Market Lifecycle Stage

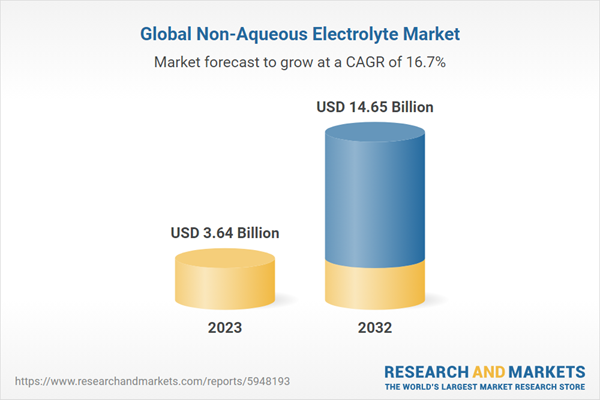

The non-aqueous electrolyte market is in the growth phase. The market is propelled by the growing adoption of electric vehicles worldwide and is expected to boost the market. Furthermore, growing investments in energy storage solutions, rising urbanization, and consumer spending across the globe contribute to the overall growth of the non-aqueous electrolyte market. Moreover, the non-aqueous electrolyte market is expected to benefit from the expansion of manufacturing facilities in emerging markets, which represents a strategic move that holds immense potential for advanced economies in the non-aqueous electrolyte market.Industrial Impact

Non-aqueous electrolytes offer numerous advantages. Non-aqueous electrolytes significantly enhance lithium-ion batteries, especially in high-energy-density applications such as electric vehicles. Solvents such as ethylene carbonate widen the voltage window, boosting energy density and meeting demands for extended range and rapid charging. Furthermore, these electrolytes offer a broader tolerance of temperature ranges, ensuring optimal battery function across various climates. Their stability under extreme conditions aligns with automotive safety standards, contributing to safer and more reliable automotive operations. Furthermore, low self-discharge rates attributed to non-aqueous electrolytes contribute to prolonged device lifespan, meeting consumer expectations for durable and long-lasting electronics. Their continual advancements drive innovation, shaping the future of consumer tech. Their adaptability spans industries, fostering innovation in materials and technology, contributing to advancements in healthcare devices, construction materials, and aerospace and defense systems, showcasing their versatile applications.Market Segmentation:

Segmentation 1: by Application

- Lithium-ion Battery

- Sodium-ion Battery

- Solid-State Battery

- Others

Segmentation 2: by End-Use Industry

- Automotive

- Consumer Electronics

- Energy Storage

- Others

Segmentation 3: by Type

- Organic

- Inorganic

Segmentation 4: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, U.K., and Rest-of-Europe

- Asia-Pacific - China, India, Japan, South Korea, and Rest-of-Asia-Pacific

- Rest-of-the-World - Middle East and Africa and South America

Recent Developments in the Global Non-Aqueous Electrolyte Market

- On May 17, 2023, GS Yuasa Corporation (Tokyo Stock Exchange: 6674) announced that consolidated subsidiary GS Yuasa International Ltd. (“GS Yuasa”) developed a technology that achieves both higher energy density and longer service life through a series of improvements in silicon-based negative electrode batteries, which face many practical challenges.

- On February 15, 2021, Ampcera Inc., a pioneer in solid-state electrolyte manufacturing and next-generation solid-state battery development, announced that its all-solid-state battery (ASSB) technology had achieved a fast-charging milestone of 0% to 80% state of charge (SOC) in under 15 minutes at a peak C-rate of 4C. This advancement demonstrates the fast-charging potential of ASSB, a key requirement for the widespread adoption of electric vehicles (EVs).

- On April 10, 2017, Mitsui Chemicals, Inc. announced the startup of its electrolyte solution production facilities, which have been built at Nagoya Works to accommodate growing domestic demand for lithium-ion battery-use electrolyte solutions.

- On January 23, 2023, Ampcera announced that it got selected to receive $2.1 million in funding from the U.S. Department of Energy Advanced Research Projects Agency-Energy (ARPA-E). The funding is part of the ARPA-E Electric Vehicles for American Low-Carbon Living program, which seeks to develop more affordable, convenient, efficient, and resilient electric vehicle (EV) batteries.

Demand - Drivers and Challenges

The following are the demand drivers for the global non-aqueous electrolyte market:

- Increasing Adoption of Electric Vehicles Worldwide

- Growing Investments in Energy Storage Solutions

- Rising Urbanization and Consumer Spending across the World

The market is expected to face some limitations as well due to the following challenges:

- High Cost of Non-aqueous Electrolyte Materials

- Regulatory and Safety Concerns

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different non-aqueous electrolytes for various applications such as lithium-ion battery, sodium-ion battery, solid-state battery, and others. Moreover, the study provides the reader with a detailed understanding of the non-aqueous electrolyte market based on the end-use industries, including automotive, consumer electronics, energy storage, and others.Growth/Marketing Strategy: The non-aqueous electrolyte market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, and joint ventures. The favored strategy for the companies has been product developments, business expansions, and acquisitions to strengthen their position in the non-aqueous electrolyte market. For instance, Samsung Electronics Co., Ltd., NVIDIA Corporation, Intel Corporation, IBM, and Micron Technology Inc. are a few companies that have been highly active in undertaking strategic decisions.

Competitive Strategy: Key players in the market analyzed and profiled in the study involve non-aqueous electrolyte manufacturers and the overall ecosystem. Moreover, a detailed competitive benchmarking of the players operating in the non-aqueous electrolyte market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on input gathered from primary experts, analyzing company coverage, product portfolio, and market penetration.The non-aqueous electrolyte market has been segmented based on type, among which inorganic accounted for around 61.6% and organic held for approximately 38.4% of the total non-aqueous electrolyte revenue in the year 2022.

Some of the prominent established names in this market are:

- Ampcera

- Electrovaya

- GS Yuasa International Ltd.

- LG Chem

- POSCO

- Mitsubishi Gas Chemical Company, Inc.

- Solid Power

- CAPCHEM

- Mitsui Chemicals, Inc.

- UBE Corporation

- Contemporary Amperex Technology Co., Limited

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Ampcera

- Electrovaya

- GS Yuasa International Ltd.

- LG Chem

- POSCO

- American Elements

- NEI Corporation

- Targray

- Mitsubishi Gas Chemical Company, Inc.

- Solid Power

- CAPCHEM

- Mitsui Chemicals, Inc.

- UBE Corporation

- Contemporary Amperex Technology Co., Limited

- Amprius Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 111 |

| Published | March 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 3.64 Billion |

| Forecasted Market Value ( USD | $ 14.65 Billion |

| Compound Annual Growth Rate | 16.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |