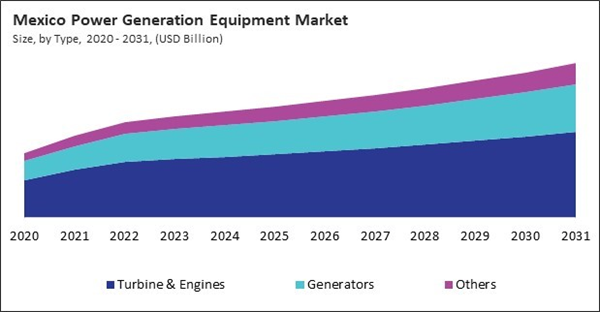

The US market dominated the North America Power Generation Equipment Market, by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $38,303.6 Million by 2031. The Canada market is experiencing a CAGR of 6.4% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 5.5% during (2024 - 2031).

Renewable energy sources, including solar, wind, hydroelectric power, and biomass, are on the rise. Governments, utilities, and businesses invest in renewable energy technologies and infrastructure to reduce carbon emissions, enhance energy security, and mitigate climate change. Many countries are transitioning from coal-fired power generation towards natural gas due to lower emissions, improved efficiency, and abundant natural gas resources. The adoption of natural gas-fired power plants, combined cycle gas turbines (CCGT), and cogeneration systems is increasing as coal plants are retired or repurposed.

Similarly, there is growing interest in decentralized energy systems that enable on-site generation, storage, and distribution of electricity, heat, and cooling. Distributed generation technologies such as solar PV, wind turbines, microturbines, and fuel cells are deployed in residential, commercial, and industrial settings to enhance energy resilience and efficiency. Hydrogen-based power generation technologies, including hydrogen fuel cells and hydrogen combustion turbines, are emerging as clean and sustainable alternatives to traditional fossil fuel-based generation.

Canada is investing in new power generation facilities to meet its growing electricity needs. Canada’s total installed electricity generation capacity was approximately 149 GW in 2021 and is projected to reach 170 GW in 2035. The Canada Small Modular Reactors (SMR) Roadmap will be decisive in reaching this goal. The total electricity generated in Canada in 2022 was 640.3 TWH, approximately 2% higher than in 2021. These projects need to procure power generation equipment to increase generation capacity and improve energy security. In conclusion, the increasing electricity generation in the region is driving the market’s growth.

Based on Type, the market is segmented into Turbine & Engines, Generators, and Others. Based on Application, the market is segmented into Utility, Industrial, Commercial, and Residential. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Mitsubishi Heavy Industries Ltd.

- Wartsila Corporation

- ABB Ltd.

- Siemens Energy AG

- General Electric Company

- Caterpillar, Inc.

- Bharat Heavy Electricals Ltd.

- Schneider Electric SE

- Cummins, Inc.

- Toshiba Energy Systems & Solutions Corporation (Toshiba Corporation)

Market Report Segmentation

By Type- Turbine & Engines

- Generators

- Others

- Utility

- Industrial

- Commercial

- Residential

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Mitsubishi Heavy Industries Ltd.

- Wartsila Corporation

- ABB Ltd.

- Siemens Energy AG

- General Electric Company

- Caterpillar, Inc.

- Bharat Heavy Electricals Ltd.

- Schneider Electric SE

- Cummins, Inc.

- Toshiba Energy Systems & Solutions Corporation (Toshiba Corporation)