Within automotive interiors, flock adhesives are employed in applications such as dashboard trim, door panels, center consoles, and pillar covers, where they contribute to noise reduction, vibration damping, and scratch resistance. Additionally, flock adhesives are used to create anti-slip surfaces on dashboard trays and storage compartments, enhancing safety and convenience for drivers and passengers. Therefore, the U.S market will utilize 45.01 kilo Tonnes of Resin in Automotive by 2030.

The US market dominated the North America Flock Adhesives Market, by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $498 Million by 2030. The Canada market is experiencing a CAGR of 7.5% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 6.6% during (2023 - 2030).

Flock adhesives provide superior bonding strength and durability, making them suitable for demanding automotive and furniture upholstery applications. These adhesives offer excellent adhesion to various substrates, including plastics, metals, textiles, and paper, ensuring long-lasting performance even under harsh environmental conditions. The reliability and durability of flock adhesives have led to their widespread adoption in critical applications where bond strength and durability are paramount.

Additionally, Flock adhesives are extensively used in automotive interiors for bonding flock fibers to substrates such as dashboard panels, door panels, consoles, and headliners. These adhesives ensure the secure attachment of flock fibers, providing a soft, luxurious finish and enhancing the aesthetic appeal of interior trim components. Flock adhesives are employed in automotive upholstery applications for bonding flock fibers to fabric or synthetic substrates used in seats, armrests, and door panels.

The exponential growth of e-commerce has led to a considerable increase in demand for packaging materials in North America to simplify product shipment and delivery. E-commerce retailers prioritize customized packaging solutions to enhance brand identity, customer experience, and product presentation in North America. Hence, the factors mentioned above will drive the regional market growth.

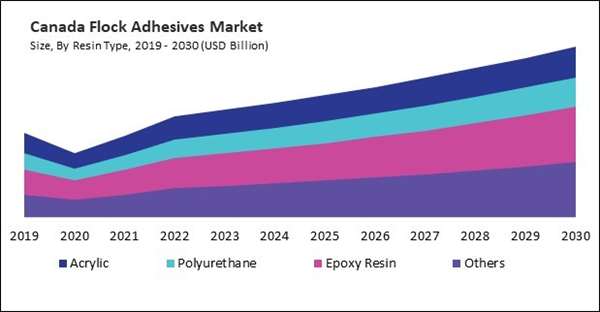

Based on Resin Type, the market is segmented into Acrylic, Polyurethane, Epoxy Resin, and Others. Based on Application, the market is segmented into Textiles, Automotive, Paper & Packaging, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Sika AG (Sika Automotive AG)

- H.B. Fuller Company

- The Dow Chemical Company

- Avient Corporation

- Parker Hannifin Corporation

- Stahl Holdings B.V.

- Nyatex Adhesive and Chemical Company

- CHT Germany GmbH (RB Beitlich Industrie Beteiligungen GmbH)

- Kissel + Wolf GmbH

- SwissFlock AG (Dimontonate Floccati S.p.A.)

Market Report Segmentation

By Resin Type (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Acrylic

- Polyurethane

- Epoxy Resin

- Others

- Textiles

- Automotive

- Paper & Packaging

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Sika AG (Sika Automotive AG)

- H.B. Fuller Company

- The Dow Chemical Company

- Avient Corporation

- Parker Hannifin Corporation

- Stahl Holdings B.V.

- Nyatex Adhesive and Chemical Company

- CHT Germany GmbH (RB Beitlich Industrie Beteiligungen GmbH)

- Kissel + Wolf GmbH

- SwissFlock AG (Dimontonate Floccati S.p.A.)