Market Introduction

The tactical Unmanned Aerial Vehicle (UAV) market is experiencing a transformative surge, presenting a paradigm shift in military and security solutions globally. Their deployment in military and law enforcement applications is marked by stealth, endurance, and precision, making them invaluable assets. Equipped with advanced sensors, cameras, and payload delivery systems, tactical unmanned aerial vehicles (UAVs) are at the forefront of modern technology, enhancing operational efficiency and situational awareness. As global tensions rise, the demand for these unmanned aerial vehicles (UAVs) is escalating, with military forces and law enforcement agencies seeking reliable and agile solutions. The market is witnessing a shift towards compact, yet powerful, drones that offer versatility and real-time data collection capabilities. With ongoing advancements in autonomy and artificial intelligence, the tactical unmanned aerial vehicle (UAV) market is poised for sustained growth, providing essential tools to address emerging security challenges on a global scale.Industrial Impact

The tactical UAV market has had a substantial impact on various industries, driving innovation, creating economic opportunities, and enhancing operational capabilities. Firstly, in the defense sector, the integration of advanced unmanned aerial systems has revolutionized military operations. Tactical unmanned aerial vehicles (UAVs) provide real-time intelligence, surveillance, and reconnaissance capabilities, improving situational awareness and response times. This has led to increased demand from defense organizations globally, stimulating growth in the defense industry.Secondly, the aerospace and technology sectors have experienced a surge in research and development activities related to unmanned aerial vehicle (UAV) technology. Companies specializing in unmanned aerial vehicle (UAV) manufacturing, avionics, and software solutions have emerged, contributing to job creation and economic growth. The pursuit of cutting-edge technologies, such as artificial intelligence and autonomous flight systems, has driven innovation in these industries, positioning them at the forefront of technological advancements.

Moreover, the tactical unmanned aerial vehicle (UAV) market has influenced the security and law enforcement sectors. Law enforcement agencies utilize unmanned aerial vehicles (UAVs) for surveillance, search and rescue operations, and monitoring public events. This has enhanced the efficiency of law enforcement efforts, providing cost-effective solutions for tasks that were traditionally resource-intensive. The integration of unmanned aerial vehicles (UAVs) in security operations has become a strategic imperative for safeguarding critical assets and ensuring public safety.

Market Segmentation:

Segmentation 1: by UAV Type

- Fixed Wing

- Rotary Wing

Fixed Wing Segment to Dominate the Global Tactical UAV Market (by UAV Type)

The global tactical unmanned aerial vehicle (UAV) market based on UAV type is led by fixed wing unmanned aerial vehicle (UAV). The section provided a detailed view of tactical unmanned aerial vehicles (UAVs) categorized into fixed wing and rotary wing unmanned aerial vehicles (UAVs) along with the key developments happening in this segment.Segmentation 2: by System

- Communication

- Surveillance

- Propulsion

- Others

Surveillance Segment to Dominate the Global Tactical UAV Market (by System)

The global tactical UAV market based on system is led by surveillance system. This section offers an in-depth look at unmanned aerial vehicles (UAVs) categorized by the systems they utilize, highlighting significant advancements in this regional market.Segmentation 3: by Application

- ISR

- Target Acquisition

- Combat Operations

- Electronic Warfare

- Others

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

North America Segment to Dominate the Global Tactical UAV Market (by Region)

The global tactical unmanned aerial vehicle (UAV) market based on region is led by North America The region's robust technological infrastructure and a thriving defense industry contribute to the development and deployment of cutting-edge unmanned aerial vehicle (UAV) technologies. Additionally, the rising need for surveillance and reconnaissance capabilities in various security applications further propels the demand for tactical unmanned aerial vehicles (UAVs) in North America.Recent Developments in the Global Tactical UAV Market

- In May 2022, Marlborough Communications Limited (MCL) and its technology partner, Skydio, were awarded a contract valued at $3.2 million from the UK Ministry Of Defence (MOD) as part of the Future Capabilities Group (FCG) nano unmanned aerial systems (nUAS) framework. Spiral 4 of the framework would inform future drone concepts and requirements, with the contract positioning MCL as a key UAS provider in the UK.

- In Sept 2023, BAE Systems signed a collaboration with QinetiQ to develop a family of UAS, and associated mission management systems, to support interoperability with existing and future crewed and uncrewed systems; generating operational effects and providing a concentration of combat air power.

- In November 2023, AeroVironment, Inc. announced the successful performance of the company's JUMP 20 VTOL Medium UAS in the recent U.S. Naval Forces Southern Command/4th Fleet Hybrid Fleet Campaign Event (HFCE), which demonstrated human-machine teaming in the maritime domain. Throughout the week-long, at-sea exercise onboard USNS Burlington, the JUMP 20 delivered ship-based intelligence, surveillance, reconnaissance, and targeting (ISR-T) support to USFOURTHFLT and USSOUTHCOM. Notably, during HFCE, the JUMP 20 demonstrated its capability to launch and recover at vessel speeds exceeding 20 knots, operating with fully autonomous flight from takeoff to landing.

- In Aug 2023, Red Cat Holdings, Inc. , announced that subsidiary Teal Drones received a second $2.6 million Contract to supply Teal 2 systems (sUAS) to the U.S. Defense Logistics Agency (DLA). Teal would deliver an additional 172 units of the Teal 2 drone plus spare parts and training. The initial order from DLA for 172 units, also totalled to $2.6 million. Combined, the total amount for the two orders is $5.2 million.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of services available for deployment and their potential globally. Moreover, the study provides the reader with a detailed understanding of the global tactical UAV market by products based on UAV type and systems.Growth/Marketing Strategy: The global tactical UAV market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been contracts and product launches to strengthen their position in the global tactical unmanned aerial vehicle (UAV) market. For instance, in Apr 2023, Insitu, a subsidiary of Boeing, launched its Integrator Vertical Take-off and Landing (VTOL) uncrewed aircraft system (UAS) at the Navy League’s Sea-Air-Space Exhibition in National Harbor, Maryland. The Integrator VTOL was capable of launching vertically on ships or land without compromising payload capacity or endurance. The system maintained the performance of fixed-wing aircraft, delivering the same long-range wide-area surveillance capability for extended periods.

Competitive Strategy: Key players in the tactical UAV market analyzed and profiled in the study involve tactical unmanned aerial vehicle (UAV) products offering companies. Moreover, a detailed competitive benchmarking of the players operating in the global tactical UAV market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Methodology:

The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, have been employed to build the predictive and forecast models.Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Exact revenue information, up to a certain extent, has been extracted for each company from secondary sources and databases. Revenues specific to product/service/technology were then estimated based on fact-based proxy indicators as well as primary inputs.

- Based on the classification, the average selling price (ASP) has been calculated using the weighted average method.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and/or other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The term “product” in this document may refer to “service” or “technology” as and where relevant.

- The term “manufacturers/suppliers” may refer to “service providers” or “technology providers” as and where relevant.

Primary Research

The primary sources involve industry experts from the global tactical UAV industry, including tactical unmanned aerial vehicle (UAV) product providers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Businessweek and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites.Secondary research was done to obtain critical information about the industry’s value chain, the market’s monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The tactical UAV market comprises key players that have established themselves thoroughly and have the proper understanding of the market accompanied by start-ups who are looking forward to establishing themselves in this highly competitive market.For instance, in February 2023, Rheinmetall signed a collaboration with AeroVironment to participate in a NATO special forces project. Rheinmetall Technical Publications GmbH (a subsidiary of Rheinland AG) and AeroVironment applied to join a procurement program for a small unmanned aerial system (UAS) designed for special operations and infantry applications. Apart from that, in September 2023, Skydio launched Skydio X10, a drone designed for first responders, infrastructure operators, and the U.S. and allied militaries around the world. It includes sensors to capture every detail of the data that matters and the AI-powered autonomy to put those sensors wherever they are needed.

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- Raytheon

- Boeing

- Lockheed Martin Corporation/li>

- AIRBUS

- Northrop Grumman

- Thales

- Leonardo S.p.A.

- Textron, Inc.

- Adani Group

- Elbit Systems Ltd./li>

- Saab AB

- Kratos Defense & Security Solutions, Inc.

- AeroVironment, Inc.

- Parrot Drone SAS

- BlueBird

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Raytheon

- Boeing

- Lockheed Martin Corporation

- AIRBUS

- Northrop Grumman

- Thales

- Leonardo S.p.A.

- Textron, Inc.

- Adani Group

- Elbit Systems Ltd.

- Saab AB

- Kratos Defense & Security Solutions, Inc.

- AeroVironment, Inc.

- Parrot Drone SAS

- BlueBird

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | March 2024 |

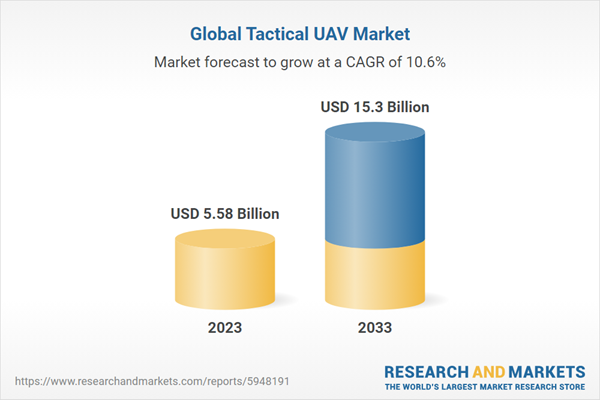

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 5.58 Billion |

| Forecasted Market Value ( USD | $ 15.3 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |