The China market dominated the Asia Pacific AC Electric Motor Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2,330.2 Million by 2030. The Japan market is experiencing a CAGR of 4.2% during (2023 - 2030). Additionally, The India market would exhibit a CAGR of 5.5% during (2023 - 2030).

The AC electric motor is a vital component of numerous industries, facilitating the conversion of electrical energy into mechanical energy. It has undergone significant advancements, evolving into versatile and efficient machines powering various applications across diverse sectors. The adoption of AC electric motors has seen remarkable growth over the years, driven by various factors, including technological advancements, regulatory requirements, economic considerations, and environmental concerns. AC motors are known for their high efficiency compared to their DC counterparts. Progress in motor design, materials, and control technologies has resulted in notable enhancements in energy efficiency, positioning AC motors as the preferred option for industries and applications prioritizing energy conservation. The quest for energy efficiency, driven by rising energy costs and environmental consciousness, has incentivized the adoption of AC motors across sectors.

Governments and regulatory authorities have enforced rigorous standards and regulations about energy efficiency for motors and systems driven by motors. Compliance with standards such as the International Electrotechnical Commission’s (IEC) IE3 efficiency class and the United States’ National Electrical Manufacturers Association (NEMA) premium efficiency levels has become mandatory in many regions. As a result, industries are compelled to adopt high-efficiency AC motors to meet regulatory requirements and minimize energy consumption.

The modernization and expansion of power generation infrastructure in India may drive the adoption of more efficient and technologically advanced AC motors. According to the Ministry of Power, India’s electricity generation target for 2023-24 has been fixed as 1,750 Billion Units (BU), growth of around 7.2% over the actual generation of 1,624.158 BU for the previous year (2022-23). The power generation during 2022-23 was 1,624.158 BU compared to 1,491.859 BU generated during 2021-22, representing a growth of about 8.87%. As India expands its power generation capacity to meet the growing energy demand, there will be a higher demand for AC electric motors used in various components of power plants. Hence, increasing power generation and growing investments in wastewater treatment is driving the growth of the market.

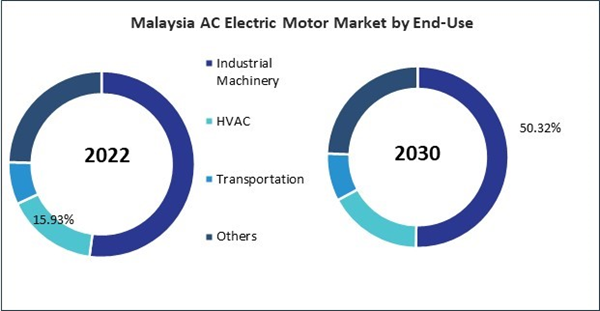

Based on Sales Type, the market is segmented into New Sales, and Aftermarket. Based on Output Power, the market is segmented into 1,000 HP up to 10,000 HP, 10,000 HP up to 20,000 HP, and 20,000 HP up to 30,000 HP. Based on End-Use, the market is segmented into Industrial Machinery, HVAC, Transportation, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- WEG Equipamentos Eletricos SA

- Toshiba Corporation

- General Electric Company

- Hitachi, Ltd.

- ABB Ltd.

- Nidec Corporation

- Siemens AG

- Kirloskar Electric Co. Ltd.

- Schneider Electric SE

- Emerson Electric Co.

Market Report Segmentation

By Sales Type- New Sales

- Aftermarket

- 1,000 HP up to 10,000 HP

- 10,000 HP up to 20,000 HP

- 20,000 HP up to 30,000 HP

- Industrial Machinery

- HVAC

- Transportation

- Others

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- WEG Equipamentos Eletricos SA

- Toshiba Corporation

- General Electric Company

- Hitachi, Ltd.

- ABB Ltd.

- Nidec Corporation

- Siemens AG

- Kirloskar Electric Co. Ltd.

- Schneider Electric SE

- Emerson Electric Co.