The growth of the packaging industry is a crucial factor in the higher demand for it. Thus, the packaging segment captured 7.6% revenue share in 2022. For instance, as per the National Investment Promotion & Facilitation Agency, the Indian packaging industry is expected to reach $ 204.81 Bn by 2025, with a rate of 26.7% from 2020-2025. Therefore, the segment will grow rapidly in the coming years.

Polyurethane foams are widely used in producing mattresses, sofas, chairs, and other upholstered furniture due to their exceptional comfort and durability. Polyurethane foam offers superior cushioning properties, providing support and resilience for extended periods and enhancing furniture products’ overall comfort and longevity.

Additionally, according to the European Commission, the Italian government is considering extending the measure until 2023. EU funding for energy-efficient housing investment and social housing promotion are EUR 18.5 billion and EUR 2.8 billion, respectively. Additionally, households have steadily grown since 2010, reaching 26.1 million in 2020 (+5.7%). Therefore, the expansion of the global construction industry is driving the market’s growth.

However, Polyurethane production relies heavily on petrochemical-based raw materials such as polyols and isocyanates. Fluctuations in crude oil prices, which serve as the primary feedstock for petrochemicals, directly impact the cost of raw materials for its manufacturers. Any disruptions in the global oil supply, geopolitical tensions, or changes in oil production quotas by major oil-producing nations can lead to rapid and unpredictable changes in raw material prices. Thus, volatility in raw material prices is hampering the market’s growth.

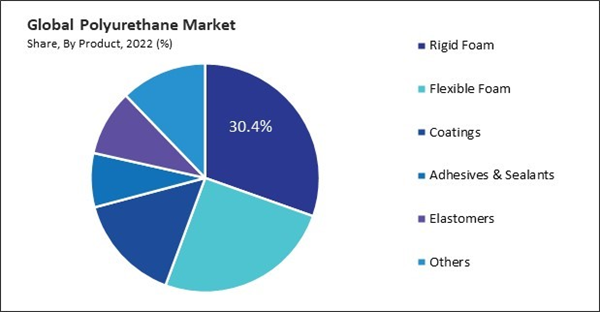

By Product Analysis

On the basis of the product, the market is segmented into rigid foam, flexible foam, coatings, adhesives & sealants, elastomers, and others. The rigid foam segment recorded 30.4% revenue share in the market in 2022. Rigid foam is highly valued for its excellent thermal insulation properties. It is extensively used in construction to insulate roofs, walls, floors, and refrigeration systems.By Raw Material Analysis

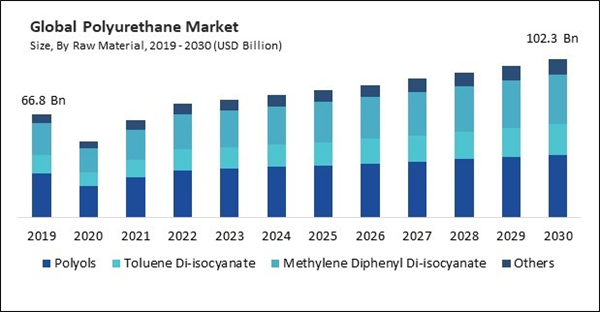

Based on raw material, the market is divided into toluene di-isocyanate, methylene diphenyl di-isocyanate, polyols, and others. In 2022, the polyols segment garnered 41.6% revenue share in the market. Polyols serve as one of the main building blocks in its production. They can be derived from various sources, including petrochemicals and renewable feedstocks like soybeans or corn.By Application Analysis

Based on application, the market is categorized into furniture & interiors, construction, electronics & appliances, automotive, footwear, packaging, and others. The furniture and interiors segment procured 21.3% revenue share in the market in 2022. In terms of volume furniture and interiors segment would register 6,652.5 kilo tonnes in 2022. Polyurethane foam is lightweight compared to traditional furniture materials such as wood or metal.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe region generated 16.2% revenue share in the market. Europe has stringent energy efficiency regulations and building codes to reduce carbon emissions and promote sustainable construction practices.Market Competition and Attributes

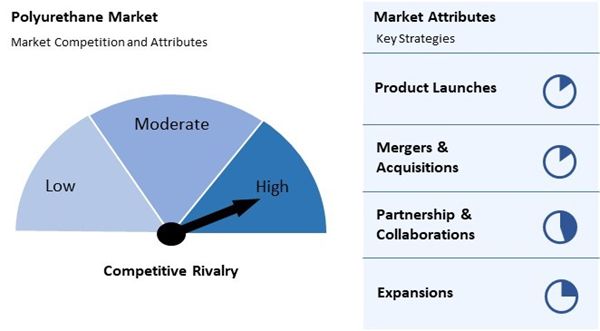

The polyurethane market is marked by fierce competition and dynamic attributes, driven by its versatile applications in construction, automotive, furniture, electronics, and packaging. Key players continually innovate to meet evolving demands and regulatory standards, emphasizing lightweight, durability, and insulation properties. Sustainability is a growing focus, with bio-based polyurethane gaining prominence. Economic conditions, technological advancements, and regulatory changes impact market trends. The material's popularity is closely tied to industries like construction and automotive.

Recent Strategies Deployed in the Market

- Jan-2024: BASF SE came into partnership with Xuchuan Chemical, a chemical manufacturing company. Through this partnership, BASF SE would enhance its portfolio and market presence in China.

- Dec-2023: BASF SE establishes production capacity for essential specialty amines in the Americas. This expansion would enhance its production capabilities for essential polyether amines and amine catalysts, which are marketed under the Baxxodur® and LupragenTM brands.

- Nov-2023: Covestro AG introduced five state-of-the-art, environmentally friendly polyurethane coating solutions "The Desmodur® N 31500 hardener, Desmodur® ultra-E 30800, NeoCryl® XK 824, NeoCryl® A 2085, Decovery® CQ 6010". These solutions are designed to meet the needs of various industries, spanning transportation, construction, printing and packaging, and industrial coatings.

- Mar-2023: BASF SE established a polymer dispersions production plant in the Daya Bay Petrochemical Industrial Park in Guangdong, China. The news plant would aid the architectural coatings, construction, and battery binder sectors.

- Aug-2023: Covestro AG established a new production facility for polyurethane dispersions (PUDs) in Shanghai, China. The plant would manufacture waterborne polyurethane dispersions (PUDs) that exhibit performance properties comparable to solvent-based varieties.

- May-2023: Mitsui Chemicals, Inc. came into partnership with Sanyo Chemical Industries, Ltd., a chemical manufacturing company. Through this partnership, Mitsui Chemicals, Inc. would bolster the production and supply of polypropylene glycols (PPGs) in Japan.

List of Key Companies Profiled

- ArcelorMittal S.A.

- thyssenkrupp AG

- BASF SE

- Covestro AG

- The Dow Chemical Company

- Huntsman Corporation

- Lanxess AG

- Mitsui Chemicals, Inc.

- Tosoh Corporation

- Eastman Chemical Company

Market Report Segmentation

By Raw Material (Volume, Kilo Tonnes, USD Billion,2019-2030)- Polyols

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Others

- Construction

- Furniture & Interiors

- Electronics & Appliances

- Footwear

- Automotive

- Packaging

- Others

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- ArcelorMittal S.A.

- thyssenkrupp AG

- BASF SE

- Covestro AG

- The Dow Chemical Company

- Huntsman Corporation

- Lanxess AG

- Mitsui Chemicals, Inc.

- Tosoh Corporation

- Eastman Chemical Company