Medical disposables refer to single-use products and devices that are utilized in various healthcare settings, contributing to infection control, patient safety, and efficient medical practices. These items are designed to be used once and then disposed of, preventing the risk of cross-contamination and the transmission of infectious diseases. Medical disposables encompass a wide range of products, including gloves, face masks, syringes, needles, surgical gowns, drapes, bandages, catheters, and more. These items play a crucial role in maintaining hygiene and preventing the spread of infections in healthcare facilities such as hospitals, clinics, and laboratories.

The growing awareness of healthcare-associated infections (HAIs) has prompted a heightened focus on infection control measures. Medical disposables, being designed for single use, play a pivotal role in reducing the risk of cross-contamination and HAIs, driving their demand. Additionally, the escalating prevalence of chronic diseases, such as diabetes and cardiovascular conditions, necessitates frequent medical interventions and monitoring. Single-use medical disposables like syringes, insulin pens, and test strips are crucial for managing these conditions, bolstering market growth. Other than this, the COVID-19 pandemic underscored the vital role of medical disposables in safeguarding healthcare workers and patients.

Personal protective equipment (PPE), such as masks, gloves, and gowns, have become emblematic of infection control, resulting in increased consumption and demand. Besides this, the emerging economies are investing in healthcare infrastructure to provide accessible and quality medical services. This expansion requires a consistent supply of medical disposables, both for routine care and emergency response. In line with this, medical disposables simplify procedures, enhance efficiency, and reduce turnaround times.

They also eliminate the need for complex sterilization processes and reduce the risk of human errors, thereby improving patient outcomes. Moreover, technological progress has led to the development of innovative medical procedures and devices that require sterile environments and disposable tools to minimize complications. The expanding landscape of minimally invasive surgeries and diagnostic techniques is further expected to provide a favorable market outlook.

Medical Disposables Market Trends/Drivers:

Increasing Emphasis on Infection Control

HAIs pose significant risks to patients and can lead to extended hospital stays, increased healthcare costs, and even mortality. To combat this, medical disposables have gained prominence as critical tools for infection prevention. Single-use products, such as gloves, masks, and sterile drapes, create a barrier between patients, healthcare workers, and potentially harmful pathogens. These disposables significantly reduce the likelihood of cross-contamination, thus safeguarding both patients and medical personnel. With healthcare institutions focusing on reducing HAIs to improve patient outcomes, the demand for medical disposables remains robust.Rising Chronic Diseases

Conditions like diabetes, requiring regular blood glucose monitoring and insulin administration, necessitate the use of disposable syringes, lancets, and test strips. Similarly, cardiovascular diseases demand frequent interventions such as catheterizations, stent placements, and angioplasties, all of which require sterile single-use tools. The convenience, safety, and accuracy offered by medical disposables play a pivotal role in managing chronic diseases effectively. As populations age and chronic disease rates continue to climb, the reliance on these disposable products is expected to grow, driving innovation and expansion within the medical disposables market.Advancements in Medical Technology

Rapid advancements in medical technology have transformed the landscape of healthcare, leading to the emergence of innovative medical procedures and devices. Many of these cutting-edge procedures require a sterile environment to minimize the risk of infections. Medical disposables, such as specialized catheters, surgical drapes, and diagnostic tools, ensure that these advanced procedures can be conducted safely and effectively.Moreover, the trend toward minimally invasive surgeries, enabled by sophisticated instruments and tools, relies heavily on disposable equipment to maintain the highest standards of hygiene. As the field of medical technology continues to evolve, the demand for specialized medical disposables will remain a driving force in shaping the market's growth trajectory.

Medical Disposables Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global medical disposables market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on product, raw material and end use.Breakup by Product:

- Wound Management Products

- Drug Delivery Products

- Diagnostic and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

- Respiratory Supplies

- Sterilization Supplies

- Non-woven Disposables

- Disposable Masks

- Disposable Eye Gear

- Disposable Gloves

- Hand Sanitizers

- Others

Sterilization supplies dominate the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes wound management products, drug delivery products, diagnostic and laboratory disposables, dialysis disposables, incontinence products, respiratory supplies, sterilization supplies, non-woven disposables, disposable masks, disposable eye gear, disposable gloves, hand sanitizers, and others. According to the report, sterilization supplies represented the largest segment.Sterilization supplies encompass a wide range of products, including sterilization wraps, pouches, indicators, and autoclave tapes. These disposables are vital in ensuring that medical instruments and equipment are effectively sterilized before use in procedures and patient care. With stringent regulatory standards mandating the use of sterile instruments, healthcare facilities rely heavily on these supplies to prevent cross-contamination and HAIs.

Furthermore, the increasing adoption of minimally invasive surgeries and advanced medical procedures necessitates impeccable instrument sterilization. The global medical community's continued efforts to curb the spread of infectious diseases, along with the ongoing emphasis on patient safety, drive the demand for sterilization supplies, making it the largest and most crucial segment within the global medical disposables market.

Breakup by Raw Material:

- Plastic Resin

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metals

- Glass

- Others

Plastic resin holds the largest share in the market

A detailed breakup and analysis of the market based on the raw material has also been provided in the report. This includes plastic resin, nonwoven material, rubber, paper and paperboard, metals, glass, and others. According to the report, plastic resin accounted for the largest market share.Plastics are renowned for their versatility, enabling them to be molded into a wide variety of medical disposable products, ranging from syringes and catheters to gloves and tubing. This adaptability allows manufacturers to address the diverse needs of healthcare facilities efficiently. Additionally, plastic resins can be engineered to exhibit properties crucial for medical applications, such as biocompatibility, chemical resistance, and sterility maintenance. They can be formulated to prevent interactions with medications and bodily fluids while ensuring a safe and effective environment for patient care.

Other than this, plastic disposables are often lightweight and cost-effective, aligning well with the demands of both healthcare providers and patients. The ease of mass production and customization further enhances their attractiveness for medical applications. Moreover, plastics' ability to be produced with minimal risk of contamination and to withstand sterilization processes like autoclaving or ethylene oxide treatment contributes to their prevalence in medical disposables.

Breakup by End Use:

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

Hospitals dominate the market

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals, home healthcare, outpatient/primary care facilities, and others. According to the report, hospitals represented the largest segment.Hospitals serve as vital centers for medical diagnosis, treatment, surgery, and patient care, thereby requiring a substantial volume of medical disposables to ensure optimal infection control and patient safety. Within hospitals, a wide range of medical procedures, surgeries, and interventions take place, each demanding specific disposable items. Sterile gloves, masks, drapes, syringes, and catheters are few medical disposables needed to maintain a safe and hygienic environment.

The criticality of infection prevention, particularly in a high-risk environment like a hospital, drives the demand for these single-use products. Additionally, hospitals cater to a diverse patient population with varying medical needs. This diversity necessitates an extensive array of medical disposables to address different conditions and procedures, contributing to the significant consumption of these products.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America possesses a well-established and sophisticated healthcare ecosystem, characterized by world-class hospitals, research institutions, and medical facilities. The region's emphasis on delivering high-quality patient care and advanced medical procedures necessitates a substantial demand for medical disposables. Additionally, the region's high healthcare expenditure allows for the consistent procurement of medical disposables to maintain rigorous infection control standards. The priority placed on patient safety and infection prevention drives the utilization of single-use products, contributing to the robust demand for medical disposables.

Other than this, stringent regulatory frameworks and quality standards in North America ensure that medical disposables adhere to the highest levels of safety and efficacy. This focus on regulatory compliance enhances trust in these products, further bolstering their consumption. Furthermore, North America's responsiveness to technological advancements and innovations in healthcare fosters the adoption of novel medical procedures and devices, many of which rely on disposable tools to maintain sterility and prevent infections.

Competitive Landscape:

Prominent companies invest significantly in research and development to create cutting-edge medical disposable products that align with emerging medical trends. This includes developing materials with enhanced biocompatibility, sustainability, and infection resistance, as well as designing disposables tailored to specific medical procedures. Additionally, leading companies continually expand their portfolios to encompass a wide array of medical disposables, catering to various medical disciplines and procedures. This diversification ensures they can offer comprehensive solutions that meet the needs of different healthcare settings. Other than this, key players are actively entering new markets and regions to tap into unmet healthcare demands.By leveraging their expertise and distribution networks, they aim to provide medical disposables to underserved areas, thus contributing to global healthcare access. Besides this, collaboration with healthcare institutions, research centers, and regulatory bodies enables key players to stay updated on industry trends and regulatory changes. These partnerships foster knowledge exchange, aid in compliance, and drive mutual growth. In line with this, numerous major players are focusing on sustainability by exploring eco-friendly materials and manufacturing processes for their disposables. These efforts align with growing environmental awareness and consumer demands for greener healthcare solutions.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- 3M Company

- Abbott Laboratories

- AMMEX Corporation

- Ansell Ltd.

- B Braun Melsungen AG

- Becton Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health Inc.

- Medline Industries LP

- Medtronic plc

- Narang Medical Limited

- Smith & Nephew plc

- Terumo Cardiovascular Systems Corporation (Terumo Medical Corporation)

Key Questions Answered in This Report:

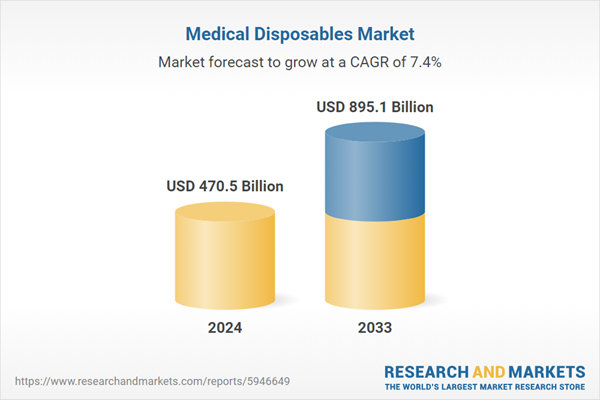

- What was the size of the global medical disposables market in 2024?

- What is the expected growth rate of the global medical disposables market during 2025-2033?

- What are the key factors driving the global medical disposables market?

- What has been the impact of COVID-19 on the global medical disposables market?

- What is the breakup of the global medical disposables market based on the product?

- What is the breakup of the global medical disposables market based on the raw material?

- What is the breakup of the global medical disposables market based on end use?

- What are the key regions in the global medical disposables market?

- Who are the key players/companies in the global medical disposables market?

Table of Contents

Companies Mentioned

- 3M Company

- Abbott Laboratories

- AMMEX Corporation

- Ansell Ltd.

- B Braun Melsungen AG

- Becton Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health Inc.

- Medline Industries LP

- Medtronic plc

- Narang Medical Limited

- Smith & Nephew plc

- Terumo Cardiovascular Systems Corporation (Terumo Medical Corporation)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 470.5 Billion |

| Forecasted Market Value ( USD | $ 895.1 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |