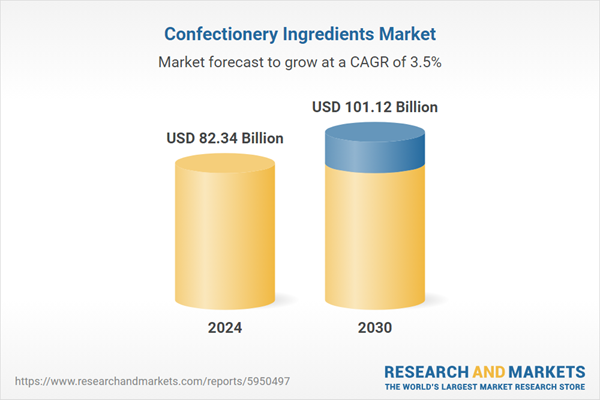

Cocoa & Chocolate is the fastest growing segment, Europe is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The confectionery ingredients market is strongly driven by evolving consumer expectations for clean-label, natural, and wholesome product formulations. Consumers are increasingly attentive to ingredient transparency and seek products free from artificial additives, flavors, and colors, prompting manufacturers to prioritize natural alternatives without compromising taste or stability. According to Barry Callebaut’s “Top Chocolate Trends 2023 - APAC FINAL [English],” 72% of APAC consumers in 2023 expressed concern about ingredients that appear chemical, demonstrating strong demand for minimally processed components.Additionally, rising interest in healthier indulgence fuels the development of reduced-sugar, plant-based, and functionally enriched confectionery. Barry Callebaut’s research, referenced in Bake Magazine (January 2023), indicated that 65% of global consumers desire chocolates with health-boosting attributes. Alongside these consumer-driven trends, industry commitments to sustainable and ethical sourcing further influence ingredient selection. AAK’s 2024 Sustainability Report (April 2025) noted that 91% of its palm supply was verified deforestation-free, with 97% global traceability to plantation, underscoring responsible procurement practices shaping the market.

Key Market Challenges

Persistent volatility in raw material prices presents a significant challenge to the Global Confectionery Ingredients Market. Fluctuating costs of essential commodities such as cocoa and sugar directly elevate production expenses and undermine profit stability for manufacturers. These price shifts complicate financial planning and strategic expansion efforts, forcing producers either to absorb cost increases or raise product prices, both of which can hinder market growth. According to the International Sugar Organization (ISO), in June 2024 the ISA Daily Price fell to USD 18.92 cents per pound and the ISO White Sugar Price Index declined to USD 542.60 per tonne, demonstrating how rapidly changing commodity prices create operational uncertainty. This economic instability limits long-term planning and makes sustained market expansion more difficult.Key Market Trends

Premiumization and Artisanal Ingredient Focus is a key trend shaping the Global Confectionery Ingredients Market, driven by consumer demand for high-quality, differentiated confectionery experiences. This trend boosts interest in single-origin cocoa, specialty botanical extracts, and unique natural flavoring agents that elevate product sophistication. Barry Callebaut’s 2024 chocolate trends study (December 2023) reported that 50% of consumers prefer premium, high-quality chocolate, highlighting strong demand for indulgent and artisanal ingredient solutions.Key Market Players Profiled:

- Cargill Inc.

- Archer Daniels Midland Company

- Barry Callebaut

- Kerry Group PLC

- Tate & Lyle PLC

- Ingredion Incorporated

- Koninklijke DSM N.V.

- Olam International Ltd.

- E. I. Du Pont De Nemours and Company

- AAK AB

Report Scope:

In this report, the Global Confectionery Ingredients Market has been segmented into the following categories:By Type:

- Dairy Ingredients

- Cocoa & Chocolate

- Emulsifiers

- Sweeteners

- Starch & Derivatives

- Oils & Shortenings

- Others

By Form:

- Dry Form

- Liquid Form

By Application:

- Chocolate

- Gum

- Sugar Confectionery

- Others

By Source:

- Synthetic

- Natural

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Confectionery Ingredients Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Confectionery Ingredients market report include:- Cargill Inc.

- Archer Daniels Midland Company

- Barry Callebaut

- Kerry Group PLC

- Tate & Lyle PLC

- Ingredion Incorporated

- Koninklijke DSM N.V.

- Olam International Ltd.

- E. I. Du Pont De Nemours and Company

- AAK AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 82.34 Billion |

| Forecasted Market Value ( USD | $ 101.12 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |