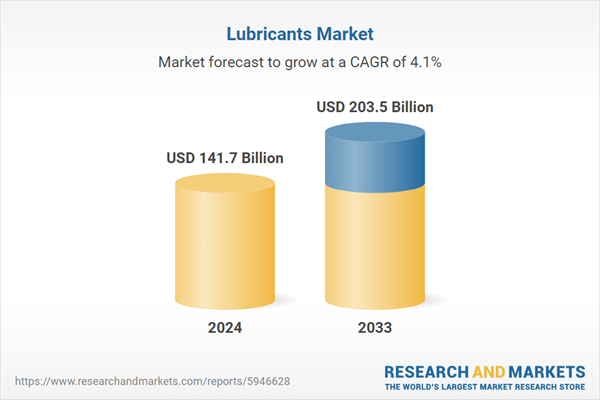

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 141.7 Billion |

| Forecasted Market Value ( USD | $ 203.5 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |