Mezcal Joven, often referred to as "young" mezcal, is a type of mezcal that is typically unaged or aged for a short period, resulting in a vibrant and fresh flavor profile. In the market, Joven serves as an excellent entry point for newcomers to the world of mezcal due to its approachable taste and versatility in cocktails. It’s clear and crisp character makes it ideal for mixing in cocktails like margaritas or palomas, where its smoky undertones add depth and complexity to the drink. Therefore, the US market consumed 4,584.8 thousand units (Bottle of 750 ml) by Jovan in the market in 2023.

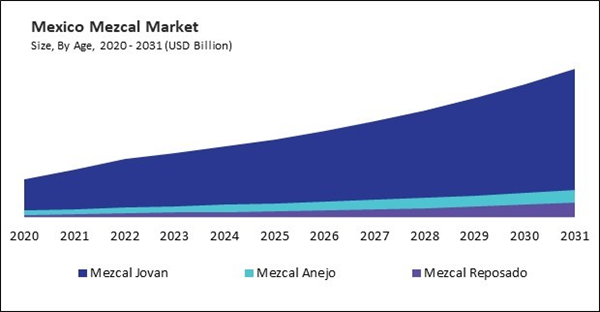

The US market dominated the North America Mezcal Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $517.8 Million by 2031. The Canada market is experiencing a CAGR of 12.4% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 11.4% during (2024 - 2031).

The revival of small batch mezcal manufacturing has been aided by the growing demand for authentic and artisanal craftsmanship. Artisanal producers, often working in family-owned distilleries or cooperatives, are celebrated for their dedication to tradition, quality, and preserving the cultural heritage of the production. Likewise, artisanal production often serves as a cornerstone of local communities, providing economic opportunities, preserving cultural traditions, and fostering social cohesion. Family-owned distilleries serve as hubs of activity where knowledge is shared, skills are passed down, and communal bonds are strengthened.

Moreover, innovation plays a pivotal role in shaping the future trajectory of the market, driving product development, sustainability efforts, and consumer engagement initiatives. While rooted in tradition and heritage, its producers leverage technology, research, and creative thinking to drive innovation across various production, distribution, and marketing aspects.

Canada's multicultural landscape and thriving food scene have led to the emergence of diverse culinary influences and fusion cuisines. Mezcal's versatility and ability to complement a wide range of flavors make it an ideal pairing for various cuisines, from traditional Mexican dishes to globally inspired creations. As per Statistics Canada, sales at food services and drinking places rose 1.1% to $8.0 billion in December 2023 (seasonally adjusted). Sales increased at limited-service eating places (+1.7%), full-service restaurants (+0.5%), special food services (+0.9%), and drinking places (+2.7%). Therefore, the growing food service sector in North America will boost the demand in the region.

Based on Age, the market is segmented into Mezcal Jovan, Mezcal Anejo, and Mezcal Reposado. Based on Distribution Channel, the market is segmented into On-Premise, and Off-Premise. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Diageo plc

- SU CASA MEZCAL

- Mezcal Amaras

- Pernod Ricard S.A.

- Xiaman Spirits GmbH

- Casa Cortes

- Wahaka Mezcal

- Rey Campero

- Bacardi Limited (Ilegal Mezcal)

- Mezcal Vago (Heaven Hill Sales Co.)

Market Report Segmentation

By Age (Volume, Thousand Units (Bottle of 750 ml), USD Billion, 2020-2031)- Mezcal Jovan

- Mezcal Anejo

- Mezcal Reposado

- On-Premise

- Off-Premise

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Diageo plc

- SU CASA MEZCAL

- Mezcal Amaras

- Pernod Ricard S.A.

- Xiaman Spirits GmbH

- Casa Cortes

- Wahaka Mezcal

- Rey Campero

- Bacardi Limited (Ilegal Mezcal)

- Mezcal Vago (Heaven Hill Sales Co.)