Rigid foam panels are made from foam plastics such as polyurethane (PUR), polyisocyanurate (PIR), and polystyrene, or from fibrous materials such as fiberglass and slag wool. Rigid foam panels are often used to provide thermal insulation in the building envelope in order to reduce thermal bridging. The market is expected to experience significant growth in the coming years owing to the expanding construction industry.

Based on material, the North America rigid foam panels market is categorized into polyurethane, polystyrene, polyisocyanurate, and others. In 2022, the polystyrene segment accounted for a significant share of the North America rigid foam panels market. Polystyrene rigid foam panels, also known as EPS foam panels, are a popular insulation material that offers a combination of thermal performance, moisture resistance, and versatility. These panels are made from expanded polystyrene, a lightweight and rigid plastic foam. They have a high R-value, which means they provide excellent resistance to heat flow. This helps reduce energy consumption and lower heating and cooling costs in buildings. Additionally, EPS foam panels have a low thermal conductivity, i.e., they minimize the transfer of heat through walls, roofs, and floors. Another important characteristic of polystyrene rigid foam panels is their moisture resistance. EPS foam is a closed-cell insulation material, which means it does not readily absorb water or moisture. This makes it suitable for use in areas where moisture intrusion is a concern, such as basements, crawl spaces, and exterior walls. Based on application, the market is subsegmented into insulation, structural, decorative, and others. The insulation segment accounts for the largest North America rigid foam panels market share. Rigid foam panels have a high insulation value, which makes them ideal for use in buildings and other applications where thermal insulation is needed. Rigid foam panels are commonly used as insulation materials in roofs, walls, and floors in the building and construction industry.

In 2022, the US dominated the North America rigid foam panels market. Factors such as the rising demand for rigid foam panels from various applications such as residential and commercial construction, cold storage of food and beverages, and automotive are driving the rigid foam panels market growth in North America. In the region, the US is a major market for rigid foam panels. North America has experienced massive growth in infrastructural development, which has surged the demand for rigid foam panels. Additionally, the growth of the construction industry in North America due to growing residential and commercial construction activities is also driving the demand for rigid foam panels. The rigid foam panels are highly used in the construction industry as insulation materials in roofs, walls, and floors. Further, the unique combination of structural stability, insulation, high strength, and other properties makes rigid foam panels an excellent choice for a range of applications.

Owens Corning, Perma R Products Inc, Carlisle Companies Inc, Kingspan Group Plc, DuPont de Nemours Inc, General Plastics Manufacturing Co, Insulation Depot Inc, Metro Home Insulation LLC, Gold Star Insulation LP, and Johns Manville Corp. are key players operating in the North America rigid foam panels market. Market players focus on providing high-quality products to fulfill customer demand. They are also adopting strategies such as investments in research and development activities and new product launches.

The overall North America rigid foam panels market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. Participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders specializing in the North America rigid foam panels market.

Reasons to Buy

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America rigid foam panels market, thereby allowing players to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.

Table of Contents

Companies Mentioned

- Owens Corning

- Perma R Products Inc

- Carlisle Companies Inc

- Kingspan Group Plc

- DuPont de Nemours Inc

- General Plastics Manufacturing Co

- Insulation Depot Inc

- Metro Home Insulation LLC

- Gold Star Insulation LP

- Johns Manville Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 111 |

| Published | February 2024 |

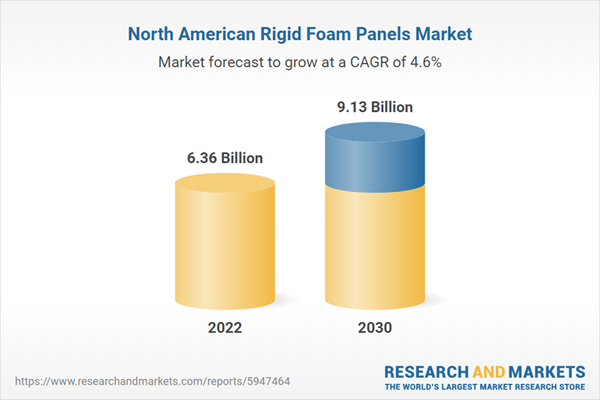

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 6.36 Billion |

| Forecasted Market Value by 2030 | 9.13 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |

![North America Rigid Foam Panels Market Size and Forecasts, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material [Polyurethane, Polystyrene, Polyisocyanurate, and Others], Application, and End Use- Product Image](http://www.researchandmarkets.com/product_images/12628/12628651_115px_jpg/market_research_report.jpg)