According to the publisher analysis, farms account for 32% of Indonesia’s total land area, and agricultural production accounts for 14% of the gross domestic product (GDP). Indonesia is also the world's third largest exporter of cocoa and rubber, and increased export-oriented crop cultivation has led to rising demand for fertilizers in Indonesia. In 2023, Indonesia's fertilizer imports reached US$ 2.03 billion, and Indonesia is one of the world's largest fertilizer importers.

In 2020-2022, the COVID -19 pandemic had an adverse impact on the Indonesian fertilizer industry. Fertilizer production in Indonesia fell by 20-30% due to supply constraints. In addition, due to the turmoil in the international situation, which has had a huge impact on the supply side of the fertilizer market, especially the potash fertilizer market, Indonesian fertilizer market prices have also increased.

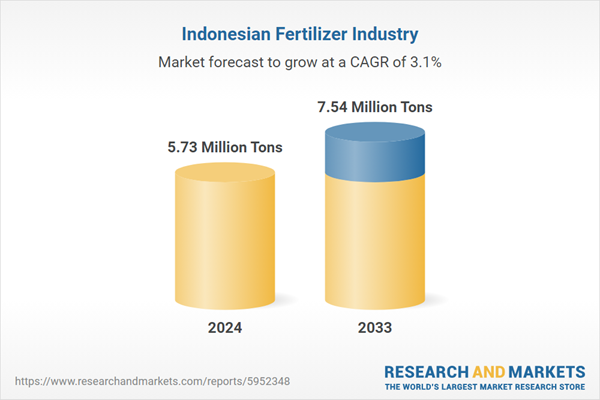

The publisher predicts that with the development of Indonesia's agriculture and planting industry, Indonesia's demand for fertilizers will continue to rise from 2024 to 2033.

Due to Indonesia's limited domestic fertilizer production capacity, annual fertilizer imports will continue to rise. The publisher predicts that Indonesia's fertilizer imports will reach 7.54 million tons in 2033, with a compound annual growth rate of 3.1 % from 2024 to 2033.

Topics covered:

- Indonesia Fertilizer Industry Overview

- Economic environment and policy environment of fertilizers in Indonesia

- Indonesian fertilizer market size from 2019 to 2023

- Analysis of major Indonesian fertilizer manufacturers

- Key Drivers and Market Opportunities of Indonesia’s Fertilizer Industry

- What are the key drivers, challenges and opportunities for the Indonesian fertilizer industry during the forecast period 2024-2033?

- What is the expected revenue of the Indonesia Fertilizer market during the forecast period 2024-2033?

- What strategies are adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesian Fertilizer Market is expected to dominate the market in 2033?

- Indonesia Fertilizer Market Forecast from 2024 to 2033

- What are the main headwinds facing Indonesia’s fertilizer industry?

Table of Contents

Companies Mentioned

- PT. Pupuk Sriwidjaya Palembang

- PT Petrokimia Gresik

- PT Pupuk Kujang

- PT. Pupuk Kalimantan Timur

- PT Pupuk Iskandar Muda

- PT Jadi Mas

- Wilmar International Limited

- Kuok Group

- Agrifert

- PT. Dupan Anugerah Lestari

Methodology

Background research defines the range of products and industries, which proposes the key points of the research. Proper classification will help clients understand the industry and products in the report.

Secondhand material research is a necessary way to push the project into fast progress. The analyst always chooses the data source carefully. Most secondhand data they quote is sourced from an authority in a specific industry or public data source from governments, industrial associations, etc. For some new or niche fields, they also "double-check" data sources and logics before they show them to clients.

Primary research is the key to solve questions, which largely influence the research outputs. The analyst may use methods like mathematics, logical reasoning, scenario thinking, to confirm key data and make the data credible.

The data model is an important analysis method. Calculating through data models with different factors weights can guarantee the outputs objective.

The analyst optimizes the following methods and steps in executing research projects and also forms many special information gathering and processing methods.

1. Analyze the life cycle of the industry to understand the development phase and space.

2. Grasp the key indexes evaluating the market to position clients in the market and formulate development plans

3. Economic, political, social and cultural factors

4. Competitors like a mirror that reflects the overall market and also market differences.

5. Inside and outside the industry, upstream and downstream of the industry chain, show inner competitions

6. Proper estimation of the future is good guidance for strategic planning.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 60 |

| Published | April 2024 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 5.73 Million Tons |

| Forecasted Market Value by 2033 | 7.54 Million Tons |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Indonesia |

| No. of Companies Mentioned | 10 |