Onshore is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Global Downhole Tools Market growth is significantly influenced by expanding exploration and production (E&P) activities. This ongoing expansion necessitates a continuous demand for advanced downhole equipment to access and develop new hydrocarbon resources, often in challenging geological formations and remote areas. For instance, according to the IEA's World Energy Investment 2024 report, in June 2024, global upstream oil and gas investment is expected to increase by 7% in 2024 to reach US$570 billion, following a 9% rise in 2023. These substantial investments directly translate into increased drilling, completion, and intervention operations, driving demand for a wide array of specialized downhole tools.Key Market Challenges

The inherent volatility of crude oil prices presents a significant impediment to the growth of the Global Downhole Tools Market. Fluctuations in crude oil prices directly influence upstream capital expenditure decisions by oil and gas companies. When prices are low or unstable, companies often reduce their investments in new exploration and production projects, as well as in existing well completion and intervention activities, to manage financial risk and preserve liquidity.Key Market Trends

Innovations in advanced material science are significantly influencing the Global Downhole Tools Market by enabling the development of more durable and performance-enhanced equipment. These advancements allow tools to withstand extreme operating conditions, including high temperatures, pressures, and corrosive downhole environments, which are increasingly common in complex drilling operations. For example, Halliburton introduced its BaraFLC® Nano-1 wellbore sealant in October 2023, which utilizes a nanoparticle approach to form a more secure seal, decreasing fluid loss into formations and mitigating pore pressure transmission in reactive shale formations. This material-driven innovation extends tool lifespan, reduces maintenance needs, and improves overall well integrity and operational efficiency.Key Market Players Profiled:

- National Oilwell Varco (NOV) Inc.

- Weatherford International Plc.

- Wenzel Downhole Tools Ltd.

- Baker Hughes Company

- Hunting PLC

- Schlumberger Limited

- RPC, Inc.

- APS Technology Inc.

- TechnipFMC Plc.

- United Drilling Tools Ltd

Report Scope:

In this report, the Global Downhole Tools Market has been segmented into the following categories:By Tool Type:

- Drilling Tools

- Pressure & Flow Control Tools

- Handling Tools

- Impurity Control Tools

- Others

By Application:

- Well Drilling

- Well Completion

- Well Intervention

- Well Production

- Formation & Evaluation

By Location:

- Onshore

- Offshore

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Downhole Tools Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- National Oilwell Varco (NOV) Inc.

- Weatherford International Plc.

- Wenzel Downhole Tools Ltd.

- Baker Hughes Company

- Hunting PLC

- Schlumberger Limited

- RPC, Inc.

- APS Technology Inc.

- TechnipFMC Plc.

- United Drilling Tools Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

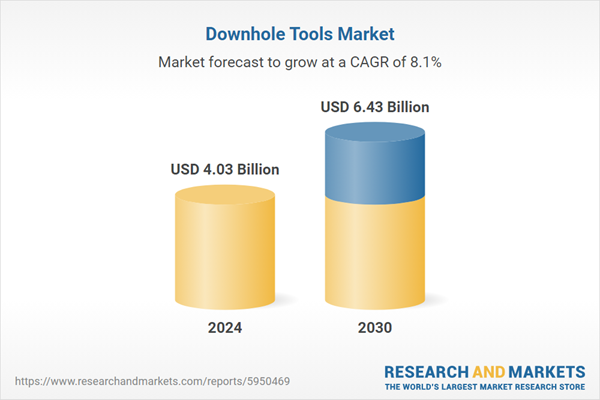

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.03 Billion |

| Forecasted Market Value ( USD | $ 6.43 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |