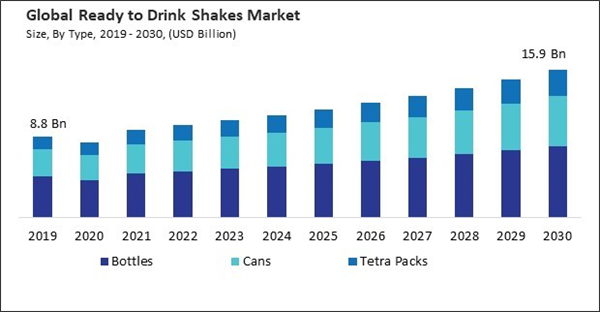

The compact and portable nature of RTD shakes makes them easily accessible in various settings. Whether stored in a gym bag, desk drawer, or refrigerator, these beverages are designed to be carried and consumed at any time, fitting seamlessly into the lifestyles of busy individuals. Consequently, the bottles segment would generate a 50 % share of the market by 2030. Also, Russia would utilize 55.57 million units (200 ML - PACK OF 6) of bottles by 2030.For those who prioritize efficiency, the simplicity of opening a bottle and consuming a complete, balanced drink is a compelling factor. Thus, these aspects will boost the demand in the segment.

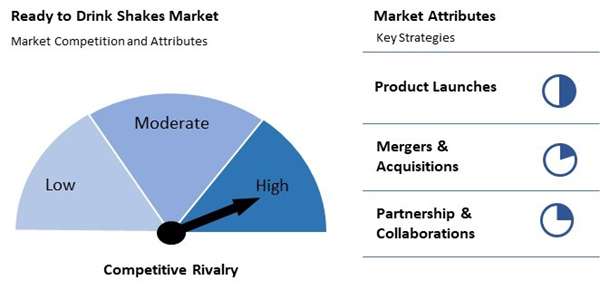

The major strategies followed by the market participants are product launch as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January 2024, Abbott Laboratories has introduced a new brand named PROTALITY, featuring a high-protein nutrition shake designed to cater to individuals seeking weight loss while prioritizing muscle maintenance and nutritional balance. In June 2023, PepsiCo, Inc. introduced an enhanced version of Pepsi Zero Sugar. The updated recipe of Pepsi Zero Sugar incorporates a new sweetener system, resulting in a more invigorating and intensified flavor profile compared to the previous iteration of Pepsi Zero Sugar.

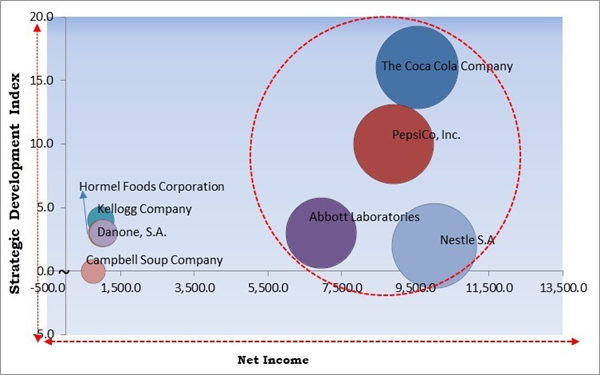

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; The Coca Cola Company, PepsiCo, Inc., Nestle S.A and Abbott Laboratories are the forerunners in the Ready to Drink Shakes Market. In November, 2023, Honest Tea, Inc., a subsidiary of The Coca-Cola Company, introduced a fresh ready-to-drink beverage category under the name Honest Tea. This new line features iced green tea available in lemon-Tulsi and mango varieties. The primary objective of this launch is to offer consumers a broader selection of beverage choices. And Companies such as Danone, S.A., Hormel Foods Corporation, and Kellogg Company are some of the key innovators in Market.Market Growth Factors

Consumers are increasingly looking for products that go beyond basic nutrition and provide a well-rounded profile of essential nutrients. RTD shakes have responded by formulating beverages that include proteins, fibers, vitamins, and minerals, offering a convenient way for individuals to meet their nutritional needs. Hence, these aspects will lead to increased demand for market.RTD shakes designed for older consumers often feature nutrient-dense formulations. These beverages are enriched with essential vitamins and minerals to meet the changing nutritional requirements associated with aging. Thus, these aspects can help in the growth of the market.

Market Restraining Factors

The processing involved in achieving shelf stability often includes additives and preservatives. Some consumers express concerns about the presence of these ingredients in their food and beverages, associating them with potential health risks. Thus, these aspects can restrain the growth of the market.By Distribution Channel Analysis

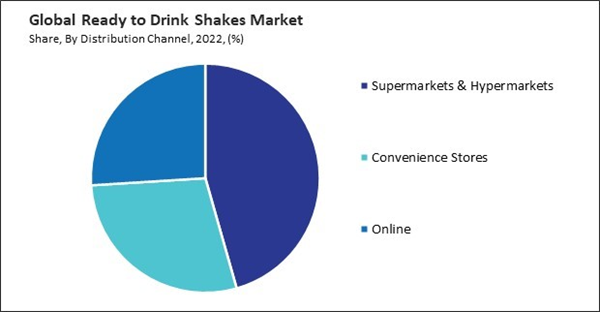

On the basis of distribution channel, the market is divided into supermarkets & hypermarkets, convenience stores, and online. The supermarkets and hypermarkets segment recorded the 45.58 % revenue share in the market in 2022. The shelf space available in supermarkets and hypermarkets allows for a diverse selection of RTD shakes from various brands. Consumers can choose from different flavors, formulations, and brands, providing ample options to cater to their tastes and preferences. Supermarkets and hypermarkets often use strategic promotional displays and merchandising techniques to highlight RTD shakes. Therefore, these aspects will lead to enhanced growth in the segment.By Type Analysis

Based on type, the market is segmented into bottles, cans, and tetra packs. In 2022, the cans segment garnered a 33.2 % revenue share in the market. In terms of volume, cans segment would register 471.9 million units (200 ml - pack of 6) in 2022. Canned RTD shakes offer convenience and portability, making them an attractive option for busy-conscious consumers. The sealed and airtight nature of cans helps preserve the freshness and quality of the beverage for a longer duration, reducing the risk of spoilage and waste. Hence, these factors will assist in the growth of the segment.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired a 29.88 % revenue share in the market. Europe has been witnessing a growing emphasis on health and wellness, with consumers seeking convenient yet nutritious options. RTD shakes, positioned as on-the-go health solutions, are likely to benefit from this trend. The busy lifestyles of European consumers, especially in urban areas, contribute to the demand for convenient food and beverage options. RTD shakes align with the need for quick and accessible nutrition. Hence, these aspects will lead to increased demand in the segment.Market Competition and Attributes

The ready-to-drink (RTD) shakes market is characterized by intense competition among established brands like Ensure, Premier Protein, Muscle Milk, and Orgain, as well as newer entrants vying for market share by offering innovative formulations, flavors, and packaging to cater to the growing demand for convenient and nutritious beverages driven by health-conscious consumers with busy lifestyles. Key players in the market are Nestle S.A, The Coca Cola Company and PepsiCo, Inc. and compete on factors such as taste, nutritional content, brand reputation, distribution channels, and marketing strategies, while also focusing on specific consumer segments such as athletes, fitness enthusiasts, or those seeking meal replacement options. Product innovation and differentiation, along with strategic partnerships with retailers and gyms, are crucial for companies to stand out in this crowded and dynamic market.

Recent Strategies Deployed in the Market

- Jan-2024: Abbott Laboratories has introduced a new brand named PROTALITY, featuring a high-protein nutrition shake designed to cater to individuals seeking weight loss while prioritizing muscle maintenance and nutritional balance. This shake, the flagship product of the PROTALITY line, addresses the needs of adults aiming for weight management with its carefully selected key nutrients. Each PROTALITY shake contains 30 grams of premium protein to aid in muscle preservation, 8 essential B vitamins crucial for protein and energy metabolism, 4 grams of comforting fiber for digestive well-being, just 1 gram of sugar, along with 150 calories, and a blend of 25 essential vitamins and minerals.

- Nov-2023: Honest Tea, Inc., a subsidiary of The Coca-Cola Company, has introduced a fresh ready-to-drink beverage category under the name Honest Tea. This new line features iced green tea available in lemon-tulsi and mango varieties. The primary objective of this launch is to offer consumers a broader selection of beverage choices.

- Sep-2023: Kellogg Company has partnered with Nestlé S.A, a renowned Swiss multinational food and beverage corporation. Through this partnership, Kellogg intends to introduce two breakfast-inspired beverages under the Frosted Flakes and Eggo brands. The "Nestlé Sensations Frosted Flakes" cereal-flavored milk offers the flavor of frosted cornflakes, coupled with a lusciously creamy dairy finish. Meanwhile, the "Nestlé Sensations Eggo" maple waffle-flavored milk is infused with hints of toasty waffles, butter, and maple syrup.

- Jun-2023: PepsiCo, Inc. has introduced an enhanced version of Pepsi Zero Sugar. The updated recipe of Pepsi Zero Sugar incorporates a new sweetener system, resulting in a more invigorating and intensified flavor profile compared to the previous iteration of Pepsi Zero Sugar.

- Jan-2022: Coca-Cola HBC AG, a division of The Coca-Cola Company, has completed the acquisition of Coca-Cola Bottling Company of Egypt S.A.E. This strategic move provides Coca-Cola HBC with entry into the second-largest non-alcoholic ready-to-drink ("NARTD") market in Africa in terms of volume. By expanding its presence in Africa, Coca-Cola HBC aims to further leverage its existing scale in the region and enhance its exposure to high-growth markets.

List of Key Companies Profiled

- Abbott Laboratories

- Kellogg Company

- The Coca Cola Company

- PepsiCo, Inc.

- Nestle S.A.

- Hormel Foods Corporation (MegaMex Foods, LLC)

- Danone S.A.

- Campbell Soup Company

- KeHE Distributors, LLC

- Huel GmbH

Market Report Segmentation

By Type (Volume, Million Units (200ml-pack of 6), USD Billion, 2019-2030)- Bottles

- Cans

- Tetra Packs

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Kellogg Company

- The Coca Cola Company

- PepsiCo, Inc.

- Nestle S.A.

- Hormel Foods Corporation (MegaMex Foods, LLC)

- Danone S.A.

- Campbell Soup Company

- KeHE Distributors, LLC

- Huel GmbH