Smart meters are digital devices that are currently revolutionizing the way utility consumption is measured and managed. Replacing traditional analog meters, these innovative tools offer real-time monitoring of electricity, gas, and water usage. Unlike conventional meters, which necessitate manual reading by utility personnel, smart meters automatically send consumption data to the utility company. This automation enables more accurate billing and eliminates the need for estimated usage charges. Moreover, they provide detailed insights into consumption patterns, empowering consumers to manage their usage more effectively.

Smart meters also expedite fault detection, allowing quicker service restoration during outages. They serve as the backbone for smart grids, systems that optimize electricity distribution, reducing waste and improving sustainability. As a result, smart meters are gaining immense traction in modernizing utility management and enhancing consumer experience.

The heightened consumer awareness and demand for transparency will stimulate the growth of the smart meters market during the forecast period. As people become more conscious of their consumption patterns, the demand for tools that can provide real-time insights is growing. Smart meters fulfill this need, offering detailed analyses of utility usage directly to consumers' smartphones or computers, thereby fueling product demand. Additionally, the integration of Internet of Things (IoT) technology with smart meters is gaining traction. IoT capabilities allow smart meters to interact seamlessly with other smart devices in homes and commercial spaces, contributing to the development of smarter cities and communities.

Moreover, advancements in grid technology are facilitating the transition from centralized energy distribution systems to more localized, grid-connected setups, necessitating the deployment of smart meters for accurate, real-time monitoring. This shift enhances both the resilience and sustainability of energy systems. Furthermore, the increasing threat of utility fraud is another major growth-inducing factor.

Smart meters come with advanced security features, helping utility companies to detect and prevent unauthorized usage or tampering. Besides this, the rising competition among manufacturers is resulting in technological innovations and reductions in the cost of smart meters, making them more accessible to a broader consumer base, thus supporting market growth.

Smart Meters Market Trends/Drivers:

Rise in Emphasis on Energy Efficiency:

One of the key factors driving the growth of the global smart meters market is the increasing emphasis on energy efficiency. Traditional metering systems often lack the capability to provide detailed insights into energy consumption, making it challenging to identify areas of wastage or inefficiency. Smart meters resolve this issue by offering real-time data on utility usage.This transparency empowers both consumers and utility companies to make data-driven decisions, leading to optimized energy utilization. Governments and organizations across the globe are increasingly recognizing the value of energy-efficient operations owing to cost savings and as a crucial component of sustainability efforts. Consequently, initiatives and policies are being enacted to promote the adoption of smart meters as a vital tool in achieving energy efficiency goals.

Modernization of Utility Infrastructure:

Aging utility infrastructures around the world are unable to meet the demands of growing populations and evolving technological landscapes. The need for modernization is another crucial market driver, stimulating investment in smart meters. These advanced devices enhance operational efficiency, reducing the manual labor required for meter reading and fault identification. They also improve accuracy in billing, thereby minimizing revenue leakage for utility companies. Modernizing infrastructure through the integration of smart meters is seen as a long-term solution for sustainable utility management, making it a high priority for both governmental bodies and private sector players.Increase in Regulatory Push and Incentives

Government regulations and incentives constitute a significant force propelling the smart meters market forward. Many countries are adopting legislation that either mandates or encourages the installation of smart meters, often setting deadlines for full-scale implementation. These policies may also be accompanied by financial incentives, such as grants or tax benefits, to expedite adoption rates. Regulatory efforts serve dual purposes: they aim to standardize utility management for optimal performance and promote environmental sustainability by encouraging energy-efficient practices. The presence of strong regulatory support substantially accelerates the penetration of smart meters in both developed and emerging markets.Smart Meters Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global smart meters market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on product, technology and end use.Breakup by Product:

- Smart Electricity Meter

- Smart Water Meter

- Smart Gas Meter

Smart electricity meter dominates the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes smart electricity meter, smart water meter, and smart gas meter. According to the report, smart electricity meters represented the largest segment.Smart electricity meters are the most widely used product due to the universal necessity of electricity for various applications across residential, commercial, and industrial sectors. Electricity is the backbone of modern life, powering everything from homes and offices to factories and data centers. This ubiquity fuels the demand for efficient and accurate monitoring systems, making smart electricity meters indispensable. They offer features like real-time tracking and consumption analytics, which facilitate precise billing while optimizing energy usage.

Moreover, the transition toward renewable energy sources further necessitates the use of smart electricity meters to manage complex grid interactions. Governmental regulations and incentives often focus more on electricity meters owing to their crucial role in achieving energy efficiency and sustainability targets. Given these factors, smart electricity meters have become a highly preferred product by both utility providers and consumers, propelling the segment growth.

Breakup by Technology:

- AMI (Advanced Metering Infrastructure)

- AMR (Automatic Meter Reading)

AMI (Advanced Metering Infrastructure) holds the largest share in the market

A detailed breakup and analysis of the market based on technology has also been provided in the report. This includes AMI (Advanced Metering Infrastructure) and AMR (Automatic Meter Reading). According to the report, AMI (advanced metering infrastructure) accounted for the largest market share.Advanced metering infrastructure (AMI) offers comprehensive capabilities that extend beyond mere meter reading to include two-way communication, real-time data monitoring, and remote-control functionalities. AMI's robust features provide significant advantages to utility companies and consumers alike. For utility providers, AMI systems facilitate streamlined operations, enhanced billing accuracy, and the ability to implement demand response programs, leading to increased operational efficiencies and cost savings. For consumers, AMI offers detailed consumption analytics, aiding in better energy management and conservation.

The technology's scalability enables easy integration with other smart grid solutions, making it a future-proof investment. Moreover, governments and regulatory bodies often favor AMI as it aligns with broader objectives of energy efficiency, grid modernization, and sustainability. These multifaceted benefits make AMI the preferred choice for stakeholders, thereby contributing to the segment growth.

Breakup by End Use:

- Residential

- Commercial

- Industrial

The residential segment is one of the most significant in terms of volume. In this sector, smart meters primarily serve households, aiding in more accurate billing and providing real-time data to consumers. This technology helps residents manage their utility consumption more effectively, thereby contributing to energy conservation efforts. As awareness grows and costs decline, the adoption of smart meters in residential settings is expected to rise steadily.

In the commercial sector, smart meters are commonly deployed in offices, retail spaces, and other business establishments. These meters offer accurate billing and provide valuable data analytics capabilities. By analyzing patterns in energy or water usage, businesses can implement measures to improve efficiency, reduce operational costs, and adhere to sustainability goals. Advanced features like demand response also facilitate optimized usage during peak times.

The industrial segment includes factories, manufacturing plants, and other large-scale operations where utility consumption is high and needs to be meticulously managed. In these settings, smart meters are essential for real-time monitoring and precise control over resource usage. They often integrate with other industrial control systems to facilitate comprehensive management of utilities, ensuring operational efficiency and safety.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share.Asia-Pacific held the biggest share in the market since the region is witnessing rapid urbanization and population growth in countries like China and India. The rise in demand for electricity, water, and gas in these populous nations necessitates advanced metering solutions for efficient resource management. Governments in the Asia-Pacific region are increasingly supportive of smart meter initiatives as part of broader plans for infrastructure modernization and sustainable development. For instance, China's commitment to reducing its carbon footprint involves large-scale deployment of smart meters to optimize energy usage. Similarly, India's Smart Cities Mission incorporates smart metering as a key component.

Additionally, the relatively lower penetration of traditional metering systems in some parts of Asia Pacific offers a less obstructed path for the adoption of advanced technologies like AMI and AMR. The region also benefits from competitive manufacturing capabilities, which helps in lowering the overall costs of smart meters, thereby facilitating broader adoption. This unique confluence of regulatory support, demographic factors, and economic advantages positions Asia-Pacific as the leading regional market for smart meters.

Competitive Landscape:

The market is experiencing moderate growth as key players in the industry are actively engaged in research and development (R&D) to innovate and enhance product features, focusing on factors such as accuracy, reliability, and security. They are also entering into strategic partnerships and collaborations with utility companies, technology firms, and governments to expand their market reach. Acquisitions and mergers are common tactics employed by these industry players to consolidate market presence and acquire technical expertise.Several leading companies are heavily investing in marketing campaigns to educate both consumers and policymakers about the benefits of smart meters, thereby accelerating product adoption rates. Moreover, numerous manufacturers are exploring ways to integrate their products with emerging technologies, such as the Internet of Things (IoT) and Artificial Intelligence (AI), to stay ahead in this competitive market landscape.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Aichi Tokei Denki Co. Ltd.

- Apator SA

- Arad Group

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Holley Technology Ltd.

- Itron Inc.

- Landis+Gyr

- Neptune Technology Group Inc. (Roper Technologies Inc.)

- Schneider Electric SE

- Sensus USA Inc. (Xylem Inc.)

- Shenzhen Kaifa Technology Co. Ltd.

- Zenner International GmbH & Co. KG.

Key Questions Answered in This Report:

- What is smart meters?

- How big is the smart meters market?

- What is the expected growth rate of the global smart meters market during 2025-2033?

- What are the key factors driving the global smart meters market?

- What is the leading segment of the global smart meters market based on the product?

- What is the leading segment of the global smart meters market based on technology?

- What is the leading segment of the global smart meters market based on end use?

- What are the key regions in the global smart meters market?

- Who are the key players/companies in the global smart meters market?

Table of Contents

Companies Mentioned

- Aichi Tokei Denki Co. Ltd.

- Apator SA

- Arad Group

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Holley Technology Ltd.

- Itron Inc.

- Landis+Gyr

- Neptune Technology Group Inc. (Roper Technologies Inc.)

- Schneider Electric SE

- Sensus USA Inc. (Xylem Inc.)

- Shenzhen Kaifa Technology Co. Ltd.

- Zenner International GmbH & Co. KG

Table Information

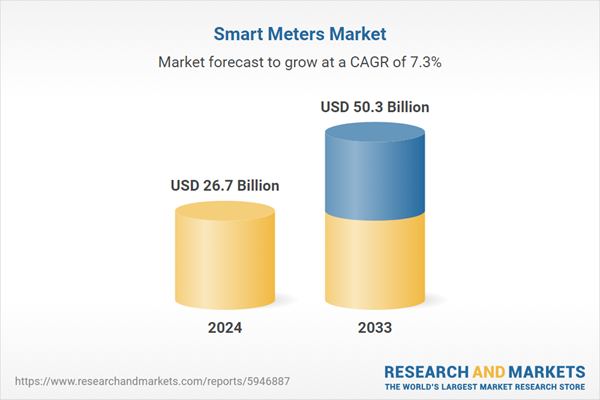

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 26.7 Billion |

| Forecasted Market Value ( USD | $ 50.3 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |