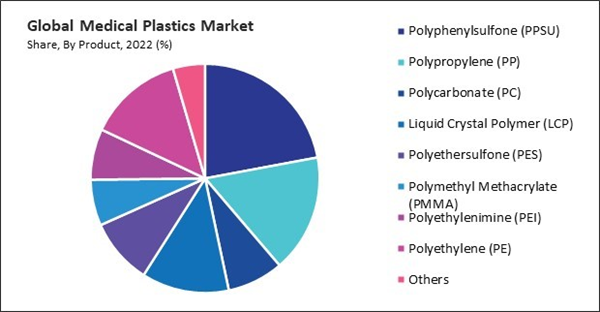

PE is relatively inexpensive compared to other medical plastics, making it a cost-effective choice for disposable devices and packaging. Thus, the polyethylene (PE) segment generated 13.5% revenue share in 2022. It is also durable and suitable for long-term use in medical devices such as implants and orthopedic braces. PE is lightweight, which can be advantageous for this that need to be portable or worn by patients, such as prosthetics or orthopedic braces. Therefore, the segment will grow in the coming years owing to the increasing use of PE.

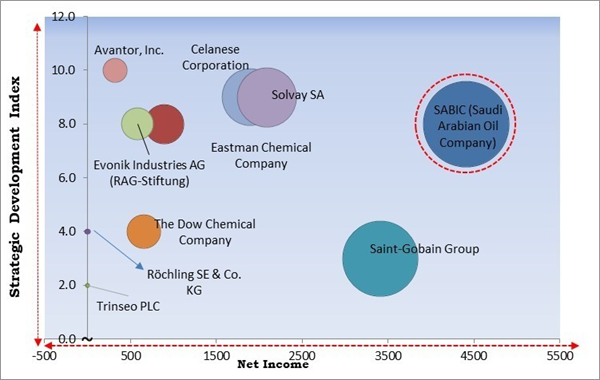

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, July, 2023, SABIC joined hands with Saudi Aramco, a state-owned petroleum and natural gas company, and TotalEnergies SE, a French multinational integrated energy and petroleum company. Under this collaboration, the companies converted the oil produced from plastic waste into circular polymers. Additionally, the collaboration assisted in strengthening the value chain for the conversion of recycled plastics into circular polymers in Saudi Arabia. Additionally, in 2023, May, The Dow Chemical Company teamed up with New Energy Blue LLC, a bio-conversion company. Under this collaboration, the companies manufactured bio-based ethylene utilizing renewable agricultural residues. Additionally, this collaboration helped the companies satisfy the demand of customers for bio-based plastics and strengthen the landscape for renewable solutions.

Cardinal Matrix - Market Competition Analysis

Companies such as Saint-Gobain Group, Celanese Corporation, Solvay SA are some of the key innovators in Market. In January, 2024, Celanese Corporation expanded its collaboration with Biesterfeld AG, a distributor for plastics and chemicals. Under this extended collaboration, the companies strengthened their joint product portfolio. Additionally, the collaboration assisted in the development of new markets.COVID-19 Impact Analysis

The pandemic increased demand for it and equipment, such as ventilators, diagnostic equipment, and protective gear, all of which require this. Additionally, it generated advancements in the sector, which resulted in the creation of novel technologies and products to tackle the obstacles presented by COVID-19. The pandemic underscored the criticality of healthcare systems being well-prepared and resilient. This factor is anticipated to propel the market's long-term expansion as healthcare facilities make investments in novel technologies and infrastructure. As a consequence, the market was generally unaffected by the pandemic.Market Growth Factors

Rising healthcare expenditures globally increase the demand for it and equipment. Increased healthcare expenditures are influenced by a number of factors, including population expansion, aging populations, the prevalence of chronic diseases on the rise, and technological advances in the medical field.Additionally, musculoskeletal disorders (129%), HIV/AIDS (128%), depressive disorders (61%), and low back pain (47%) are prevalent from adolescence to old age. For instance, the number of DALYs attributed to ischaemic heart disease increased by over 400% in the Philippines between 1990 and 2019, whereas the number of DALYs attributed to diabetes increased by over 1000% in the United Arab Emirates. Elevated rates of illness pose a significant challenge to healthcare systems that are inadequately prepared to manage the chronic ailments that accompany the aging and expansion of populations.

