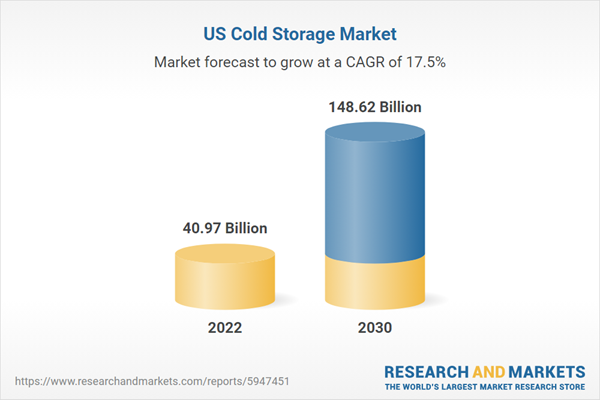

The US cold storage market size was valued at US$ 40,972.22 million in 2022 and is projected to reach US$ 148,623.44 million by 2030; it is expected to register a CAGR of 17.5% during 2022-2030.

Based on warehouse type, the US cold storage market share is segmented into public, private, and semi-private. Government entities, semi-government bodies, and private third-party companies usually own warehouses. Increasing consumer inclination for perishable products and growing demand for frozen food items are a few of the key factors leading to the growth of US cold storage market size. Also, the rising incidents of unwanted natural calamities and other crises are boosting the need for cold storage facilities to store food and other pharmaceutical products.

provide flexible space and usage provisions. Companies prefer not to spend on developing or renting their warehouse and choose to share operational and maintenance costs with other companies using the same facility. In addition, public warehouses allow companies to leverage their storage space on a flexible basis. Public warehouse service providers also specialize in logistics and warehouse management. Public warehouses are equipped with high-end systems and involve processes that maintain inventory effectively, which leads to improved operational productivity for businesses. Moreover, public warehouses are often located at transportation routes, hubs, ports, or near major cities. This decreases transportation costs and time, which allows companies to attend to their customers quickly. Companies with changing demand for their products are the major end users of public warehouses that help them optimize inventory management. In addition, businesses that deal in seasonal products, such as summer or winter clothing or festival decorative items, can benefit from public warehousing for storing their inventory during peak times. Moreover, startup companies that do not have the leverage to invest in their warehouse can utilize public warehousing to manage their inventory. Furthermore, international companies can benefit from public warehousing near major port cities for fast distribution of their goods in target markets.

The US cold storage market analysis is carried out by identifying and evaluating key players in the market. Americold Logistics Inc., Lineage Logistics LLC, United States Cold Storage Inc, Interstate Warehousing Inc, Newcold Cooperatief, Kloosterboer, Arcadia Cold Storage & Logistics, CTW Logistics, Burris Logistics, and VersaCold Logistics Services are among the key players analyzed in the US cold storage market report. The US cold storage market report also includes growth prospects in light of current US cold storage market trends and driving factors influencing the market growth.

Companies operating in the US cold storage market highly adopt inorganic strategies such as mergers and acquisitions. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings to increase their US cold storage market share.

Reasons to Buy

Increasing Demand for Convenience Food Among Consumers is Boosting the US Cold Storage Market Growth

Over the years, consumers' lifestyles have evolved drastically, owing to which consumers are inclining toward canned and processed food for convenience. As canned food items have a high tendency to get rotten within a few days or weeks if not preserved well, cold storage facilities cannot be overlooked. These facilities help maintain optimal temperature and proper storage conditions to extend the shelf life of processed or canned food. Further, increased marketing exposure of processed food is attracting the younger generation toward consuming processed food. Thus, the increasing demand for convenience food items due to rising urbanization, increasing disposable income, and rising busy lifestyles are accelerating the US cold storage market growth.Based on warehouse type, the US cold storage market share is segmented into public, private, and semi-private. Government entities, semi-government bodies, and private third-party companies usually own warehouses. Increasing consumer inclination for perishable products and growing demand for frozen food items are a few of the key factors leading to the growth of US cold storage market size. Also, the rising incidents of unwanted natural calamities and other crises are boosting the need for cold storage facilities to store food and other pharmaceutical products.

provide flexible space and usage provisions. Companies prefer not to spend on developing or renting their warehouse and choose to share operational and maintenance costs with other companies using the same facility. In addition, public warehouses allow companies to leverage their storage space on a flexible basis. Public warehouse service providers also specialize in logistics and warehouse management. Public warehouses are equipped with high-end systems and involve processes that maintain inventory effectively, which leads to improved operational productivity for businesses. Moreover, public warehouses are often located at transportation routes, hubs, ports, or near major cities. This decreases transportation costs and time, which allows companies to attend to their customers quickly. Companies with changing demand for their products are the major end users of public warehouses that help them optimize inventory management. In addition, businesses that deal in seasonal products, such as summer or winter clothing or festival decorative items, can benefit from public warehousing for storing their inventory during peak times. Moreover, startup companies that do not have the leverage to invest in their warehouse can utilize public warehousing to manage their inventory. Furthermore, international companies can benefit from public warehousing near major port cities for fast distribution of their goods in target markets.

The US cold storage market analysis is carried out by identifying and evaluating key players in the market. Americold Logistics Inc., Lineage Logistics LLC, United States Cold Storage Inc, Interstate Warehousing Inc, Newcold Cooperatief, Kloosterboer, Arcadia Cold Storage & Logistics, CTW Logistics, Burris Logistics, and VersaCold Logistics Services are among the key players analyzed in the US cold storage market report. The US cold storage market report also includes growth prospects in light of current US cold storage market trends and driving factors influencing the market growth.

Companies operating in the US cold storage market highly adopt inorganic strategies such as mergers and acquisitions. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings to increase their US cold storage market share.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the cold storage market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the cold storage market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution.

Table of Contents

1. Introduction

2. Executive Summary

3. Research Methodology

4. US Cold Storage Market Landscape

5. US Cold Storage Market - Key Market Dynamics

6. US Cold Storage Market - US Market Analysis

7. US Cold Storage Market Analysis - by Application

8. US Cold Storage Market Analysis - by Temperature Type

9. US Cold Storage Market Analysis - by Warehouse Type

10. US Cold Storage Market - Impact of COVID-19 Pandemic

11. Competitive Landscape

12. Industry Landscape

13. Company Profiles

14. Appendix

List of Tables

List of Figures

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Americold Logistics Inc

- Lineage Logistics LLC

- United States Cold Storage Inc

- Interstate Warehousing Inc

- Newcold Cooperatief

- Kloosterboer

- Arcadia Cold Storage & Logistics

- CTW Logistics,

- Burris Logistics

- VersaCold Logistics Services

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | February 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 40.97 Billion |

| Forecasted Market Value by 2030 | 148.62 Billion |

| Compound Annual Growth Rate | 17.5% |

| Regions Covered | United States |