In the USA, the active pharmaceutical ingredients (API) market growth is stimulated by the mounting need for innovative and generic drugs with the share of 90.8%. Its strong healthcare infrastructure and heavy investments in pharmaceutical research and development are major drivers for the growth in API markets. Regulatory efforts, such as speeded-up drug approval procedures and orphan drug development incentives, have facilitated the launch of new treatments. According to the sources, in March 2024, Catalyst Pharmaceuticals commercially launched AGAMREE® (vamorolone) oral suspension in the U.S. for treating Duchenne muscular dystrophy in patients aged two years and older.

Moreover, the heightening incidence of chronic diseases, especially cardiovascular conditions, diabetes, and cancer, fuels API demand for efficacious treatments. The growing trend toward biologics and specialty pharmaceuticals also fuels API production. The effort of the U.S. government to enhance domestic pharma manufacturing to minimize dependence on foreign drug makers has spurred investments in API manufacturing plants. In addition, advanced manufacturing technologies, such as continuous manufacturing and practices of green chemistry, have increased production efficiency as well as cut down on the environmental footprint. The growing pharma pipeline along with higher health expenditure further propel the U.S. API market.

Active Pharmaceutical Ingredients (API) Market Trends:

Rising Prevalence of Chronic Diseases

The increasing number of chronic diseases, such as cancer, cardiovascular diseases, and diabetes, are contributing positively towards the development of the market. For instance, according to 2022 data published by the International Diabetes Federation (IDF), diabetic instances are anticipated to increase to USD 643 Million and USD 784 Million by 2030 and 2045, respectively. Along with this, the Australian Bureau of Statistics reported in December 2023 that there were approximately 1.3 million Australians who had diabetes in 2022 and it made up 5.3% of Australia's population.Besides, the extensive application of APIs in the development of novel and innovative drugs is also fueling the global market. For instance, in March 2023, yet another study in Indian Journal of Medical Research, the prevalence of cancer in India is set to rise from 1.46 million in 2022 to 1.57 million in 2025. All this data indicates how quickly the number of cancer cases is increasing in the country.

Advancements in Biotechnology and Biopharmaceuticals

The incorporation of digital technologies and data analytics in API production processes to track product methods, maximize efficiency, and enhance the product quality is the key driver for the active pharmaceutical ingredient market share. The biotech industry's strong investment scenario also supports the trend. It has been reported that more than 100 startups raised USD 100 Million or more in funding rounds through May 2024, beating 2023's figure. Interestingly, almost half of these high-value deals belonged to the biotech industry, reflecting robust investor optimism. In addition, progress in biopharmaceuticals, such as vaccines, monoclonal antibodies, and recombinant proteins, is also driving the growth of the market.For example, in September 2022, the Center for Biologics Evaluation and Research (CBER) licensed Bluebird Bio, Inc.'s SKYSONA (elivaldogene autotemcel), which is approved to delay the progression of neurologic dysfunction in boys 4-17 years old with early, active cerebral adrenoleukodystrophy (CALD). Likewise, in June 2022, CBER licensed GlaxoSmithKline's PRIORIX, a live vaccine for measles, mumps, and rubella. Therefore, these product approvals enhance the market presence of new drugs, which is anticipated to grow the market under consideration during the forecast period.

Focus on Personalized Medicine and Targeted Drug Delivery Systems

The evolving need of the market leaders towards patient-friendlier therapies is fueling the growth of the active pharmaceutical ingredient business. Moreover, the continuous innovation in targeted drug delivery systems to improve the effectiveness of medicine, lower side effects, and increase patient compliance is also proving to be beneficial to the market growth. The U.S. Food and Drug Administration (FDA) announced that in 2024, the Center for Drug Evaluation and Research (CDER) approved 50 new drugs, representing a milestone in the new therapy approval.For instance, in April 2022, a report in the journal Nature Medicine declared that the expanding application of genomic profiling for diagnosis and treatment choice in many types of tumors has augmented the use of precision medicine in cancer patients. Further, Zuberitamab of BioRay Biopharmaceutical Co., Ltd. In addition, the world's first allosteric inhibitor of TYK2, Sotyktu (deucravacitinib), was approved for the treatment of psoriasis and Selumetinib, a MEK inhibitor co-developed by AstraZeneca and Merck Sharp & Dohme (MSD), was the first drug approved in China for neurofibromatosis type I (NF1) treatment.

Active Pharmaceutical Ingredients (API) Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global active pharmaceutical ingredients (API) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug type, type of manufacturer, type of synthesis, and therapeutic application.Analysis by Drug Type:

- Innovative Active Pharmaceutical Ingredients (API)

- Generic Active Pharmaceutical Ingredients (API)

The growth of biopharmaceutical research and growing usage of precision medicine are also boosting the market. Improvements in technology for synthetic biology and drug development are backing productive production processes. As patients highly demand advanced treatment, the innovative APIs market is likely to continue its strong growth in the future.