Market Restraining Factors

The market faces competition from alternative materials, such as metals, ceramics, and natural materials, also used in this and equipment. These materials may offer different properties or advantages, posing a challenge to the dominance of plastics in certain applications. Metals like stainless steel and titanium are valued for their strength and durability, making them suitable for implants and surgical instruments. Thus, all these factors may obstruct the expansion of the market.By Application Analysis

By application, the market is divided into it packaging, medical components, orthopedic implant packaging, orthopedic soft goods, wound care, cleanroom supplies, BioPharm devices, mobility aids, sterilization & infection prevention, tooth implants, denture base material, other implants, and others.By Product Analysis

Based on product, the market is characterized into polyethylene (PE), polypropylene (PP), polycarbonate (PC), liquid crystal polymer (LCP), polyphenylsulfone (PPSU), polyethersulfone (PES), polyethylenimine (PEI), polymethyl methacrylate (PMMA), and others. The polyphenylsulfone (PPSU) segment garnered 22.1% revenue share in the market in 2022. PPSU is highly resistant to chemicals, including harsh disinfectants, as well as cleaning agents, utilized in healthcare settings.By Process Technology Analysis

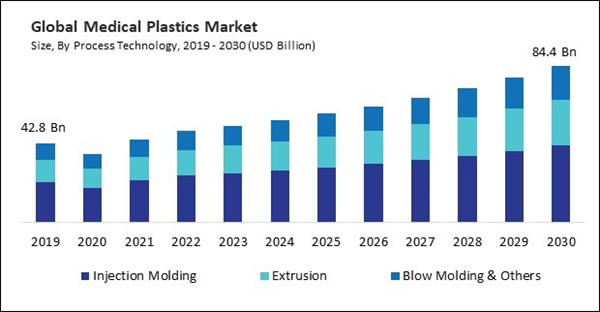

On the basis of process technology, the market is classified into extrusion, injection molding, blow molding, and others. The extrusion segment garnered 28.3% revenue share in the market in 2022. Extrusion is a highly adaptable manufacturing technique that finds application in the production of an extensive array of this and components - such as profiles, catheters, and tubing.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 29.9% revenue share in 2022. North America has one of the highest healthcare expenditures globally, driven by factors such as an aging population, technological advancements, and the prevalence of chronic diseases.Recent Strategies Deployed in the Market

- Jan-2024: Celanese Corporation expanded its collaboration with Biesterfeld AG, a distributor for plastics and chemicals. Under this extended collaboration, the companies strengthened their joint product portfolio. Additionally, the collaboration assisted in the development of new markets.

- Nov-2023: Eastman Chemical Company came into a partnership with Ostium Group SAS, a medical device startup. Under this partnership, the Eastar 6763 Renew copolyester from Eastman was combined with the CILLAR Acetabular and Femoral kits from Ostium Group. Additionally, the partnership assisted in the development of a circular economy and decreasing plastic waste.

- Sep-2023: Avantor, Inc. came into an agreement with Tobin Scientific, the leading provider of biopharma cold chain services. Under this agreement, the companies offered complex logistics solutions combined with specific temperature needs to the customers.

- Jul-2023: Evonik Industries AG completed the acquisition of NOVA Chemicals Corporation, a leading producer of plastics and chemicals. Through this acquisition, Evonik utilized the strong skin and hair care portfolio of NOVA Chemicals to enhance its Systems Solutions and Care Solutions businesses.

- Jul-2023: SABIC joined hands with Saudi Aramco, a state-owned petroleum and natural gas company, and TotalEnergies SE, a French multinational integrated energy and petroleum company. Under this collaboration, the companies converted the oil produced from plastic waste into circular polymers. Additionally, the collaboration assisted in strengthening the value chain for the conversion of recycled plastics into circular polymers in Saudi Arabia.

- Jul-2023: SABIC launched two products, SABIC PP compound H1090 resin and STAMAX 30YH611 resin. The new products are produced from 30 percent glass fibre-reinforced and flame-retardant (FR) materials. The new products have applications in electric vehicle (EV) battery pack components.

List of Key Companies Profiled

- Röchling SE & Co. KG

- Saint-Gobain Group

- SABIC (Saudi Arabian Oil Company)

- Eastman Chemical Company

- Celanese Corporation

- The Dow Chemical Company

- Solvay SA

- Avantor, Inc.

- Trinseo PLC

- Evonik Industries AG (RAG-Stiftung)

Market Report Segmentation

By Application (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Medical Components

- Medical Device Packaging

- Orthopedic Soft Goods

- Wound Care

- Cleanroom Supplies

- BioPharma Devices

- Mobility Aids

- Sterilization & Infection Prevention

- Tooth Implants

- Denture Base Material

- Others

- Injection Molding

- Extrusion

- Blow Molding & Others

- Polyphenylsulfone (PPSU)

- Polypropylene (PP)

- Polycarbonate (PC)

- Liquid Crystal Polymer (LCP)

- Polyethersulfone (PES)

- Polymethyl Methacrylate (PMMA)

- Polyethylenimine (PEI)

- Polyethylene (PE)

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Röchling SE & Co. KG

- Saint-Gobain Group

- SABIC (Saudi Arabian Oil Company)

- Eastman Chemical Company

- Celanese Corporation

- The Dow Chemical Company

- Solvay SA

- Avantor, Inc.

- Trinseo PLC

- Evonik Industries AG (RAG-Stiftung)