Ortho-Xylene Market Analysis:

Market Growth and Size: The global market is experiencing robust growth, primarily driven by the expanding paint and coating industry and the rising demand in the polyester sector. This growth is further fueled by urbanization and industrial development, particularly in emerging economies, leading to an increased market size.Technological Advancements: Advancements in production technologies are leading to more efficient and environmentally friendly processes. Innovations in catalysis and process optimization contribute to higher yield and purity, enhancing overall market efficiency.

Industry Applications: It finds extensive applications in key industries such as paints and coatings, where it's used for phthalic anhydride production, and in the polyester industry for manufacturing purified terephthalic acid (PTA) and dimethyl terephthalate (DMT). Its role in these industries underlines its market significance.

Key Market Trends: A significant trend in the market is the increasing demand from emerging markets, particularly in the Asia-Pacific regions. Another trend is the market's sensitivity to crude oil price fluctuations, impacting production costs and market dynamics.

Geographical Trends: The Asia-Pacific region, especially China and India, is leading the market growth due to rapid industrialization and the expansion of end-use industries. North America and Europe also maintain substantial market shares, driven by consistent demand in various industrial applications.

Competitive Landscape: The market is characterized by the presence of several key players, with competition based on factors such as price, quality, and technological advancements. Market players are focusing on strategic expansions and collaborations to enhance their market position.

Challenges and Opportunities: The market faces challenges such as environmental concerns and regulatory policies regarding chemical production and use. However, these challenges also present opportunities for innovation in green chemistry and sustainable practices, potentially opening new market avenues.

Ortho-Xylene Market Trends:

Increasing demand from the paint and coating industry

The global market is significantly propelled by the growing demand from the paint and coating industry. Ortho-Xylene, a critical raw material for producing phthalic anhydride, plays a vital role in the manufacturing of various coatings and plasticizers. Along with this, the rise in construction activities, especially in emerging economies, is leading to an upswing in demand for paints and coatings, thereby stimulating the market. Additionally, the automotive industry, which extensively uses paints and coatings for vehicle finishes, contributes to this demand. The growth in these end-use sectors is significantly supporting the market, aligning with the expansion in the construction and automotive sectors across the globe.Expansion of the polyester industry

The global market is also driven by its substantial application in the polyester industry. In confluence with this, it is a key component in the production of purified terephthalic acid (PTA) and dimethyl terephthalate (DMT), which are essential in manufacturing polyester. Moreover, the polyester industry, characterized by its applications in textiles, packaging, and PET bottles, is witnessing considerable growth, especially in Asia-Pacific regions. This growth is attributed to the rising demand for polyester fibers in the textile industry and the increasing consumption of PET bottles. The expanding polyester market, particularly in countries such as China and India, due to rapid industrialization and urbanization, is further positively influencing the market, making it a crucial link in the value chain of polyester production.Fluctuations in crude oil prices

The price and availability are closely linked to the global crude oil market, as it is a petroleum-derived chemical. Fluctuations in crude oil prices directly impact the market, making it one of the critical factors influencing its global demand and supply dynamics. In addition to this, periods of low oil prices can lead to reduced costs in production, potentially increasing its market demand. Conversely, high oil prices can lead to increased production costs, which may affect the demand negatively. This dependency on the volatile oil market presents both opportunities and challenges for the market, making the monitoring of crude oil trends essential for stakeholders in this sector. Furthermore, the market's sensitivity to these fluctuations necessitates strategic planning and forecasting by manufacturers and end-users in the value chain.Ortho-Xylene Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on application and end use.Breakup by Application:

- Phthalic Anhydride

- Bactericides

- Soybean Herbicides

- Lube Oil Additives

- Others

Phthalic anhydride accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the ortho-xylene market based on the application. This includes phthalic anhydride, bactericides, soybean herbicides, lube oil additives, and others. According to the report, phthalic anhydride represented the largest segment.The phthalic anhydride segment holds the largest share in the global market. This dominance is primarily due to the extensive use of phthalic anhydride in the production of plasticizers, which are crucial in manufacturing flexible PVC. This segment's growth is closely tied to the construction and automotive industries, where PVC finds significant applications. As these industries continue to expand, especially in emerging economies, the demand for phthalic anhydride remains high, thereby sustaining its leading position in the market.

On the contrary, it is used in the production of bactericides, representing a smaller yet important segment of the market. Bactericides formulated with it are employed in various sectors, including agriculture and healthcare, for preventing bacterial growth. Additionally, the rising focus on sanitation and hygiene, along with the increasing need for crop protection solutions, contributes to the steady growth of this segment.

In addition, the use of it in soybean herbicides forms a niche segment of the market. These herbicides are essential for controlling weeds and ensuring healthy soybean crop yields. Moreover, the growing global demand for soybeans, driven by their diverse applications in food, animal feed, and even biofuels, indirectly supports the demand in this segment.

Moreover, it is utilized in the formulation of certain lube oil additives, contributing to another specific market segment. These additives enhance the performance of lubricating oils used in various industries and automotive applications. The steady demand for high-performance lubricants, particularly in the automotive sector and industrial machinery, supports the growth of this segment.

Breakup by End Use:

- Automotive

- Building and Construction

- Paints and Coatings

- Aerospace and Defense

- Marine

- Electrical and Electronics

- Agrochemical

- Oil and Gas

- Chemical

- Others

Building and Construction holds the largest share of the industry

A detailed breakup and analysis of the ortho-xylene market based on the end use has also been provided in the report. This includes automotive, building and construction, paints and coatings, aerospace and defense, marine, electrical and electronics, agrochemical, oil and gas, chemical, and others. According to the report, building and construction accounted for the largest market share.The building and construction segment is the predominant consumer, primarily due to its extensive application in producing phthalic anhydride, a key ingredient in plasticizers for PVC. The growth in this sector is propelled by the global increase in construction activities, including residential and commercial buildings, particularly in emerging economies. The demand for durable and versatile materials in construction further cements this segment's position as the largest in the market.

On the other hand, in the automotive sector, it is used in the production of various components, coatings, and plasticizers. The demand in this segment is driven by the global automotive industry's growth, focusing on lightweight and efficient vehicles. Its role in enhancing the quality and durability of automotive paints and coatings is particularly significant, contributing to this segment's substantial share in the market.

Along with this, the paint and coatings industry represents a significant segment of the market. It is crucial in manufacturing high-quality paints and coatings used in various industries, including construction, automotive, and marine. The growth of this segment is sustained by the consistent demand for protective and aesthetic coatings across these industries.

Also, In the aerospace and defense sector, it is used in specialty coatings and composite materials. This segment, although smaller in comparison, is essential due to the high-value applications in aerospace manufacturing and maintenance. The demand in this segment is influenced by global defense spending and the aerospace industry's technological advancements.

In addition, the marine segment utilizes it in marine coatings and paints, essential for protecting vessels against harsh marine environments. This segment's growth is influenced by global shipping and maritime activities, including commercial shipping, naval fleets, and leisure boating.

Moreover, in the electrical and electronics industry, it finds applications in the production of insulation materials and components. The growth in consumer electronics, along with advancements in electrical infrastructure, supports the demand in this segment.

Apart from this, it is used in the agrochemical industry, particularly in the formulation of certain herbicides and pesticides. This segment's growth correlates with the global agricultural sector's need for effective crop protection solutions.

Furthermore, the oil and gas sector uses it in various applications, including as a solvent and in the production of certain additives. The segment's demand is influenced by global energy trends, exploration activities, and the oil and gas industry's overall health.

Concurrently, in the broader chemical industry, it is used as an intermediate in synthesizing various chemical products. This segment encompasses a diverse range of applications, contributing to the steady demand. The growth of this segment is closely linked to the overall health of the global chemical industry.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest ortho-xylene market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific region dominates the global market, largely due to the rapid industrialization and urbanization in countries such as China and India. This region's substantial growth in the building and construction, automotive, and chemical industries significantly contributes to the high demand. Additionally, the expanding polyester industry in the Asia Pacific, particularly for textile applications, reinforces its position as the market leader. The region's large population base and growing middle class also drive demand in end-use sectors, supporting the continued growth of the market.

In North America, the market is driven by advanced manufacturing sectors, including automotive, aerospace, and chemicals. The United States, being a major market player, exhibits a steady demand, attributed to its well-established industrial infrastructure and technological advancements. Additionally, the region's focus on high-performance materials in various industries, along with stringent environmental regulations, shapes the market dynamics in North America.

Along with this, Europe's market is characterized by its mature industrial sectors, including automotive, paints and coatings, and construction. The demand in this region is influenced by the focus on quality and sustainability, with European countries often leading in environmental and safety regulations. The market in Europe is supported by a strong chemical industry and a significant emphasis on advanced materials for various applications.

In addition, the market in Latin America is emerging, with countries including Brazil and Mexico showing growth potential. The region's market is driven by the development in the construction and automotive sectors, along with an increasing focus on industrialization.

Moreover, the market in the Middle East and Africa is relatively smaller but shows growth potential, particularly in the Gulf Cooperation Council (GCC) countries and South Africa. The market in this region is driven by the growth in construction activities and the increasing industrial base. The Middle East, with its significant oil and gas sector, also presents opportunities for its applications in petrochemical industries.

Leading Key Players in the Ortho-Xylene Industry:

The key players in the global market are actively engaged in various strategic initiatives to strengthen their market positions. These include investments in capacity expansions to meet the growing demand, particularly in the Asia Pacific region. Additionally, companies are focusing on technological advancements to enhance production efficiency and environmental compliance. Mergers and acquisitions are another prominent strategy, allowing companies to diversify their product portfolios and enter new markets. Furthermore, these market leaders are increasingly investing in research and development to innovate and develop sustainable and high-performance products, responding to the changing industry requirements and stringent environmental regulations. This proactive approach by the key players is vital in maintaining their competitiveness and adapting to the dynamic market landscape.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Braskem S/A

- China Petroleum & Chemical Corporation (China Petrochemical Corporation)

- Exxon Mobil Corporation

- Flint Hills Resources LLC (Koch Industries Inc.)

- Formosa Chemicals & Fibre Corp.

- Honeywell International Inc.

- Lotte Chemical Corporation

- Nouri Petrochemical Company

- Reliance Industries Limited

- SK geo centric Co. Ltd. (SK Innovation Co. Ltd.)

Key Questions Answered in This Report:

- How has the global ortho-xylene market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global ortho-xylene market?

- What is the impact of each driver, restraint, and opportunity on the global ortho-xylene market?

- What are the key regional markets?

- Which countries represent the most attractive ortho-xylene market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the ortho-xylene market?

- What is the breakup of the market based on the end use?

- Which is the most attractive end use in the ortho-xylene market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global ortho-xylene market?

Table of Contents

Companies Mentioned

- Braskem S/A

- China Petroleum & Chemical Corporation (China Petrochemical Corporation)

- Exxon Mobil Corporation

- Flint Hills Resources LLC (Koch Industries Inc.)

- Formosa Chemicals & Fibre Corp.

- Honeywell International Inc.

- Lotte Chemical Corporation

- Nouri Petrochemical Company

- Reliance Industries Limited

- SK geo centric Co. Ltd. (SK Innovation Co. Ltd.)

Table Information

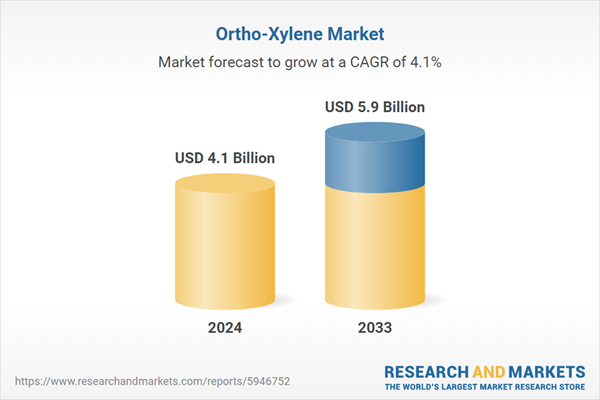

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |