Market Lifecycle Stage

The global DNA methylation detection technology market can be considered to be in the mature growth stage of its lifecycle. This stage is characterized by rapid market expansion, driven by the increasing adoption of DNA methylation analysis tools and technologies in both research and clinical settings. The growing understanding of the role of DNA methylation in various biological processes and diseases, coupled with advancements in detection methods and analytical platforms, fuels the market's growth. Additionally, the rising demand for personalized medicine and precision diagnostics further accelerates market expansion. While competition intensifies as more players enter the market, opportunities for innovation, product development, and market penetration abound.Industry Impact

The global DNA methylation detection technology market has made a profound impact across various industries, revolutionizing healthcare, biotechnology, pharmaceuticals, and research. By enabling the identification of epigenetic biomarkers associated with disease susceptibility, progression, and treatment response, these technologies have advanced precision medicine approaches, allowing for personalized treatment strategies tailored to individual patient's genetic and epigenetic profiles. In drug discovery and development, DNA methylation analysis accelerates the identification of novel drug targets, biomarkers for patient stratification, and predictors of drug response, leading to the development of more effective and safer therapies. Moreover, these technologies are increasingly used in clinical diagnostics for early disease detection, diagnosis, and prognosis, offering high sensitivity and specificity for improved patient outcomes.The global DNA methylation detection technology market continues to drive transformative advancements across industries, with far-reaching implications for human health and environmental sustainability.

Market Segmentation:

Segmentation 1: by Product

- Consumables

- Instruments

- Software

Consumables to Dominate the Global DNA Methylation Detection Technology Market (by Product)

Based on product, the consumables segment dominated the global DNA methylation detection technology market in FY2022. The recurring need for consumables such as bisulfite conversion kits, PCR reagents, and sequencing libraries drives continuous demand. Secondly, the increasing adoption of high-throughput methods such as next-generation sequencing and microarray analysis requires large quantities of consumables to process samples efficiently. Additionally, as research and clinical applications of DNA methylation analysis expand, the demand for consumables is expected to grow steadily, further solidifying their dominance in the market.Segmentation 2: by Technology

- Polymerase Chain Reaction (PCR)

- Microarray

- Sequencing

- Other Technologies

PCR to Hold its Dominance in the Global DNA Methylation Detection Technology Market (by Technology)

Based on technology, the PCR segment accounted for the largest share of the global DNA methylation detection technology market in FY2022. Moreover, PCR is expected to maintain its dominance in the global DNA methylation detection technology market by technology due to its widespread adoption, versatility, and reliability. PCR-based methods, such as methylation-specific PCR (MSP) and quantitative real-time PCR (qPCR), offer high sensitivity and specificity for detecting DNA methylation patterns, making them essential tools in epigenetic research and clinical diagnostics.Segmentation 3: by Application

- Translational Research

- Diagnostic Procedure

Diagnostic Procedure to Hold its Dominance in the Global DNA Methylation Detection Technology Market (by Application)

Based on application, diagnostic research accounted for the largest share of the global DNA methylation detection technology market in FY2022, primarily due to clinicians' increasing focus on utilizing DNA methylation analysis for clinical diagnostics. DNA methylation patterns have been extensively studied as potential biomarkers for various diseases, including cancer, neurological disorders, and autoimmune conditions.Segmentation 4: by End User

- Contract Research Organization (CRO)

- Research and Academic Laboratories

- Biopharmaceutical and Biotech Companies

- Other End User

Biopharmaceutical and Biotech Companies Segment to Hold its Dominance in the Global DNA Methylation Detection Technology Market (by End User)

Based on end user, the biopharmaceutical and biotech companies segment accounted for the largest share of the global DNA methylation detection technology market in FY2022 due to their extensive use of DNA methylation analysis in drug discovery, development, and personalized medicine applications.Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest-of-the-World

Recent Developments in the Global DNA Methylation Detection Technology Market

- In August 2023, Pacific Biosciences of California, Inc., and GeneDx initiated a research collaboration with the University of Washington. This partnership focuses on studying the effectiveness of long-read whole genome sequencing in improving diagnostic accuracy in neonatal care.

- In February 2023, Ultima Genomics, Inc. announced a partnership with New England Biolabs to integrate NEB's NEBNext reagents and library preparation kits into Ultima's sequencing platforms. This collaboration would develop and optimize next-generation sequencing (NGS) processes for DNA, RNA, and methylation sequencing applications.

- In April 2022, Pacific Biosciences of California, Inc. announced the introduction of the new Revio long-read sequencing system. This system would significantly enhance the use of PacBio's acclaimed HiFi sequencing technology among its users, allowing for more extensive application.

- In September 2021, Zymo Research Corporation announced that its EZ DNA methylation-lightning kit had been approved for use in the European Union (EU) with the CE IVD Mark. This approval would allow the distribution of the kit within the EU market. The kit's technology, which involves the chemical treatment of DNA with bisulfite, could prove to be essential for various methylation-based diagnostic assays.

Demand - Drivers, Restraints, and Opportunities

Market Demand Drivers:

Increasing Adoption of DNA Methylation Detection Technology as Epigenetic Biomarkers: The growing use of DNA methylation detection technology as epigenetic markers significantly drives the global market for DNA methylation detection technology. Its importance stems from its capabilities in the early detection of diseases, tailoring medical treatments to individual needs, and deepening one’s understanding of how diseases develop. As research progresses and technology advances, DNA methylation is anticipated to play an increasingly vital role in healthcare, boosting the market's growth and expansion.Market Restraints:

Complexity in Data Interpretation of DNA Methylation Data: The complexity of data interpretation in DNA methylation detection underscores the need for multidisciplinary collaboration involving molecular biologists, bioinformaticians, clinicians, and data scientists. It also highlights the importance of continuous research and development in the field to refine data analysis methodologies and enhance one’s understanding of the epigenetic mechanisms underlying various diseases.Market Opportunities:

Expansion of DNA Methylation Detection in Emerging Geographies: The expansion of DNA methylation detection technology in emerging geographies is expected to signify its global relevance and potential impact. In these regions, where healthcare infrastructure and resources may be more limited, DNA methylation detection could offer an efficient means of early disease diagnosis.How can this report add value to an organization?

Workflow/Innovation Strategy: The global DNA methylation detection technology market (by product) has been segmented into detailed segments, including different types of consumables, such as kits and assays, reagents, and enzymes, as well as instruments and software.Growth/Marketing Strategy: A strategic growth and marketing approach for the DNA methylation detection technology market would involve positioning the company as a leader in innovative solutions that address the evolving needs of researchers, clinicians, and pharmaceutical partners. This would entail leveraging technological advancements to develop cutting-edge products with enhanced sensitivity, specificity, and scalability while also investing in comprehensive customer support, training programs, and collaborative partnerships to foster customer loyalty and drive market penetration. Furthermore, targeted marketing campaigns highlighting the clinical relevance, cost-effectiveness, and competitive advantages of the company's offerings would help to increase brand visibility, attract new customers, and expand market share in this rapidly growing and dynamic industry.

Competitive Strategy: Key players in the global DNA methylation detection technology market have been focusing on innovation, differentiation, and strategic collaborations to gain a competitive edge. By investing in research and development, companies can develop novel detection methods, improve assay sensitivity, and expand application areas. Differentiation through the development of proprietary technologies, customizable solutions, and value-added services can help companies stand out in a crowded market, strengthen market positions, acquire new technologies, and broaden product portfolios.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

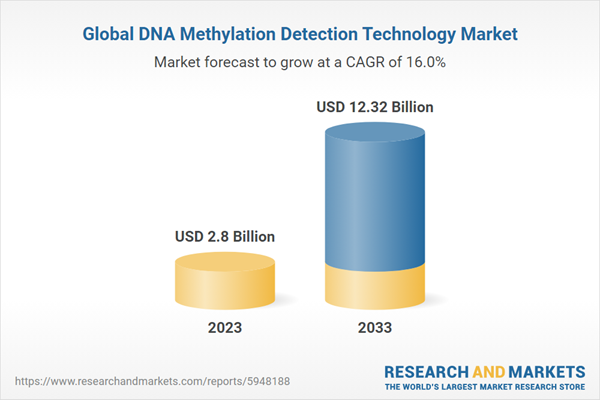

- The base year considered for the calculation of the market size is 2022. The historical year analysis has been done from FY2020 to FY2021, and the market size has been calculated for FY2022 and projected for the period 2023-2033.

- The geographical distribution of the market revenue has been estimated to be the same as the company’s net revenue distribution. All the numbers have been adjusted to two digits after decimals for report presentation reasons. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. CAGR has been calculated from 2023 to 2033.

- The market has been mapped based on different types of products available in the market and based on several indications. All the key manufacturing companies that have a significant number of offerings to the global DNA methylation detection technology market have been considered and profiled in the report.

- In the study, the primary respondent’s verification has been considered to finalize the estimated market for the global DNA methylation detection technology market.

- The latest annual reports of each market player have been taken into consideration for market revenue calculation.

- Market strategies and developments of key players have been considered for the calculation of sub-segment split.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year. The currency conversion rate has been taken from the historical exchange rate of the Oanda website or from the annual reports of the respective company, if stated.

Primary Research

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report’s segmentation and key qualitative findings

- Understanding of the numbers of the various markets for market type

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- National Center for Biotechnology Information (NCBI), PubMed, Science Direct, World Bank Group, and World Health Organization (WHO)

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolio

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentations, split-ups, and percentage shares

- Data for market value

- Key industry trends of the top players in the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

In the DNA methylation detection technology market, several key players dominate the landscape with their diverse range of products and solutions. Thermo Fisher Scientific, Illumina, Inc. QIAGEN, Zymo Research Corporation, and Agilent Technologies, Inc. are among the prominent market players offering innovative tools and platforms for DNA methylation analysis. These companies provide bisulfite conversion kits, methylation-specific PCR assays, microarray platforms, next-generation sequencing solutions, and bioinformatics software to researchers and clinicians worldwide.Competition in this market is fierce, driven by continuous technological innovation, expansion of product portfolios, effective marketing strategies, and a focus on regulatory compliance. Additionally, market players vie for market share by establishing strong customer support networks and ensuring high-quality service delivery. As the demand for DNA methylation detection technologies grows, competition intensifies, with companies striving to meet the evolving needs of the research and clinical communities while maintaining a competitive edge in the market.

Some of the prominent companies in this market are:

- Agilent Technologies, Inc.

- Abcam plc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Pacific Biosciences of California, Inc.

- Exact Sciences Corporation

- Merck KGaA

- Enzo Life Sciences, Inc.

- Takara Bio Inc.

- Revvity, Inc. (PerkinElmer, Inc.)

- New England Biolabs

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Agilent Technologies, Inc.

- Abcam plc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Pacific Biosciences of California, Inc.

- Exact Sciences Corporation

- Merck KGaA

- Enzo Life Sciences, Inc.

- Takara Bio Inc.

- Revvity, Inc. (PerkinElmer, Inc.)

- New England Biolabs

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | February 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 12.32 Billion |

| Compound Annual Growth Rate | 15.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |