Online is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global packaged salad market is significantly influenced by increasing health and wellness consciousness among consumers, alongside a strong demand for convenient and ready-to-eat meal solutions. Heightened awareness regarding nutrition and its impact on well-being has driven a notable shift towards fresh produce consumption. Consumers are actively seeking food options that align with healthier lifestyles, leading to a sustained demand for nutrient-rich, easy-to-prepare alternatives. This trend is evident in the growth of specific segments within the fresh produce sector; for instance, according to the Organic Trade Association, in April 2025, its "US Organic Food Sales Continue to Rise, Driven by Health-Conscious Consumers" report highlighted that organic produce sales climbed 5.2% to $21.5 billion in 2024.Key Market Challenges

The inherent limited shelf life of fresh produce presents a significant challenge to the growth of the global packaged salad market. This characteristic necessitates rigorous cold chain management and stringent quality control measures throughout the supply chain, from sourcing and processing to distribution and retail. Such requirements lead to increased operational complexities and considerable costs for market participants. The perishable nature of ingredients directly contributes to higher rates of spoilage and waste, diminishing product availability and impacting overall profitability.Key Market Trends

The global packaged salad market is significantly influenced by the adoption of sustainable and biodegradable packaging solutions, reflecting a shift in consumer preferences and regulatory landscapes. Manufacturers are moving towards materials such as plant-based plastics, compostable films, and recycled content for salad kits and containers. These efforts reduce environmental impact, minimize waste, and enhance brand appeal among eco-conscious consumers. According to Western Growers, in June 2024, Environment and Climate Change Canada (ECCC) proposed that 75 percent of all produce be sold in bulk or non-plastic packaging by 2026, increasing to 95 percent by 2028.Key Market Players Profiled:

- Bonduelle Group

- Dole Food Company, Inc.

- Fresh Express, Incorporated

- Taylor Fresh Foods, Inc.

- Mann Packing Co., Inc.

- Organicgirl, LLC

- Zina's Fine Foods

- Curation Foods, Inc. (Eat Smart)

- BrightFarms, Inc.

- Gotham Greens Holdings, PBC

Report Scope:

In this report, the Global Packaged Salad Market has been segmented into the following categories:By Product:

- Vegetarian

- Non-vegetarian

By Type:

- Packaged Greens

- Packaged Kits

By Distribution Channel:

- Online

- Offline

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Packaged Salad Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bonduelle Group

- Dole Food Company, Inc.

- Fresh Express, Incorporated

- Taylor Fresh Foods, Inc.

- Mann Packing Co., Inc.

- Organicgirl, LLC

- Zina's Fine Foods

- Curation Foods, Inc. (Eat Smart)

- BrightFarms, Inc.

- Gotham Greens Holdings, PBC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

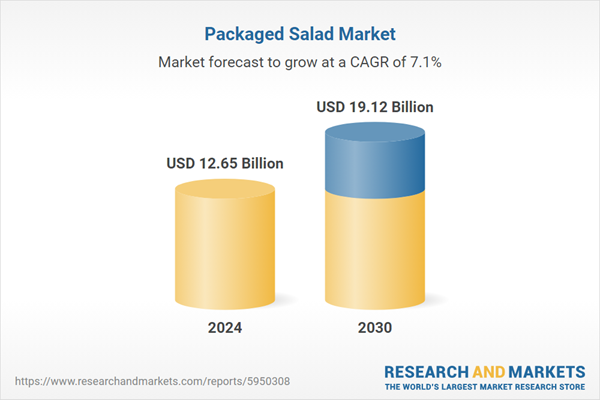

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.65 Billion |

| Forecasted Market Value ( USD | $ 19.12 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |