The steel sector is the biggest user of refractories, and its steady expansion plays a key role in driving market growth. Steel manufacturing involves extreme heat, with temperatures exceeding 1,600°C, which demands materials that can withstand such conditions. Refractories are essential for safeguarding the equipment involved in steel production, including blast furnaces, converters, and ladles. During mid-January 2025, local raw steel production reached 1,659,000 net tons in the United States, operating at a capability utilization rate of 74.5%. This marked a 1.8% increase from the same period in 2024, which recorded 1,629,000 net tons and a 73.3% utilization rate. This continuous production highlights the persistent demand for top-quality refractories capable of enduring the intense temperatures in steel manufacturing processes. Furthermore, the shift towards electric arc furnaces (EAF) in steelmaking, which are more energy-efficient and environmentally friendly, has opened up opportunities for innovation in refractory materials. Companies are focusing on developing specialized refractories suited for EAF processes, further driving the refractories market growth.

The United States stands out as a key market disruptor, driven by the rising energy efficiency need among industries to reduce operational costs and environmental impact. In 2023, the U.S. Department of Energy’s Industrial Efficiency and Decarbonization Office invested over $350 million in industrial innovation to promote cleaner and more efficient energy use. This investment has encouraged the adoption of advanced refractory materials that enhance thermal efficiency in high-temperature industrial processes, thereby driving demand in the market. Furthermore, urbanization trends in the U.S. continue to influence infrastructure development. The degree of urbanization increased from 75.3% in 1990 to 83.3% in 2023, reflecting a steady population shift toward urban areas. This urban growth drives the construction of residential and commercial buildings, roads, and bridges, subsequently increasing the demand for materials like steel and cement. The production of these materials relies heavily on refractories, thereby stimulating the expansion of the refractories market share in United States.

Refractories Market Trends:

Industrial expansion and modernization

The continuous expansion and modernization of various industries are significant drivers for the global refractories market demand. For instance, industrial production in India increased 5.20% in November of 2024 over the same month in the previous year. Industries such as steel, cement, glass, petrochemicals, and non-ferrous metals rely heavily on refractory materials. As these sectors grow and upgrade their facilities, there is a growing need for refractories to line and protect high-temperature equipment, such as blast furnaces, rotary kilns, and glass melt tanks. This demand is particularly evident in emerging economies where rapid industrialization and infrastructure development are ongoing. In developed nations, refurbishing and upgrading aging infrastructure also contribute to the sustained demand for refractories.Technological advancements and energy efficiency

The growing use of cutting-edge and energy-efficient technologies in industrial operations is another important refractory market trends. Manufacturers are always looking for ways to decrease emissions, increase overall operational sustainability, and improve energy efficiency. Refractories, which can tolerate high temperatures and chemical reactions, are essential to these efforts. In order to endure the demands of contemporary industrial processes, new, high-performance refractory materials are being created, which helps to improve energy efficiency and lessen environmental effect. For instance, firebricks are refractory bricks that can, with one composition, store heat, and with another, insulate the firebricks that store the heat. A 31% reduction in annual hydrogen production for grid electricity indicates that firebricks could minimize reliance on hydrogen, which is often used for energy storage and grid balancing. These developments help industries achieve their objectives of lowering their carbon footprint and complying with strict environmental requirements.Infrastructure development and urbanization

The growth in infrastructure development and urbanization, particularly in emerging economies, is boosting demand for refractories in the construction and housing sectors. The World Bank reports that Private Participation in Infrastructure (PPI) investment reached USD 86.0 billion in 2023. Refractory materials are necessary to keep facilities such as industrial incinerators, fireplaces, and chimneys structurally sound. The need for strong, heat-resistant buildings is growing as more metropolitan areas develop, and this is driving the refractories market's constant expansion. Refractory bricks and materials for insulation and fireproofing are also frequently used in the construction of residential and commercial structures, which fuels the market's growth. This pattern is strongly associated with improving living standards and more building in developing areas.Refractories Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global refractories market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on form, alkalinity, manufacturing process, composition, refractory mineral, and application.Analysis by Form:

- Shaped Refractories

- Unshaped Refractories

Analysis by Alkalinity:

- Acidic and Neutral

- Basic

Analysis by Manufacturing Process:

- Dry Press Process

- Fused Cast

- Hand Molded

- Formed

- Unformed

Analysis by Composition:

- Clay-Based

- Nonclay-Based

Analysis by Refractory Mineral:

- Graphite

- Magnesite

- Chromite

- Silica

- High Alumina

- Zirconia

- Others

Analysis by Application:

- Iron and Steel

- Cement

- Non-Ferrous Metals

- Glass

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

North America Refractories Market Analysis

The steady demand from the industries of steel, cement, and glass manufacturing is majorly driving the North American refractories market. As the region shifts focus towards energy efficiency and sustainability, the use of advanced refractory solutions has increased, aiming to improve thermal efficiency and minimize environmental impact. In the United States, growth in steel production and investments in infrastructure projects consistently contribute to the demand in the market. The improvements in technology, like refractory material, which offers lightweight and durable products, also supports the industrial modernization process. Also, manufacturers are focusing on developing eco-friendly and recyclable refractory, pushing compliance towards a more sustainable and green North American market.United States Refractories Market Analysis

The growing adoption of refractories is being significantly influenced by the expansion of the chemical industries, particularly driven by increasing production activities. According to International Trade Administration, the U.S. chemical manufacturing industry total FDI in the industry was USD 766.7 Billion in 2023. As manufacturing processes in industries like petrochemicals, fertilizers, and plastics see heightened demand, refractories are becoming essential for ensuring high efficiency and safety. These materials are crucial for withstanding extreme temperatures, abrasions, and chemical reactions during production. The robust development of chemical plants and refineries, especially in regions with booming industrial capacities, is stimulating the market for advanced refractory products. Refractories, offering superior performance and longevity, are increasingly favored for their resistance to thermal shock and chemical corrosion. The continued rise in industrial outputs necessitates refractories to maintain system integrity, ensuring streamlined production in high-demand markets.Asia Pacific Refractories Market Analysis

Growth in the adoption of refractories is seen in the Asia-Pacific region, driven by its booming electronics production. As per the India Brand Equity Foundation, India's domestic electronics production increased from USD 29 billion in 2014-15 to USD 101 billion in 2022-23. As the demand for electronics grows exponentially, so does the requirement for performance materials that can tolerate the rigors of semiconductor manufacturing environments and other high-tech manufacturing processes. Refractories are critical in maintaining the dependability and productivity of machinery used in these areas because of their superior heat and wear resistance. As countries in the region build up their manufacturing capabilities to fulfil the growing world demand for electronics, refractories are becoming critical to the continued operation and stability of equipment in the manufacturing process, meeting production standards.Europe Refractories Market Analysis

The growing adoption of refractories in Europe is tied closely to the expansion and modernization of industrial production, particularly in the banking sector. The EU's industrial production in 2021 increased by 8.5% compared with 2020, as reported. It continued to rise in 2022 by 0.4% compared with 2021. As the industrial facilities expand, upgrade, and modernize their operations, there is an increased demand for durable and efficient refractory materials to support new production technologies. These materials are especially essential to energy-intensive industries; ensuring operational continuity and constant performance level is vital. Advanced developments in machinery and equipment have made refractories a vital component in maintaining the stability and resiliency of the infrastructure and helping drive higher productivity in industrial operations. This trend is further propelled by increasing demands for better-performing materials to maintain competitiveness.Latin America Refractories Market Analysis

The automotive industry in Latin America is consistently growing and with that, the demand for refractory also rises. For example, Stellantis announces USD 6.03 Billion in new investment in South America, its biggest investment ever into the region's automotive sector. The production increase of automobiles as well as vehicle parts pushes the development within the industry where high temperature is required. Automotive manufacturing processes like casting, heat treatment, and welding require refractories, as the temperatures at which they are conducted are extreme. Hence, in Latin America, with the continuous growth of the industry, the demand for refractories that resist such conditions without performance degradation is increased considerably. The rising automotive production in the region is therefore directly contributing to the increased adoption of refractories, making them an integral part of the sector’s technological advancements and production efficiency.Middle East and Africa Refractories Market Analysis

In the Middle East and Africa, the refractory industry is registering growing adoption through the cement sector, which in turn is propelled by construction activities that have witnessed increasing momentum. Reportedly, construction in Saudi Arabia is experiencing massive growth with more than 5,200 projects underway valued at USD 819 Billion. As urbanization is gaining faster pace and infrastructure development becoming a top priority, the demand for cement increases and hence requires the utilization of refractories in cement manufacturing plants. These materials are necessary for maintaining the high temperatures and abrasive conditions of cement kilns and other heavy-duty machinery. The growth in construction activities is creating an environment where refractories are critical to maintaining continuous and efficient operations, meeting the growing demands for infrastructure development across the region.Competitive Landscape:

The key players in this market are dynamically focusing on developing strategies to build their market stronghold and cater to the changing industrial demands. These companies are entering new markets with acquisitions and joint ventures, emerging as well as established, diversifying their customers and product base. Innovation continues to be a key driver, with significant investments in the research and development of environmentally friendly, energy-efficient refractory solutions. The technological development is aimed to meet the standards of environmental legislation and to achieve the requirement for sustainable manufacturing across industries. On the other hand, market leaders are using digital monitoring systems along with other high technologies to upgrade the performance as well as lifespan of refractory materials. The high-performance product development is also achieved to withstand high temperatures and chemical stresses, critical for steel, cement, and glass industries.The report provides a comprehensive analysis of the competitive landscape in the refractories market with detailed profiles of all major companies, including:

- Chosun Refractories Eng Co. Ltd.

- Compagnie de Saint-Gobain S.A.

- Coorstek Inc.

- Imerys Usa Inc.

- Krosaki Harima Corporation

- Morgan Advanced Materials Plc

- Refratechnik Holding GmbH

- RHI Magnesita GmbH

- Vesuvius Plc

Key Questions Answered in This Report

1. How big is the refractories market?2. What is the future outlook of refractories market?

3. What are the key factors driving the refractories market?

4. Which region accounts for the largest refractories market share?

5. Which are the leading companies in the global refractories market?

Table of Contents

Companies Mentioned

- Chosun Refractories Eng Co. Ltd.

- Compagnie de Saint-Gobain S.A.

- Coorstek Inc.

- Imerys Usa Inc.

- Krosaki Harima Corporation

- Morgan Advanced Materials Plc

- Refratechnik Holding GmbH

- RHI Magnesita GmbH

- Vesuvius Plc

Table Information

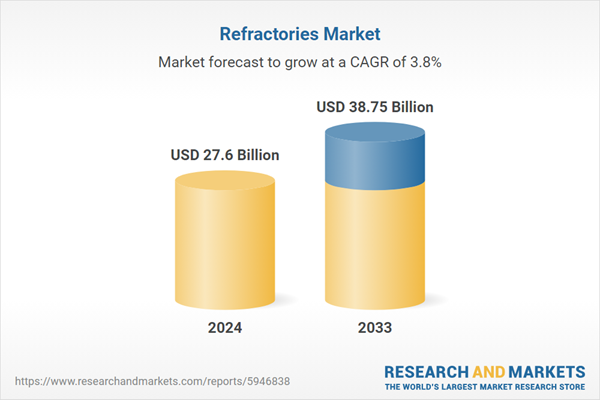

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 27.6 Billion |

| Forecasted Market Value ( USD | $ 38.75 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |