Tyres are one of the essential components in automobiles as they aid in transferring the load of the vehicle from the axle to the ground. They are manufactured using materials such as fabric, wire, carbon black, natural and synthetic rubber, and other chemical compounds. As tyres are pneumatically inflated, they provide a flexible cushion for absorbing shock when the vehicle travels on a rough surface. Presently, the rising vehicle motorization rate in Pakistan is impelling the demand for tyres in the country.

The Pakistan tyre (tire) industry is currently experiencing moderate growth on account of the increasing vehicle ownership in the country. This can also be attributed to numerous infrastructural and macroeconomic reforms undertaken by the Government of Pakistan, which is resulting in the development of industrial, construction and agricultural industries.

For instance, the Government has reduced the prices of fertilizers, approved the Seed Act and Plant Breeders Bill, and increased loans for farmers to improve agricultural activities which, in turn, is boosting the overall sales of tyres in this sector. Apart from this, the Government is also imposing taxes on tyre imports to support domestic manufacturers.

Furthermore, due to a consistent rise in the demand for tyres, local and foreign investors are showing interest in the industry, which is anticipated to strengthen the market growth in the upcoming years. For example, General Tyre and Rubber Company (GTR), one of the leading companies in Pakistan, is planning to set up a new manufacturing unit in the Special Economic Zone (SEZ) in Faisalabad.

Key Market Segmentation:

The research provides an analysis of the key trends in each segment of the Pakistan tyre market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on vehicle type, OEM and replacement segment, domestic production and imports, legitimate and grey market, radial and bias tyres, and tube and tubeless tyres.Breakup by Vehicle Type:

- Two-Wheeler and Three-Wheeler

- Passenger Cars and Light Truck

- Heavy Commercial and OTR

Breakup by OEM and Replacement Segment:

- OEM

- Replacement

Breakup by Domestic Production and Imports:

- Domestic Production

- Imports

Breakup by Legitimate and Grey Market:

- Legitimate

- Grey

Breakup by Radial and Bias Tyres:

- Bias

- Radial

Breakup by Tube and Tubeless Tyres:

- Tube Tyres

- Tubeless Tyres

Regional Insights:

- Punjab

- Sindh

- Khyber Pakhtunkhwa

- Balochista.

Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Some of these players are:

- General Tyre and Rubber Co. Ltd.

- Panther Tyres Limited

- Diamond Tyres Limited

- Service Industries Limited

- Ghauri Tyre and Tube Pvt. Limite.

Key Questions Answered in This Report

- How big is the tyre market in Pakistan?

- What factors are driving the growth of the Pakistan tyre market?

- What is the forecast for the tyre market in Pakistan?

- Which segment accounted for the largest Pakistan tyre segment market share?

- Who are the major players in the Pakistan tyre market?

- What is the market breakup on the basis of tube and tubeless tyres?- What is the market breakup on the basis of tube and tubeless tyres?

- What are the key driving factors and challenges in the Pakistan tyre industry?- What are the key driving factors and challenges in the Pakistan tyre industry?

- What is the degree of competition in the Pakistan tyre industry?- What is the degree of competition in the Pakistan tyre industry?

- What is the degree of competition in the Pakistan tyre industry?- What is the degree of competition in the Pakistan tyre industry?

- What are the various unit operations involved in a tyre manufacturing plant?- What are the various unit operations involved in a tyre manufacturing plant?

- What are the machinery requirements for setting up a tyre manufacturing plant?- What are the machinery requirements for setting up a tyre manufacturing plant?

- What are the packaging requirements for a tyre manufacturing plant?- What are the packaging requirements for a tyre manufacturing plant?

- What are the utility requirements for setting up a tyre manufacturing plant?- What are the utility requirements for setting up a tyre manufacturing plant?

- What are the infrastructure costs for setting up a tyre manufacturing plant?- What are the infrastructure costs for setting up a tyre manufacturing plant?

- What are the operating costs for setting up a tyre manufacturing plant?- What are the operating costs for setting up a tyre manufacturing plant?

Table of Contents

Companies Mentioned

- General Tyre and Rubber Co. Ltd.

- Panther Tyres Limited

- Diamond Tyres Limited

- Service Industries Limited

- Ghauri Tyre and Tube Pvt. Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 116 |

| Published | June 2025 |

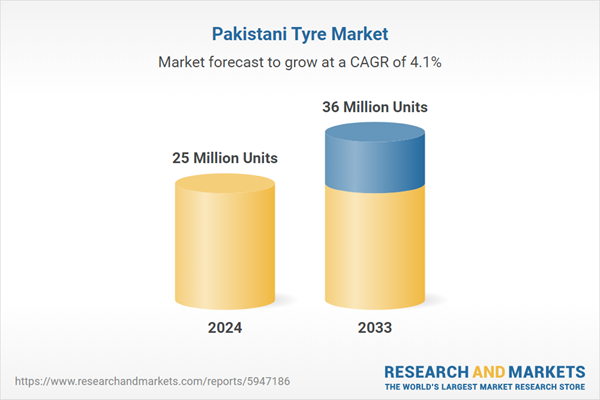

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 25 Million Units |

| Forecasted Market Value by 2033 | 36 Million Units |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Pakistan |

| No. of Companies Mentioned | 5 |