Speak directly to the analyst to clarify any post sales queries you may have.

MARKET DRIVERS

Growth in E-Commerce: This driver refers to the expansion of online retailing and shopping platforms that offer a wide range of garage furniture products and services. E-commerce allows customers more variety, convenience, and affordability in their garage furniture purchases. It also enables garage furniture sellers to reach more potential customers, reduce operational costs, and improve customer satisfaction. This driver can impact the market by increasing the supply and demand for garage furniture products and creating more competition and innovation among garage furniture providers. Market players can cope with this driver by enhancing their online presence, offering delivery and installation options, and providing customer support and feedback channels.Rise in Home Improvement & DIY Activities: This driver refers to customers' growing interest and participation in home improvement and do-it-yourself (DIY) projects, especially during and after the COVID-19 pandemic. Home improvement and DIY activities involve renovating, remodeling, decorating, or repairing various parts of the home, including the garage. Customers may engage in these activities to improve their living comfort, functionality, aesthetics, or value of their homes. This driver can impact the market by creating more demand for garage furniture products to facilitate or complement home improvement and DIY activities. Market players can cope with this driver by offering more garage furniture products that are easy to install, use, and maintain, as well as providing more guidance, tips, and inspiration for home improvement and DIY enthusiasts.

U.S. GARAGE FURNITURE MARKET HIGHLIGHTS

The bench and table product segment is growing significantly, with the fastest-growing CAGR of 3.01% in the U.S. garage furniture market. The segment is driven by increasing interest in multifunctional workbenches equipped with integrated storage, lighting, and power outlets. Also, there is a shift towards durable and weather-resistant materials for outdoor use. There is a growing demand for versatile benches that serve as workspace and storage solutions and a preference for foldable or modular tables to optimize space in smaller garages.Based on distribution channels, the big box stores segment holds the largest share of over 50% in the U.S. garage furniture market. The segment is growing due to its function of leveraging large spaces to provide an extensive selection catering to diverse consumer needs. Big box stores are also witnessing a trend towards offering exclusive garage furniture collections, collaborating with well-known designers or brands to provide unique and stylish options.

The commercial segment is growing prominently, with the highest CAGR during the forecast period. Commercial buyers, such as workshops, automotive repair centers, and warehouses, require garage furniture that can withstand heavy usage, resulting in a market focus on industrial-grade materials and ergonomic designs. In the commercial sector, there's a trend towards optimizing garage spaces for efficiency, leading to a demand for heavy-duty and durable furniture suitable for industrial use, thus driving the segment growth.

VENDOR LANDSCAPE

The U.S. garage furniture market report consists of exclusive data on 36 vendors. The U.S. garage furniture market's competitive scenario is intensifying, with global and domestic players offering diverse products. Regarding market share, a few major players are currently dominating the market. California Closets, ClosetMaid, Dorel Industries, Rubbermaid, and Container Store dominate the market.In 2023, DEWALT's launch of a customizable metal workshop storage system introduced a comprehensive solution for organizing garage tools and equipment. This development in the U.S. Garage Furniture Market emphasizes the importance of versatile and integrated storage solutions. Competitors can innovate by focusing on modular and customizable designs to meet the diverse needs of consumers.

SEGMENTATION & FORECAST

Product Type

- Cabinets & Drawers

- Shelves & Racks

- Benches & Tables

- Chairs & Stools

- Others

Distribution Channel

- Big Box/Superstores

Online Channels

- Speciality Furniture Stores

- Others

End-User

- Residential

- Commercial

VENDORS LISTS

Key Vendors

- California Closets

- ClosetMaid

- Dorel Industries

- Rubbermaid

- The Container Store

Other Prominent Vendors

- Homak

- Obsessed Garage

- ATD Tools

- Whalen Furniture

- VAULT

- Greenberg Casework Company

- NewAge Products

- Carolina Garage Company

- Ulti-MATE Garage

- TOOLSiD

- Garage Organization

- Gladiator

- Flow Wall

- Suncast

- Prepac

- Garage Living

- GarageTek

- Stanley Black & Decker

- Seville Classics

- Edsal

- TRINITY

- Organized Living

- CTech Manufacturing

- PremierGarage

- Garage Art

- Sterilite

- Triton Products

- Redline Garagegear

- Quality Craft

- Stack-On

- VIPER TOOL STORAGE

KEY QUESTIONS ANSWERED

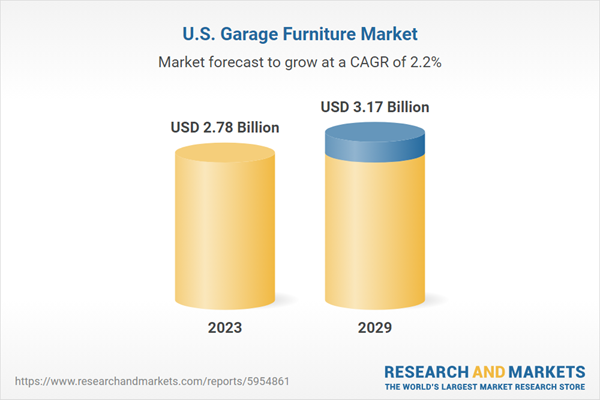

1. How big is the U.S. garage furniture market?2. What is the growth rate of the U.S. garage furniture market?

3. What are the trends in the U.S. garage furniture market?

4. Who are the major players in the U.S. garage furniture market?

Table of Contents

Companies Mentioned

- California Closets

- ClosetMaid

- Dorel Industries

- Rubbermaid

- The Container Store

- Homak

- Obsessed Garage

- ATD Tools

- Whalen Furniture

- VAULT

- Greenberg Casework Company

- NewAge Products

- Carolina Garage Company

- Ulti-MATE Garage

- TOOLSiD

- Garage Organization

- Gladiator

- Flow Wall

- Suncast

- Prepac

- Garage Living

- GarageTek

- Stanley Black & Decker

- Seville Classics

- Edsal

- TRINITY

- Organized Living

- CTech Manufacturing

- PremierGarage

- Garage Art

- Sterilite

- Triton Products

- Redline Garagegear

- Quality Craft

- Stack-On

- VIPER TOOL STORAGE

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 67 |

| Published | April 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 2.78 Billion |

| Forecasted Market Value ( USD | $ 3.17 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 36 |