Acrylic-based flock adhesives exhibit good flexibility and compatibility with different flocking fibers, allowing for the creation of soft, textured surfaces with enhanced aesthetic appeal. Furthermore, acrylic resins can be formulated to meet specific regulatory requirements, including low volatile organic compound (VOC) emissions, contributing to their popularity in environmentally sensitive applications. Therefore, the China market utilized 48.96 kilo Tonnes of Acrylic Resin in 2022.

The China market dominated the Asia Pacific Flock Adhesives Market, by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $430.6 Million by 2030. The India market is registering a CAGR of 6.2% during (2023 - 2030). Additionally, The Japan market would showcase a CAGR of 4.7% during (2023 - 2030).

Flock adhesives play a crucial role in textile embellishment and flocking processes, where flock fibers adhere to fabric surfaces to create decorative designs, patterns, or textures. These adhesives enable precise control over flock placement, ensuring uniform coverage and adhesion to various textile substrates. Flock adhesives are used in flock printing applications, where designs or patterns are printed onto fabric surfaces using adhesive-coated screens or stencils. The adhesive is selectively applied to the fabric, allowing flock fibers to adhere only to the adhesive-coated areas, resulting in intricate and durable printed designs.

Moreover, flock adhesives are employed in luxury packaging applications to create visually appealing and tactile packaging designs. These adhesives enhance packaged products' perceived value and premium aesthetic by bonding flock fibers to packaging materials such as paperboard, cardboard, or plastic. Flock adhesives offer a unique way to differentiate brands and products through distinctive packaging finishes. Manufacturers can use flocking to create textured or velvety surfaces on packaging, adding a touch of elegance and sophistication that sets their products apart in the market.

Urbanization in the Asia Pacific region is accompanied by extensive infrastructure development to support growing populations and city economic activities. As urban areas develop, there is a growing demand for interior design and fit-out services in commercial and residential properties in Asia Pacific. Therefore, due to the above-mentioned factors, the flock adhesives market will grow significantly in this region.

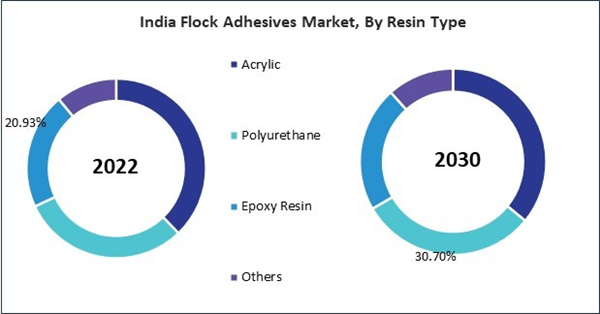

Based on Resin Type, the market is segmented into Acrylic, Polyurethane, Epoxy Resin, and Others. Based on Application, the market is segmented into Textiles, Automotive, Paper & Packaging, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Sika AG (Sika Automotive AG)

- H.B. Fuller Company

- The Dow Chemical Company

- Avient Corporation

- Parker Hannifin Corporation

- Stahl Holdings B.V.

- Nyatex Adhesive and Chemical Company

- CHT Germany GmbH (RB Beitlich Industrie Beteiligungen GmbH)

- Kissel + Wolf GmbH

- SwissFlock AG (Dimontonate Floccati S.p.A.)

Market Report Segmentation

By Resin Type (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Acrylic

- Polyurethane

- Epoxy Resin

- Others

- Textiles

- Automotive

- Paper & Packaging

- Others

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Sika AG (Sika Automotive AG)

- H.B. Fuller Company

- The Dow Chemical Company

- Avient Corporation

- Parker Hannifin Corporation

- Stahl Holdings B.V.

- Nyatex Adhesive and Chemical Company

- CHT Germany GmbH (RB Beitlich Industrie Beteiligungen GmbH)

- Kissel + Wolf GmbH

- SwissFlock AG (Dimontonate Floccati S.p.A.)