Hospitals is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing prevalence of respiratory diseases significantly propels demand within the global respiratory filters market. This driver is multifaceted, encompassing both chronic conditions and acute infectious diseases that necessitate effective airborne contaminant protection for patients, healthcare workers, and the general public. As an illustration of this impact, according to the Centers for Disease Control and Prevention, in March 2024, the number of tuberculosis cases in the United States increased from 8,320 in 2022 to 9,615 in 2023, directly influencing the need for specialized respiratory protection in clinical and public health settings. The consistent burden of such diseases underscores a fundamental and enduring requirement for high-performance filtration solutions capable of mitigating disease transmission and protecting vulnerable individuals.Key Market Challenges

The high costs associated with advanced filtration technologies present a significant impediment to the expansion of the global respiratory filters market. These elevated expenses directly translate into higher acquisition costs for end-users, including industrial facilities, healthcare providers, and individual consumers. This economic barrier can deter smaller businesses or organizations with limited budgets from investing in state-of-the-art respiratory protection, opting instead for less effective or outdated solutions, or even foregoing proper protection entirely when severe budget constraints are encountered. Consequently, the adoption rate of premium, more effective respiratory filters is constrained, especially in cost-sensitive regions or sectors.Key Market Trends

Advancements in filtration material technology represent a pivotal trend reshaping the global respiratory filters market. This trend focuses on the development of novel filter media that offer superior efficiency in capturing microscopic particles, reduced breathing resistance for improved user comfort, and enhanced durability. Innovations include the integration of nanofibers, electrostatically charged materials, and hydrophobic treatments, enabling filters to perform effectively in diverse and challenging environments. Such material improvements are essential for meeting evolving safety benchmarks; indeed, the European Committee for Standardization published fifteen new or revised standards for respiratory protective devices between 2023 and 2024.Key Market Players Profiled:

- GE Healthcare Inc

- Koninklijke Philips NV

- ICU Medical Group Ltd

- Invacare Corp

- Medtronic PLC

- Fisher & Paykel Healthcare Ltd.

- ResMed Inc

- CAIRE Inc

- Linde India Ltd

- Mindray Medical International Ltd

Report Scope:

In this report, the Global Respiratory Filters Market has been segmented into the following categories:By Product:

- Nebulizer Filters

- Humidifier Filters

- Positive Airway Pressure Device Filters

- Oxygen Concentrators Filters

- Ventilator Filters

- Others

By End-use:

- Hospitals

- Outpatient Facilities

- Home Care

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Respiratory Filters Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- GE Healthcare Inc

- Koninklijke Philips NV

- ICU Medical Group Ltd

- Invacare Corp

- Medtronic PLC

- Fisher & Paykel Healthcare Ltd.

- ResMed Inc

- CAIRE Inc

- Linde India Ltd

- Mindray Medical International Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

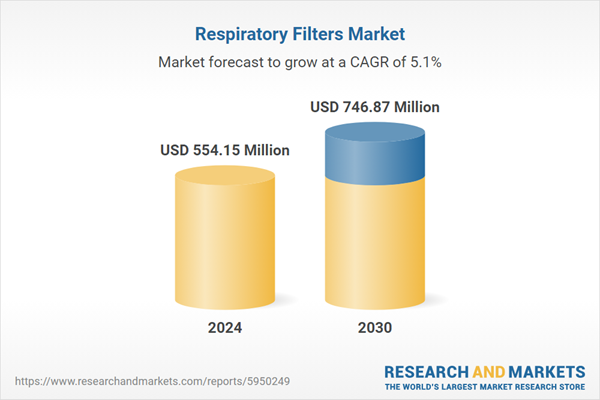

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 554.15 Million |

| Forecasted Market Value ( USD | $ 746.87 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |