Nitrocellulose Market Analysis:

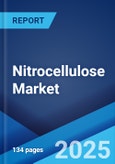

- Market Growth and Size: The nitrocellulose market is experiencing substantial growth, primarily driven by its applications in automotive and wood coatings, as well as printing inks and adhesives. The market size is expanding due to the increasing demand for these versatile products.

- Major Market Drivers: Two major drivers for the nitrocellulose market are the growing demand for automotive and wood coatings, fueled by the automotive industry's expansion and the flourishing furniture industry. Additionally, the market benefits from its role in producing printing inks and adhesives, with the packaging industry's rapid growth being a significant factor.

- Technological Advancements: Continual advancements in technology, particularly in the printing industry, are spurring innovation and application of nitrocellulose-based products. Its unique properties, such as quick-drying and flexibility, make it indispensable in various applications.

- Industry Applications: Nitrocellulose finds extensive use in automotive paints, varnishes, wood coatings, printing inks, and adhesives. Its ability to provide high-quality finishes, quick drying, and thin film formation makes it a preferred choice in these industries.

- Key Market Trends: A notable trend is the development of eco-friendly nitrocellulose variants, driven by environmental concerns and regulatory requirements. This trend aligns with the market's emphasis on quality and sustainability.

- Geographical Trends: The market is influenced by geographical factors, with emerging economies experiencing significant growth in the automotive and furniture industries. These regions contribute to the market's expansion.

- Competitive Landscape: The market features competition among companies focused on producing high-quality nitrocellulose products. Companies are investing in research and development to create safer, more sustainable variants, thus enhancing their competitive position.

- Challenges and Opportunities: Regulatory frameworks pose challenges for nitrocellulose manufacturers in terms of safety standards and production costs. However, these regulations also create opportunities for innovation and the development of environmentally conscious products. Adherence to safety standards and the production of eco-friendly variants are crucial for market sustainability.

Nitrocellulose Market Trends:

Growing demand for automotive and wood coatings

The expansion of the nitrocellulose market is significantly driven by its extensive application in automotive and wood coatings. Nitrocellulose offers a perfect blend of durability and aesthetic appeal, making it a preferred choice for high-quality finishes in these industries. Its fast-drying properties, ease of application, and ability to produce a smooth, glossy finish have positioned it as a vital component in automotive paints and varnishes. The automotive industry's growth, particularly in emerging economies, directly boosts the demand for nitrocellulose. Additionally, the burgeoning furniture industry, driven by urbanization and increased disposable incomes, further escalates the need for wood coatings, thereby fueling the nitrocellulose market. These industries' emphasis on quality and durability, along with the growing environmental concerns leading to the development of eco-friendly nitrocellulose variants, results in the market's expansion.Continual advancements in printing inks and adhesives

The market is also propelled by its significant role in the production of printing inks and adhesives. Nitrocellulose's unique characteristics, such as quick-drying, flexibility, and the ability to form thin films, make it an indispensable ingredient in the formulation of various inks and adhesives. The rapid growth of the packaging industry, fueled by the increase in e-commerce and consumer goods sectors, necessitates high-quality printing inks for packaging and labeling. This demand directly influences the nitrocellulose market. Furthermore, the evolving technology in the printing industry, aiming for more efficient and higher-quality outputs, continually drives the innovation and application of nitrocellulose-based products. Its usage in specialty adhesives, essential in automotive, aerospace, and electronics industries, also contributes to market growth.Regulatory and environmental considerations

The market is further impelled by stringent regulatory frameworks and growing environmental concerns. Nitrocellulose, classified as a hazardous material, is subject to tight regulation in terms of storage, handling, and transportation. This regulatory environment compels manufacturers to adhere to safety standards, influencing production costs and market operations. Additionally, the increasing awareness and concern about environmental impact are driving the demand for eco-friendly variants of nitrocellulose. The development and adoption of such variants are essential for market sustainability and compliance with environmental regulations. These environmental and regulatory factors not only pose challenges but also create opportunities for innovation and development in the nitrocellulose industry. As a result, companies are investing in research to produce safer, more sustainable products, thus steering the market towards a more environmentally conscious direction.Nitrocellulose Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, application, and end use industry.Breakup by Product:

- M Grade Cellulose

- E Grade Cellulose

- A Grade Cellulose

- Others

M grade cellulose accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes M grade cellulose, E grade cellulose, A grade cellulose, and others. According to the report, M grade cellulose represented the largest segment.M Grade Cellulose's market growth is primarily driven by its widespread use in the production of high-quality paints and coatings, where its quick-drying and film-forming properties are highly valued. It's also extensively used in the automotive sector for car paints, given its durability and glossy finish. The demand in the printing industry, especially for flexographic and gravure inks, further propels its market due to its excellent solubility and compatibility with various dyes and pigments. Additionally, the pharmaceutical industry's use of M Grade Cellulose in film coatings for tablets and capsules underscores its versatility and contributes to its market expansion.

On the other hand, E grade cellulose's market is driven by its use in the pharmaceutical industry, particularly in coating applications for pills and capsules. Its compatibility with various drugs and its non-toxic nature make it a preferred choice. The growing pharmaceutical industry, especially with the increasing demand for medication worldwide, directly impacts the demand for this cellulose type.

Furthermore, the market for A grade cellulose is primarily driven by its application in high-quality printing papers and archival papers, where its high purity and stability are crucial. This cellulose type is also sought after in the specialty packaging industry, further boosting its demand.

Breakup by Application:

- Printing Inks

- Automotive Paints

- Wood Coatings

- Leather Finishes

- Nail Varnishes

- Others

Wood coatings hold the largest share in the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes printing inks, automotive paints, wood coatings, leather finishes, nail varnishes, and others. According to the report, wood coatings accounted for the largest market share.The wood coatings market is predominantly driven by the booming construction and furniture industries, where the demand for high-quality, durable finishes is consistently high. Environmental concerns and regulatory policies are pushing for the development of eco-friendly, low-VOC wood coatings, which is a significant trend in this segment. Urbanization and rising living standards globally also contribute to the increased demand for aesthetically appealing wood furniture and finishes. Moreover, advancements in coating technologies, aiming for better performance and ease of application, are constantly evolving, thus fueling the market growth for wood coatings.

On the contrary the market for printing inks is propelled by the booming packaging industry, particularly due to the rise in e-commerce and the need for high-quality packaging and labeling. Advancements in printing technology and the growing demand for eco-friendly inks are also significant factors.

Moreover, the automotive paints market is growing due to the automotive industry's expansion, with an increasing demand for both new vehicles and aftermarket paints. Technological innovations in paint durability and eco-friendliness, along with aesthetic trends, also drive this market.

Additionally, leather finishes market growth is primarily driven by the fashion and automotive industries, where high-quality leather is in constant demand. Advances in eco-friendly and durable finish technologies also contribute to this growth.

Besides this, the nail varnish market benefits from the booming beauty and personal care industry, with trends in fashion and aesthetics playing a crucial role. Innovation in long-lasting and quick-drying formulations also drives demand.

Furthermore, the textile market is driven by the fashion industry's demand for high-quality and diverse fabrics. Technological advancements in fabric production and the growing trend of sustainable textiles also significantly influence this market.

Breakup by End Use Industry:

- Building and Construction

- Textile

- Automobile

- Aerospace

- Personal Care and Cosmetics

- Marines

- Others

Building and construction represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes building and construction, textile, automobile, aerospace, personal care and cosmetics, marines, and others. According to the report, building and construction represented the largest segment.The building and construction segment's growth is largely influenced by the global increase in infrastructure development and urbanization, leading to higher demand for construction materials, including paints and coatings. The push towards sustainable and green building practices is driving innovation in eco-friendly and energy-efficient materials, directly impacting the nitrocellulose market in this segment. Government initiatives and investments in infrastructure projects in emerging economies are also significant contributors to this market's expansion. Additionally, the increasing trend of home renovation and remodeling in developed countries adds to the growing demand for high-quality construction materials.

Besides this, the textile industry is being driven by the rising global population and increasing disposable income, leading to higher consumer spending on apparel and home textiles. Technological innovations in fabric production and processing, including the adoption of sustainable practices, are propelling the industry forward. The growth of e-commerce platforms has also significantly expanded the market reach of textile products.

Also, the automobile sector is growing due to the rising demand for passenger vehicles, particularly in emerging markets. Technological advancements, such as electric and autonomous vehicles, are reshaping the industry, with sustainability and innovation being key drivers. Government policies promoting vehicle safety and emission standards are further influencing market dynamics.

Moreover, the aerospace industry's growth is primarily driven by increasing air travel demand and the expansion of global airline fleets. Advancements in aircraft technology focusing on fuel efficiency and reduced emissions are key factors. Defense spending and the development of space exploration programs also significantly contribute to this sector's growth.

Furthermore, personal care and cosmetics industry is growing due to the rising awareness of personal hygiene and grooming, coupled with increasing disposable incomes. The shift towards natural and organic products is a significant trend, driven by consumer health consciousness. Technological innovations in product formulation and packaging are also key factors.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific leads the market, accounting for the largest nitrocellulose market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share.Asia-Pacific's market is expanding primarily due to rapid industrialization and urbanization in major economies like China and India, which boosts demand in various nitrocellulose applications. The region's growing automotive industry, coupled with an increasing middle-class population with higher disposable incomes, significantly drives the demand for automotive paints and coatings. The expansion of the manufacturing sector, especially in packaging, textiles, and electronics, where nitrocellulose is widely used, further fuels the market growth. Additionally, the region's focus on sustainable and environmentally friendly practices is leading to innovations and adaptations in nitrocellulose products, aligning with global environmental standards.

The North American market is characterized by technological innovation, a strong industrial base, and high consumer spending power. The region's focus on sustainability and renewable energy is driving market evolution. The presence of major global players in various industries also contributes to the market's dynamism. Government policies and regulations, particularly in the United States and Canada, significantly influence market trends.

Europe's market is driven by its strong emphasis on sustainability and environmental regulations, influencing various industry sectors. Technological innovation and the presence of a well-established industrial and technological infrastructure are key growth factors. The region's focus on renewable energy and efficient resource utilization also plays a significant role. Furthermore, the European Union’s policies and economic stability are critical in shaping market dynamics.

Latin America's market growth is influenced by increasing urbanization and economic development in key countries. The region's rich natural resources and agricultural strength play a vital role in its market dynamics. Infrastructure development and government initiatives are also driving market growth. Additionally, the increasing penetration of digital technology and the internet is opening new avenues for various industries.

The Middle East and Africa are experiencing market growth due to factors like increasing investment in infrastructure and the diversification of economies beyond oil. The region's growing young population and rising urbanization are key drivers. Investments in renewable energy and technological advancements, particularly in the Gulf countries, are influencing market dynamics. Additionally, Africa's untapped potential and improving economic stability offer significant growth opportunities.

Leading Key Players in the Nitrocellulose Industry:

The key players in the nitrocellulose market are actively engaging in various strategic actions to ensure sustained market growth. They are focusing on technological advancements to improve product quality and efficiency. These entities are constantly expanding their production capabilities to meet the growing global demand. By investing in research and development, they are innovating new applications and enhancing existing ones. These market leaders are also forming strategic partnerships and collaborations to leverage mutual strengths and expand market reach. They are exploring eco-friendly production methods, addressing environmental concerns associated with nitrocellulose manufacturing. In addition, these players are enhancing their distribution networks to ensure seamless supply chain management. They are actively participating in mergers and acquisitions to consolidate their market positions and gain competitive advantages.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- DuPont de Nemours Inc.

- GRN Cellulose Pvt. Ltd.

- Hagedorn NC

- Hubei Xufei Chemical Co. Ltd.

- IVM Chemicals srl

- Nitrex Chemicals India Ltd.

- Nitro Chemical Industry Ltd.

- Nitro Química

- Rayonier Advanced Materials

- Rheinmetall AG

- Synthesia a.s.

- T.N.C. Industrial Co. Ltd.

- The Nitrocellulose Group

Key Questions Answered in This Report

1. What was the size of the global nitrocellulose market in 2024?2. What is the expected growth rate of the global nitrocellulose market during 2025-2033?

3. What are the key factors driving the global nitrocellulose market?

4. What has been the impact of COVID-19 on the global nitrocellulose market?

5. What is the breakup of the global nitrocellulose market based on the product?

6. What is the breakup of the global nitrocellulose market based on the application?

7. What is the breakup of the global nitrocellulose market based on the end use industry?

8. What are the key regions in the global nitrocellulose market?

9. Who are the key players/companies in the global nitrocellulose market?

Table of Contents

Companies Mentioned

- DuPont de Nemours Inc.

- GRN Cellulose Pvt. Ltd.

- Hagedorn NC

- Hubei Xufei Chemical Co. Ltd.

- IVM Chemicals srl

- Nitrex Chemicals India Ltd.

- Nitro Chemical Industry Ltd.

- Nitro Química

- Rayonier Advanced Materials

- Rheinmetall AG

- Synthesia a.s.

- T.N.C. Industrial Co. Ltd.

- The Nitrocellulose Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.91 Billion |

| Forecasted Market Value ( USD | $ 1.34 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |