The North America dog food market growth is attributed to the increasing trend of pet ownership due to the growing disposable incomes and changes in lifestyles. The 2024 APPA National Pet Owners Survey reports that 82 million households in the United States now possess a pet, reflecting how important pet care is in America's homes. Due to the humanization of pets, owners are on the lookout for healthy, nutrient-rich food just like humans follow diet trends. Premium, organic, and natural ingredients, with no artificial additives or fillers, are becoming an increasing requirement among consumers to increase their pets' life expectancy and ensure good health. Growing demand for functional pet foods enriched with probiotics, antioxidants, and omega fatty acids addresses specific health concerns related to joint health, digestion, and skin. Grain-free, high-protein, and raw diets are also in high demand among pet owners interested in specialized nutrition. Increased pet adoptions continue to drive demand for superior-quality pet food products.

Another driver is the accelerated growth of the e-commerce/direct-to-consumer sales platforms, which means premium, and niche products are that much more reachable. Subscription services for pet foods have also begun to take a foothold here, offering unique meal plans centered on the breed, age, and dietary-specific needs of your dog. Pet owners seek sustainable and ethically sourced products, making manufacturers shift to eco-friendly packaging and responsibly sourced ingredients. The growing influence of social media, celebrity endorsements, and veterinary recommendations has further propelled demand for specialized pet foods. Innovation is also being focused upon by pet food companies, who are introducing freeze-dried, fresh, and customized meal options to cater to evolving consumer preferences. Yet, the increasing veterinary health care costs also push pet owners to invest in preventive nutrition, further elevating North America dog food demand.

North America Dog Food Market Trends:

Rise of premium and functional dog food

One of the prominent North America dog food market trends is the growing demand for premium and functional pet food. Owners are increasingly treating their pets as family members, with improvements in lifestyle urging people to upgrade to human-grade ingredients for their dogs. The most emerging health-specific foods are functional ones, which include added probiotics, antioxidants, and omega fatty acids, addressing specific health challenges in animals such as joint health, digestive health, and skin issues. Grain-free, high-protein diets, and raw diets are becoming more common as pet owners increasingly demand more biologically appropriate nutrition for their pets. Overall, fresh and freeze-dried dog food is trending, offering better nutrition for dogs compared to the traditional kibbles. Brands have been emphasizing ingredient disclosure, and removing artificial additives, fillers, and byproducts. Another growing trend is individualized and breed-specific nutrition given surging cases of pet obesity and allergies. Morris Animal Foundation suggests that around 56% of dogs in the United States are plagued by weight-related issues. This is one of the reasons for healthier, well-balanced diets in pets. This reason has compelled pet owners to seek personalized diet plans that cater to the management of weight and wellness in general. The eagerness of consumers to spend extra money on higher-quality food encourages brands to research innovative methods. Novel proteins like venison, bison, and insect-based ingredients are gaining ground by serving specific dietary requirements.E-commerce and subscription-based services

North America Dog Food Market forecast shows that e- commerce has transformed the dog food market, with pet owners increasingly opting for the convenience of online shopping. Easy access to a great variety of pet food products, handy price comparisons, and doorstep delivery services prove to be a good reason for the rapid increase in sales online. Subscription-based dog food services have taken off, allowing for customized meal plans based on a pet's breed, age, weight, and dietary preferences. Such services provide fresh, frozen, or freeze-dried meals delivered at a regular frequency to ensure that pets are kept convenient and their nutrition consistent. DTC brands are capitalizing on this trend, bypassing traditional retail channels to offer high-quality, personalized nutrition. Besides that, social media and influencer marketing have been very critical in advancing online sales. Pet owners look at peer reviews and expert recommendations before purchasing a product. The COVID-19 pandemic was bound to hasten the effect as even after all restrictions were lifted, a good percentage of consumers still favored shopping online. Technological advancements such as AI-driven customization will continue to propel the growth of e-commerce and subscription-based pet food services, thus changing the way pet owners purchase and engage with dog food brands.Sustainability and ethical sourcing in pet food

The dog food industry in North America is beginning to place a greater emphasis on sustainability. Pet owners are already expressing a need for dog food product lines that are ethically and ecologically sourced. Growing consumer understanding of pet food's environmental impact makes them realize that using sustainable, ethical components, such as plant-based proteins and meats from ethical sources, is necessary. To lessen their carbon impact, manufacturers are also experimenting with different protein sources, such as lab-grown beef and additives derived from insects. Certified organic and free-range meats are examples of ethical sourcing methods that are becoming more popular as animal welfare rises to the top of most customers' minds. According to an NSF survey, 67% of participants said that animal welfare plays a significant role in their purchase decisions, and 68% underlined how crucial it is for businesses to show transparency and compliance in this area. Pet food manufacturers have responded to this heightened awareness by highlighting their sustainability initiatives through eco-labels, certifications, and even thorough ingredient traceability. Many businesses strive to reduce plastic waste, and sustainable packaging solutions that use recyclable and biodegradable materials are growing in popularity. To fulfill customer expectations, a lot of other businesses are committing to carbon-neutral operations and responsible sourcing programs. Sustainability will continue to influence product development and consumer choices in the North American dog food industry as environmental concerns increase.North America Dog Food Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the North America dog food market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, pricing type, ingredient type, and distribution channel.Analysis by Product Type:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

Analysis by Pricing Type:

- Mass Products

- Premium Products

Analysis by Ingredient Type:

- Animal Derived

- Plant Derived

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Country Analysis:

- United States

- Canada

Competitive Landscape:

Market players in the North American dog food industry are focusing on innovation, sustainability, and health-conscious formulations to meet the evolving demands of consumers. Major players are increasingly introducing premium, plant-derived, and functional pet food products that emphasize high-quality ingredients, transparency, and ethical sourcing. Many companies are investing in research and development to create formulations that meet specific health needs, including weight management, joint health, and digestion, and products addressing allergies or skin conditions. Plant-based and grain-free ingredients are strong, given consumer demand for cruelty-free and hypoallergenic options. Moreover, sustainability is now the core theme, where brands are embracing eco-friendly packaging, reducing carbon footprints, and using sustainable ingredients such as plant proteins and insect-based options. Many players are expanding their presence through e-commerce channels, offering subscription services and personalized meal plans to cater to the growing trend of convenience. Increased consumer trends for online purchases forced pet food manufacturers to adjust the digital sites of their platforms so that there would be greater customer access. Moreover, the usage of social media and its influence in marketing has seen increased uptake; the latter part of marketing leverages platforms of social media to win and educate people on the goodness and value-added of their pet foods. These activities together create a positive North America Dog Food Market outlook.The report provides a comprehensive analysis of the competitive landscape in the North America dog food market with detailed profiles of all major companies.

Key Questions Answered in This Report

1. How big is the dog food market in the North America?2. What factors are driving the growth of the North America dog food market?

3. What is the forecast for the dog food market in North America?

4. Which region accounted for the largest North America dog food segment market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Dog Food Market

5.1 Market Performance

5.2 Market Breakup by Product Type

5.3 Market Breakup by Pricing Type

5.4 Market Breakup by Ingredient Type

5.5 Market Breakup by Distribution Channel

5.6 Market Breakup by Region

5.7 Market Forecast

6 North America Dog Food Market

6.1 Market Performance

6.2 Impact of COVID-19

6.3 Market Forecast

7 North America Dog Food Market: Breakup by Product Type

7.1 Dry Dog Food

7.2 Dog Treats

7.3 Wet Dog Food

8 North America Dog Food Market: Breakup by Pricing Type

8.1 Mass Products

8.2 Premium Products

9 North America Dog Food Market: Breakup by Ingredient Type

9.1 Animal Derived

9.2 Plant Derived

10 North America Dog Food Market: Breakup by Distribution Channel

10.1 Supermarkets and Hypermarkets

10.2 Specialty Stores

10.3 Online Stores

10.4 Others

11 North America Dog Food Market: Breakup by Country

11.1 United States

11.1.1 Historical Market Trends

11.1.2 Market Breakup by Product Type

11.1.3 Market Breakup by Pricing Type

11.1.4 Market Breakup by Ingredient Type

11.1.5 Market Breakup by Distribution Channel

11.1.6 Market Forecast

11.2 Canada

11.2.1 Historical Market Trends

11.2.2 Market Breakup by Product Type

11.2.3 Market Breakup by Pricing Type

11.2.4 Market Breakup by Ingredient Type

11.2.5 Market Breakup by Distribution Channel

11.2.6 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

13.1 Overview

13.2 Raw Material Procurement

13.3 Manufacturer

13.4 Marketing

13.5 Distributor

13.6 Retailer/Exporter

13.7 End-User

14 Porter’s Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Rivalry

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

List of Figures

Figure 1: North America: Dog Food Market: Major Drivers and Challenges

Figure 2: Global: Dog Food Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Dog Food Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Dog Food Market: Breakup by Pricing Type (in %), 2024

Figure 5: Global: Dog Food Market: Breakup by Ingredient Type (in %), 2024

Figure 6: Global: Dog Food Market: Breakup by Distribution Channel (in %), 2024

Figure 7: Global: Dog Food Market: Breakup by Region (in %), 2024

Figure 8: Global: Dog Food Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: North America: Dog Food Market: Sales Value (in Billion USD), 2019-2024

Figure 10: North America: Dog Food Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 11: North America: Dog Food Market: Breakup by Product Type (in %), 2024

Figure 12: North America: Dog Food (Dry Dog Food) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 13: North America: Dog Food (Dry Dog Food) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 14: North America: Dog Food (Dog Treats) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 15: North America: Dog Food (Dog Treats) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 16: North America: Dog Food (Wet Dog Food) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 17: North America: Dog Food (Wet Dog Food) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 18: North America: Dog Food Market: Breakup by Pricing Type (in %), 2024

Figure 19: North America: Dog Food (Mass Products) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 20: North America: Dog Food (Mass Products) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 21: North America: Dog Food (Premium Products) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 22: North America: Dog Food (Premium Products) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 23: North America: Dog Food Market: Breakup by Ingredient Type (in %), 2024

Figure 24: North America: Dog Food (Animal Derived) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 25: North America: Dog Food (Animal Derived) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 26: North America: Dog Food (Plant Derived) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 27: North America: Dog Food (Plant Derived) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 28: North America: Dog Food Market: Breakup by Distribution Channel (in %), 2024

Figure 29: North America: Dog Food Market: Sales through Supermarkets and Hypermarkets (in Billion USD), 2019 & 2024

Figure 30: North America: Dog Food Market Forecast: Sales through Supermarkets and Hypermarkets (in Billion USD), 2025-2033

Figure 31: North America: Dog Food Market: Sales through Specialty Stores (in Billion USD), 2019 & 2024

Figure 32: North America: Dog Food Market Forecast: Sales through Specialty Stores (in Billion USD), 2025-2033

Figure 33: North America: Dog Food Market: Sales through Online Stores (in Billion USD), 2019 & 2024

Figure 34: North America: Dog Food Market Forecast: Sales through Online Stores (in Billion USD), 2025-2033

Figure 35: North America: Dog Food Market: Sales through Other Distribution Channels (in Billion USD), 2019 & 2024

Figure 36: North America: Dog Food Market Forecast: Sales through Other Distribution Channels (in Billion USD), 2025-2033

Figure 37: North America: Dog Food Market: Breakup by Country (in %), 2024

Figure 38: United States: Dog Food Market: Sales Value (in Billion USD), 2019-2024

Figure 39: United States: Dog Food Market: Breakup by Product Type (in %), 2024

Figure 40: United States: Dog Food Market: Breakup by Pricing Type (in %), 2024

Figure 41: United States: Dog Food Market: Breakup by Ingredient Type (in %), 2024

Figure 42: United States: Dog Food Market: Breakup by Distribution Channel (in %), 2024

Figure 43: United States: Dog Food Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 44: Canada: Dog Food Market: Sales Value (in Billion USD), 2019-2024

Figure 45: Canada: Dog Food Market: Breakup by Product Type (in %), 2024

Figure 46: Canada: Dog Food Market: Breakup by Pricing Type (in %), 2024

Figure 47: Canada: Dog Food Market: Breakup by Ingredient Type (in %), 2024

Figure 48: Canada: Dog Food Market: Breakup by Distribution Channel (in %), 2024

Figure 49: Canada: Dog Food Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 50: North America: Dog Food Industry: SWOT Analysis

Figure 51: North America: Dog Food Industry: Value Chain Analysis

Figure 52: North America: Dog Food Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: North America: Dog Food Market: Key Industry Highlights, 2024 and 2033

Table 2: North America: Dog Food Market Forecast: Breakup by Product Type (in Billion USD), 2025-2033

Table 3: North America: Dog Food Market Forecast: Breakup by Pricing Type (in Billion USD), 2025-2033

Table 4: North America: Dog Food Market Forecast: Breakup by Ingredient Type (in Billion USD), 2025-2033

Table 5: North America: Dog Food Market Forecast: Breakup by Distribution Channel (in Billion USD), 2025-2033

Table 6: North America: Dog Food Market Forecast: Breakup by Country (in Billion USD), 2025-2033

Table 7: North America: Dog Food Market: Competitive Structure

Table 8: North America: Dog Food Market: Key Players

Table Information

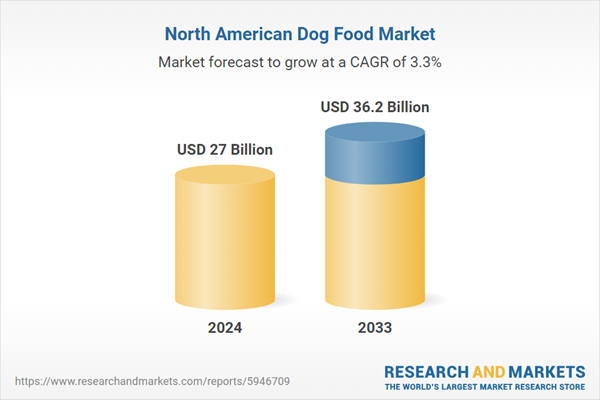

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 27 Billion |

| Forecasted Market Value ( USD | $ 36.2 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | North America |