The global graphene market is driven by its increasing adoption across diverse industries, including electronics, energy, automotive, and healthcare. Graphene's exceptional properties, such as high electrical conductivity, lightweight structure, mechanical strength, and thermal stability, make it a preferred choice for advanced applications such as batteries, sensors, and flexible electronics. The growing demand for sustainable and energy-efficient solutions further accelerates graphene's usage in renewable energy technologies and next-generation semiconductors. On 19th December 2024, Westlake Innovations, a subsidiary of Westlake Corporation, invested in Burlington-based Universal Matter, Inc., a firm that focuses on sustainable graphene production. FJH technology patented by Universal Matter guarantees the upcycling of carbon waste into high-quality graphene for industrial purposes through the cost-effective Flash Joule Heating technology. This investment aligns with Westlake's commitment to sustainability and innovation in advanced materials. Additionally, rising investments in research and development, coupled with government initiatives supporting nanotechnology, are fostering market growth. Moreover, the expanding scope of graphene-based materials in composites and coatings also propels the market's advancement worldwide.

The United States stands out as a key regional market, primarily driven by robust advancements in nanotechnology and material science, supported by strong government and private sector investments. On 18th July 2024, the U.S. Department of Energy's Advanced Materials and Manufacturing Technologies Office (AMMTO) has announced USD 33 Million for smart manufacturing technologies, representing an important step toward the clean energy transition. It is geared to enhance efficiency, sustainability, and innovation in areas such as circular supply chains, clean transportation, and high-performance materials, and enhance American competitiveness in manufacturing. The country's focus on innovation fuels the demand for graphene in high-performance applications such as aerospace, defense, and renewable energy. The rapid development of electric vehicles (EVs) and the need for efficient energy storage solutions have bolstered graphene's use in batteries and supercapacitors. Concurrently, the U.S. healthcare sector's exploration of graphene-based biomedical applications, including drug delivery and biosensors, contributes to market growth. Furthermore, growing partnerships between academic institutions and industries further catalyze graphene innovation in the region.

Graphene Market Trends:

Growing advancements in the production of semiconductors

Advancements in the production of semiconductors are offering a positive graphene market outlook. Graphene exhibits enhanced electrical conductivity and heat dissipation properties that help in increasing the performance of semiconductors. Apart from this, manufacturers in the graphene market are focusing on producing electronic devices faster and more energy efficient. They are also exploring various methods to incorporate graphene into transistors and other semiconductor components. The semiconductor industry sales totaled USD 46.2 Billion worldwide during February 2024, as reported by the Semiconductor Industry Association (SIA).Rising improvements in biomedical applications

The integration of graphene into biosensing technologies is expanding the graphene market scope. According to the publisher, the global biosensors market reached USD 30.9 Billion in 2024. Graphene-based materials are used for wound dressings and healing applications as they exhibit antimicrobial properties and can help fasten the wound healing process by maintaining a sterile environment. In line with this, advancements in biomedical applications are strengthening the graphene market demand in the medical sector. Furthermore, researchers and healthcare professionals are focusing on employing graphene-based biosensors to identify pathogens and health-related indicators. For instance, researchers at IIT Guwahati made crucial discoveries regarding the use of modified graphene oxide for biomedical applications. They introduced cost-effective experiments for modifying graphene oxide on 8 November 2023.Increasing demand for lighter and durable construction materials

Due to the growing construction sector, graphene application is increasing. It is applied in the components of building such as concrete, composites, and coatings, to fortify infrastructure projects and extend their lifetime. This will help enhance the durability and efficiency of building materials. Additionally, construction projects are becoming increasingly sophisticated, making them require creative solutions. According to the Invest India, the construction sector in India is anticipated to achieve USD 1.4 Trillion by 2025.Graphene Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global graphene market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end-use industry.Analysis by Type:

- Mono-layer & Bi-layer Graphene

- Few Layer Graphene (FLG)

- Graphene Oxide (GO)

- Graphene Nano Platelets (GNP)

- Others

Analysis by Application:

- Batteries

- Supercapacitors

- Transparent Electrodes

- Integrated Circuits

- Others

Analysis by End-Use Industry:

- Electronics and Telecommunication

- Bio-medical and Healthcare

- Energy

- Aerospace and Defense

- Others

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Graphene Market Analysis

The advancements in technology, rising demand for lightweight and durable materials, and increasing investment in research and development (R&D) activities is propelling the market growth. One key driver is the increasing use of graphene in energy storage systems, including lithium-ion batteries and supercapacitors. With the growing demand for electric vehicles (EVs) and renewable energy, graphene’s ability to improve battery efficiency and lifespan is attracting significant attention. In 2023, sales of new electric light-duty vehicles in the United States reached about 1.4 Million, as reported by the International Council on Clean Transportation. In addition, the U.S. Department of Energy’s focus on enhancing energy storage technologies is contributing to increased research funding in this domain. The electronics sector is another major growth area. Graphene’s high electrical conductivity and transparency make it ideal for applications in flexible displays, sensors, and high-speed transistors. Additionally, rising environmental concerns are encouraging the use of graphene in water filtration systems, where it aids in removing contaminants efficiently. Federal policies promoting sustainable technologies are further impelling the adoption of graphene in environmental applications.Asia Pacific Graphene Market Analysis

The Asia Pacific region’s graphene market is driven by robust industrial growth, increasing investments in advanced materials, and government initiatives supporting innovation. India's industrial production increased to 3.8% in December 2023, as per the Ministry of Statistics and Programme Implementation (MoSPI). This region, home to leading economies including China, Japan, South Korea, and India, is becoming a global hub for graphene research, development, and commercialization. Moreover, rapid advancements in the electronics industry are a major driver in the Asia Pacific market. Countries, such as South Korea and Japan, known for their cutting-edge semiconductor and display technologies, are increasingly incorporating graphene into flexible displays, transistors, and high-speed circuits. Furthermore, the rising focus on energy storage is supporting the market growth. Additionally, with rising adoption of electric vehicles (EVs) and renewable energy solutions, graphene is being used to improve the performance and longevity of lithium-ion batteries and supercapacitors. China, a global leader in EV production, is driving demand for graphene-based energy storage solutions, supported by significant government incentives for clean energy technologies. China and India are using graphene to improve the performance of materials, reduce the weight of vehicles and aircraft, and enhance energy efficiency. Apart from this, the significant government support through funding, partnerships, and other positive policies on advanced material research is driving graphene development in the region.Europe Graphene Market Analysis

Increased investment in research and development, the demand for advanced materials, and the region's focus on sustainability and innovation is driving the growth of the market. Europe has emerged as a leader in graphene technology through partnerships between industry, academia, and government. The commitment to green energy solutions and decarbonization is one key driver. This would complement Europe's general thrust of devising renewables as an energy base while encouraging electric vehicles. Graphene can improve the energy storage efficiency of batteries and supercapacitors. The European Environment Agency estimates that 24.1% of the EU's total energy consumption in 2023 came from renewable sources. Moreover, the European Green Deal and initiatives such as Horizon Europe are providing substantial funding for graphene research, particularly in energy applications. The electronics and semiconductors industries are other contributors to growth in the market. Graphene's properties also include high electrical conductivity and mechanical flexibility, giving it an application in developing cutting-edge components: sensors, transistors, and flexible displays. European firms are already using graphene-based technology to improve their device performance based on a relatively well-established electronic ecosystem. Automotive and aerospace segments constitute considerable market share for graphene in Europe, integrating it into lightweight composites for fuel efficiency and emission management according to EU regulations. The exceptional strength and durability of graphene make it particularly useful for electric vehicles and high-performance aerospace components.Latin America Graphene Market Analysis

The region’s expanding automotive and aerospace sectors are adopting graphene to enhance material strength, reduce weight, and improve energy efficiency. According to the CEIC, Brazil motor vehicle production was reported at 2,324,838.000 units in December 2023. In line with this, Brazil, with its robust industrial base, is a leading contributor, supported by government-backed research programs. Energy storage solutions are another key driver, as Latin America’s renewable energy initiatives and the rising adoption of electric vehicles spur demand for graphene-enhanced batteries and supercapacitors. Countries such as Chile, a major lithium producer, are exploring synergies between local resources and graphene technologies. Besides this, graphene’s use in water purification aligns with regional efforts to improve water quality. Its ability to efficiently remove contaminants makes it a valuable material in addressing water scarcity and pollution challenges. Furthermore, collaborations between academia and industry are further accelerating graphene innovation across Latin America.Middle East and Africa Graphene Market Analysis

The Middle East and Africa graphene market is driven by growing investments in advanced materials, increasing demand for sustainable technologies, and regional economic diversification initiatives. The rising number of renewable energy projects in the Middle East, particularly solar power, is enhancing interest in graphene-based energy storage and photovoltaic applications. By the end of 2023, the production capacity of renewable energy projects under construction in Saudi Arabia will exceed 8 GW, as per the Saudi and Middle East.Graphene’s high conductivity and efficiency enhance the performance of solar panels and batteries, aligning with the region’s clean energy goals. In Africa, the need for effective water purification technologies is a key driver. Graphene’s capability to filter impurities and improve water quality addresses critical challenges in water-scarce areas, supporting governmental and non-governmental sustainability initiatives. Additionally, increased collaborations between local industries and global research institutions are accelerating graphene innovation and commercialization in the region.

Competitive Landscape:

Key market players are investing hugely to expand the application range of graphene, which include new manufacturing techniques, improving graphene product quality, and discovering new applications for graphene in different fields. They also diversify their product portfolios in order to reach a wider spectrum of graphene-based materials and products. Along with this, large companies have taken to upscaling their manufacturing process through designing large-scale manufacturing plants and further refining manufacturing methodologies. The organizations also forge strategic collaborations with others such as the university, research institute, or even other organizations operating in this sector for new products that might incorporate graphene-based innovation. Haydale Graphene Industries announced its collaboration with Cadent Ltd to manufacture graphene ink-based low-power radiator heaters on 24 July 2023.The report provides a comprehensive analysis of the competitive landscape in the graphene market with detailed profiles of all major companies, including:

- ACS Material, LLC,

- Global Graphene Group, Inc.

- CVD Equipment Corporation

- Grafoid Inc.

- G6 Materials Corp. (Graphene 3D Lab Inc.)

- Graphene NanoChem PLC

- Graphenea Inc.

- Haydale Graphene Industries Plc

- Vorbeck Materials Corp.

- XG Sciences Inc.

Key Questions Answered in This Report

1. How big is the global graphene market?2. What is the expected growth rate of the global graphene market during 2025-2033?

3. What are the key factors driving the global graphene market?

4. What are the key regions in the global graphene market?

5. Who are the key players/companies in the global graphene market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Graphene Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Mono-layer & Bi-layer Graphene

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Few Layer Graphene (FLG)

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Graphene Oxide (GO)

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Graphene Nano Platelets (GNP)

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Others

6.5.1 Market Trends

6.5.2 Market Forecast

7 Market Breakup by Application

7.1 Batteries

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Supercapacitors

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Transparent Electrodes

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Integrated Circuits

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by End-Use Industry

8.1 Electronics and Telecommunication

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Bio-medical and Healthcare

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Energy

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Aerospace and Defense

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Others

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Indicators

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 ACS Material, LLC

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.2 Global Graphene Group, Inc.

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.3 CVD Equipment Corporation

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.4 Grafoid Inc.

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.5 G6 Materials Corp. (Graphene 3D Lab Inc.)

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.5.3 Financials

14.3.6 Graphene NanoChem PLC

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.6.3 Financials

14.3.7 Graphenea Inc.

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 Financials

14.3.8 Haydale Graphene Industries Plc

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.9 Vorbeck Materials Corp.

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.10 XG Sciences Inc.

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

List of Figures

Figure 1: Global: Graphene Market: Major Drivers and Challenges

Figure 2: Global: Graphene Market: Sales Value (in Million USD), 2019-2024

Figure 3: Global: Graphene Market: Breakup by Type (in %), 2024

Figure 4: Global: Graphene Market: Breakup by Application (in %), 2024

Figure 5: Global: Graphene Market: Breakup by End-Use Industry (in %), 2024

Figure 6: Global: Graphene Market: Breakup by Region (in %), 2024

Figure 7: Global: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 8: Global: Graphene (Mono-layer & Bi-layer Graphene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Graphene (Mono-layer & Bi-layer Graphene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Graphene (Few Layer Graphene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Graphene (Few Layer Graphene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Graphene (Graphene Oxide) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Graphene (Graphene Oxide) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Graphene (Graphene Nano Platelets) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Graphene (Graphene Nano Platelets) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Graphene (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Graphene (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Graphene (Batteries) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Graphene (Batteries) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Graphene (Supercapacitors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Graphene (Supercapacitors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Graphene (Transparent Electrodes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Graphene (Transparent Electrodes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Graphene (Integrated Circuits) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Graphene (Integrated Circuits) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Graphene (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Graphene (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Graphene (Electronics and Telecommunication) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Graphene (Electronics and Telecommunication) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Graphene (Bio-medical and Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Graphene (Bio-medical and Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Graphene (Energy) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Graphene (Energy) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Graphene (Aerospace and Defense) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Graphene (Aerospace and Defense) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Graphene (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Graphene (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: North America: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: North America: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: United States: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: United States: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Canada: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Canada: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Asia Pacific: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Asia Pacific: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: China: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: China: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Japan: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Japan: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: India: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: India: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: South Korea: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: South Korea: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Australia: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Australia: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Indonesia: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Indonesia: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Others: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Others: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Europe: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Europe: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Germany: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Germany: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: France: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: France: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: United Kingdom: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: United Kingdom: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Italy: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Italy: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Spain: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Spain: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Russia: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Russia: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Others: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Others: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Latin America: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Latin America: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Brazil: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Brazil: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Mexico: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Mexico: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Others: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Others: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Middle East and Africa: Graphene Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Middle East and Africa: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Global: Graphene Industry: SWOT Analysis

Figure 87: Global: Graphene Industry: Value Chain Analysis

Figure 88: Global: Graphene Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Graphene Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Graphene Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: Graphene Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Graphene Market Forecast: Breakup by End-Use Industry (in Million USD), 2025-2033

Table 5: Global: Graphene Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Graphene Market: Competitive Structure

Table 7: Global: Graphene Market: Key Players

Companies Mentioned

- ACS Material LLC

- Global Graphene Group Inc.

- CVD Equipment Corporation

- Grafoid Inc.

- G6 Materials Corp. (Graphene 3D Lab Inc.)

- Graphene Nanochem plc

- Graphenea Inc.

- Haydale Graphene Industries plc

- Vorbeck Materials Corp.

- XG Sciences Inc.

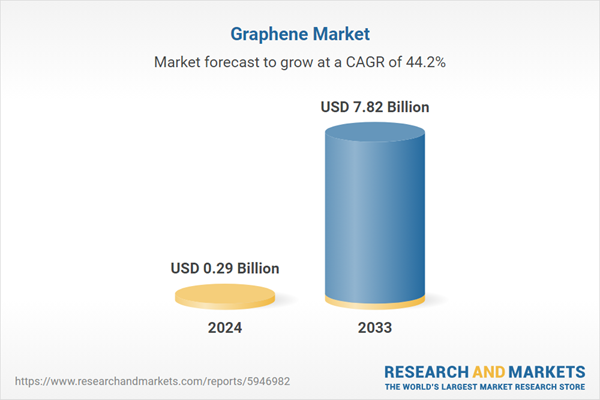

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.29 Billion |

| Forecasted Market Value ( USD | $ 7.82 Billion |

| Compound Annual Growth Rate | 44.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |