Immunotherapy drugs are medical treatments designed to utilize or modify the immune system to fight or control diseases. They focus on specific cells and proteins and aid in minimizing harm to healthy tissues. They reduce the likelihood of developing resistance, offer better outcomes, and have fewer side effects as compared to other treatments. They are utilized in treating various types of cancers, including melanoma, lung, and breast cancer. They are also used in managing specific allergic reactions and treating diseases like rheumatoid arthritis, lupus, and multiple sclerosis. Besides this, as they are effective in controlling chronic inflammatory diseases, the demand for immunotherapy drugs is increasing across the globe.

The rise in the pharmaceutical industry and the expansion of pharmacies worldwide is offering a favorable market outlook. Moreover, strategic collaborations and mergers and acquisitions (M&A) between biotech firms, pharmaceutical companies, and research institutions are supporting the research, development, and commercialization activities of immunotherapy products. Furthermore, the integration of artificial intelligence (AI) and big data analytics in research and development (R&D) activities is enhancing efficiency and precision. This technological integration is enabling the rapid identification of targets, optimization of clinical trials, and prediction of patient responses.

Immunotherapy Drugs Market Trends/Drivers:

The increasing prevalence of target diseases

The rising occurrence of different types of cancer due to lifestyle changes and unhealthy dietary patterns is catalyzing the demand for innovative and effective treatments like immunotherapy is growing. Additionally, the early detection and need for personalized therapy options are encouraging patients and healthcare providers to adopt these advanced treatment alternatives. Apart from this, rapid urbanization and rising pollution levels due to harmful vehicular emissions are resulting in various chronic diseases, which is creating new opportunities for immunotherapy treatments. Furthermore, the increasing aging population, which is highly susceptible to tumor, cancer, and other health conditions, is driving the need for effective treatments and technologies, like immunotherapy drugs.Adoption of personalized medicines

The increasing utilization of personalized medicines in various medical fields to promote a more patient-centered approach is positively influencing the market. Additionally, the development of advanced diagnostic tools, such as next-generation sequencing and biomarker analysis, is enabling the precise identification of patients for specific immunotherapies. These advancements in diagnostics facilitate early intervention and allow for personalized treatment plans, which aid in enhancing the overall effectiveness of immunotherapy. Apart from this, personalized immunotherapies reduce the likelihood of trial-and-error approaches. Furthermore, this targeted approach minimizes the use of ineffective treatments, avoids unnecessary side effects, facilitates quicker recoveries, and reduces healthcare costs, which is contributing to market growth.Governmental and regulatory support

Governments and regulatory bodies of various countries are continuously focusing on the development of immunotherapy drugs and therapies, which is offering a favorable market outlook. Additionally, they are providing financial support for conducting the in-depth studies required to develop novel immunotherapies and optimize existing ones. Apart from this, partnerships between governments, research institutions, and private companies are supporting market growth. These collaborations facilitate knowledge exchange and accelerate the development of groundbreaking immunotherapy treatments across borders. Furthermore, the introduction of several supportive governmental healthcare policies is encouraging the adoption and reimbursement of immunotherapies.Immunotherapy Drugs Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global immunotherapy drugs market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on drug type, therapy area and end user.Breakup by Drug Type:

- Monoclonal Antibodies

- Vaccines

- Interferons Alpha and Beta

- Interleukins

Monoclonal antibodies represent the largest market segment

A detailed breakup and analysis of the market based on the drug type has also been provided in the report. This includes monoclonal antibodies, vaccines, interferons alpha and beta, and interleukins. According to the report, monoclonal antibodies accounted for the largest market share. These antibodies offer a highly specific and targeted approach. They are designed to attach distinct proteins and receptors on the surface of diseased cells, enabling precise intervention. Additionally, regulatory bodies support monoclonal antibody therapies, providing streamlined approval processes and encouraging rapid development and commercialization. Apart from this, ongoing research and investment into the development of monoclonal antibodies contribute to their dominant position in the market. Furthermore, increasing funding and collaboration within the scientific community continue to yield innovative solutions. Moreover, technological advancements in manufacturing processes are making the production of monoclonal antibodies more scalable and cost-effective.Breakup by Therapy Area:

- Cancer

- Autoimmune and Inflammatory Diseases

- Infectious Diseases

- Others

Cancer accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes cancer, autoimmune and inflammatory diseases, infectious diseases, and others. According to the report, cancer represented the largest segment. The rising prevalence of cancer due to the aging population, lifestyle changes, and environmental factors represent one of the key factors positively influencing the market. Additionally, the growing awareness among individuals about the benefits of early diagnosis and treatment of cancer is catalyzing the demand for immunotherapy drugs. Immunotherapy offers targeted treatments that can identify and attack specific cancer cells, minimizing damage to healthy tissue, enhancing effectiveness, and reducing side effects. Apart from this, continuous investments from governmental bodies, private sectors, and philanthropic organizations are supporting cancer research, including the development of immunotherapies, which is offering a favorable market outlook. Furthermore, rising partnerships between pharmaceutical companies, research institutions, and healthcare providers are accelerating the development and accessibility of cancer immunotherapies.Breakup by End User:

- Hospitals

- Clinics

- Others

Hospitals hold the majority of the market share

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes hospitals, clinics, and others. According to the report, hospitals hold the largest market share. Hospitals have a multidisciplinary team of specialists, including oncologists, immunologists, pharmacists, and nurses. These integrated teams enable a collaborative approach to patient care, ensuring the appropriate application and monitoring of immunotherapies. Additionally, they are equipped with state-of-the-art medical technologies and equipment. This access allows for the utilization of advanced immunotherapies. Apart from this, collaborations with pharmaceutical companies allow hospitals to gain early access to new immunotherapy drugs and technologies. These partnerships enhance the ability of hospitals to offer cutting-edge treatment options. Furthermore, they have established relationships with insurance providers and a better understanding of reimbursement policies. Moreover, many hospitals are involved in clinical trials and research collaborations, actively contributing to the advancement of immunotherapy.Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest immunotherapy drugs market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share as the region has a well-established healthcare infrastructure that allows for the efficient distribution and utilization of immunotherapy drugs. Sophisticated medical facilities and well-trained healthcare professionals facilitate the widespread adoption of these treatments. Additionally, the region witnesses substantial investments from public and private sectors in healthcare and biotechnology, which facilitates research, drug development, and commercialization of immunotherapy products. Apart from this, the regulatory bodies in North America, such as the Food and Drug Administration (FDA), offer a conducive environment for drug approval. Furthermore, strategic collaborations between academia, biotech firms, and pharmaceutical companies ensure a dynamic environment for continuous innovation and growth in the field of immunotherapy.Competitive Landscape:

Companies are actively engaged in various activities to stay competitive and innovate. They are conducting extensive research and development (R&D) activities, working on discovering new targets and optimizing existing therapies. Additionally, these companies are forming strategic partnerships with academic institutions, leveraging their expertise to fuel innovation. Apart from this, they are investing in cutting-edge manufacturing technologies to produce immunotherapy drugs efficiently and at scale. Furthermore, regulatory teams within these companies are collaborating with governmental bodies to ensure compliance with emerging rules and gain expedited approvals for novel treatment. Moreover, many companies are actively participating in international conferences and symposia, sharing knowledge, and learning from global peers.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche AG

- GSK plc

- Merck & Co. Inc.

- Pfizer Inc.

- Sanofi S.A.

Key Questions Answered in This Report

- How big is the global immunotherapy drugs market?

- What is the expected growth rate of the global immunotherapy drugs market during 2025-2033?

- What are the key factors driving the global immunotherapy drugs market?

- What has been the impact of COVID-19 on the global immunotherapy drugs market?

- What is the breakup of the global immunotherapy drugs market based on the drug type?

- What is the breakup of the global immunotherapy drugs market based on the therapy area?

- What is the breakup of the global immunotherapy drugs market based on the end user?

- What are the key regions in the global immunotherapy drugs market?

- Who are the key players/companies in the global immunotherapy drugs market?

Table of Contents

Companies Mentioned

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche AG

- GSK plc

- Merck & Co. Inc.

- Pfizer Inc.

- Sanofi S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | March 2025 |

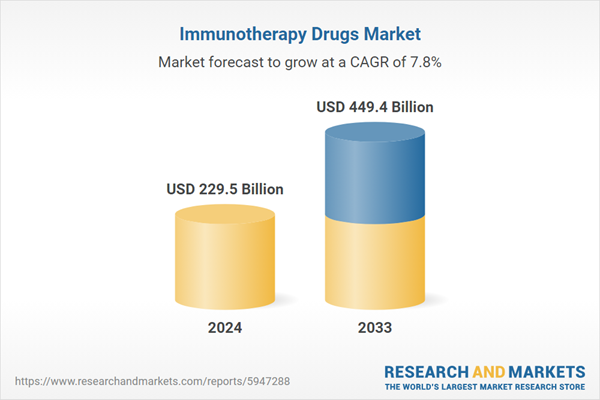

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 229.5 Billion |

| Forecasted Market Value ( USD | $ 449.4 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |