Textile Coating Market Analysis:

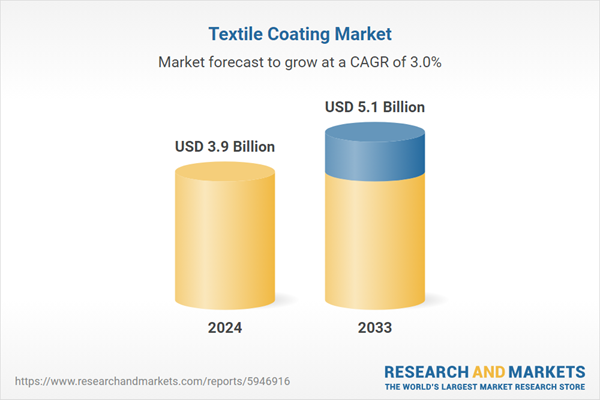

- Market Growth and Size: The global textile coating market has been experiencing significant growth, attributed to the versatile application of coated textiles, ranging from industrial uses to consumer products. The market's expansion is also fueled by the integration of innovative materials and coating techniques, which have broadened the scope of textile applications. The market size reflects the increasing adoption of these textiles in numerous domains, from protective gear to advanced apparel, indicating a robust upward trajectory.

- Major Market Drivers: The key drivers shaping the textile coating market include the surge in outdoor recreational activities, increased focus on thermal insulation in textiles, escalating demand for antimicrobial coatings in public health sectors, and growth in the luxury apparel market. Additionally, the surging demand for advanced agricultural textiles, increased military spending on protective gear, development in digital printing on textiles, the rising importance of geotextiles in civil engineering, and the demand for coated textiles in renewable energy sectors are supporting the market growth.

- Technological Advancements: Technological advancements in the textile coating market are pivotal, involving the development of eco-friendly and sustainable coating materials, integration of nanotechnology for finer and more durable coatings, advancements in polymer science enhancing the versatility of coatings, and the advent of smart textiles integrating electronics. The industry is also seeing a shift towards green chemistry in coatings, reducing environmental impact and addressing sustainability concerns.

- Industry Applications: Textile coatings find diverse applications across industries, ranging from protective clothing in healthcare to waterproof and breathable fabrics in outdoor and sportswear. The construction industry uses coated textiles for awnings and roofing materials, while in fashion, they provide weather resistance and aesthetic enhancements

- Key Market Trends: The emerging trends in the textile coating market include the increasing use of bio-based coatings, the focus on lightweight and flexible textiles for user comfort, the rise in the use of recycled materials, and the growing demand for textiles with integrated sensors. In line with this, the trend of fashion technology blending aesthetics with functionality, increasing use of three-dimensional (3D) printing technology in textile coatings, focus on ultraviolet (UV) protective and antimicrobial textiles, and shift towards self-cleaning and water-repellent textiles are other growth-inducing factors.

- Geographical Trends: The Asia-Pacific region leads the global textile coating market, largely due to its robust textile manufacturing base, particularly in countries like China and India. The region benefits from lower production costs, technological advancements, and a growing domestic market. Additionally, significant investments in industries such as automotive, healthcare, and construction within the region contribute to its dominance. Europe and North America also hold substantial market shares, attributed to their technological innovations and stringent regulatory standards in textile production.

- Competitive Landscape: The competitive landscape of the textile coating market is characterized by the presence of several key players who are focusing on research and development (R&D) to introduce innovative products. There's a significant emphasis on strategic collaborations, mergers, and acquisitions to expand market presence. Companies are also investing in scaling up production capabilities and exploring new applications of textile coatings. The market is witnessing a trend of partnerships between manufacturers and end-use industries to develop customized solutions, enhancing competitive dynamics.

- Challenges and Opportunities: The market faces challenges such as environmental concerns related to the use of certain chemicals in coatings and the need for balancing performance with sustainability. However, these challenges also present opportunities for innovation, particularly in developing eco-friendly coating materials and sustainable manufacturing processes. There's also an opportunity to explore new applications in emerging sectors like wearable technology and smart textiles, which could open new avenues for growth in the textile coating market.

Textile Coating Market Trends:

Demand for high-performance and functional textiles

In the global textile coating market, a primary driver is the increasing demand for high-performance and functional textiles across various industries. This trend is particularly evident in sectors like automotive, construction, and healthcare. In construction, they provide essential properties like thermal insulation and fire resistance. The healthcare sector utilizes coated textiles for hygienic and protective applications, such as in surgical gowns and equipment covers. These textiles offer unique features like antimicrobial properties, fluid resistance, and improved mechanical strength, making them indispensable in demanding environments. The overall market growth is propelled by this cross-industry demand for textiles that offer specialized functionalities beyond conventional fabric attributes.Advancements in textile coating technologies

Technological advancements in textile coating are significantly driving the market growth. Innovations such as nanocoatings and smart polymers are at the forefront, offering new capabilities in textile treatments. Nanocoatings provide a thin, yet highly effective barrier against water, oil, and dirt, without compromising the textile's breathability and flexibility. Smart polymers, on the other hand, react to environmental stimuli like temperature changes, enabling textiles to adapt their properties accordingly. These advancements are making textile coatings more efficient, durable, and environmentally friendly. They also allow for the creation of smart textiles that can change color, release medication, or alter their thermal properties, opening up new applications in fashion, medical, and other industries.Stringent regulations and worker safety

The global textile coating market is also influenced by stringent safety regulations and rising awareness regarding worker safety. Regulations, especially in industries like construction, manufacturing, and healthcare, mandate the use of protective clothing and gear. Coated textiles play a vital role in meeting these requirements. They are used to manufacture personal protective equipment (PPE) that offers resistance to heat, chemicals, and mechanical stress. For example, fire-resistant coatings are essential for protective clothing in firefighting and metalworking industries. Similarly, in the healthcare sector, coated textiles are used to prevent the spread of infections and ensure a sterile environment. The increasing emphasis on workplace safety standards and protective measures across industries thus significantly contributes to the growth of the textile coating market.Expanding sports and leisure industry

The sports and leisure industry's expansion is a major driver for the textile coating market. Coated textiles in this sector are utilized for creating sportswear and outdoor gear that offer enhanced functionality like moisture management, UV protection, and improved durability. These properties are essential for athletes and outdoor enthusiasts who require clothing and equipment that can withstand extreme conditions and rigorous use. Additionally, the aesthetics of sportswear is also enhanced through coatings that allow for vibrant colors and patterns, which are resistant to fading and wear. The growing popularity of outdoor activities and fitness, coupled with the rising awareness of health and wellness, has led to an increased demand for high-quality, performance-oriented sportswear and gear.Textile Coating Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, application, technology, and coating method.Breakup by Type:

- Thermoplastics

- Polyvinyl Chloride

- Polyurethane

- Acrylic

- Others

- Thermosets

- Natural Rubber

- Styrene Butadiene Rubber

- Others

Thermoplastics accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes thermoplastics (polyvinyl chloride, polyurethane, acrylic, others) and thermosets (natural rubber, styrene butadiene rubber, others). According to the report, thermoplastics represented the largest segment.The thermoplastics (polyvinyl chloride, polyurethane, acrylic, others) segment is driven by the increasing demand for lightweight, durable, and recyclable materials in various industries. Thermoplastics, known for their ability to be remolded and recycled, are highly sought after in automotive, packaging, and consumer goods sectors due to their versatility and environmental sustainability. In the automotive industry, the shift towards electric vehicles and the need for fuel efficiency are propelling the use of thermoplastics for lightweight components. The packaging industry values thermoplastics for their clarity, flexibility, and food safety characteristics, making them ideal for food and beverage packaging. Additionally, the growing trend of 3D printing technology heavily relies on thermoplastics due to their ease of processing.

The thermosets (natural rubber, styrene butadiene rubber, others) segment is driven by the increasing need for materials with high thermal stability, chemical resistance, and mechanical strength in industrial applications. Thermosets, known for their rigidity and heat resistance, are extensively used in electronics, aerospace, automotive, and construction industries. In electronics, their excellent insulating properties make them ideal for circuit boards and electrical components. The aerospace industry values thermosets for their lightweight yet strong characteristics, essential for aircraft components. Furthermore, the growth in wind energy has spurred the use of thermoset composites in wind turbine blades, highlighting their importance in renewable energy applications.

Breakup by Application:

- Clothing

- Transportation

- Medical

- Construction

- Others

Clothing accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes clothing, transportation, medical, construction, and others. According to the report, clothing represented the largest segment.The clothing segment is driven by the increasing demand for functional and fashionable apparel. Consumers seek durability, comfort, and aesthetic appeal in their clothing, leading to innovations in textile coatings that enhance fabric properties such as water resistance, UV protection, and breathability. The trend towards smart clothing, incorporating technologies for health monitoring or connectivity, is also propelling this segment. Additionally, the growing awareness of sustainable fashion is driving the development of eco-friendly and recyclable textile coatings, catering to a market increasingly conscious about environmental impact and ethical production practices.

The transportation segment is driven by the increasing need for durable and lightweight materials in automotive, aerospace, and marine industries. Coated textiles are essential in these sectors for their contribution to vehicle safety, interior aesthetics, and functionality. Moreover, the push towards lighter materials in aerospace and automotive sectors for fuel efficiency also significantly influences the demand for advanced textile coatings in this segment.

The medical segment is driven by the increasing demand for hygienic, protective, and functional textiles in healthcare settings. This includes the need for antimicrobial, liquid-resistant, and breathable fabrics for medical gowns, curtains, and bedding to prevent infection spread. Additionally, the growing elderly population and the subsequent rise in healthcare requirements are fueling the demand for advanced medical textiles with specialized coatings.

The construction segment is driven by the increasing demand for durable, weather-resistant, and energy-efficient materials. The growing emphasis on sustainable building practices also plays a significant role, with a focus on energy-saving materials and environmentally friendly coatings. Moreover, the expansion of infrastructure and construction activities worldwide, especially in emerging economies, further boosts the demand for coated textiles in this segment.

The others segment, encompassing various industries like sports, leisure, and home furnishings, is driven by the increasing demand for specialized textiles that offer enhanced performance and comfort. Furthermore, the trend towards personalization and the growing interest in home decor also contribute to this segment's growth, as consumers seek unique and functional materials for their living spaces.

Breakup by Technology:

- Dot Coating Technology

- Full Surface Coating Technology

Full surface coating technology accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology. This includes dot coating technology and full surface coating technology. According to the report, full surface coating technology represented the largest segment.The full surface coating technology segment is driven by the increasing need for protective and durable textile applications in various industries. It involves coating the entire surface of the textile, providing uniform protection and enhanced properties such as water resistance, fire retardancy, and thermal insulation. These features are essential in sectors like construction, automotive, and protective clothing, where consistent performance across the entire textile surface is critical. The technology's ability to extend the life and functionality of textiles makes it indispensable in these sectors. Additionally, advancements in coating materials and processes have improved the environmental footprint and efficiency of full surface coating, aligning with the market's move towards sustainable practices.

The dot coating technology segment is driven by the increasing demand for precision and material efficiency in textile coating applications. Dot coating offers a unique advantage of applying the coating material in controlled, specific areas rather than over the entire fabric, leading to reduced material usage and weight, which is particularly beneficial in industries like sportswear and healthcare. Moreover, dot coating is favored for its ability to create innovative patterns and designs, making it popular in the fashion industry. The growing focus on sustainability and cost-efficiency in textile manufacturing further propels this segment, as dot coating minimizes waste and environmental impact compared to traditional full-surface methods.

Breakup by Coating Method:

- Traditional

- Evaporation

- Sputtering

- Plasma Spray

- Others

Traditional accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the coating method. This includes traditional, evaporation, sputtering, plasma spray, and others. According to the report, traditional represented the largest segment.The traditional segment is driven by the increasing demand for cost-effective and well-established coating methods. This segment, often relying on techniques like roll-to-roll and dip coating, benefits from its simplicity, scalability, and broad applicability across various industries. Traditional methods are favored for their proven effectiveness in applications ranging from protective clothing to upholstery. The segment's growth is also supported by its adaptability to a wide range of materials and its ability to meet diverse market needs without the necessity for highly specialized equipment.

The evaporation segment is driven by the increasing need for precision and uniformity in thin-film coatings. This method, particularly used in electronics and optical applications, is valued for its ability to produce high-purity coatings. The segment is also bolstered by the growing electronics industry, which requires consistent and high-quality coatings for components like semiconductors and display screens.

The sputtering segment is driven by the increasing demand for advanced coating techniques in sectors requiring high-performance coatings. Sputtering is preferred for its versatility and the superior quality of coatings it produces, especially in electronics and automotive industries. Its growth is further supported by technological advancements in the sector, which enhance its efficiency and application scope.

The plasma spray segment is driven by the increasing need for high-quality, durable coatings in extreme environments. It is particularly crucial in aerospace, automotive, and energy sectors where materials are subjected to high temperatures and corrosive conditions. Plasma spray's ability to apply coatings on a variety of materials, including metals, ceramics, and polymers, makes it invaluable in these industries. The demand in this segment is also driven by the method's flexibility in coating complex shapes and its effectiveness in enhancing material properties like wear resistance and thermal insulation.

The others segment, encompassing various emerging and specialized coating technologies, is driven by the increasing demand for innovative and customized coating solutions. This segment includes methods like chemical vapor deposition (CVD), electroplating, and laser coating, each serving niche applications where specific properties are required.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest textile coating market share

North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific textile coating market is driven by the increasing industrialization and growth of the textile industry in countries like China and India. The region's cost-effective manufacturing capabilities and expanding automotive, construction, and healthcare sectors significantly contributing to the market growth. Additionally, Asia Pacific's focus on technological advancements and innovation in textile coatings aligns with the global trend towards sustainable and high-performance textiles.

The North America textile coating market is driven by the increasing demand for technical textiles in various industries, such as automotive and healthcare. This region's focus on innovation and high-performance materials, coupled with stringent safety and environmental regulations, has led to the development of advanced textile coatings.

The Europe textile coating market is driven by the increasing emphasis on quality and sustainability. Europe's strong environmental regulations have led to the development of eco-friendly and high-performance coatings. The market is further bolstered by the region's flourishing fashion industry, which demands innovative textile coatings for aesthetic and functional purposes. Additionally, the growing automotive industry in Europe, requiring high-quality coated textiles for interiors and safety components, significantly contributes to the market growth.

The Latin America textile coating market is driven by the increasing demand for technical textiles in sectors such as agriculture, construction, and automotive. The region’s focus on improving industrial safety standards and personal protective equipment also fuels the market growth. Latin America's growing urbanization and development projects contribute to the demand for coated textiles in construction and architectural applications.

The Middle East and Africa textile coating market is driven by the increasing demand for technical textiles, particularly in construction and infrastructure projects due to rapid urbanization. The region's growing healthcare sector also contributes significantly to the market growth, with a rising need for hygienic and protective textile coatings. The market is also influenced by the rising fashion industry and the increasing demand for luxury and high-performance textiles in these regions.

Leading Key Players in the Textile Coating Industry:

In the textile coating market, key players are actively engaged in various strategic initiatives to strengthen their market position and drive innovation. These companies are heavily investing in R&D to create advanced, sustainable, and eco-friendly coating solutions that meet the evolving demands of various industries, such as automotive, healthcare, and construction. Recognizing the potential of emerging markets, these players are also expanding their global presence, often through mergers, acquisitions, and partnerships with local firms, to tap into new customer bases and leverage regional manufacturing advantages. Additionally, they are focusing on enhancing their production capacities and optimizing supply chains to improve efficiency and reduce costs. A significant trend among these companies is the collaboration with technology firms and research institutions to develop smart textiles and next-generation coatings that offer enhanced functionality, such as self-cleaning properties, ultraviolet (UV) protection, and improved durability, catering to the dynamic needs of modern consumers and industries.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- BASF SE

- Covestro AG

- Clariant International Ltd

- Tanatex Chemicals B.V.

- The Lubrizol Corporation

- Solvay

- Huntsman International LLC

Key Questions Answered in This Report:

- How has the global textile coating market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global textile coating market?

- What is the impact of each driver, restraint, and opportunity on the global textile coating market?

- What are the key regional markets?

- Which countries represent the most attractive textile coating market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the textile coating market?

- What is the breakup of the market based on application?

- Which is the most attractive application in the textile coating market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the textile coating market?

- What is the breakup of the market based on the coating method?

- Which is the most attractive coating method in the textile coating market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global textile coating market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Textile Coating Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Thermoplastics

6.1.1 Market Trends

6.1.2 Major Types

6.1.2.1 Polyvinyl Chloride

6.1.2.2 Polyurethane

6.1.2.3 Acrylic

6.1.2.4 Others

6.1.3 Market Forecast

6.2 Thermosets

6.2.1 Market Trends

6.2.2 Major Types

6.2.2.1 Natural Rubber

6.2.2.2 Styrene Butadiene Rubber

6.2.2.3 Others

6.2.3 Market Forecast

7 Market Breakup by Application

7.1 Clothing

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Transportation

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Medical

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Construction

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by Technology

8.1 Dot Coating Technology

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Full Surface Coating Technology

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Coating Method

9.1 Traditional

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Evaporation

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Sputtering

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Plasma Spray

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Others

9.5.1 Market Trends

9.5.2 Market Forecast

10 Market Breakup by Region

10.1 North America

10.1.1 United States

10.1.1.1 Market Trends

10.1.1.2 Market Forecast

10.1.2 Canada

10.1.2.1 Market Trends

10.1.2.2 Market Forecast

10.2 Asia Pacific

10.2.1 China

10.2.1.1 Market Trends

10.2.1.2 Market Forecast

10.2.2 Japan

10.2.2.1 Market Trends

10.2.2.2 Market Forecast

10.2.3 India

10.2.3.1 Market Trends

10.2.3.2 Market Forecast

10.2.4 South Korea

10.2.4.1 Market Trends

10.2.4.2 Market Forecast

10.2.5 Australia

10.2.5.1 Market Trends

10.2.5.2 Market Forecast

10.2.6 Indonesia

10.2.6.1 Market Trends

10.2.6.2 Market Forecast

10.2.7 Others

10.2.7.1 Market Trends

10.2.7.2 Market Forecast

10.3 Europe

10.3.1 Germany

10.3.1.1 Market Trends

10.3.1.2 Market Forecast

10.3.2 France

10.3.2.1 Market Trends

10.3.2.2 Market Forecast

10.3.3 United Kingdom

10.3.3.1 Market Trends

10.3.3.2 Market Forecast

10.3.4 Italy

10.3.4.1 Market Trends

10.3.4.2 Market Forecast

10.3.5 Spain

10.3.5.1 Market Trends

10.3.5.2 Market Forecast

10.3.6 Russia

10.3.6.1 Market Trends

10.3.6.2 Market Forecast

10.3.7 Others

10.3.7.1 Market Trends

10.3.7.2 Market Forecast

10.4 Latin America

10.4.1 Brazil

10.4.1.1 Market Trends

10.4.1.2 Market Forecast

10.4.2 Mexico

10.4.2.1 Market Trends

10.4.2.2 Market Forecast

10.4.3 Others

10.4.3.1 Market Trends

10.4.3.2 Market Forecast

10.5 Middle East and Africa

10.5.1 Market Trends

10.5.2 Market Breakup by Country

10.5.3 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Indicators

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 BASF SE

15.3.1.1 Company Overview

15.3.1.2 Product Portfolio

15.3.1.3 Financials

15.3.1.4 SWOT Analysis

15.3.2 Covestro AG

15.3.2.1 Company Overview

15.3.2.2 Product Portfolio

15.3.2.3 Financials

15.3.2.4 SWOT Analysis

15.3.3 Clariant International Ltd

15.3.3.1 Company Overview

15.3.3.2 Product Portfolio

15.3.3.3 Financials

15.3.4 Tanatex Chemicals B.V.

15.3.4.1 Company Overview

15.3.4.2 Product Portfolio

15.3.4.3 Financials

15.3.5 The Lubrizol Corporation

15.3.5.1 Company Overview

15.3.5.2 Product Portfolio

15.3.5.3 SWOT Analysis

15.3.6 Solvay

15.3.6.1 Company Overview

15.3.6.2 Product Portfolio

15.3.6.3 Financials

15.3.6.4 SWOT Analysis

15.3.7 Huntsman International LLC

15.3.7.1 Company Overview

15.3.7.2 Product Portfolio

15.3.7.3 Financials

15.3.7.4 SWOT Analysis

List of Figures

Figure 1: Global: Textile Coating Market: Major Drivers and Challenges

Figure 2: Global: Textile Coating Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Textile Coating Market: Breakup by Type (in %), 2024

Figure 4: Global: Textile Coating Market: Breakup by Application (in %), 2024

Figure 5: Global: Textile Coating Market: Breakup by Technology (in %), 2024

Figure 6: Global: Textile Coating Market: Breakup by Coating Method (in %), 2024

Figure 7: Global: Textile Coating Market: Breakup by Region (in %), 2024

Figure 8: Global: Textile Coating Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: Textile Coating (Thermoplastics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Global: Textile Coating (Thermoplastics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Global: Textile Coating (Thermosets) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Textile Coating (Thermosets) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Textile Coating (Clothing) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Textile Coating (Clothing) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Textile Coating (Transportation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Textile Coating (Transportation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Textile Coating (Medical) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Textile Coating (Medical) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Textile Coating (Construction) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Textile Coating (Construction) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Textile Coating (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Textile Coating (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Textile Coating (Dot Coating Technology) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Textile Coating (Dot Coating Technology) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Textile Coating (Full Surface Coating Technology) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Textile Coating (Full Surface Coating Technology) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Textile Coating (Traditional) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Textile Coating (Traditional) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Textile Coating (Evaporation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: Textile Coating (Evaporation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: Textile Coating (Sputtering) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: Textile Coating (Sputtering) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Global: Textile Coating (Plasma Spray) Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Global: Textile Coating (Plasma Spray) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Global: Textile Coating (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Global: Textile Coating (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: North America: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: North America: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: United States: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: United States: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Canada: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Canada: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Asia Pacific: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Asia Pacific: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: China: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: China: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Japan: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Japan: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: India: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: India: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: South Korea: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: South Korea: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: Australia: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: Australia: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: Indonesia: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: Indonesia: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: Others: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: Others: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: Europe: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: Europe: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: Germany: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: Germany: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 63: France: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 64: France: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 65: United Kingdom: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 66: United Kingdom: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 67: Italy: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 68: Italy: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 69: Spain: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 70: Spain: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 71: Russia: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 72: Russia: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 73: Others: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 74: Others: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 75: Latin America: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 76: Latin America: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 77: Brazil: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 78: Brazil: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 79: Mexico: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 80: Mexico: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 81: Others: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 82: Others: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 83: Middle East and Africa: Textile Coating Market: Sales Value (in Million USD), 2019 & 2024

Figure 84: Middle East and Africa: Textile Coating Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 85: Global: Textile Coating Industry: SWOT Analysis

Figure 86: Global: Textile Coating Industry: Value Chain Analysis

Figure 87: Global: Textile Coating Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Textile Coating Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Textile Coating Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: Textile Coating Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Textile Coating Market Forecast: Breakup by Technology (in Million USD), 2025-2033

Table 5: Global: Textile Coating Market Forecast: Breakup by Coating Method (in Million USD), 2025-2033

Table 6: Global: Textile Coating Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: Textile Coating Market: Competitive Structure

Table 8: Global: Textile Coating Market: Key Players

Companies Mentioned

- BASF SE

- Covestro AG

- Clariant International Ltd

- Tanatex Chemicals B.V.

- The Lubrizol Corporation

- Solvay

- Huntsman International LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |