Market Introduction

The Asia-Pacific satellite and spacecraft subsystem market has witnessed significant growth, driven by the region's burgeoning space exploration initiatives and increasing demand for satellite-based services. With countries like China, India, and Japan expanding their space programs, there's a growing emphasis on developing advanced satellite subsystems. This market encompasses various critical components such as propulsion systems, power systems, communication systems, and payloads. Companies in the region are investing heavily in research and development to enhance the efficiency, reliability, and performance of these subsystems. Additionally, the rising adoption of satellite technology for communication, navigation, Earth observation, and remote sensing applications further propels market growth. As APAC nations continue to invest in space exploration and satellite technology, the satellite and spacecraft subsystem market in the region is poised for continuous growth and innovation.Market Segmentation:

Segmentation 1: by End User

- Commercial

- Civil Government

- Defense

- Academic/Research Group

Segmentation 2: by Satellite Subsystem

- Payload

- Electrical and Power Subsystem

- Command and Data Handling System

- Communication Subsystem

- Thermal Control Subsystem

- Attitude Determination and Control Subsystem

- Propulsion System

- Mechanism

- Actuator

- Structure

Segmentation 3: by Launch Vehicle Subsystem

- Structure

- Avionics

- Propulsion System

- Control System

- Electrical System

- Stage Separation

- Thermal System

Segmentation 4: by Region

- China

- India

- Japan

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of subsystems available for deployment and their potential. Moreover, the study provides the reader with a detailed understanding of the Asia-Pacific satellite and spacecraft subsystem market based on satellite subsystem, launch vehicle subsystem, and deep space probe subsystem.Growth/Marketing Strategy: The Asia-Pacific satellite and spacecraft subsystem market has seen major development by key players operating in the market, such as contract, collaboration, and joint venture. The favored strategy for the companies has been contracted to strengthen their position in the satellite and spacecraft subsystem market.

Competitive Strategy: Key players in the Asia-Pacific satellite and spacecraft subsystem market analyzed and profiled in the study involve major satellite and spacecraft subsystem companies providing subsystems, respectively. Moreover, a detailed market share analysis of the players operating in the satellite and spacecraft subsystem market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Mitsubishi Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | March 2024 |

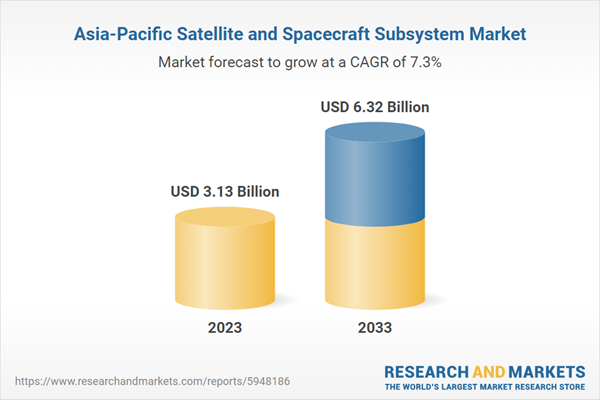

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 3.13 Billion |

| Forecasted Market Value ( USD | $ 6.32 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Asia Pacific |