Using glass flake coatings in the chemical industry leads to long-term cost savings. The robust corrosion resistance and durability of these coatings reduce the need for frequent maintenance, repairs, and replacements, resulting in economic efficiency over the lifecycle of assets. Consequently, the chemical industry segment would acquire approximately 17.9% revenue share by 2030 of market. Also, Mexico would utilize 18.96 hundred tonnes of glass flake coatings in construction by 2030. Ongoing research and development efforts have led to innovations in glass flake coating formulations tailored specifically for the chemical industry.

Glass flake coatings provide a robust barrier against corrosion, helping extend the service life of infrastructure such as bridges, highways, pipelines, and industrial facilities. The coatings create a protective layer that shields surfaces from the corrosive effects of moisture, chemicals, and other environmental factors, reducing the need for premature replacements. Therefore, the market is expanding significantly due to corrosion protection in infrastructure development.

Additionally, Manufacturers operating on a global scale seek consistent quality and performance from their coating solutions. Glass flake coatings offer uniform protection against corrosion, providing manufacturers with the assurance that their assets are consistently safeguarded regardless of the geographical location of their facilities. Glass flake coatings often offer ease of application, making them suitable for various manufacturing processes and application methods. Thus, because of the increasing globalization of manufacturing, the market is anticipated to increase significantly.

However, Industries, especially those with stringent budget constraints, may hesitate to invest in glass flake coatings due to their higher upfront costs. Budget concerns frequently play an important part in decision-making. If the initial cost is perceived as prohibitive, it can lead to the selection of alternative, more budget-friendly coatings. Industries may exhibit heightened cost sensitivity during financial uncertainty or economic downturns. Thus, high initial costs can slow down the growth of the market.

By End User Analysis

Based on end-use, the market is classified into oil & gas, chemical, industrial, construction, marine, and others. In 2022, the marine segment witnessed the 32.8% revenue share in the market. In terms of volume, industrial segment would use 677.36 hundred tonnes in 2022. Glass flake coatings offer excellent weathering resistance, making them suitable for application in maritime environments. Whether on ships, docks, or offshore installations, these coatings withstand the challenges posed by UV radiation, temperature fluctuations, and atmospheric conditions. Floating structures, including floating docks, pontoons, and buoys, benefit from glass flake coatings. These coatings protect the surfaces of floating structures from corrosion, ensuring their stability and longevity in marine environments.By Material Analysis

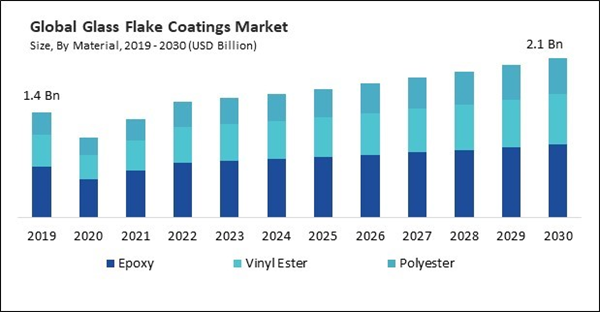

By material, the market is categorized into epoxy, vinyl ester, and polyester. The vinyl ester segment covered a 30.7% revenue share in the market in 2022. Vinyl-based formulations provide ease of application. Depending on the specific chemistry, these coatings can be applied using multiple methods, such as spraying or brushing, making them adaptable to different application scenarios. Vinyl-based coatings can often be easily customized by incorporating various additives, such as plasticizers or stabilizers. This flexibility allows tailoring the coatings to specific performance requirements or environmental conditions.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region acquired a 23.8% revenue share in the market. North America has extensive infrastructure exposed to diverse weather conditions, including bridges, pipelines, and industrial structures. A significant oil and gas sector in North America, particularly in regions like the Gulf of Mexico and Western Canada, can drive the demand for glass flake coatings. North America is home to a substantial number of chemical processing facilities. North America has extensive coastlines, and glass flake coatings find applications in the maritime industry to protect ships, offshore platforms, and other marine structures.List of Key Companies Profiled

- Akzo Nobel N.V.

- Hempel A/S

- PPG Industries, Inc.

- KCC Corporation (Momentive Performance Materials Inc.,)

- Kansai Paint Co., Ltd.

- Berger Paints India Limited

- The Sherwin-Williams Company

- Jotun A/S

- Deccan Mechanical & Chemical Industries Pvt. Ltd

- Chugoku Marine Paints, Ltd.

Market Report Segmentation

By Material (Volume, Hundred Tonnes, USD Billion, 2019-2030)- Epoxy

- Vinyl Ester

- Polyester

- Marine

- Oil & Gas

- Chemical

- Industrial

- Construction

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Akzo Nobel N.V.

- Hempel A/S

- PPG Industries, Inc.

- KCC Corporation (Momentive Performance Materials Inc.,)

- Kansai Paint Co., Ltd.

- Berger Paints India Limited

- The Sherwin-Williams Company

- Jotun A/S

- Deccan Mechanical & Chemical Industries Pvt. Ltd

- Chugoku Marine Paints, Ltd.