Analysis by Type of Manufacturer:

- Captive Manufacturers

- Merchant API Manufacturers

- Innovative Merchant API Manufacturers

- Generic Merchant API Manufacturers

In addition, the emphasis on biologics and personalized medicine has propelled the demand for customized API manufacturing capabilities within owned facilities. Sustained investment in cutting-edge manufacturing technologies and process optimization has further entrenched the position of captive manufacturers. As regulatory oversight grows and high-quality APIs are demanded, pharmaceutical companies are likely to continue relying on captive manufacturing for more control and reliability over operations.

Analysis by Type of Synthesis:

- Synthetic Active Pharmaceutical Ingredients (API)

- Market Breakup by Type

- Innovative Synthetic APIs

- Generic Synthetic APIs

- Biotech Active Pharmaceutical Ingredients (API)

- Market Breakup by Type

- Innovative Biotech APIs

- Biosimilars

- Market Breakup By Product

- Monoclonal Antibodies

- Vaccines

- Cytokines

- Fusion Proteins

- Therapeutic Enzymes

- Blood Factors

- Market Breakup By Expression System

- Mammalian Expression Systems

- Microbial Expression Systems

- Yeast Expression Systems

- Transgenic Animal Systems

- Others

As markets for generic and specialty drugs rise, demand for synthetic APIs stays robust. Innovation in the development of synthetic APIs is supported continuously by regulatory authorities, promoting low-cost, quality medicines. The increasing incidence of chronic diseases as well as augmenting pharmaceutical R&D expenditure is also likely to propel the market for synthetic API.

- Oncology

- Cardiovascular and Respiratory

- Diabetes

- Central Nervous System Disorders

- Neurological Disorders

- Others

Increasing usage of combination therapy and biologics' development is also broadening the scope of cancer treatment using APIs. Advances in technology for API synthesis and formulation are improving drug effectiveness and patient outcomes. With growing cancer incidence and broadening oncology drug pipelines, demand for APIs in this therapeutic area is likely to continue strong.

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The presence of large pharmaceutical companies and state-of-the-art production units strengthens local market growth. Government programs to increase domestic API production and lower dependence on imports have also favored market growth. With rising healthcare expenditure and the ongoing launch of new therapies, North America continues to be a leader in the worldwide API market.

Key Regional Takeaways:

United States Active Pharmaceutical Ingredients (API) Market Analysis

The API market in the United States is growing strongly due to rising pharma production, growing demand for specialty medicines, and advances in biotechnology. A robust healthcare infrastructure and good R&D investment are driving API innovation. Increased incidence of chronic diseases and the aging population are also propelling demand for high-quality APIs. 42% of Americans have two or more chronic conditions, and 12% have five or more, as stated by the CDC, emphasizing the growing demand for efficient pharmaceutical drugs. The implementation of new manufacturing methods, including continuous manufacturing and green chemistry, is enhancing efficiency and sustainability in production.Regulation and high quality standards are dictating the market, promoting the manufacture of high-purity APIs. Growing use of biologics and biosimilars is also largely driving the growth of the market. Growing associations between drug makers and API manufacturers are also augmenting the supply chain's efficiency and rising capacities. Based on strong technological support and top-grade API manufacturing, the market will see constant growth, augmenting the changing requirements of the pharmaceutical industry.

Europe Active Pharmaceutical Ingredients (API) Market Analysis

The European API market is experiencing steady growth as a result of the growing pharmaceutical industry, improved drug formulations, and robust regulatory mechanisms guaranteeing quality production. Growing demand for novel medicines, in addition to a concentration on individualized healthcare, is stimulating API development. The market is boosted by large research investments, which allow new therapies to be introduced. The use of cutting-edge pharma manufacturing technology, such as automation and green chemistry, is further increasing efficiency.The increasing trend of biologics and biosimilars is driving the API scenario, with a focus on high-value API manufacture by manufacturers. Significantly, the Europe biosimilar market had reached USD 13.86 billion in 2024 and is expected to grow at a CAGR of 17.1% for 2025-2033, reaching USD 59.73 billion by 2033, as per the research. This fast growth is propelling demand for premium APIs, most notably in the biologics space.

Asia Pacific Active Pharmaceutical Ingredients (API) Market Analysis

The Asia Pacific API market is growing at a fast pace based on growing pharma production, rising generic medicine demand, and advances in pharmaceutical manufacturing technology. The region has the advantage of an expanding health sector and improving R&D investment in high-quality API manufacturing. The use of innovative manufacturing practices, including automation and continuous processing, is enhancing efficiency and value for money. The market for biologics and biosimilars is on the rise, and hence production of APIs in this category is increasing. Also, the region's robust export performance in the pharmaceutical sector is driving growth in the market.Pharmaceutical and drug exports at USD 2.13 Billion during July 2023 rose by 8.36% to USD 2.31 Billion during July 2024, as per the Press Information Bureau. This points to the region's increasing production capacity and increasing global footprint in the supply of APIs. The emphasis on sustainability and adherence to international quality standards is also redefining market dynamics, leading to innovation and growth.

Latin America Active Pharmaceutical Ingredients (API) Market Analysis

The Latin America API market is increasing consistently with the growth of the pharmaceutical industry and growing demand for cheap drugs. The increased production of generic medicines and the increasing emphasis on new drug formulations are driving market growth. Significantly, the generic drug market in Brazil amounted to USD 22.4 Billion in 2024 and is expected to grow at a CAGR of 6.43% during 2025-2033, reaching USD 39.3 Billion by 2033, as per the research. This growing demand for generics is fueling the demand for affordable and quality APIs in the region. Investment in pharmaceutical R&D, new processes of manufacturing, and transition to high-value APIs are enhancing the production capability and global competitiveness and making Latin America a strong player.Middle East and Africa Active Pharmaceutical Ingredients (API) Market Analysis

The Middle East and Africa API market is expanding based on pharmaceutical sector growth, increasing demand for crucial medicines, new manufacturing methods, and joint ventures between drug makers and pharma companies, boosting production and supply chain efficiency. Industrial Center forecasts that the KSA pharmaceutical sector will grow at a 4.1% rate until 2024 and reach about USD 9.6 Billion.This expansion indicates the growing needs for pharmaceuticals within the region, which fuels the growing requirement for quality APIs. The development of the healthcare sector and targeted investment in drug production is strengthening the API market further, with the region positioning itself as an emerging force within the global supply chain of pharmaceuticals.

Competitive Landscape:

The API market is dominated by a large number of manufacturers, varying from large pharmaceutical corporations to specialized API manufacturers. Businesses are increasing their production levels in order to accommodate the increased demand for new as well as generic APIs. Research and development investments are promoting the development of new technologies in synthesis and green manufacturing techniques. Contract development and manufacturing organizations (CDMOs) are important in offering specialized API manufacturing services, assisting pharmaceutical firms in complying with regulatory requirements and ensuring supply chain effectiveness.Local market players are also concentrating on producing affordable APIs for export and local consumption. Mergers, acquisitions, and alliances are prevalent means of improving production capacity and geographical presence. Furthermore, advances in biotechnology and increased emphasis on individualized medicine are adding to the competitive landscape, driving ongoing innovation and effective manufacturing in the international API market.

The report provides a comprehensive analysis of the competitive landscape in the active pharmaceutical ingredients (API) market with detailed profiles of all major companies, including:

- Pfizer, Inc.

- Novartis International AG

- Sanofi

- Boehringer Ingelheim

- Bristol-Myers Squibb

- Teva Pharmaceutical Industries Ltd.

- ELI Lilly and Company

- GlaxoSmithKline

- Merck & Co., Inc.

- Abbvie Inc.

Key Questions Answered in This Report

- 1.How big is the active pharmaceutical ingredients (API) market?

- 2.What is the future outlook of active pharmaceutical ingredients (API) market?

- 3.What are the key factors driving the active pharmaceutical ingredients (API) market?

- 4.Which region accounts for the largest active pharmaceutical ingredients (API) market share?

- 5.Which are the leading companies in the global active pharmaceutical ingredients (API) market?

Table of Contents

Companies Mentioned

- Pfizer Inc.

- Novartis International AG

- Sanofi

- Boehringer Ingelheim

- Bristol-Myers Squibb

- Teva Pharmaceutical Industries Ltd.

- ELI Lilly and Company

- GlaxoSmithKline

- Merck & Co. Inc.

- Abbvie Inc

Table Information

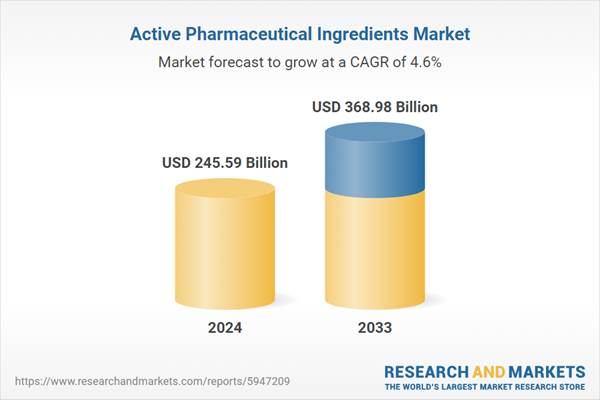

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 245.59 Billion |

| Forecasted Market Value ( USD | $ 368.98 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |